Financial results rebounded in 2017 on higher oil prices, tax benefits

Conglin Xu

Senior Editor-Economics

Laura Bell

Statistics Editor

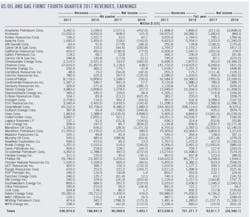

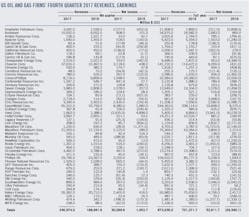

A sample of 51 US-based oil and gas producers and refiners collectively posted full-year 2017 net earnings of $52.61 billion on revenues of $873.04 billion compared with net losses of $29.54 billion in 2016 on revenues of $701.27 billion. Compared with 2016, oil and gas prices increased markedly during 2017 and were the primary driver for improvements in producers’ earnings and cash flows.

Supported by increasing global demand and historically high compliance by members of the Organization of Petroleum Exporting Countries with oil-production cuts, average West Texas Intermediate and Brent oil prices increased 18% and 22%, respectively, from $43.32/bbl and $45.04/bbl in 2016 to $50.95/bbl and $54.82/bbl in 2017. Average New York Mercantile Exchange natural gas prices increased 28% from $2.42/Mcf in 2016 to $3.09/Mcf in 2017.

In 2017, US crude oil production averaged 9.3 million b/d, up from 8.8 million b/d a year earlier. Natural gas marketed production totaled 28.8 MMcfd compared with 28.48 MMcfd in 2016.

Meantime, the US oil and gas industry also benefits from the new tax bill passed by Congress in December 2017 that lowered the corporate tax rate to 21% from 35%.

Refining margins in the US also were higher in 2017 compared with 2016, thanks to rising US crude production, increased product demand, and reduced crude runs because of Hurricane Harvey. According to Muse, Stancil & Co., refining cash margins for the full-year 2017 averaged $13.95/bbl for Midwest refiners, $16.59/bbl for West Coast refiners, $9.67/bbl for Gulf Coast refiners, and $5.05/bbl for East Coast refiners. In 2016, these refining margins were a respective $11.14/bbl, $14.18/bbl, $9.25/bbl, and $3.73/bbl.

A sample of 9 oil and gas producers and pipeline companies with headquarters in Canada posted combined net earnings of $19.48 billion (Can.) on revenues of $177.53 billion compared with net earnings of $4.02 billion on revenues of $139.79 billion in the prior year.

The Canadian producers benefited from higher average benchmark crude oil prices, including Western Canadian Select, which increased 32% compared with 2016. In 2017, the average differential between WCS and WTI narrowed from the previous year but widened significantly towards the end of last year and into 2018. The Canadian dollar averaged 77¢ in 2017, an increase of about 2¢ from 2016.

US oil and gas producers

ExxonMobil Corp. reported 2017 net earnings of $19.85 billion on revenues of $244.36 billion compared with net earnings of $8.37 billion on revenues of $208.11 billion a year earlier.

ExxonMobil’s worldwide upstream earnings were $13.4 billion, up from $13.2 billion in 2016. US upstream earnings were $6.6 billion in 2017, including $7.6 billion of tax reform benefits and asset impairments of $521 million. US upstream earnings excluding tax reform and impairments were a loss of $459 million.

On an oil-equivalent basis, worldwide production of 4 million b/d was down 2% compared with 2016. Liquids production of 2.3 million b/d decreased 82,000 b/d as field decline and lower entitlements were partly offset by increased project volumes and work programs. Natural gas production of 10.2 bcfd increased 84 MMcfd from 2016 as project ramp-up, primarily in Australia, was partly offset by field decline and regulatory restrictions in the Netherlands.

ExxonMobil’s downstream earnings of $4.2 billion decreased by $2.35 billion from 2015 because of weaker refining and marketing margins. Chemical earnings of $4.6 billion increased by $197 million from 2015 with stronger margins.

Chevron reported net earnings of $9.2 billion for full-year 2017 compared with a net loss of $431 million in 2016. Included in 2017 were noncash provisional tax benefits of $2.02 billion related to US tax reform, gains on asset sales of $1.44 billion, and impairments and other noncash charges of $840 million. Foreign currency effects decreased earnings in 2017 by $446 million.

