Cabot fuels Marcellus operations with gas

Rachael Seeley, Editor

SUSQUEHANNA COUNTY, Pa.—Cabot Oil & Gas Corp. is reducing costs and lowering emissions at its Marcellus shale operations by using natural gas as fuel for its equipment. The company is working to convert its fleet of light duty trucks, rigs, generators, and hydraulic fracturing equipment to run on gas and is pleased with the results.

George Stark, spokesperson for Cabot, said the effort began early last year with the decision to convert the company's fleet of Ford and Chevrolet trucks to run on CNG or diesel. To keep its fleet well supplied with fuel, Cabot made the move to install the first CNG refueling station in Susquehanna County, Pa.

"We wanted to showcase, locally, the benefits of natural gas," Stark told UOGR. "We're coming to drill for [natural gas]; we ought to be a company that utilizes it."

Stark said the CNG station is in Auburn Township, no more than a 45 min drive from all of Cabot's Pennsylvania operations. The station supplies a fleet of 60 trucks equipped with bifuel technology, which enables them to run on either diesel or CNG. Cabot initially paid about $10,000/vehicle to convert the trucks, but can now purchase them directly from the manufacturer.

From there, Cabot expanded its natural gas conversion efforts to include rigs. Stark said Cabot worked with contractors to modify its rigs in the Marcellus shale to be capable of running on a combination of natural gas and diesel using another variation of bifuel technology.

Cabot is running four bifuel rigs in the Marcellus shale, with a fifth rig set to be added to its fleet in 2015. The company plans to transition to bifuel rigs across all of its Marcellus shale operations in coming years.

Stark said the upfront cost of converting a rig's diesel engine can run from $150,000 to $200,000. Cabot's rigs were converted by Eco Alternative Fuel Systems Inc., of North Dakota.

The bifuel rigs working at Cabot's operations run on a combination of CNG and diesel. As the demand for electricity changes in step with the nature of operations at the rig, a computer adjusts the ratio of natural gas to diesel. Cabot says the technology enables it to displace 30-60% of the rig's diesel consumption with natural gas.

Under ideal circumstances, locally produced gas powers the rigs, a process that entails tapping into nearby pipelines. "If we've got a natural gas pipeline there we have the ability to, in essence, plug the drilling rig right in and operate off of field gas," Stark said. Field gas reduces the need for processing and transportation, lowering the cost and environmental impact of the fuel.

Where field gas is not readily available, a tube trailer is filled with CNG at Cabot's Susquehanna County station and trucked to the drillsite. Cabot has two tube trailers that each can hold 1,000 gal of diesel-equivalent of CNG.

Speaking at the ribbon-cutting for Cabot's Susquehanna County CNG station last year, Cabot's Gary Hlavinka said running one rig on natural gas has the potential to displace the equivalent of 600 gal/day of diesel usage, for a cost savings of $2/gal or more. Diesel currently costs about $4/gal in the area of Cabot's operations, compared with about $1.20/gal of diesel-equivalent for CNG.

A recent white paper by researchers at the nonprofit Environmentally Friendly Drilling (EFD) consortium found that dual-fuel technology generates power output that is "nearly indistinguishable from using straight diesel fuel in high pressure fracturing pumps and other support equipment."

Gas-powered frac jobs

During the summer of 2013, Cabot also began using bifuel engines to power its hydraulic fracturing operations in Northeast Pennsylvania. Stark said the company figured, "If we can run the drilling equipment [on natural gas], why don't we run our fracing equipment too?"

At Cabot's first 10-well pad in the Marcellus shale, in Susquehanna County, Pa., the company late last year reached the milestone of powering all its hydraulic fracturing operations at a pad drilling site using a fleet of bifuel, hydraulic fracturing pump units. The 16 pump units, owned by Baker Hughes, were powered by a combination of diesel and line gas from nearby wells. The job entailed the completion of 170 fracture stimulation stages at the pad over 27 days.

Cabot figures that bifuel pumps displaced 110,000 gal of diesel with natural gas and saved the company nearly $200,000 in fuel costs. "The biggest savings is in your hydraulic completions," Stark said.

Substituting a portion of diesel with natural gas during hydraulic fracturing can generate substantial savings as much power is needed to pump fluids and proppant into the well under high pressure. Data from Baker Hughes indicate that the company's bifuel pumps can reduce diesel usage by up to 65% with no loss of hydraulic power.

Cabot plans to begin using bifuel frac fleets across all of its Marcellus shale operations over the next few years.

Transition drivers

Cabot is not alone in its efforts to use natural gas to power operations. The adoption of natural gas as a fuel for vehicles and equipment at drillsites is growing in the US. The trend is underpinned by the recent growth in gas reserves brought about by the unconventional resource boom, low gas prices, and the need to reduce emissions of carbon dioxide.

Tom Williams, EFD senior advisor, has been following the switch and thinks that the technology has reached an inflection point.

