Rystad: Permian drilling permits hit all-time monthly high in March

Horizontal drilling permits for new wells in the Permian basin hit an all-time high in March, with 904 total permit awards, driven by elevated oil prices and production demand, Rystad Energy research shows.

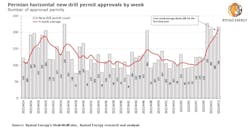

Weekly approved permits have hovered between 188 and 227 since Mar. 7, 2022, an unprecedented period of high activity that pushed the 4-week average to 210 for the week ending Apr. 3, a record for horizontal permit approvals in the US shale play over 4 weeks.

“This is a clear signal that operators in the basin are kicking into high gear on their development plans, positioning for a significant ramp-up of activity level and an acceleration in the speed of output expansion over the next few months once supply chain bottlenecks ease. The surge in permitting activity positions the industry for continuous rig count additions in the second half of 2022 and foreshadows a significant increase in supply capacity from early 2023,” said Artem Abramov, Rystad’s head of shale research.

Rystad advises caution when using the numbers as an indicator of future drilling plans, however. Many permits never get drilled, and operators follow diverse permitting strategies. The time from permit approval to the start of drilling varies widely across producers in the same basin.

Even so, the current permit activity trend points to a continuous uptick in drilling in the coming months. Weekly horizontal permit approvals have occasionally spiked above 200 in recent years, but the persistently elevated levels currently seen from regulators in Texas and New Mexico are unprecedented. Thus, the current surge shouldn’t be viewed as a temporary anomaly caused by major permitting round timings overlapping. Instead, the trend reflects a robust expansion in activity plans for many Permian operators.

Basin breakdown

The regular monthly average for permit approvals ranges from 400-500 locations, which makes the magnitude of the sequential increase between February and March particularly extreme. The Delaware and Midland portions of the basin contributed to the elevated permit activity in March, although only the Midland delivered at an all-time high level. The Delaware basin ended March with 398 approved horizontal permits—comparable to the run rate of permit activity recorded in second-quarter 2021, supported by post-moratorium federal permit stockpiling in the New Mexico portion of the Permian.

Privately owned operators finished with almost 500 new horizontal drill permits approved in March—larger than the number of wells currently being drilled in the Permian in any given month by all operators. Public independent producers also saw a material increase, being awarded 410 horizontal locations—an unusually high number compared to the usual 230-320 in recent months.

Another indication that the increase in permit activity is structural is the number of permits obtained by the largest contributors to Permian permits in March relative to their typical monthly counts over the last 12 months. As many as 10 of the 22 largest contributors saw higher activity in March than their maximum monthly count between March 2021 and February 2022.

Pioneer Natural Resources stood out, with 99 horizontal permits approved in March—a record high for the operator’s portfolio on a pro-forma current operatorship basis. Diamondback Energy was another public producer with unusually high activity in March, at 59, while Franklin Mountain Energy, Birch Resources, and Spur Energy Partners were the most significant among private operators in terms of the number of permits in March relative to the average rate in the previous 12 months.

As many as 81 unique operators got at least one new horizontal drill permit approved in the Permian in March—a record-high number of active operators, and a significant increase from the typical 60 active operators per month observed in second-half 2021.

Other major oil regions outside the Permian—the Bakken, Eagle Ford, and Niobrara combined—also delivered a healthy uptick, with 61 unique operators obtaining new permits in March. The Eagle Ford in South Texas contributed the most to this activity expansion.

“While permit activity in March could, to some extent, end up as an outlier, driven at least partially by the timing of major rounds, there is a clear indication the industry is moving towards a new elevated permit rate, which will likely be sustained over the coming weeks,” said Abramov.