WoodMac: US tight oil faces tariff cost pressures, but increases will be offset elsewhere

US Lower 48 tight oil well costs will see pressures from tariffs, but significant increases will be offset by cost deflation elsewhere, particularly in declining prices for proppant, drilling rig and pressure pumping, according to a recent analysis from Wood Mackenzie.

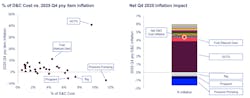

Tariffs on consumables such as imported steel, Oil Country Tubular Goods (OCTG), cement, and drilling fluids result in near-immediate price increases that will see higher costs passed directly to operators, the report indicated.

Quarterly fluctuations due to tariffs will be more pronounced, with fourth-quarter 2025 drilling and completion costs expected to rise 4.5% year over year. OCTG prices are expected to be 40% higher year-over-year in this year’s fourth quarter, adding 4% to total well costs, according to Wood Mackenzie’s North American Cost Service.

That said, Wood Mackenzie noted annual increases are expected to remain flat in 2025 but increase 2% next year as tariffs are fully realized.

"Tariffs are creating significant cost pressures, particularly for consumable inputs like imported steel and OCTG," said Nathan Nemeth, principal analyst, Wood Mackenzie.

“However, there is nuance to the story. While operators are facing inflated costs in some areas, much of this will be offset by deflation in other areas. Declining prices for proppant, drilling rig and pressure pumping are all areas that will yield lower costs this year, allowing operators to absorb most of the increases from tariffs.”

Rig count decline

Wood Mackenzie expects Lower 48 rig activity to gradually decline through 2025-2026, primarily driven by oil plays. Its analysis shows a projected oil rig count some 45–50 units below its April 2025 outlook but notes a gradual rise in natural gas rigs will partially offset the drop, thus ending with a net decline of around 30 rigs from March to July 2025.

“Completion activity is set to rise in gas-driven regions, while oil-focused operators are expected to see declining activity levels if oil prices remain near US$60/bbl WTI,” said Nemeth.

Uncertainty around US tariff policy could persist until 2028, the report noted.

Nemeth said tariff-driven well cost inflation is undesirable, but manageable, but that “broader economic weakness and lower commodity prices would force difficult decisions and activity reductions.

The full impact is still unfolding, he said, but expect operators to work to offset increases through efficiency gains and new technologies. “The industry's ability to innovate will be key to maintaining competitiveness in this uncertain trade environment,” he said.