OGJ Newsletter

GENERAL INTEREST Quick Takes

China, Philippines sign oil and gas MOU

The governments of China and the Philippines have signed a memorandum of understanding for cooperation in oil and gas exploration and development, easing a territorial dispute in the South China Sea. The MOU was one of a series of documents signed during meetings in Manila between Chinese President Xi Jingping and Philippines President Rodrigo Duterte.

In 2016, the Philippines government won a United Nations arbitration challenge to China’s claim to nearly all the South China Sea. Brunei, Malaysia, Taiwan, and Vietnam also challenge the Chinese territorial assertion (OGJ Online, Mar. 26, 2018).

The Philippines wants to include an area it calls Rector Bank, which China calls Reed Bank, in a future licensing round. It suspended exploration of the area in 2014 because of the territorial dispute but wants exploration to advance before deepwater Malampaya gas field offshore Palawan depletes. The country depends heavily on Malampaya gas for power generation.

Duterte has not pressed for enforcement of the arbitration ruling. His government began discussing joint exploration with China last year (OGJ Online, Aug. 17, 2017).

In a joint statement in Manila, the governments agreed “to exercise self-restraint in the conduct of activities in the South China Sea that would complicate or escalate disputes and affect peace and stability.”

The oil and gas MOU calls for the formation of a steering committee involving the countries’ foreign and energy ministries to produce cooperation agreements within 12 months.

Australia’s treasurer blocks CK’s APA acquisition

Australia’s Treasurer Josh Frydenberg has made his final decision to block CK Asset Holdings Ltd.’s proposed $13-billion acquisition of Sydney-based gas pipeline operator APA Group, saying it would be contrary to the national interest.

“I have formed this view on the basis that it would result in a single foreign company group having sole ownership and control over Australia’s most significant gas transmission business,” Frydenberg said.

Last month the Australian government decided against the acquisition citing national security concerns (OGJ Online, Nov. 9, 2018).

“My decision is not an adverse reflection on CK Group or the individual companies. CK Group companies are already a substantial investor in Australia’s gas and electricity sectors and a significant provider of infrastructure services that millions of Australians rely upon. The Australian government welcomes CK Group’s investments in Australia and its broader contribution to the Australian economy,” the treasurer said.

Frydenberg added that he considers each foreign investment proposal on its merits.

CO2 storage project off UK wins early nod

A project that would store carbon dioxide in a deep saline aquifer off the UK has won an early nod from the Scottish government. Crown Estate Scotland awarded a lease option to Acorn CCS, a project of Pale Blue Dot Energy, that would capture CO2 emitted by industries near the St. Fergus Gas terminal and transport it offshore through existing pipelines.

The CO2 would be injected into the Early Cretaceous Captain sandstone 2 km below the seabed about 100 km offshore in the Central North Sea. Blue Dot Energy said the lease option is a precursor to a full storage lease that allows Acorn CCS to advance detailed studies. Crown Estate Scotland said the lease option is the first it has granted for CO2 storage.

UK Clean Gas Project partnership forms

OGCI Climate Investments is entering a strategic partnership with six oil and gas companies to advance the Clean Gas Project at Teesside that is to include the country’s first commercial, full-chain carbon capture, utilization, and storage program.

The project is to anchor the Tees Valley CCUS Cluster, which will capture carbon dioxide emitted by new power generators fueled by natural gas and by area industries. The CO2 will be carried by pipeline for injection below the southern North Sea.

OGCI Climate Investments was formed by CEOs of 13 companies in the Oil and Gas Climate Initiative, which seeks practical action on climate change (OGJ Online, Sept. 20, 2018).

Its Clean Gas Project partners are OGCI members BP, Eni, Equinor, Occidental Petroleum, Shell, and Total.

