Norway's Johan Sverdrup to increase NCS production

Johan Sverdrup field, scheduled to come on stream in late 2019, is expected to increase Norway's oil and gas production. Illustration of Phase 2 from Statoil.

Paula Dittrick

OGJ Upstream Technology Editor

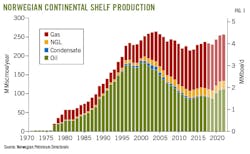

Oil and natural gas production on the Norwegian Continental Shelf in 2022 is forecast to rival record 2004 production, the Norwegian Petroleum Directorate (NPD) said. But production is expected to decline until 2020 when Johan Sverdrup field is scheduled to come on stream.

The North Sea field, discovered in 2010, has estimated resources of 2-3 billion boe and is among the biggest NCS discoveries, operator Statoil said. Johan Sverdrup reservoirs feature a fault-bounded trap against the Southern Utsira Basement High and overlying Jurassic shales and Cretaceous Asgard marls. The main reservoirs consist of a sequence of Middle and Upper Jurassic sandstones.

Johan Sverdrup is being developed in phases. Phase 1 is expected to start in late 2019 with production capacity estimated at 440,000 b/d. Phase 2 is expected to start in 2022, with full field production estimated at 660,000 b/d.

Statoil holds 40% interest. Partners are Lundin Norway with 23% interest, Petoro 17%, Aker BP 12%, and Maersk Oil 8%. Peak production on Johan Sverdrup will make up 25% of all Norwegian production, Statoil said.

Oil accounted for most of Norway's record 2004 production. Natural gas is expected to account for about half of anticipated 2023 production, said NPD's January 2018 report, "The Shelf in 2017."

NCS total production increased in 2017 for a fourth consecutive year. Preliminary figures show 236.4 million standard cu m of oil equivalent (MMscmoe) sold in 2017, 2.7% more than 2016. Fig. 1 shows 2018 total production forecast to fall slightly to 233 MMScmoe.

Oil production fell marginally in 2017 to 1.59 million b/d from 1.61 million b/d in 2016. NPD forecast oil production will fall to 1.55 million b/d for 2018.

Unplanned maintenance on Goliat field in the Barents Sea caused overall 2017 NCS oil production to drop. Operator Eni Norge received authorization from the Norwegian Petroleum Safety Authority to restore full Goliat production following required modifications stemming from a September 2017 audit of the field's electrical safety.

Production initially started in 2016 from Goliat on Production License 229 in an ice-free area following numerous delays and cost overruns. Eni calls Goliat the world's northernmost producing offshore oil field. The cylindrical floating production, storage, and offloading vessel stationed at Goliat and built to withstand harsh Arctic conditions, can hold 1 million bbl of oil.

Gas sales climb

Fig. 2 shows Norwegian gas sales reached a record 124.2 billion standard cu m (bscm) in 2017, 6.6% higher than NPD had forecast a year earlier. "This is due, in part, to consistently high demand for gas from Europe," the report said.

Stable gas sales are forecast to slightly increase through 2023. But NPD notes the forecast depends on successful drilling, timing of field startups, and actual deliverability of reservoirs.

Approved developments account for 90% of production forecast for 2018-22. Improved recovery from existing fields will make up the other 10%. After 2020, production also is expected to come from discoveries currently awaiting development decisions.

Norwegian fields are producing more than previously anticipated, which NPD attributed to improved drilling and efficiency.

As of Dec. 31, 2017, NPD reported 85 fields producing on the NCS, five of which came on stream that year. Companies submitted plans for development and operation (PDOs) of 10 new projects during 2017.

"If production is to be maintained at a high level also beyond 2025, more profitable resources must be proven…. Therefore, the Norwegian Petroleum Directorate believes that exploration activity must be increased from today's level, in both mature and frontier areas," said NPD Director Gen. Bente Nyland.

Separately, Rystad Energy reports a rebound in offshore project commitments worldwide with Norway being the leader.

"Service companies have been squeezed quite tightly for the past few years, but the developments in 2017 in Norway and elsewhere show the future is brightening," said Audun Martinsen, Rystad Energy vice-president, oil field services research.

Fig. 3 shows production from as-yet undiscovered resources becoming increasingly important closer to 2030. NPD reports 34 exploration wells completed in 2017, of which 17 were in the Barents Sea, 12 in the North Sea, and 5 in the Norwegian Sea.

Uncertainty as to undiscovered resources is greatest in the Barents Sea where exploration only started in 1980. Exploration in the North Sea, by contrast, began in the mid-1960s so more plays have been confirmed there.

In 2017, the NPD increased its estimates for Norway's undiscovered resources based on mapping of unopened areas in the northern Barents Sea. Nyland said nearly two‐thirds of the undiscovered resources are in the Barents Sea.

NPD believes Barents Sea resources are about 80% higher than it estimated in 2015. Resource estimates for the North Sea and Norwegian Sea are unchanged.

Costs decreasing

The average cost per exploration well was $30 million in 2017, about half the 2013-14 well cost. The largest 2017 discovery was Lundin Petroleum's Filicudi oil and gas discovery in the southern Barents Sea (10-20 MMcmoe). Filicudi involves Jurassic and Triassic sandstone reservoirs.

Submitted plans for 2018 indicate most NCS exploration wells will be drilled in the North Sea. Overall NCS exploration and production costs have decreased since 2014 following changes in project planning, execution, and operations that improved efficiency. The changes also simplified and standardized best operating procedures.

Development project costs have dropped 30-50% since 2014 when oil prices worldwide slumped. Operating costs are 30% lower since 2013-14, partly as a result of streamlining and supplier discounts. But suppliers are expected to raise prices as activity increases.

"The projects now being approved generally…can tolerate an oil price as low as $30‐40/bbl," Nyland said.

The NPD forecasts total investment of $15.3 billion in 2018, rising to about $17.6 billion in 2019.

Meanwhile, nine field developments are ongoing. North Sea developments are Johan Sverdrup, Martin Linge, Utgard, Oda, and Hanz fields. Norwegian Sea developments are Aasta Hansteen, Dvalin, Bauge, and Trestakk.

Plans for new projects and anticipated projects to be submitted in 2018-19 have a total estimated investment of about $30 billion. But NPD said few major new projects are under consideration.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.