OGJ Newsletter

GENERAL INTERESTQuick Takes

DOI: Payments to states, tribes rose 26% from 2017

The US Department of the Interior’s Office of Natural Resources Revenue distributed $8.93 billion in revenue and royalties from energy produced on federal managed public and Indian tribal land to states, tribes and three special funds, 26% more than the $7.11 billon it distributed in fiscal 2017, Interior Sec. Ryan Zinke said.

“President Trump’s energy dominance strategy is paying off and local communities across America are the beneficiaries,” Zinke said. “This critical source of funding will be used for educational and infrastructure improvements and land and water conservation projects, and to create good-paying American jobs.”

Often the second-highest generator of federal income following taxes, energy revenue disbursements are a critical funding source for states and American Indian tribes to which they otherwise would not be available because they aren’t able to collect local taxes from operations on federally managed land or offshore acreage along the US Outer Continental Shelf.

The disbursements also provide important contributions to the Land and Water Conservation Fund (LWCF), Reclamation Fund, and Historic Preservation Fund. Of the 35 states receiving federal energy revenue disbursements during the 12 months ended Sept. 30, New Mexico received $634.9 million, followed by Wyoming ($563.9 million), Colorado ($112.5 million), Louisiana ($91 million), and Utah ($76 million).

More than $1 billion was disbursed to tribes and individual Indian mineral owners; $1.22 billion to the Reclamation Fund; $893 million to the LWCF; more than $76 million from 2007 Gulf of Mexico Energy Security Act revenue to the LWCF; $150 million to the Historic Preservation Fund; and the remaining $3.5 billion to the US Treasury, ONRR said.

Aussie government blocks CK’s acquisition of APA

The Australian government has decided against the Hong Kong-based CK Group’s $13-billion (Aus.) bid to acquire gas pipeline operator APA Group, Sydney, citing national security concerns.

Treasurer Josh Frydenberg said the proposed acquisition of APA lead to an undue concentration of foreign ownership by a single company group in one of Australia’s most important gas transmission businesses. Frydenberg said he would make a final decision within weeks.

CK Group is headed by Hong Kong businessman Victor Li. If the acquisition had gone through, CK would control pipelines that deliver half of the country’s gas. CK’s portfolio in Australia already includes power distributor Duet Group.

Frydenberg pointed out that his preliminary view was not an adverse reflection on CK Group or the individual companies, saying that the government welcomes CK Group’s investments in Australia and its broader contribution to the economy.

The knock-back comes despite the deal being cleared by the Australian Competition and Consumer Commission (ACCC) in September after CK Group agreed to sell natural gas pipeline and storage infrastructure assets in Western Australia to allay monopoly fears. However, Frydenberg said concentration of foreign ownership was not a question looked at by the ACCC.

The Australian Foreign Investment Review Board assessed the deal for the government. It did not reach a unanimous decision but did express concerns about aggregation and the national interest implications of such a dominant player in the gas and electricity sectors over the long term.

CK Group has previously been blocked when its bid for the electricity network Ausgrid was declined in 2016 on similar grounds of undermining national security.

Eni, Cadogan exiting Ukraine shale gas group

Eni SPA is withdrawing its controlling interest from a group that holds five shale gas licenses in Ukraine, reports partner Cadogan Petroleum PLC, London. Cadogan said Eni will pay it $1.715 million for a commitment not to exercise preemptive rights to Eni’s transfer of a 50.01% of Westgasinvest LLC to Nadra Ukrayny, holder of 34.99% of the consortium.

Cadogan also is to transfer its 15% share of Westgasinvestment to Nadra Ukrayny for nominal consideration as well as its interest in the company operating the Debeslavetska and Cheremkhivsko-Strupkivska gas licenses, where production is negligible. Cadogan CEO Guido Michelotti welcomed the chance to withdraw from gas operations he called “subeconomic under the current 70% royalty regime.”

Eni sells Mubadala 20% of block off Egypt

Eni SPA has agreed to sell a 20% participating interest in the Nour North Sinai Offshore Concession in Egypt to Mubadala Petroleum, Abu Dhabi. Eni’s interest before the transaction is 85%. Tharwa Petroleum Co. holds the other 15% of the contractor’s share, where Eni and Tharwa are collectively the contractor in participation with Egyptian Natural Gas Holding Co.

