Demystifying Russia’s oil and gas taxes

Eugene M. Khartukov

Moscow State University for International Relations

Moscow

Western oil men well know that Russian petroleum taxes are quite heavy and generally not profit-related. But what are the specifics behind those taxes?

Generally, the fiscal regime that applies now in Russia to the petroleum industry consists of a combination of royalties—called in Russian mineral extraction tax or MET or NDPI for short—and export duties. Besides, oil and gas companies pay bonuses specified in a license as well as excise duties and other common taxes applicable to legal entities, including corporate income and profits tax (CIT), assets and property tax, and insurance contributions, contributions to social funds, value-added tax (VAT), and road tax.

The highest norm of Russia tax law is in the Russian Constitution, Article 57, which states that “all are obliged to pay legally established taxes and duties” and the principle that new taxes and adverse changes to taxes cannot be applied retrospectively. There are direct references to taxation in other articles of the constitution: Articles 57, 71, 75, 104, 106, and 132. Article 57 contains the main general reference to taxation proclaiming: “Everyone is obliged to pay legally established taxes and levies. Laws introducing new taxes impairing the situation of the taxpayer do not carry retroactive effect.” Article 71 states that taxation laws are the prerogative of the Russian Federation—as opposed to being in regional competence. According to Article 75, Item 3 of the Constitution, the general principles of taxation are determined by federal law, or rather, the laws incorporated in the Tax Code.

Since 1998 the main laws governing taxation have been codified in the Tax Code, which consists of two parts. Tax Code Part I was adopted in 1998 and entered into force on Jan. 1, 1999. Tax Code Part I regulates general taxation matters, setting out the most important provisions of the Russian taxation system. Tax Code Part I specifies the procedures on how taxes are introduced and repealed and defines all aspects of interactions between state, taxpayers, and tax agents. The first part of the Tax Code also provides the general principles of taxation and the rules for tax administration including the rights and obligations of taxpayers and tax authorities.

There also are a number of obligatory official charges—duties, dues—that are not recognized as taxes (quasi-taxes) but that de facto are of tax nature in the sense of being mandatory contributions imposed by the lawmaker and collected for the purpose of financing state functions and expenditure.

Such mandatory charges are:

• Customs duty.

• Customs payments, including import duty, export duty, VAT levied on goods imported into the customs territory of the Customs Union, excise duty levied on goods imported into the customs territory of the Customs Union, and customs fees.

• Employer’s social contributions.

• Dues for use of water resources

• Environmental protection fees and charges.

By an explicit provision of the Tax Code (Article 3), all compulsory payments and charges that are of the nature of a tax and levy as defined in the Tax Code fall under the general regulations of the code. Thus taxes, levies, other dues, and charges also would be regulated by the same set of principles and rules. The regulations concerning employer’s social contributions are a case in point. Presently an employer pays such contributions to the Pension Fund, Social Fund, and Medical Fund. These funds are considered off the balance of the Russian State budget. Some experts would like to draw from this the conclusion that employer’s social contributions were therefore not to be considered under the general tax laws.

Prior to a change of law, with effect of January 2010, the employer’s contributions were paid in form of a so-called unified social tax, which was regulated by the Tax Codes and especially its Chapter 24. And yet before the Unified Social Tax was introduced in 2001, the contributions were paid similarly to four different funds.

Different taxes, special tax regimes

Below is a list of the different types of taxes and tax regimes grouped in categories based on the hierarchical status of the taxes and dues: federal, regional, or local (municipal).

Federal taxes and levies:

• Profit tax (Tax Code Chapter 25).

• Value-added tax (Tax Code Chapter 21).

• Excises (Tax Code Chapter 22).

• Personal income tax (Tax Code Chapter 23).

• MET (Tax Code Chapter 1).

• State duty (Tax Code Chapter 3).

• Water tax (Tax Code Chapter 2).

• Charges for use of natural resources (fauna dues) (Tax Code Chapter 1).

Regional taxes and fees:

• Property tax (corporate) (Tax Code Chapter 30).

• Tax on gambling business (Tax Code Chapter 29).

• Transport (road)tax (Tax Code Chapter 28).

Local (municipal) taxes and fees:

• Land tax (Tax Code Chapter 31).

• Individual property tax (Tax Code Chapter 32).