Industry groups ask Congress not to extend EV credit

The American Fuel & Petrochemical Manufacturers, American Petroleum Institute, and three other national trade associations asked Republican leaders on Nov. 19 not to extend or expand the federal tax credit for electric vehicles (EV) during the rest of this session of the US Congress.

“We encourage the House and Senate to build on tax reform and not take a step backward by expanding the EV tax credit this Congress,” said the groups, which also included the Petroleum Marketers Association of America, Society of Independent Gasoline Marketers of America, and National Association of Convenience Stores.

“Even if the new policy has a phaseout year, once it is included as part of tax extenders, it is very likely to be renewed year-by-year,” they said in their letter.

The EV tax credit is particularly bad policy because it’s a giant transfer to wealthy Americans, the groups said. “According to the congressional Joint Committee on Taxation, 78% of the individual filers for the credit make more than $100,000/year and receive 83% of the credits,” they said.

Automakers are investing billions of dollars in EV research and development, the letter said. “Sales of EVs are increasing, and product offerings are growing. These vehicles should compete for customers without government choosing sides,” it said.

“In summary, it is unwise public policy to subsidize a highly inefficient means of [greenhouse gas] reduction that primarily benefits the wealthy, driving up the deficit or forcing taxpayers to make up the difference,” the groups said.

DNO makes cash offer for Faroe shares

DNO ASA, Oslo, made an unsolicited cash offer for all shares of Faroe Petroleum PLC that it does not own. The Norwegian firm acquired 15.37% of Faroe earlier this year from Delek Group Ltd. and now owns 28.22% (OGJ Online, Apr. 4, 2018).

Faroe has exploration, development, and producing interests off the UK, Norway, and Ireland.

DNO estimated the value of its offer at £443.8 million on a fully diluted basis--£402.6 million for currently issued share capital it doesn’t own and the rest for outstanding share options of directors, managers, and employees.

It said its offer represents a 20.8% premium to the target company’s Nov. 23 share price.

Exploration & DevelopmentQuick Takes

Shell lets contract for Great White Frio

Shell Exploration & Production Co. has let subsea umbilical and flowline installation contract to McDermott International Inc. for the Great White Frio development in Alaminos Canyon Block 857 in the Gulf of Mexico.

The project’s scope includes project management and engineering; installation of a flexible flowline from the well to a pipeline end termination; installation of one 2,000-ft steel flying lead; and installation of two electrical flying leads (EFLs) in 8,000 ft of water. Project management and engineering are to be performed in Houston with offshore installation targeted for completion in mid-2019.

The Shell Offshore Inc.-operated Great White development is a deepwater oil and gas project that has unlocked a frontier of energy development in the gulf’s Lower Tertiary Paleogene formation. The Shell-operated Perdido Regional Host production hub, which saw first production in 2011, processes oil and gas from Silvertip, Great White, and Tobago fields. The Perdido Host has the capacity to handle 100,000 bbl of oil and 200 MMcfd of gas.

Gas found in Elixir’s Mongolian CSG play

Perth-based Elixir Petroleum Ltd. has a risked best estimate recoverable coal seam gas prospective resource of 7.6 tcf in its wholly owned Nomgom IX prospect in southern Mongolia according to global independent petroleum reserves and resources auditor ERC Equipoise Pte. Ltd.

The Nomgom IX production-sharing contract is in the southern Gobi Desert close to market in northern China.

The report adds that the best estimate unrisked recoverable gas prospective resource figure is 40 tcf.

The independent report was prepared for Golden Horde Ltd., a company that Elixir intends to acquire pending shareholder approval at a meeting next week. Golden Horde is a private company in South Australia established in 2011 with the sole purpose of building a coal seam gas project in Mongolia.

Elixir said the resource assessments were estimated using probabilistic methods from information including gravity and magnetic data, detailed field mapping and interpretation of relevant core-hole logs within the PSC.

Other input parameters include net coal thickness, coal density, gas content, ash, and moisture content.

Elixir says the PSC encompasses about 7 million acres containing known thermal coal deposits and has a 10-year exploration period.

