SilverBow enters deals to increase liquids production mix to one-third

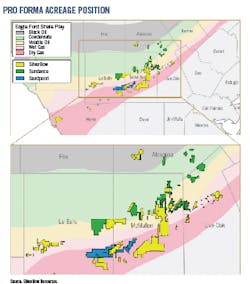

SilverBow Resources Inc., Houston, entered into definitive agreements to acquire liquids-weighted assets in the western Eagle Ford from two privately held companies in a deal poised to increase the company’s acreage footprint by 50% to about 198,000 net acres and facilitate double-digit annual production growth with less than 60% reinvestment rate through 2024.

In one deal, SilverBow intends to acquire assets from Sundance Energy Inc. and certain affiliates for $354 million. The deal also calls for up to $15 million of contingent payments based on future commodity prices.

With the deal, SilverBow would gain acreage contiguous to its existing position, adding 39,000 net acres in Atascosa, La Salle, McMullen, and Live Oak counties in Texas. January 2022 net production from the assets was 11,100 boe/d (84% liquids, 65% oil). The company envisions some 200 gross/155 net de-risked, high return locations.

Sundance emerged from Chapter 11 as a private entity in April 2021 having eliminated over $250 million of funded debt obligations.

In a separate deal, the company agreed to acquire certain assets from SandPoint Operating LLC, a subsidiary of SandPoint Resources LLC, San Antonio, for $71 million. The oil and gas assets target the Eagle Ford and Olmos formations in La Salle and McMullen counties, Tex., with 27,000 net acres gained.

May 2022 net production of 4,650 boe/d (70% gas, 30% liquids) is estimated with two new wells expected to come online in this year’s second quarter. The acreage includes some 45 gross/44 net de-risked, high return locations.

Go forward

Pro forma, SilverBow projects full-year 2022 net production of 300-330 MMcfed (64% gas), adjusted EBITDA of $490-530 million, capital expenditures of $260-300 million, and free cash flow of $180-250 million.

Annual synergies of about $15 million are expected, with additional potential savings upon integration.

Going forward in this year’s second half, SilverBow plans to run one drilling rig on the acquired assets in addition to the one rig the company is running currently.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.