Chevron Corp.’s upstream earnings in the US were $3.64 billion in 2017 compared with a loss of $2.05 billion in 2016. International upstream earnings were $4.51 billion in 2017 compared with a loss of $483 million in 2016. The company’s worldwide net oil-equivalent production was 2.73 million b/d for the full year 2017 compared with 2.59 million b/d from the prior year.

Chevron’s US downstream operations earned $2.94 billion in 2017 compared with $1.31 billion in 2016. The increase benefited from US tax reforms, higher refining margins, lower operating expenses, and asset impairments. Chevron’s international downstream earned $2.28 billion in 2017 compared with $2.13 billion in 2016 because of higher gains on asset sales.

ConocoPhillips reported a 2017 net loss of $793 million compared with a net loss of $3.56 billion in 2016. The company achieved full-year production—excluding Libya—of 1.35 million boe/d compared with 1.56 million boe/d for the same period in 2016. Excluding the impact of dispositions, underlying production increased 32,000 boe/d, or 3%.

In 2017, cash provided by operating activities was $7.1 billion, exceeding $4.6 billion in capital expenditures and investments and dividends of $1.3 billion. In addition, ConocoPhillips received cash proceeds from asset dispositions of $13.9 billion, paid $7.9 billion to reduce debt, and repurchased company common stock for $3 billion.

EOG Resources Inc. realized a net income of $2.58 billion during 2017 compared with a net loss of $1.09 billion for 2016. Wellhead crude oil and condensate revenues in 2017 increase $1.94 billion, or 45%, due primarily to a higher composite average price and an increase in production.

During 2017, EOG completed 172 net wells in the Permian basin and 217 net wells in the Eagle Ford play. In 2018, the company expects to complete 240 net wells in the Permian and 260 net wells in the Eagle Ford.

Thanks to higher unhedged realized prices, Devon Energy Corp. reported net earnings of $1.07 billion in 2017 compared with a net loss of $1.45 billion in 2016. The company’s production declined in 2017 because of its US noncore divestitures that occurred throughout 2016 and 2017. Retained production volumes decreased because of reduced completion activity in the Eagle Ford and natural production declines in the Barnett shale. These decreases were partially offset by expanding drilling and performance in the STACK.

Supported by improved commodity prices and sales, Range Resources Corp. reported net earnings of $333.1 million for 2017 compared with a net loss of $521.4 million in 2016. The company’s total gas production reached 490.3 bcf in 2017, an increase of 30% from 2016. Its total NGL production totaled 35.7 million bbl (including ethane) last year, an increase of 28% from the 2016 level. Drilling in the Marcellus shale in Pennsylvania drove production growth. In addition, the merger with Memorial Resources Development Corp. in September 2016 also positively impacted 2017 production.

Marathon Oil Corp. reported a net loss of $5.7 billion in 2017 compared with a net loss of $2.1 billion in 2016. In second-quarter 2017, Marathon closed on the sale of its Canadian business that included its oil sands mining segment and exploration stage in-situ leases. The sale resulted in an aftertax noncash impairment charge of $4.96 billion.

Chesapeake Energy Corp. reported a net income of $953 million in 2017 compared with a net loss of $4.39 billion in 2016. Chesapeake’s oil, gas, and NGL unhedged revenue increased 18% year-over-year because of an increase in average price, despite a 14% reduction in production volumes sold.

Refiners

For 2017, Valero Energy Corp. reported net income of $4.15 billion compared with $2.42 billion for 2016. The increase is mainly because of a $1.9 billion income tax benefit in 2017 resulting from the provisions under tax reform. Adjusted operating income was $3.7 billion in 2017 compared with $2.9 billion in 2016.

Valero’s refining segment margin increased $1.2 billion in 2017 compared with 2016 because of improved distillate and gasoline margins and higher throughput volumes, partially offset by lower discounts on sour crude oil and other feedstocks, higher cost of biofuel credits, and higher operating expenses. Ethanol segment adjusted operating income decreased $118 million because of lower ethanol and corn related coproducts prices.