Following completion of an environmental impact study, the exploration program will begin with a 2D seismic acquisition program scheduled for May 2019 to identify locations for an initial drilling program later in 2019.

Drilling & ProductionQuick Takes

Chevron starts production from Big Foot field

Chevron Corp. has started crude oil and natural gas production from the deepwater Big Foot project in the Gulf of Mexico.

Big Foot field, discovered in 2006, is estimated to contain more than 200 million boe of total recoverable resources with a projected production life of 35 years. The project uses a 15-slot drilling and production tension-leg platform in 5,200 ft of water 225 miles south of New Orleans, with a design capacity of 75,000 bo/d and 25 MMcfd of gas (OGJ Online, Dec. 16, 2010).

BP starts up Clair Ridge production

BP PLC reported the start of oil production from the Clair Ridge project 75 km west of the Shetland Islands. Clair Ridge is a multibillion investment in the second phase of development of Clair field comprising two bridge-linked platforms and pipeline systems to connect storage and redelivery facilities on Shetland.

The new facilities are designed for 40 years of production. The project has been designed to recover an estimated 640 million bbl of oil with production expected to ramp up to a peak at plateau level of 120,000 b/d, BP said.

BP describes Clair Ridge as the first sanctioned large-scale offshore enhanced oil recovery scheme using reduced salinity water injection to extract a higher proportion of oil over the life of the field. Over the life of the development, up to an additional 40 million bbl could be cost-effectively recovered.

The project also included new pipeline infrastructure with the installation of a 5½-km, 22-in. oil export pipeline tying into the Clair Phase 1 export pipeline. A 14.6-km, 6-in. gas export pipeline tying Clair Ridge into the West of Shetland Pipeline Systems (WOSPS) also was also installed. The WOSPS transports gas from West of Shetland to the Sullom Voe terminal.

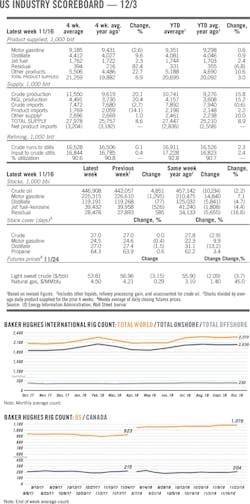

Another flat drilling year seen for Canada

Another flat drilling year is in prospect for Canada, according the Canadian Association of Oilwell Drilling Contractors.

The association projects drilling of 6,962 oil and gas wells in 2019, up 51 from the total forecast for 2018, which is little changed from the prior year. CAODC projects operating days to increase 507 from 2018 to 69,617.

Suppression of Canadian crude prices relative to the West Texas Intermediate marker and related pipeline delays “will continue to curtail capital expenditures,” CAODC said.

The group expects the drilling rig fleet to decrease by 58 units to 522 as rigs move to the US. This year, CAODC members delisted 26 rigs, 11 of which moved to the US.

“Once again the politicization of oil and gas infrastructure in Canada, along with increased taxation and regulatory requirements, resulted in significant delays and additional costs for Canadian producers and sustained price differentials for Canadian crude blends,” CAODC said.

CAODC Pres. Mark Scholz said, “The Canadian oil and gas industry is simply too dysfunctional to anticipate any kind of quick recovery…Our members are on life support.”

OGUK trims decommissioning-cost outlook

Expected spending on decommissioning of oil and gas facilities off the UK is down from earlier forecasts. In an annual report, the trade group Oil & Gas UK projects spending of £1.5 billion/year during 2018-27, about 20% less than it forecast last year.

Although some of the decline reflects work delayed beyond the 10-year forecast period, OGUK says, “real-world decommissioning experience is also driving new efficiencies.”

Decommissioning accounted for about 8% of total spending by the oil and gas industry on the UK Continental Shelf. Decommissioning is planned for 1,465 wells, about one fifth of the UKCS total, and topsides weighing a total 605,000 tonnes.

