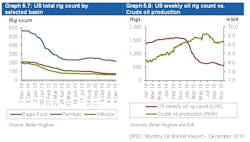

BHI: Overall US rig count plunges 28 units

The overall US drilling rig count plunged 28 units to 709 during the week ended Dec. 11, representing its lowest level since Sept. 17, 1999, according to Baker Hughes Inc. data (OGJ Online, Dec. 4, 2011).

The count has fallen in 15 of the last 16 weeks since a short-lived summer rebound, giving up 176 units over that time. Since this week a year ago, 1,184 units have gone offline.

The drop was again anchored by oil-directed rigs, which lost 21 units to 524, down 1,022 year-over-year and their lowest point since Apr. 30, 2010. Gas-directed rigs declined 7 units to 185.

Meanwhile, BHI this week reported that the average US rig count for November was 760, down 31 from October and down 1,165 from November 2014.

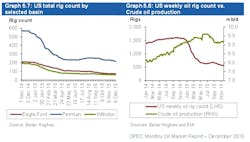

US oil output declines advance

According to the US Energy Information Administration’s latest Drilling Productivity Report (DPR), crude oil production in January from seven major US shale plays is expected to drop 116,000 b/d to 4.86 million b/d (OGJ Online, Dec. 7, 2015).

As usual, the Eagle Ford is expected to represent a bulk of the decline, losing 77,000 b/d to 1.2 million b/d. The Bakken is seen falling 27,000 b/d to about 1.1 million b/d, and Niobrara is seen falling 24,000 b/d to 344,000 b/d.

Double-digit growth is again expected in the Permian, which EIA projects to rise 14,000 b/d to about 2.4 million b/d.

In its Short-Term Energy Outlook for December, EIA reported that overall US crude production fell by about 60,000 b/d in November compared with October (OGJ Online, Dec. 9, 2015). US production began declining in May, and declined from 9.6 million b/d in April to 9.2 million b/d in November.

EIA expects US production declines to continue through September 2016, when total output is forecast to average 8.5 million b/d, which would be 1.1 million b/d less than the recent monthly peak reached in April. Forecast production begins increasing in late 2016, returning to an average of 8.7 million b/d in the fourth quarter.

EIA notes that projected oil prices below $60/bbl throughout the forecast period are expected to limit onshore drilling activity and well completion totals, despite continued increases in rig and well productivity, and falling drilling and completion costs.

US land rigs down in 16th straight week

Land-based rigs lost 26 units in their 16th consecutive week of losses to 684, down 1,136 year-over-year. Rigs engaged in horizontal drilling fell 15 units to 554, down 813 year-over-year. Directional drilling rigs were unchanged at 64.

Offshore rigs fell 2 units this week to 23, their lowest total since the industry’s post-Macondo recovery. Both of those rigs operated off Louisiana. Rigs drilling in inland waters were unchanged at 2.

Canada’s rig count dropped 3 units this week to 174, down 257 year-over-year. Oil-directed rigs lost 4 units to 73, down 142 year-over-year; while gas-directed rigs edged up a unit to 101.

The average Canadian rig count for November was 178, down 6 from October and down 243 from November 2014.

The worldwide rig count for November was 2,047, down 39 from October 2015 and down 1,623 from November 2014. Outside North America, Latin America again led in declines with a 10-unit drop to 284, down 109 year-over-year. A bulk of those losses came in Colombia, down 5 units to 15; and Argentina, down 4 units to 101.

Gains continued in the Middle East, which rose 16 units to 419, also up 16 year-over-year. The most noticeable increases came in Egypt, up 5 units to 45; Oman, up 4 units to 72; UAE-Abu Dhabi, up 4 units to 52; and Kuwait, up 3 units to 43.

Texas, Permian counts fall

Texas led the major oil- and gas-producing states with a 9-unit decline to 324, down 548 year-over-year and its lowest total since June 12, 2009, when that year’s drilling downturn hit its nadir.

The Permian plunged 13 units to 204, down 344 year-over-year. The Eagle Ford, meanwhile, gained 3 units to 76, still down 128 year-over-year.

Murphy Oil Corp. this week said it will slash its 2016 budget by more than 60%, a move that will impact its Eagle Ford output (OGJ Online, Dec. 9, 2015). During the year, the company in the play plans to average 1.75 rigs, down from 3 in the fourth-quarter 2015.

ConocoPhillips reported plans to maintain current activity levels in 2016 with 13 rigs across the Eagle Ford, Bakken, and Permian, with ongoing flexibility to ramp up or down activity in the plays (OGJ Online, Dec. 10, 2015).

New Mexico and Ohio each dropped 4 units to respective totals of 36 and 15. New Mexico’s count is its lowest since June 12, 2009. The Utica fell 4 units as well, settling at 16.

North Dakota and Colorado lost 2 units to 58 and 25, respectively. For North Dakota, its total is its lowest since Nov. 20, 2009. For Colorado, its total is its lowest since Dec. 6, 2002. The Williston and Niobrara each declined 2 units as well, settling at 58 and 23, respectively.

Edging down 1 unit each was Wyoming at 21, West Virginia at 13, Alaska at 11, and Arkansas at Utah each with 3.

Unchanged from a week ago were Louisiana at 60, Kansas at 10, and California at 9.

Oklahoma and Pennsylvania each edged up a unit to respective totals of 85 and 30. The Cana Woodford led the major basins with a 2-unit rise to 37.

Contact Matt Zborowski at [email protected].