Anadarko, UPR to merge in $4.43 billion deal

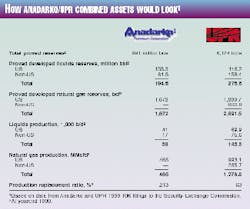

Anadarko Petroleum Corp., Houston, signed a definitive agreement to merge with Union Pacific Resources Group Inc., Fort Worth, in an all-stock transaction valued at about $4.43 billion. The merger will create one of the world's largest independent exploration and production companies, as measured by combined reserves, production, and drilling activities, the firms say (see table).

The new company is to retain the Anadarko name and will be headquartered in Houston. At the close of the deal-which is slated for July, pending regulatory and shareholder approval-UPR will become a wholly owned subsidiary of Anadarko.

The stock-for-stock deal-approved unanimously by both companies' boards-will involve the exchange of 0.455 Anadarko common share for each UPR share. Anadarko will own 53% of the combined firm and UPR 47%.

Based on the Anadarko closing price of $38.6875/share on Mar. 31, the combine will have about 243 million shares outstanding, which implies a value of $17.60/share for UPR shares-a 21% premium over UPR's Mar. 31 closing price. The new company will have a market capitalization of over $9 billion, the firms say.

Anadarko says the proposed merger will be accretive to its cash flow and earnings "immediately." Also, as a result of the transaction, Anadarko's debt level will be raised to about $4.3 billion, due to the assumption of $2.8 billion of UPR debt.

If the companies were combined for 2000, Anadarko estimates cash flow would have been about $1.8 billion, or $7.50/share, say the firms. Cash flow for 2001, based on the current commodity price outlook, is expected to reach $2 billion, or $9/share, says the firm.

The new Anadarko

The post-merger Anadarko will boast proved reserves of 1.94 billion boe-split equally between oil and natural gas. About 80% of these reserves will be in North America.

The combined companies' asset portfolio includes 100 exploration prospects with more than 11 billion bbl of net unrisked reserve potential, says Anadarko. The new company will have a 10.8-year combined life index based on current rates of production.

The new company intends to focus its E&P activities in seven core areas. In North America, activities will center in prospect areas in Canada and Alaska; the US Midcontinent; Texas and Loui- siana; land grants in Utah, Wyoming, and Colorado; and in conventional, subsalt, and deepwater plays in the Gulf of Mexico. Elsewhere, the new combine will focus efforts in the Sahara Desert of Tunisia, the North Atlantic margin, and Latin America.

"This merger is an excellent fit for both companies," said Anadarko Chairman and CEO Robert J. Allison, Jr., who will retain both positions for the new Anadarko. "We blend Ana- darko's strengths in exploration with what UPR does best-profitable exploitation with industry-leading drill- ing and completion technology."

Allison said that, although the deal should create certain cost savings, it was not about cost savings. Rather, he said, "It's about complementary skills and assets that can give us dramatic growth and profitability. We expect to grow faster and beyond the levels either company could achieve individually.

"Given the current outlook for energy markets, now is the time to step up the pace of drilling for new energy reserves-particularly North American natural gas."

Allison also said at a press conference Apr. 3 in New York that the deal would not mean that Anadarko would "change its spots" and that the new entity would remain an exploration company. "We have looked at a lot of potential acquisitions, and I haven't seen one better than Anadarko, until now," Allison said.

George Lindahl III, chairman, president, and CEO of UPR, will become vice-chairman of the new company following the merger. A 13-member board has been proposed-pending Ana- darko shareholders' approval-comprising 5 UPR members that will join Anadarko's existing 8 members.

"We are very excited about the new Anadarko," said John Seitz, president and COO of Anadarko. "The new Anadarko has great assets and great opportunities andellipsewe've [now] got the cash flow to get the job done."

There are four critical issues that E&P companies today need to grasp in order to compete effectively, Seitz explained. These are people, skill sets, access, and critical mass.

"On every single issue, I think we are a stronger company after the merger than before," he said. "These are issues that other companies will have to come to grips with if they are going to compete with us," Seitz said.

Reactions, benefits

Despite being billed by both companies as a "win-win" situation, Ana- darko's stock price took a plunge of more than 10% Apr. 3 on the New York Stock Exchange, following word of its proposed takeover of UPR. Initial concerns were that the company had overpaid for its peer rival.

As presstime neared, however, both Anadarko and UPR stock prices were inching their way back up, albeit moderately.

Standard & Poor's, New York, placed UPR and its affiliates' ratings on watch with positive implications. "The affirmation of the ratings on Anadarko reflect the positive impact of the merger on Anadarko's cash flow," said the credit agency, "which should enable the company to fund more capably a strong, high-graded exploration and development portfolio.

"Over time, the UPR transaction provides an opportunity for Anadarko to strengthen its profitability from both enhanced capital efficiency and the potential contribution from an enlarged portfolio of exploration acreage," Standard & Poor's said.

Meanwhile, Duff & Phelps Credit Rating Co. (DCR), Chicago, placed Anadarko's senior unsecured debt rating of A-, preferred stock rating of BBB+, and its commercial paper rating of D- on rating watch with negative implications. The change was based on the increased debt level and associated interest expense arising from the merger.

"The cash flow increase will now be spread over more debt and interest expense as a result of the merger agreement," said DCR.