Eni and Tharwa are drilling an exploration well as part of the first exploration period of the 739-sq-km East Nile basin concession, which is 50 km offshore in 50-400 m of water.

Gastar files for bankruptcy, restructures

Gastar Exploration Inc. has filed chapter 11 bankruptcy cases in the Southern District of Texas to implement the terms of its restructuring plan. The company also filed various motions in support of its financial restructuring, noting it intends to continue to pay employee wages and provide healthcare and other benefits without interruption in the ordinary course of business and to pay suppliers and vendors in full under normal terms provided on or after the chapter 11 filing date.

The restructuring has the support of the company’s largest—and only—funded-debt creditor and largest common shareholder, Ares Management LLC and its affiliated funds, as well as all other creditors entitled to vote to accept or reject the plan. Ares will provide $100 million in new financing to fund ongoing business operations as Gastar moves through the bankruptcy process, which it intends to conclude by yearend.

The plan, which is subject to confirmation by the bankruptcy court, will leave obligations owing to trade creditors and other operational obligations unimpaired, eliminate more than $300 million of the firm’s funded-debt obligations and preferred equity interests, and cancel common equity interests.

Early in the year, the company restarted its single-rig drilling program to more fully delineate and develop the Meramec and Osage formations in its core STACK position. Drilling and completions operations were halted in August.

Exploration & DevelopmentQuick Takes

Total outlines investment decisions offshore Angola

Total SA executives announced investment decisions to develop satellite fields on Block 17 offshore Angola. The satellite field investments were announced during an inauguration ceremony for the Block 32 Kaomba project, which came on stream in July (OGJ Online, July 27, 2018).

The CLOV Phase 2 project, which requires drilling 7 wells, is expected to come on stream in 2020 with a production plateau of 40,000 b/d. The Dalia Phase 3 project, which requires drilling 6 wells, is expected to come on stream in 2021 with a production plateau of 30,000 b/d.

Zinia 2, CLOV 2, and Dalia 3 together are expected to maintain Block 17’s production plateau above 400,000 b/d until 2023, Total said. Already, the block has produced more than 2.6 billion bbl. The final investment decision for Zinia 2 came earlier this year (OGJ Online, May 29, 2018).

Total has a 40% interest in Block 17, where production averaged 600,000 b/d last year. Partners are Equinor, 23.33%; ExxonMobil 20%; and BP, 16.67%. Sonangol is the concessionaire.

Total, ADNOC to launch unconventional gas exploration

Total SA and Abu Dhabi National Oil Co. (ADNOC) will launch an unconventional gas exploration program in the Diyab play that covers more than 6,000 sq km west of the ADNOC Onshore concession in Abu Dhabi.

The concession allows for two exploration and appraisal phases for a period of up to 7 years, followed by a 40-year development and production period. Total will operate the exploration phase with 40% interest. ADNOC will hold the remaining 60%. In case of positive exploration, the concession will be developed in stages in line with growing gas demand in the UAE and potential export opportunities.

“The Diyab play has the potential to be a high-impact play ranking alongside the most prolific North American shale gas plays,” said Total Chairman and CEO Patrick Pouyanne.

Total has been present in the UAE for nearly 80 years. In 2017, the group’s equity production in Abu Dhabi was 290,000 boe/d.

In partnership with ADNOC, Total holds 20% in the Umm Shaif and Nasr and 5% in the Lower Zakum 40-year concessions; 10% in the 40-year ADNOC Onshore concession; 15% in ADNOC Gas Processing; 5% in ADNOC LNG; and 24.5% in Dolphin Energy Ltd. (OGJ Online, Mar. 19, 2018). In addition, Total owns 100% stake and operates the Abu Al Bukoosh field.

BP, Hess complete Aspy exploration well drilling

The BP Canada-operated Aspy exploration well, drilled 330 km off Nova Scotia, did not find commercial quantities of hydrocarbons, partner Hess reported (OGJ Online, Apr. 23, 2018). The Aspy D-11 was spudded in April and drilled to 7,400 m TD.