Special taxation regimes

Russian law may provide for some special taxation regimes (systems of taxation) for the calculation and payment of taxes for certain types of activities or taxpayers.

Currently, the following special tax regimes are in force:

• A special tax regime for producers of agricultural goods (Tax Code Chapter 26.1; Chapter 20 Taxation of Small and Medium Enterprises (SME), and Certain Activities of Individual Entrepreneurs in Russia of the present book).

• The simplified system of taxation (Tax Code Chapter 26.2, Chapter 20 Taxation of SME, and Certain Activities of Individual Entrepreneurs in Russia of the present book).

• The unified tax on imputed income for certain types of activities (Tax Code Chapter 26.3, Chapter 20 Taxation of SME, and Certain Activities of Individual Entrepreneurs in Russia of the present book).

• A special tax regime for the performance of production-sharing agreements (Tax Code Chapter 26.4, Chapter 20 Taxation of SME, and Certain Activities of Individual Entrepreneurs in Russia).

• Taxation by license (taxation based on a patent; from January 2013, Tax Code Chapter 26.5, Chapter 20 Taxation of SME, and Certain Activities of Individual Entrepreneurs in Russia).

• Regimes in special economic zones (agreement on the free (special) economic zones in the customs territory of the Customs Union and the customs procedure of free customs zone.

Quasi-tax payments

Quasi-tax payments are those legally imposed obligatory payments that essentially are like taxes albeit not regulated by the Tax Code. These include:

• Customs duties.

• Customs dues (or fees).

• Employer’s social and pension contributions.

• Environmental protection charges.

• MET.

• Excise tax.

• Gambling tax.

• State duty.

• Fishing, hunting, and trapping dues.

Currently fiscal regime in Russian oil and gas industries looks like this: Russian oil and gas producers are to pay the following taxes:

• MET.

• Payments for the use of mineral resources.

• Customs payments (dues and duties).

Excise duties.

The main tax burden on Russian upstream companies consists of MET and export duties, which account for more than 90% of total tax payments in that segment. Downstream companies pay neither MET nor make payments for the use of mineral resources but do pay excise duties on petroleum products.

Mineral extraction tax

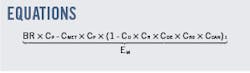

MET is charged on mineral resources, including natural fuel gas, gas condensate, and commercial crude oil and in the case of the latter is calculated according to the equation shown below, where BR is the base rate. The rate in 2015 was 766 rubles/tonne, but it has increased incrementally over the last 2 years: 857 rubles/tonne in 2016 and 919 rubles/tonne from 2017.

CP represents the dynamics of world oil prices, calculated using the following formula:

CP = (P – 15) × R/261, where P is the average price of Urals oil for the tax period in dollars per barrel and R is the average exchange rate of the US dollar against the Russian ruble in a tax period, as established by the Central Bank of the Russian Federation.

CD, CR, CDE, CRD, and CCAN are coefficients reflecting level of reserves’ depletion and their size, difficulty of production, quality of reserves, particularities of producing region, and cumulative production at a site. Particularly, CMET is equal to 530 in 2015 and 559 from 2016. CCAN, representing oil-producing region and viscosity of oil, is assumed to be equal to zero for oil produced on sites that are located wholly or partially within the borders of the Republic of Sakha (Yakutia), the Irkutsk Region, the Krasnoyarsk Territory, to the north of the Arctic Circle, in the Sea of Azov, the Sea of Okhotsk, the Black Sea or the Caspian Sea, in the Nenets Autonomous District (NAO), or on the Yamal Peninsula in the Yamalo-Nenets Autonomous District (YaNAO). CCAN also equals zero for superviscous oil that is extracted from sites containing crude oil with viscosity exceeding 200 mPa•s and less than 10,000 mPa•s. Otherwise, CCAN is taken as equal to 1.0.

Export duties for oil, products

The rates of customs duties are set by the Ministry of Economic Development monthly using average prices for Urals crude oil on world crude markets (Mediterranean and Rotterdam) during the preceding 2-month monitoring period (from the 15th of each calendar month through the 14th of the next month).

The maximum rate of export duty on crude oil is calculated as indicated in the following table, in accordance with the provisions of the Law of the Russian Federation “On the Customs Tariff.” The government calculates the average price of Urals blend on the Mediterranean and Rotterdam markets monthly.