OGUK expects 48% of UK spending on decommissioning to occur in the central North Sea, 30% in the northern North Sea, 15% in the southern North Sea, and 7% west of the Shetlands.

Well plugging and abandonment will account for 49% of the forecast spending. Topsides and substructure removal will account for 13% of total spending, subsea infrastructure removal 11%, the costs of running facilities after production ceases just under 10%, and onshore disposal just over 2%.

President Energy expands Argentine holdings

President Energy PLC, Leeds, UK, has acquired two concessions with existing wells and infrastructure in the Nequen basin of Argentina from Rio Negro Province.

The company paid $9.904 million for 90% operating interests in the Las Bases and Puesto Prado concessions, where proved oil and gas reserves are estimated at 1 million boe. Provincially owned EDHIPSA holds the other 10%.

The concessions include 60 km of natural gas pipeline linked with a system on the company’s Estancia Vieja Concession.

The company expects to restart oil production from shut-in wells on the Puesto Prado Concession and gas production from wells on the Las Bases Concession at undetermined rates before yearend.

It’s testing the pipeline between Estancia Vieja and Puesto Prado for possible delivery of gas to generate electricity for Puesto Prado facilities.

Subject to subsurface reviews and partner approval, it might drill at least one gas well at Las Bases in the first half of 2019.

AD0NOC set to expand carbon-capture program

Abu Dhabi National Oil Co. will decide soon where to expand its carbon capture, utilization, and storage (CCUS) program in pursuit of its goal of capturing 250 MMscfd of carbon dioxide for use in enhanced oil recovery before 2030.

ADNOC Onshore, with its Al Reyadah project, now captures as much as 40 MMscfd of CO2 from Emirates Steel Industries facilities, according to Omar Suwaina Al Suwaidi, ADNOC executive office director. He told the International Carbon Capture Utilization and Storage Summit in Edinburgh that the next step in ADNOC’s CCUS program will occur at the Shah gas plant or Habshan-Bab gas processing facilities.

The plant at Shah gas field, built by ADNOC and Occidental Petroleum Corp., processes 1.3 bscfd of gas and condensate containing more than 20% hydrogen sulfide and 10% CO2.

With modification, Al Suwaidi said, the plant could capture 120 MMscfd of CO2 during sulfur recovery.

The Habshan-Bab complex, which can process 6.2 bscfd of associated gas, could capture 100 MMscfd of CO2, Al Suwaidi said.

He said ADNOC will select the facility for the next CCUS work in 2019.

PROCESSINGQuick Takes

Aramco seeks upstream-downstream ‘balance’

Saudi Aramco will invest more than $100 billion in chemicals over the next 10 years while seeking “a better balance between our upstream and downstream segments,” says the company’s president and chief executive officer.

The investment figure excludes “a prospective acquisition,” Amin H. Nasser told the Gulf Petrochemicals Association Forum in Dubai. Aramco is negotiating to buy the Saudi government’s 70% share of petrochemical manufacturer Saudi Basic Industries (SABIC; OGJ Online, July 24, 2018).

Nasser said Aramco seeks 8-10 million b/d of integrated refining and marketing capacity. He noted that the chemical share of oil demand is expected to expand from about one-third to nearly half by 2050. With investments in Saudi Arabia and high-growth countries such as China and India, Nasser said, Aramco targets capacity for conversion of crude oil into petrochemicals of 2 million b/d. “And we may eventually move our target higher to 3 million bbl,” he said.

Aramco and SABIC plan to build a 400,000-b/d crude-to-petrochemicals complex at Yanbu (OGJ Online, Nov. 1, 2018).

Alberta expands petrochemical incentives

The government of Alberta is increasing its financial incentives for investment in petrochemical development based on oil and gas produced in the province.