BP Canada and Hess hold equal interests in the well. The companies partnered to explore four deepwater licenses offshore Nova Scotia, which combined are equal in size to 600 deepwater Outer Continental Shelf blocks. Although a frontier area, Hess said based on 3D seismic data the geology appears analogous to the deepwater Gulf of Mexico.

BLM to offer 2.85 million acres in NPR-A

The US Bureau of Land Management will offer tracts totaling some 2.85 million acres within the National Petroleum Reserve-Alaska at a Dec. 12 lease sale in Anchorage, the US Department of the Interior agency’s Alaska State Office announced.

The offered tracts support Interior Sec. Ryan Zinke’s goal of strengthening US energy development, BLM Alaska Acting State Director Ted Murphy said. “This year’s lease sale demonstrates our commitment to continue Alaska energy production in [NPR-A] and create jobs and revenue for the state,” Murphy said.

The lease sale will be the 14th in the NPR-A since 1999, where there now are 199 leases covering 1,384,352 acres, Murphy said. Bids received for the 13 previous sales generated more than $282 million, half of which was paid to the state, he said.

Sealed bids must be received by 4 p.m. on Dec. 10 at the BLM’s Alaska State Office. The agency will open sealed bids that are submitted at 10 a.m. on Dec. 12 and will livestream the opening of the bids at blm.gov/live, it said.

OGA: UKCS reserves could last another 20 years

The Oil & Gas Authority estimates the UK Continental Shelf’s proved and probable reserves as of Dec. 31, 2017, were 5.4 billion boe, which could sustain production for at least another 20 years or more based on current production rates.

The report said 400 million boe were added to the categories of proved and probable reserves during 2017. About 600 million boe was produced, which equates to a reserve replacement ratio of 69%. But OGA notes the limited rate of replacement of proved and probable reserves remains a key concern. Many UKCS fields are mature.

Continued development of UKCS petroleum resources will require investment in both new field developments and incremental projects, OGA said, adding UKCS petroleum reserves and discovered resources are 70% oil and 30% natural gas.

Success in 2017 delivered an addition of 181 million boe to the total of contingent resources. A key part of exploration efforts involves the movement of attractive opportunities within the prospective resource assets into drill-ready prospects.

For 2 years, OGA worked with the British Geological Survey to reevaluate the UKCS mapped leads and prospects.

Drilling & ProductionQuick Takes

Jambaran-Tiung Biru drilling due next year

Drilling will start in next year’s second half at the Jambaran-Tiung Biru (JTB) natural gas project in Bojonegoro Regency, East Java, Indonesia. Jamsaton Nababan, president director of Pertamina EP Cepu (PEPC), the operator, said at a press briefing that drilling of two of six planned wells will begin in July, according to the Jakarta Post.

The project results from unitization of Jambaran and Tiung Biru gas fields, which former partner ExxonMobil estimated ultimately can produce 1.6 tcf of natural gas. ExxonMobil Corp. withdrew from the project, in which it held a 45% interest, last year.

JTB production is to reach 192 MMscfd, excluding a carbon dioxide cut of about 30%, according to the press report.

About 100 MMscfd of the sales gas will feed the state electricity generator. The rest will flow to industrial customers in East Java. According to PEPC’s web site, the JTB project is part of a gas development that also will include Cendana field.

PEPC last year let a contract to JGC Corp. of Japan for construction of the 330-MMcfd JTB gas processing plant (OGJ Online, Dec. 6, 2017).

Vedanta receives Rajasthan PSC extension

Vedanta Ltd. unit Cairn Oil & Gas has received its court-directed extension of the production-sharing contract covering oil and gas production in Rajasthan, India.

The Ministry of Petroleum and Natural Gas of India extended the PSC for the RJ-ON-90/1 block by 10 years from May 15, 2020, the day after the scheduled expiration.

The Delhi High Court in May had directed the government to act on the long-delayed extension request.

Cairn has made 38 discoveries on the 2,111-sq-km block, including Mangala, Bhagyam, and Aishwariya oil and gas fields, Rajasthan’s largest.