Since October 2011, the maximum marginal rate of 65% is envisaged by the law; in fact, the rate of 60% still applies, but the rate is revised each month and could be as high as 65% (Table 1).

Special reduced rates of export duty are introduced as follows:

• Superviscous oil with a viscosity under formation conditions of not less than 10,000 mPa•s.

• Oil with special physical and chemical properties produced in new oil fields in a number of remote and hard-to-reach areas, using methods that take project economy into account.

• Oil from fields in Russia’s territorial waters and on the Russian continental shelf.

Export duty is not charged on crude oil or products exported to Customs Union countries (Kazakhstan, Belarus, Armenia, and Kyrgyzstan).

The maximum rate of export duty on crude oil was 42% of the world oil price from Jan. 1, 2015, 36% in 2016, and 30% from 2017.

Export duty rates on petroleum products are set by the RF Ministry of Economic Development as a percentage rate of concurrent export duty for crude oil.

Current maximum rates for certain listed categories are as follows:

• Light petroleum products (with the exception of gasoline)—65%. Based on the parameters of the tax maneuver, this rate was lowered to 48% beginning in 2015, 40% in 2016, and 30% from 2017.

• Black petroleum products—66%. Beginning in 2015, the rate was raised to 76%, 82% in 2016, and 100% from 2017.

• Gasoline (including naphta)—90%. The rate for commercial gasoline was lowered to 78% beginning in 2015, 61% in 2016, and 30% from 2017. The rate for naphtha was also lowered to 85% beginning in 2015, 71% in 2016, and 55% from 2017.

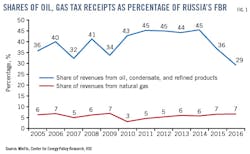

The revenues obtained from oil and gas taxation account for roughly half of federal budget revenues (43-45% for crude oil, refined products, and gas condensate and 3-7% for natural gas). Due to the sharp fall in oil prices in recent years, the proportion of revenue obtained from oil and gas taxation has declined, so that last year it accounted for only 40% of federal budget revenues. Significantly more tax revenue comes to the state from oil than from gas, because oil is taxed more heavily than gas and it is anyway the economically more significant sector for Russia (Fig. 1).

A bulk of government petroleum tax receipts—typically from two-thirds to three-quarters—comes from MET and export duty on crude oil, while such taxes on gas account for just above 10% of federal budget revenues.

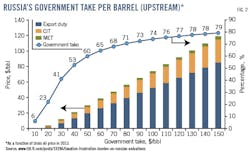

Before marketable changes in Russian oil and gas taxation started to take place, the Russian government siphoned in the form of MET, CIT, and export duties more than three quarters of petroleum companies’ sales revenues and Russia’s upstream government take looked like this (Fig. 2).

Most influential major undertakings by the Russian government were the so-called “tax maneuver” (November 2014) and introduction of “60-66-90” (August 2011) and then “55-61” (November 2014), finally modified into the currently existing “60-66-90-100” tax regime.

The impact that the 60-66 system, adopted in October 2011, is having on such key oil industry parameters as budget allocations, investments by segment, and the formation of conditions for the sector’s balanced development was still being hotly debated when the Ministry of Finance launched a new stage of tax reform. Many amendments were made to current law after only a short discussion. Key features of the change on Sept. 30, 2013, Vladimir Putin signed Law No. 263-FZ, which changed the current rates of export duty and established the future base rates of MET on crude oil. The new rates will come into force on Jan. 1, 2014. The law establishes the following rates of MET/tonne of oil produced—an increase over the then base rate of 470 rubles: 493 rubles in 2014, 530 rubles in 2015, and 559 rubles from Jan. 1, 2016.

The maximum rate of export duty on crude oil is being lowered (by reducing the coefficient in the formula) from the then-60% to 59% in 2014, 57% in 2015, and 55% from Jan. 1, 2016.

According to many mass media sources, the change also involves lowering the level of export duty on light petroleum products (with the exception of gasoline), established by government decree on a monthly basis, from the then-66% of oil duty to 65% in 2014, 63% in 2015, and 61% from Jan. 1, 2016.