EFD is working to document the trend and provide an objective analysis for companies interested in making the transition to natural gas. Williams said the switch is accelerating. "I've never seen something evolve so rapidly," he told UOGR.

About 10-12% of the roughly 1,800 rotary rigs running in North America today are capable of running on natural gas, and Williams expects that figure to double in 2014.

Natural gas is also gaining ground as a fuel source for hydraulic fracturing, as evidenced at Cabot's 10-well pad in Susquehanna County. Williams said 5-9% of the 300-400 frac spread engines in the US have been converted to run on natural gas, and that figure is expected double in the next 2 years.

Williams said several factors sparked the movement toward the use of gas. One of the first companies to try the technology in drilling was Encana Corp. Driven by a desire to reduce emissions and by access to cheap, abundant natural gas, the company converted some rigs to run on gas in Colorado and published information about the successful effort.

Another company leading the charge is Apache Corp. Apache has installed a number of CNG stations in Oklahoma to fuel its operations and fleet of CNG-powered vehicles. "There have been a lot of quick followers in the industry after they observed the savings that are going on, including Cabot and some of the other operators, so it's been a rapid transfer from there," Williams said.

Growing trend

The growing adaptation of gas-powered drilling and completion operations is evident in LNG supply deals signed late last year by Antero Resources Corp. and Apache Corp. with Prometheus Energy Group Inc. Prometheus will supply Antero with LNG to power drilling rigs in West Virginia and eastern Ohio and Apache with fuel to supply rigs and hydraulic fracturing equipment in the Midcontinent.

LNG's greater volumetric energy density is advantageous where there is not ready access to infrastructure and gas must be trucked in.

Randy Hull, business development director at Prometheus, told UOGR that there are a number of LNG sources around the US for the domestic merchant market. Sources include peak-shaving facilities owned by local distribution companies and gas processing facilities with added cryogenic gas processing capacity. Prometheus has 15 LNG supply points throughout the US.

"For drilling and frac engine fueling, generally speaking, in most of the shale basins there is readily available LNG supply," Hull told UOGR.

The supply deals with Prometheus show how a few producers are meeting the supply needs of their natural gas powered engines.

Infrastructure needs

One of hurdles to widespread adaption of gas-powered vehicles, rigs, and fracturing fleets is the relatively limited availability of refueling infrastructure.

"It's kind of a chicken and egg thing," Willams said. Companies are hesitant to invest in costly LNG and CNG facilities until there is demand, and service companies are hesitant to switch to natural gas-powered engines until they can ensure adequate supplies and a diversity of suppliers.

Right now, many companies recognize that they need to have diesel backup to power operations in the event that supply runs out, and that redundancy costs money.

"Once there is an adequate amount of infrastructure in place, that can provide the CNG to the low-horsepower engines and LNG to the higher-horsepower engines, then a lot more conversion will take place," Williams said.

Some companies, like Cabot, solve this dilemma by installing their own gas refueling equipment. Although LNG has a higher energy density than CNG, the installation of CNG stations is usually preferred by companies because the cost of installation is relatively low. The cost of obtaining equipment capable of compressing gas is less than the cost of installing equipment capable of liquefying it. It is also less expensive to install technology to decompress the gas than it is to regasify LNG before it is fed into the engines of rigs, trucks, and fracing equipment.

"The tradeoff is that you lose energy density and have more trucks hauling your CNG to your wellsite than you would if they were hauling LNG," Williams said.

Fuel savings

Figures from EFD show that running a rig on 100% natural gas or replacing a portion of diesel with gas in a bifuel mixture has the potential to generate savings of $250,000-750,000/rig/year.

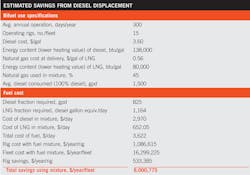

EFD has also developed a calculator for its website that helps companies estimate savings. The calculator shows, for instance, that powering a single rig with a mixture of 45% natural gas and 55% diesel over 300 days would save an estimated $533,385, assuming a cost of $3.50/gal of diesel and 56¢/gal of diesel equivalent of natural gas.

Extrapolated across a fleet of 15 rigs running on the same blend for 300 days, this equates to a savings of more than $8 million (see table).

The environmental benefits are also compelling. EFD research found that displacing diesel fuel with natural gas through the use of a bifuel or dual-fuel system greatly reduces emissions of nitrogen oxides, sulfur oxides, carbon dioxide, and volatile organic compounds.

EFD is working to document the environmental benefits of displacing diesel with natural gas through a research program cofounded by Research Partnership to Secure Energy for America and industry.

Switching to natural gas-powered operations can help operators and the communities they work in—reducing fuel usage and improving air quality. In the coming years, more operators are expected to follow in Cabot's footsteps and make the switch to natural gas-powered equipment as infrastructure is installed, more service companies like Baker Hughes convert portions of their fleets to run on gas, and organizations like EFD further research and outreach efforts.