The company early last year reported average gross operated production in Rajasthan of 157,338 boe/d.

It operates the extended PSC with a 70% participating interest. State-owned Oil & Natural Gas Corp. holds the remainder.

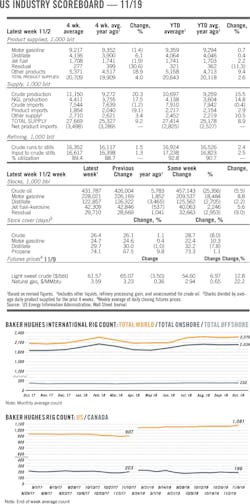

Baker Hughes: US rig count jumps 14 units to 1,081

The US drilling rig count is up 14 units to 1,081 rigs working for the week ended Nov. 9, according to Baker Hughes data. The count is up 174 units from the 907 rigs working this time a year ago. At 1,057 rigs working, 11 more units were drilling on land week-over-week. Offshore units were up 3 to 21 rigs working, while those drilling in inland waters remained unchanged at 3 rigs working for the week.

US oil-directed rigs were up 12 units from the prior week to 886 units working, and up from the 738 rigs drilling for oil the same week a year ago. Gas-directed rigs were up 2 at 195 units, and up from the 169 units drilling for gas a year ago.

Among the major oil and gas-producing states, Oklahoma and New Mexico saw big increases for the week with 4-unit gains each to reach 148 and 106 rigs running, respectively.

Louisiana increased its rig count by 3 to 65. Pennsylvania and Colorado each gained 2 units to reach 45 and 34 working rigs, respectively. North Dakota, 55, and Alaska, 6, were both up a single rig for the week.

Three states were unchanged: Wyoming, 30; West Virginia, 13; and California, 15. Three states saw a single-rig drop: Texas, 532; Ohio, 17; and Utah, 5.

Production restarted from Erskine field

Production from Erskine gas and condensate field in the UK North Sea has been restarted, reported project partner Serica Energy PLC. Formation of gas hydrates had delayed the restart of the field, where production was suspended on Jan. 16 because of a blocked condensate pipeline (OGJ Online, Oct. 12, 2018).

Serica said the remedial action to remove the gas hydrates in the pipeline connecting Erskine field to the Lomond platform had been completed and production from Erskine had restarted and that “flow rates are being optimized.”

Serica added, “Further updates will be provided once the recommissioning process is complete.”

Erskine production last year averaged 36 MMscfd of gas and 5,153 b/d of oil, according to the UK Oil and Gas Authority.

PROCESSINGQuick Takes

EPA issues final rule amendments for refiners

The US Environmental Protection Agency issued final amendments on Nov. 8 to National Emissions Standards for Hazardous Air Pollutants (NESHAP) and New Source Performance Standards (NSPS) for refiners.

EPA said that it proposed amending the regulations in April to clarify the rules’ requirements and to make technical corrections and minor revisions to work practice standards, recordkeeping, and reporting requirements.

An American Petroleum Institute official welcomed the final amendments of the two rules for refiners. The agency’s analyses and years of review confirm that refineries are operating at safe air emissions levels to protect public health, API Regulatory and Scientific Affairs Director Howard J. Feldman maintained.

“Industry is focused on the safe operation of our refineries, the health and safety of our workers and protecting the communities and the environment we work in,” he said. “EPA’s practical clarification to the language of the refinery rule’s regulatory requirements is a positive step that supports our shared goal of protecting public health, while enhancing investments in cleaner fuels that will reduce our environmental footprint.”

Lone Star to build seventh NGL frac facility

Lone Star NGL LLC, a subsidiary of Energy Transfer LP, Dallas, will construct a seventh natural gas liquids fractionation facility at Mont Belvieu, Tex., and expand the Lone Star Express Pipeline providing capacity for transportation commitments secured form the Delaware and Permian basins.

The 150,000 b/d Fractionator VII, scheduled to be operational in first-quarter 2020, is fully subscribed by multiple long-term contracts and will provide the capacity to supplement incremental demand in excess of volumes feeding Fractionators I-VI.