Particularly, on Oct. 13, 2016, the government of the Russian Federation approved draft tax policy guidelines for 2017 and further plans for 2018-19. Pursuant to the guidelines, the Ministry of Finance developed a draft law, titled “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and other regulations of the Russian Federation,” and submitted it to the Russian government for approval. On Oct. 17, the Russian government approved and tabled the bill in the State Duma.1 The bill amended the current oil and gas tax regime to introduce new definitions and make changes to the calculation methodology for MET on crude oil, gas, and gas condensate. It also established new excise duty rates on petroleum products for 2017-19.

The amendments are intended to reduce Russia’s budget deficit. However, the draft tax policy guidelines say that the proposed long-term increase in the tax burden on the oil industry would dramatically increase the likelihood of an accelerated output decline in mature oil provinces, and work is under way to develop an alternative mechanism to raise additional budgetary revenue without increasing pressure on the oil refineries.

At the end of 2015, a coefficient for gas (Cgp), standing for the export margin of one unit of fuel equivalent, was added to the formula used to calculate the coefficient Usf (unit of standard fuel) for determining MET rates on gas. Previously, the Usf formula, which is based on the prices of gas and gas condensate, as well as on the quantity of output, included a multiplication factor of 0.15 that was effectively raised to 0.2051 for taxpayers owning Unified Gas Supply System (UGSS) facilities and their affiliates in 2016. It was initially planned that increased MET rates on gas and gas condensate would only be applied in 2016. However, the bill submitted to the State Duma stipulates that for taxpayers owning UGSS facilities and their affiliates the 0.15 multiplication factor will be adjusted by a Cgp coefficient that will be equal to 1.7744 in 2017, 1.4477 in 2018, and 1.4876 in 2019.

In 2016, the above multiplier of 0.2051 also was used to calculate the amount of MET on gas condensate. Since taxpayers that own UGSS facilities and their affiliates do not receive any economic rent from gas condensate production, a decision was made to provide for a mechanism to gas compensate these producers for the increased Usf coefficient. Particularly the bill stipulates that the adjusting factor (Ccm) used in the gas condensate MET formula should be divided by the respective Cgp coefficient to equalize MET rates on gas condensate for both the above organizations and independents.

Under the reform known as “the big tax maneuver,” export duty on crude oil was to gradually lower from 42% in 2015 to 36% in 2016 and to a further 30% in 2017. The planned reduction in the maximum rate from 42% to 36% in 2016 was later postponed, however, the maximum rate of export duty on crude oil is to be lowered to 30% in 2017. MET rates on crude oil are to be raised to reduce the national budget deficit. A new value is expected to be added to the formula used to calculate Em, a coefficient representing oil extraction factors. This value is due to be set at 306 in 2017, 357 in 2018, and 428 in 2019.

In May 2012, the Russian government introduced tax breaks on production of hard-to-recover tight oil by including—with effect from September 2013—some amendments to the national Tax Code, according to which, oil from Bazhenov, Abalak, Khadum, and Domanic fields was to be actually freed from paying MET for 180 monthly tax periods (for 15 years). Minprirody’s experts have immediately calculated that those tax privileges would be equal to 326 million tonnes (nearly 2.4 billion bbl) of incremental oil production over 20 years.

In November 2014, gas was officially included in Russia’s list of excise goods and since 2015 became subject to excise duty at a rate of 30% of its value.

As for gas condensate, MET on it has gone on average from 556 rubles/tonne in 2012 to 590 rubles/tonne in 2013, 647 rubles/tonne in 2014, and 679 rubles/tonne in 2015, and that for gas, which is produced by Gazprom and its affiliates, increased from 582 rubles/1,000 cu m in the first half of 2013 and 700 rubles/1,000 cu m in 2014 to 788 rubles/1,000 cu m in 2015. For the less-privileged independent gas producers, the average rate of MET increased to 552 rubles/1,000 cu m (that was more than 30% lower than for Gazprom).

Investing in Russia

Investing in Russia’s energy industry has never been an easy task, not only because the oil business’ fiscal burden is one of the highest in the world but also because it changes regularly, making it difficult for companies to develop an investment strategy. Russia’s fiscal regime is notoriously prone to fluctuation, and this is expected to continue through the medium term. A reversal of the “tax maneuver” would be the clearest demonstration yet of the regime’s lack of stability, which increases the level of commercial risk in the sector.

While Russia’s hydrocarbon taxation, as sometimes assumed, is not the most severe in the world1, oil and gas taxes in Russia are rather inflexible and do not directly link to profits.

