Steel tariffs complicate Permian pipeline buildout

Natalie L. Regoli

Baker & McKenzie LLP

Houston

If a pipeline company decides to use imported steel for a US project, the Department of Commerce has provided a relief system through which companies may apply for an exemption from the tariffs for “any steel article determined not to be produced in the United States in a sufficient and reasonably available amount or a satisfactory quality.” More than 21,000 requests for exclusions have been submitted to the Commerce Department in response to the new levies.

The exemption process begins with a long application and can take up to 90 days to be completed, making this option less attractive to many than simply swallowing the price increase. Plains All American Pipeline LP chose the tariff-induced price increase for its Cactus II crude oil pipeline project at a cost of $40 million, an increase of 3.6%.

Background

The 2014 oil price crash drove dozens of oil and gas companies into bankruptcy. The market is booming again and production companies that survived are faster and more efficient. Costs have decreased as well, as new computer technology and smart drilling tools have helped drive the improved efficiency. These technological and operational advancements have allowed companies to increase or decrease output more quickly when the market changes. The result is less dramatic price fluctuations in an industry learning to respond to consumer demand more nimbly.

Permian basin oil production has increased by about 55% since April 2016, helping create an unprecedented excess of natural gas. Permian natural gas production is predicted to quadruple by the middle of the next decade, reaching as much as 20 bcfd, far surpassing the region’s available takeaways options. With gas prices around $3/MMbtu and oil around $70/bbl, gas is viewed as disposable. But it needs to go somewhere.

A lack of pipeline infrastructure in West Texas has trapped increasing quantities of Permian gas in the region. The immediate effect is lower gas prices and a forced slowdown of oil output as producers struggle to find a home for the gas. To offset this impact, producers have increased flaring, but environmental regulations limit the amount that can occur. It is estimated that $1 million/day of natural gas is flared in the Permian basin, and Texas state regulators have routinely accommodated requests to flare.

The inability to remove excess natural gas is placing increasing pressure on the Permian market as producers face high demand for oil, transport of which is also constrained. Natural gas production in the Permian has increased 45% since 2016 with no signs of slowing.

Permian pipelines

Bringing new pipeline capacity onstream is a lengthy process. The need for capacity must be recognized and producers willing to ship must be secured. At the other end of the pipeline, gas buyers must commit to a transportation method with enough certainty to move the pipeline project forward.

Plains All American’s Cactus II crude line is fully committed with long-term contracts totaling 525,000 b/d, 425,000 b/d supplied to shippers and the remaining 100,000 b/d associated with long-term acreage dedications. Another 60,000 b/d is reserved for “walk-up” shippers. The project involves combining two new pipelines with an existing pipeline, the first new line stretching from Wink, Tex., to McCamey, Tex., and the second from McCamey to Corpus Christi-Ingleside, Tex. Shipper support for the first project was so positive that Plains plans to conduct a second binding open season, expanding the original project to include origin points in Orla, Wink, Midland, Crane, and McCamey, Tex. Cactus II is expected to be operational third-quarter 2019 at a cost of $1.1 billion.

Plains has also signed a letter of intent with ExxonMobil to build a 1-million b/d pipeline from Wink and Midland, Tex. to delivery points in Webster, Baytown, and Beaumont, Tex.

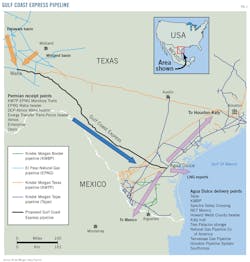

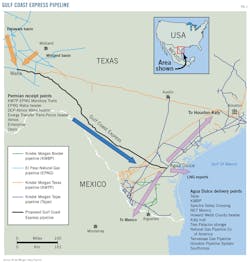

Kinder Morgan Inc. (KMI) is planning the 1.98-bcfd Gulf Coast Express (Fig. 1) natural gas pipeline from Waha, Tex., to Agua Dulce, Tex., to be completed October 2019 and cost $1.75 billion (OGJ Online, Jan. 3, 2018). Delivery to Agua Dulce will provide interconnects with Kinder Morgan’s existing Gulf Coast network and multiple other intrastate and interstate natural gas pipelines. The pipeline, a joint venture between Kinder Morgan, DCP Midstream Partners LP, and Targa Resources, has already committed multiple shippers including DCP, Targa, Apache Corp., Pioneer Natural Resources Co., and XTO Energy Inc.

KMI is also developing the Permian Highway Pipeline (PHP), with EagleClaw Midstream Ventures LLC (a portfolio company of Blackstone Energy Partners) and Apache Corp. PHP will source natural gas from each of its non-KMI partners, transporting as much as 2.0 bcfd about 430 miles from the Waha, Tex., area to the US Gulf Coast and Mexico, including the Katy market hub, the Agua Dulce market hub, and the Freeport LNG and Cheniere Corpus Christi LNG liquefaction plants. The $2-billion pipeline is expected to be operational late-2020.

Newcomer NAmerico Energy Holdings, a Houston-based company established 3 years ago, plans a 468-mile pipeline (Pecos Trail) delivering gas to Agua Dulce as its first project. NAmerico’s Permian-sourced pipeline is intended to make deliveries to multiple intrastate pipelines, in addition to Spectra Energy’s Valley Crossing Pipeline, the NET Mexico Header, and the Cheniere Energy Corpus Christi LNG Header system. NAmerico plans to have the pipeline operational by 2019.

