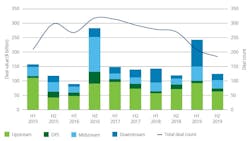

While total oil and gas deal value in 2019 increased 40% to $370 billion, thanks to several upstream and downstream mega-deals, overall deal count declined year-over-year (y-o-y) by 40% as companies continue to struggle with low commodity prices and challenging market conditions, according to a new Deloitte report.

M&A activity this year will be more of the same, but a little bit different, the report said.

Look back at 2019

In 2019, upstream deal values totaled $156 billion, the report noted, up $26 billion y-o-y. Only 208 deals were struck, 40% below the 5-year trend. The US was the hub of global upstream M&A last year, representing more than 60% in terms of both deal volume and value.

Midstream significantly increased in both deal count and deal value in 2019, striking 76 deals worth $78 billion, a 30% and 50% y-o-y increase, respectively. Private equity spending increased in this sector as investors pivoted from production to infrastructure.

Downstream deal value reached $114 billion, a decade high and almost double the prior year and 5-year average, while the number of transactions declined 15% y-o-y.

Oilfield services (OFS) deal making stalled with deal values reaching $19 billion in 2019, down $2.5 billion y-o-y and 35% below the 5-year average. Volumes decreased 20% y-o-y, 10% below the 5-year average.

Outlook for 2020

Absent an increase in commodity prices, the dampened level of deal making activity is expected to continue in 2020, the report said. However, as many companies change their portfolios to match external market conditions and their own shifts in strategic priorities, evolving trends and themes could shape the oil and gas transactions market in the year ahead and beyond.

"As we enter 2020, the new decade seems to be ushering in a new era of oil and gas portfolio design driven by changing shareholder and investor expectations. As portfolio optimization, capital discipline and sustainability issues move increasingly to the core of corporate decision making, the drivers and types of deals will likely evolve," said Duane Dickson, vice chairman and US oil, gas and chemicals leader, Deloitte Consulting LLP.

"Facing continued headwinds, many private equity firms are being forced to hold their investments for a longer period as an IPO or sale to a corporate buyer is often not a feasible exit strategy, except for the most valuable positions. These challenges are pushing most portfolio companies to focus on operations to generate returns, until an exit can be made," said Melinda Yee, partner, Deloitte & Touche LLP.

The largest driver in 2020 divestitures will likely be massive 2018 and 2019 acquisitions, the report noted. Upstream companies involved in recent deals are expected to continue to realign their portfolios and strategies while also looking for divestment opportunities that allow them to focus on expanded footprints and assets.

In looking at existing assets, some companies are considering carbon footprints when it comes to divestitures. As investor sentiment has changed, oil companies have increased their discussion of environmental, social and governance (ESG) issues. As the size of ESG investment funds grow, so could oil and gas companies’ interests in burnishing their environmental credentials. To that end, not only renewables investment will likely increase but also carbon-based divestitures, Deloitte said.

In 2020, majors are expected to be primary catalyst for global M&A. In 2019, the majors divested a wide swath of assets across a range of geographies and resource types. The pace may slow down this year, the report said, but opportunities remain for further portfolio streamlining with some potentially large asset divestitures across US shale plays, the North Sea, and Asia-Pacific in play.

Integrated and national oil companies are moving onward and downward. To capitalize on growing chemicals demand, most international oil and gas companies are continuing to expand their downstream footprints, beyond refining assets, and into distribution, retail, and chemicals businesses. This investment push, that has primarily targeted integrated refining and petrochemical assets, as well as fuel and natural gas networks in the Middle East and Asia Pacific, is expected to continue.

In 2020, it is expected to see more consolidation of upstream and OFS companies as capital markets refuse to thaw, and topline US production growth continues to decline. Sellers and management teams, however, might need to be willing to forgo significant premiums to get the deals done in order to achieve the synergies and economies of scale that form the strategic basis for executing the deal — which may make stock more palatable as currency.

A pivot in private equity’s traditional strategy may accelerate consolidation in shale. With the oil and gas IPO market dead in the water and debt issuance trending monotonically downward since 2014, private equity firms and their portfolio companies are rethinking their traditional build-and-flip strategy, Deloitte said, noting the year may see the build-to-operate model fully take flight in the Permian and beyond.