Rystad: Accelerating energy transition marks end of trillion-dollar oil and gas tax revenues

The global government income from oil and gas taxation fell to a multi-year low in 2020 of around $560 billion as production and prices shrunk. Before COVID-19, oil and gas taxes usually exceeded the trillion-dollar mark. The accelerating energy transition will cause this source of state income to shrink and never again exceed or meet $1 trillion, a Rystad Energy report projected.

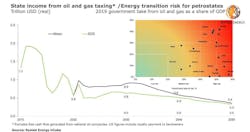

This year, 2021, will be the last year global oil and gas taxes will approach the trillion-dollar mark, reaching about $975 billion, assisted by high oil prices, according to Rystad Energy estimates. From 2022, taxes will be limited to the low $800 billion range, ticking up in the early 2030s to about $900 billion before starting their final and uninterrupted decline to as low as $580 billion in 2040 and about $350 billion in 2050.

“As the energy transition ramps up, countries highly dependent on tax revenue from the upstream industry may have no other option than to diversify their economy to sustain state budgets. This is clearly the rational course for them to follow, but there are inherent challenges in the form of insufficient economic and legal institutions, infrastructure and human capital,” said Espen Erlingsen, head of upstream research at Rystad Energy.

The earlier the energy transition risks are realized the better they can be addressed. Structural changes will be crucial to stabilize petroleum-reliant economies and avoid geopolitical instability as the global energy systems shift onto a sustainable pathway, Erlingsen added.

Using Saudi Arabia as an example, about half of the government take is at risk towards 2050, while total tax income from oil and gas made up 27% of the country’s GDP in 2019.

Algeria, Iraq, Kuwait, and Libya—all of which are heavily dependent on tax revenue from the upstream industry—garnered around 40% of GDP in 2019 from oil and gas tax revenue. In these countries, about 50% of the government take is at risk, meaning that this group is the most exposed to revenue risk as a result of the energy transition.

“Our data and tools allow us to quantify energy transition risk for the oil and gas upstream sector in different low-carbon scenarios. The above estimates are produced by Rystad Energy’s base case scenario, called the Mean scenario. To address the possibility of some deviation we also have a low-case and a high-case scenario.”

However, the International Energy Agency’s (IEA) Sustainable Development Scenario (SDS) model has perhaps become the most widely used benchmark, calling for temperature increases well below 2 degrees Celsius. According to Rystad Energy’s analysis, if the Scenario materializes, global government income from oil and gas taxes will be much lower than its own Mean Case, with petrostates losing a cumulative further $4.8 trillion from today until 2050.