Companies such as Tellurian Inc. are rolling Permian basin investments into even larger plans. The company’s Permian Global Access pipeline system will stretch roughly 625 miles and connect supply sources near Waha hub to a receipt point near Gillis, Jefferson Davis Parish, La. It will have other receipt and delivery locations, connecting multiple common gathering points and third-party pipelines. Construction is planned to begin as early as 2021, with the pipeline entering service by 2022.

Tellurian plans to build the $3.7-billion pipeline as part of a larger, $7-billion network to bring more natural gas to lower Louisiana. The pipeline is intended to reach growing export and industrial demand and establish crude production flow assurance. Investment in it is incremental to the $15.2 billion investment planned for Tellurian’s Driftwood LNG, a proposed liquefaction plant near Lake Charles, La.

Companies are also expanding their NGL systems to capitalize on increased Permian supply. Enterprise Products Partners LP, Midcoast Operating LP, Western Gas Partners LP, and DCP announced in May 2018 a binding open season for additional capacity on the Texas Express Pipeline. The project will expand the already existing pipeline which transports mixed NGL from Skellytown, Tex., to the fractionation and storage complex at Mont Belvieu, Tex. The companies plan to increase capacity of the 583-mile pipeline by 90,000 b/d. Service on the expanded Texas Express Pipeline is expected to begin second-quarter 2019.

Other infrastructure

Phillips 66, Buckeye Partners, and Andeavor plan to build a new 3.4-million bbl aboveground crude storage terminal in Ingleside, Tex. The 212-acre terminal at the mouth of Corpus Christi Bay will include two berths capable of handling very large crude carriers. The terminal will serve as the primary outlet for crude oil delivered by Phillips 66 and Andeavor’s planned 700,000-b/d Gray Oak pipeline (OGJ Online, Apr. 25, 2018). Both the terminal and pipeline are scheduled to begin operations by end-2019, backed by long-term, third-party, take-or-pay agreements.

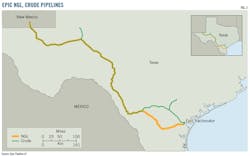

San Antonio-based Epic Pipeline LP, formed in 2017, plans to build a Corpus Christi complex with multiple 100,000 b/d fractionators to process material shipped on its 650-mile, 375,000 b/d NGL pipeline linking Permian and Eagle Ford production to the Gulf Coast (Fig. 2). The project will be big enough to accommodate expanded volume expected from a recent agreement with BP Energy Co. for offtake and processing of its NGL production from the two regions. Epic signed an engineering, procurement, and construction contract with Optimized Process Designs LLC in June 2018 for the site’s first train.

Epic is building a 730-mile, 550,000 b/d crude pipeline along a similar route. It expects the line to enter service second-half 2019 (OGJ, Feb. 5, 2018, pp. 72-82).

Magellan Midstream Partners LP is expanding its storage capacity at multiple sites. Magellan plans to build a combined 1 million bbl of above-ground refined products storage in the Dallas, East Houston, and Hearne, Tex., areas to accompany its marine storage complex already under construction in Pasadena, Tex. The Pasadena site will include 5 million bbl of above-ground refined petroleum storage and two ship docks. This project is fully supported by long-term customer commitments.

Steel tariff

Complicating the oil and gas infrastructure buildout is the 25% tariff imposed on imported steel and 10% on imported aluminum by the administration of US President Donald Trump. Companies import 77% of the steel used in US-sited pipelines and benchmark hot-rolled US steel-coil prices are up more than 50% from last year. Domestic steel manufacturers are often not a viable alternative to imported steel because they either do not offer key metal grades or diameters, or because of long production lead times that would impede construction schedules. In many cases, it would cost tens of millions of dollars for steel manufacturers to upgrade their US mills, a price most are unwilling to bear considering already low margins.

The new steel and aluminum tariffs have left pipeline companies with three choices:

• Pay the higher price on imported steel, and likely pass this cost on to shippers and end-users.

• Apply for an exemption to the tariff.

• Turn to domestic steel, which in some cases may have quality, environmental, and safety implications.

Bibliography

Conca, J., “The Effects of Trump’s Steel Tariffs on Red State Energy,” Forbes, June 2, 2018.

Egan, M., “Growing pains across America’s biggest oilfield,” CNN, June 28, 2018.

Hampton, L., “US oil pipeline companies, producers seek relief from steel tariffs,” Reuters, June 19, 2018.

Krauss, C., “9.5 Billion Purchase by Concho Is Latest Sign of West Texas Oil Boom,” New York Times, Mar. 28, 2018.

Lynch, D.J., Dawsey, J., and Paletta, D., “Trump imposes steel and aluminum tariffs on the EU, Canada, and Mexico,” The Washington Post, May 31, 2018.

Mosier, J., “Trump’s steel tariffs are costing Permian basin pipeline companies millions, but the building rush continues,” Dallas New, Aug. 2, 2018.

Nickel, R. and Sims, B., “US oil pipeline rivals look to consolidate West Texas Projects,” Reuters, Oct. 13, 2017.

Acknowledgements

Special thanks to Baker McKenzie 2018 summer associates Grant Ellis from the University of Texas and Sarah Rodrigue from Vanderbilt University.

The author

Natalie L. Regoli ([email protected]) is a lead major projects partner at Baker McKenzie representing owners-developers in energy transactions, energy finance, and project development, from upstream through midstream to downstream, with experience in LNG, LPG and other liquids, power, and gas-to-liquids development. She attended Kyushu University, Japan, on a Japanese Ministry of Education scholarship, earned a BA (1996) in economics from the University of Washington, Seattle, and her JD (2002) from University of Texas School of Law, Austin. Regoli is an advisory board member of the Institute for Energy Law.