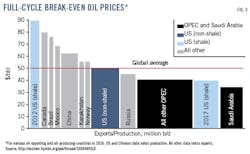

In 2014, the Federal Treasury got 6.75 trillion rubles of taxes from oil and petroleum products, or nearly $178 billion using the central bank’s average exchange rate. As Russia reviewed and adopted this year’s budget, the RF Economy Ministry and the Russian parliament worked on an average oil price of $50/bbl compared with $98/bbl in 2014. Though not as high as in some other oil-exporting countries, such as Libya or Iran, the budget break-even oil price in Russia is still no less in 2016 than $40/bbl. Using this measure, Peter Zeihan of Austin-based consultancy Zeihan on Geopolitics calculated in 2016 (Fig. 3) that countries like Russia, Canada, Brazil, Mexico, China, and Norway also will need quite a high world oil price—between $40/bbl and $80/bbl—to fulfill their state budgets and also will experience fiscal difficulties as a result of the lower oil price, which (as far as the European Brent Blend is concerned) was on the average for 2016 less than $44/bbl.

The impact of lower prices was partially offset for Russia by the weaker ruble, which has fallen in 2014 by hefty 42% against the US dollar (the steepest drop in 16 years), making dollar income from oil and gas go further when spent domestically.

Ironically, as main oil taxes in Russia are linked to world oil prices (but not to profitability of domestic projects), the price lowering is followed by a proportional decrease in the tax burden and doesn’t so severely hit Russian oil companies, which try to make up sales losses for lower taxes. Unsurprisingly, Russia’s major oil companies bravely state that, unlike the state budget, they could withstand the price decline to $30/bbl and even a temporary price drop to as low as $10/bbl. Moreover, they would be happy to produce more oil just to compensate the lower selling prices provided they had paying markets (both inside the FSU and outside) and adequate export infrastructure for the additional crude.

The recent oil tax changes could have been even more pronounced if not the sectoral anti-Russian sanctions imposed by the US, the European Union, and some other Western countries since March 2014 and blocked Russia from Western financial markets. Nonetheless, the Russian government recognized that some healthy tax adjustments were needed that time.

Footnotes

1According to IHS CERA estimates, hydrocarbon-related government take in Russia onshore in 2012 averaged 73% of sales price, while in Venezuela’s heavy oil it was 95%, in Louisiana onshore, 85%, the US Gulf of Mexico, 79%, and in the US Alaska and Texas onshore, 76%.

The author

Professor Eugene (Yevgeny) Khartukov is a leading international expert on Russian and ex-Soviet oil and gas issues. During 1970-82, he worked in various research centers, departments, and enterprises of the USSR ministries of geology, oil and gas industry, foreign trade, and foreign affairs. Since 1980, he teaches world oil and energy markets research at the Moscow State University for International Relations (MGIMO), USSR/RF Ministry of Foreign Affairs. Since 1984, he heads the Moscow-based World Energy Analysis & Forecasting Group (GAPMER), advises and consults on oil and gas economics and policies and energy pricing to various Soviet/ Russian ministries, international agencies, foreign governments, private oil and gas companies, consulting firms and financial institutions, as well as to Gorbachev, Yeltsin and Putin administrations; is a member of the Council of Energy Advisors (USA) and Gerson Lehrman Group (UK) of energy consultants. In 1994-95 he was head of Russia Energy Project, East-West Center, Hawaii. Since 1995 he was vice-president (for Eurasia) of Petro-Logistics Ltd., Switzerland. Since 1996 he was general director of (International) Center for Petroleum Business Studies (ICPBS/CPBS), Moscow, and Professor of Marketing, Management and Commerce at MGIMO. During 2003-12, he was director (for International Affairs) of PetroMarket Research Group, Moscow. Obtained all his scientific titles (PhD, Doctor of Sciences and Professor) at the MGIMO respectively in 1980, 1993, and 1994.

Prof. Khartukov has authored and co-authored more than 300 articles, brochures, and books on petroleum and energy economics, politics, management, and oil and gas in the FSU, Russia’s Far East, the Caspian, Europe, the OPEC, the Middle East, and Africa. He has participated as a speaker and a session chairman in more than 170 international energy, oil and gas and economic fora. He speaks Russian, English, and Arabic. E-mail address: [email protected].