It is expanding its March commitment of as much as $1 billion (Can.) in royalty credits and loan guarantees to attract petrochemical investment and expand infrastructure for petrochemical feedstocks (OGJ Online, Mar. 13, 2018).

That round of incentives added to $1 billion the province announced in February to support partial upgrading of bitumen.

The move adds $600 million in future royalty credits to the $500 million offered in the March commitment. The other $500 million in the March announcement was for loan guarantees.

In an earlier program, Alberta in 2016 committed $500 million in royalty credits for petrochemical projects.

Under both programs, the government has received 23 applications for investments potentially exceeding $60 billion.

“We’re fighting for Albertans to make sure we get every dollar of value for the oil and gas resources that belong to them, Premier Rachel Notley said in a statement. “For decades, we’ve been settling for less while seeing new jobs and investment go south of the border. The time is now to think big, take action and finally upgrade more of our energy at home.”

KNPC plans to boost refining capacity

Kuwait National Petroleum Corp. plans to increase Kuwait’s refining capacity to 2 million b/d by 2035.

KNPC Chief Executive Officer Mohammad Al-Mutairi discussed the plans with reporters at an event launching the company’s strategy for 2040.

Start-up next year of the 615,000-b/d Al-Zour refinery will push capacity to nearly 1.4 million b/d, he noted, according to the official Kuwait News Agency (OGJ Online, July 25, 2018).

KNPC is assessing construction of a fourth refinery, probably, like Al-Zour, in southern Kuwait, Al-Mutairi said.

TRANSPORTATIONQuick Takes

Final safety rule issued for plastic gas pipelines

The US Pipeline & Hazardous Safety Administration issued a final rule amending federal safety regulations for plastic pipelines that transport natural and other gases. The final rule’s updates aim to improve safety, allow for expanded use of plastic pipes, and allow or require the use of certain materials or practices, the agency said.

“Advancements in plastic pipe design and manufacturing have resulted in products that are much safer today than they were 20 years ago,” PHMSA Administrator Skip Elliott said. “These regulatory updates will significantly contribute to advancing public safety.”

The final rule will take effect on Jan. 22, 2019.

Updates consider the changing technologies and issues affecting plastic pipe, PHMSA said. They address concerns with installation and operational safety issues associated with plastic pipe, as observed by federal and state inspectors during routine field activities, it said.

Several petitions PHMSA received from manufacturers asked the agency to consider regulatory updates for plastic pipe that align with new manufacturing and design innovations, as well as current best practices in installation, it added.

PHMSA said the final rule will apply only to new, repaired, and replaced pipelines. It said regulatory updates include:

• An increased design factor for polyethylene pipe.

• Updated standards governing the use, maximum pressure limits, and diameters for pipelines made of polyamide 11 and 12 thermoplastics.

• New and expanded plastic pipe installation standards to help mitigate contact with other underground structures.

• Other installation and operational-related provisions for plastic pipe and plastic pipe components.

PHMSA noted that because of the final rule’s features, the cost of materials to produce new plastic pipe will be reduced by about 10%, resulting in a $32 million/year material cost saving for gathering, transmission, and distribution operators.

Yamal LNG cargo transshipped off Norway

Novatek said the Yamal LNG joint venture completed its first ship-to-ship transfer of LNG near the Norwegian port of Honningsvag in a maneuver that lowers transport costs for deliveries from the liquefaction plant at Sabetta in the Russian Arctic.

The Arc7 ice-class Vladimir Rusanov reloaded cargo from Yamal LNG into the Pskov vessel, which has a lower ice class, for onward delivery in Northwest Europe.

Leo Feodosyev, first deputy chairman of Novatek’s management board, said LNG transshipment “allows us to optimize our transport costs by decreasing the travel distance of the Arc7 ice-class tankers and to ensure timely offloading of LNG from [the] Yamal LNG project.”

Other Yamal LNG partners are Total, China National Petroleum Co., and Silk Road Fund.