Marathon Petroleum Corp. reported net earnings of $3.8 billion for 2017 compared with earnings of $1.21 billion in the previous year. The firm’s refining and marketing segment reported full-year income from operations of $2.32 billion, a $964-million increase over 2016. Results were largely driven by higher LLS-based blended crack spreads and higher utilization rates. Numerous monthly process unit and production records were achieved in both the fourth quarter and throughout the year, including monthly records for crude throughput and gasoline and distillate production.

Phillips 66’s 2017 net earnings were $5.24 billion compared with $1.64 billion in 2016, reflecting recognition of a $2.7 billion provisional income tax benefit from the enactment of the Tax Act in December 2017. Other factors included higher refining margins and aftertax gains from the consolidation of Merey Sweeny LP. These increases were partially offset by increased chemicals segment costs due to Hurricane Harvey, lower marketing margins, and higher interest and debt expense.

Net earnings of Andeavor were $1.68 billion in 2017, up from $860 million in 2016, primarily because of a $918-million benefit related to the impact of federal tax reform and the Western Refining Acquisition, partially offset by higher general and administrative costs and interest and financing costs. Andeavor’s operating income increased slightly to $1.52 billion during 2017 compared with $1.48 billion in 2016.

Canadian firms

All financial figures in this section are presented in Canadian dollars unless noted otherwise.

Suncor Energy Inc. reported a full-year 2017 net income of $4.45 billion compared with net income of $445 million in the prior year, resulting from improved benchmarks for crude oil pricing and refinery crack spreads, new production and sales records in 2017, and the sustainment of cost savings achieved between 2014 and 2016.

Suncor’s 2017 total upstream production was 685,300 boe/d, a 10% increase from 2016. Production successfully achieved at both of Suncor’s key growth projects, Fort Hills and Hebron. Oil sands production increased to 429,400 b/d in 2017 from 374,800 b/d in 2016. Oil sands operations cash operating costs decreased to $23.80/bbl in 2017 from $26.50/bbl in 2016.

Downstream, a record crude throughput of 441,200 b/d was achieved in 2017 compared with 428,200 b/d in the prior year.

Cenovus Energy ended 2017 with earnings of $3.4 billion compared with a net loss of $545 million in 2016. Paying down debt and reducing costs remain priorities for Cenovus. As part of its strategy to refocus its portfolio and deleverage its balance sheet, Cenovus successfully completed the sale of its four-conventional oil and gas assets for combined gross cash proceeds of $3.7 billion. The company repaid and retired its $3.6 billion bridge facility prior to yearend. The Suffield asset sale, which was announced in fourth-quarter 2017, closed on Jan. 5 for gross cash proceeds of $512 million.

In 2017, the company achieved refining and marketing operating margin of $598 million compared with $346 million a year earlier. The increase was largely the result of higher average market crack spreads and stronger margins on the sale of secondary products such as gas liquids. Narrower heavy crude oil differentials and the strengthening of the Canadian dollar relative to the US dollar in 2017 compared with 2016 partially offset the increase.

Imperial Oil Ltd. reported full-year earnings of $490 million for 2017, reflecting a noncash impairment charge of $566 million associated with the Horn River development and the Mackenzie gas project. The 2017 results compare with net income of $2.16 billion for 2016, which included a gain of $1.7 billion from the sale of retail sites.

The company’s gross oil-equivalent production averaged 375,000 b/d compared with 386,000 b/d in 2016. Upstream recorded a net loss of $706 million in 2017. Excluding impairment charges, the net loss of $140 million compares to a net loss of $661 million in 2016, benefitting from higher Canadian crude oil realization and higher Kearl volumes.

The company’s refinery throughput averaged 383,000 b/d, up from 362,000 b/d in 2016. Capacity utilization increased to 91% from 86% in 2016, reflecting reduced turnaround maintenance activity.

TransCanada Corp.’s 2017 earnings were $3.39 billion compared with earnings of $485 million in 2016. Excluding US tax reform adjustment, gains or losses on asset sales, and other specific items, TransCanada’s comparable earnings were $2.69 billion in 2017 and $2.1 billion 2016, respectively.