Fractionator V, which was placed in service in July, is fully contracted with long-term commitments and is operating at full capacity. Fractionator VI is under construction and expected to be in service during first-quarter 2019. Fractionator VI is fully contracted with long-term commitments and will have a capacity of 150,000 b/d. With the completion of Fractionators VI and VII, Lone Star will be capable of fractionating over 900,000 b/d at Mont Belvieu supported by long-term fee-based agreements.

The company will expand the Lone Star Express Pipeline by adding 352 miles of 24-in. pipe extending from its system near Wink, Tex., to its 30-in. pipeline south of Fort Worth. The line is expected to be in service by early in fourth-quarter 2020.

TRANSPORTATIONQuick Takes

Phillips 66 launches open seasons for pipelines

Phillips 66 Partners reports that Gray Oak Pipeline LLC will launch a binding expansion open season to solicit shipper commitments for long-term oil transportation services from West Texas. The expansion includes new takeaway capacity from Gray Oak Pipeline origination stations in West Texas to destinations in Corpus Christi and Freeport. Expected to be in service in fourth-quarter 2020, the final scope and capacity will depend on the outcome of the open season.

Separately, Phillips 66 and Bridger Pipeline LLC will launch a joint open season to solicit shipper commitments for the proposed Liberty Pipeline, which will transport crude oil from the Rockies and Bakken areas to Corpus Christi. The pipeline, anticipated to be in service in fourth-quarter 2020, is expected to have an initial throughput capacity of 350,000 b/d.

The company also will launch an open season for the proposed Red Oak Pipeline, which will provide crude oil transportation service from Cushing, Okla., to Corpus Christi, Houston, and Beaumont, Tex. The pipeline, anticipated to be in-service in fourth-quarter 2020, is expected to have an initial throughput capacity of 400,000 b/d.

EnLink gauges interest for Cajun-Sibon NGL line

EnLink NGL Pipeline LP, a unit of EnLink Midstream, launched a binding open season for expansion capacity commitments for common carrier transportation service on its Cajun-Sibon natural gas liquids pipeline system (OGJ Online, Sept. 24, 2014).

The Cajun-Sibon III expansion, a project to expand takeaway capacity from the Mont Belvieu NGL hub region to EnLink’s recently expanded fractionation facilities in Louisiana, is expected to increase current NGL throughput capacity to 185,000 bbl/d. Growth capital expenditures are estimated at $50 million, mostly for adding pump stations along the line.

Fractionation capacity in Louisiana was expanded to 193,000 b/d with a $10-million investment in upgrades to the Eunice and Plaquemine facilities. The additional capacity, along with currently available capacity, is expected to be fully utilized once Cajun-Sibon III is operational, expected in second-quarter 2019. The two projects combine to fractionate 30,000-35,000 b/d of incremental NGLs. Quarterly fractionation volumes are expected to average 180,000-185,000 b/d, taking into consideration various operational factors.

Open season launched for Voyager oil pipeline

Magellan Midstream Partners LP and Navigator Energy Services have launched an open season to assess customer interest to transport various grades of light crude oil and condensate from Cushing, Okla., to Houston.

The proposed Voyager pipeline would include construction of nearly 500 miles of 20-in. line from Magellan’s terminal in Cushing to Magellan’s terminal east of Houston. At the origin, the Voyager pipeline would provide shippers the option to begin deliveries at Cushing from Magellan-operated Saddlehorn pipeline serving the Rockies and Bakken production regions, Navigator’s Glass Mountain pipeline serving the Midcontinent, as well as other connections within the Cushing crude oil hub.

At the destination, Magellan’s Houston crude oil distribution system could further deliver the product to all refineries in the Houston and Texas City areas or to export facilities, such as Magellan’s Seabrook Logistics joint venture terminal. The system is expected to have an initial capacity of 250,000 b/d with the ability to expand. It could be operational by yearend 2020.

Magellan also is evaluating a potential crude oil pipeline from Houston to Corpus Christi, Tex., and a crude oil export terminal on Harbor Island in Corpus Christi capable of loading very large crude carriers.