Concerns rise over US trade, steel tariff policies

Mikaila Adams

Editor-News

Concerns over the Trump administration’s trade and tariff policies are rising as now months-old regulations involving steel are expected to have continued inflation pressure on oil and gas companies.

Import tariffs of 25% on steel implemented in March are particularly unsettling to energy businesses as they increase prices of many tubular and specialty steel products used across pipelines, refineries, and natural gas liquefaction and petrochemical facilities.

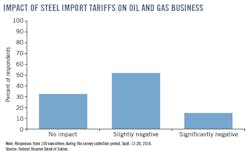

A quarterly Dallas Federal Reserve survey released in October asked respondents specifically about the impact of steel import tariffs on their businesses so far this year. The survey provides an assessment of energy activity among oil and gas firms located or headquartered in the Eleventh District (Texas, southern New Mexico, and northern Louisiana), which operate regionally, nationally, or internationally.

Data were collected Sept. 12–20, with responses from 171 energy firms—110 exploration and production firms and 61 oil field service firms.

A little more than half the executives—52%—said the steel import tariffs have had a slightly negative impact on their business thus far. Thirty-three percent noted no impact. The remaining 15%, meanwhile, said the steel import tariffs have had a significantly negative impact on their businesses (see figure).

“Slightly negative” is likely “the appropriate level of concern for many companies at this point in time, given the way the economics works out,” Michael Plante, senior research economist at the Federal Reserve Bank of Dallas, told OGJ via e-mail following the report’s release.

Estimates vary, Plante said, but steel usually makes up 10-15% of the cost of an oil or gas well. “If the 25% tariff affects all of the steel, this implies a 2½-3¾% increase in costs for a well.” As one survey respondent pointed out, the extra cost was about $100,000/well. “That is certainly a nontrivial increase in costs, but probably not big enough to cause a complete reversal of fortunes for most companies, especially given current oil prices,” Plante said.

Some companies will feel a greater impact, as 15% of executives surveyed responded. “Some companies will have tighter profit margins to begin with and some E&P companies will spend more on steel due to the characteristics of the wells they are drilling.” While the Dallas Fed hasn’t done the analysis, Plante suspects this would be “of particular concern for smaller companies operating outside the best acreage in areas with cost pressures, like the Permian.”

Capital budgets

As equipment costs rise, some E&Ps are recalculating capital budgets, with the words “steel tariffs” appearing in second-quarter financial statements—the most recently available at this writing—and voiced on subsequent analyst calls.

In its second-quarter call, following a report that the company had increased by $500 million its capital budget for this year, ConocoPhillips said steel tariffs are becoming “a significant item” for the company. Noting its earlier capital spending plan was for a $50/bbl world and that its philosophy on spending hasn’t changed, Executive Vice-Pres. Al Hirshberg said, “We have been and are going to continue to see some inflation pressure, including the steel tariffs in the US. We spend, in the US Lower 48 plus Alaska, about $300 million/year on [oil country tubular goods (OCTG)] and pipes and valves and fittings, all that kind of stuff that’s made of steel. And coil, hot-rolled steel prices in the US since the first of the year are up 26% even though the input cost to the manufacturers of this steel hasn’t changed,” he said.

From its supply-chain position, Hirshberg said, the company has been somewhat insulated, but the impact will continue to grow going into next year.

Companies of varying sizes mentioned tariffs.

Along with the four rig additions related to its 2019 plan preparation and additional proppant for its Version 3.0 completions planned in this year’s second half, Pioneer Natural Resources Co. cited a higher pricing environment—steel costs included—as one facet to its 2018 capital program increase. The Permian-focused company is set to raise its range to $3.4 billion from $3.3 billion.

“We’re now seeing the impacts of the steel tariffs flow through and they’re affecting, of course, tubulars and other steel products that we use. We can see steel easily compared to last year would be 20-25% over last year’s cost for the same products,” said PNR Chief Executive Officer Timothy Dove.

Parsley Energy Inc., Austin, Tex., is revising its 2018 capital budget due to shorter cycle times and higher working interest, noted Rob Thummel, managing director and portfolio manager-energy, Tortoise Capital Advisors, in an Aug. 14 podcast. Prior to second-quarter reporting, Thummel said, Parsley “had indicated that sustained oil price strength and associated service and equipment cost inflation would bias expectations toward the upper end of its initial guidance range of $1.35-1.55 billion. These expectations were confirmed, primarily as a function of labor tightness, while the imposition of steel tariffs also translated to higher well costs.” Parsley, another Permian-focused company, revised its 2018 capital budget to $1.65-1.75 billion to reflect the additional net wells it expects to place on production this year.

Energen, Birmingham, Ala., prior to announcing its deal to be acquired by Midland, Tex.-based Diamondback Energy Inc., left its drilling and completion budget as-is at $1.1-1.3 billion, but noted capex would likely be at the high end of the range due to service costs, steel tariffs, and non-operated properties (OGJ Online, Aug. 15, 2018).

PDC Energy, Denver, increased its 2018 capex range by 9% to $950-985 million. The company cited increased wells in Wattenberg field because of drilling efficiencies and more stages per well. In the Permian’s Delaware basin, the company noted well costs increased by about $1 million because of service cost inflation from tight labor as well as higher steel costs.

Management for another Denver-based company, Cimarex Energy Co., said steel tariffs are likely to inflate pipe and equipment costs in the foreseeable future, but said it expects to partially offset the inflation with drilling efficiencies, citing a 34% drop in drilling cycle times for a 2-mile Meramec well in the year’s first half.

Moving forward

Steel tariffs are affecting the oil and gas industry—some more than others—but “there’s no doubt you’re seeing a cost increase,” Thummel told OGJ in a Sept. 25 phone interview. Speaking to the idea of efficiencies offsetting these costs, he expressed doubt: “You’re not seeing as many efficiencies being brought into the mix in a positive way this quarter as you have historically.” Ultimately, Thummel thinks the tariffs will decrease the returns on oil and gas production. “Higher prices probably have a positive impact, but I wouldn’t say that efficiencies are going to bail out these producers from the steel tariffs and the higher costs associated with it.”

After the tariffs were introduced in March, many energy companies filed necessary tariff exclusion requests to the Department of Commerce (DOC) (OGJ Online, Mar. 19, 2018).

One case is that of Plains All American Pipeline US (PAA) (OGJ, Aug. 27, 2018, p. 14). The Houston-based company participated in the exclusion process for the Cactus II line pipe ordered in December 2017 from a mill in Greece, but the request was denied. The company stated the tariff was likely to cost them $40 million for the Cactus II pipeline, an estimated 3.6% increase in cost.

In written testimony to Congress in late July, Willie Chiang, then the company’s incoming chief executive officer, said the original project scope envisioned a 24-in. OD, high-frequency welded (HFW) pipeline, but was later increased to 26-in. due to customer demand as the 2-in. increase allows for a nearly 20% increase in pipeline capacity. As quotes were requested from prequalified US and foreign mills to manufacture the steel pipe with specifications intended to limit the number of girth welds and the length and location of seam welds, Chiang said, “American mills either did not bid” or “submitted alternative specifications for the 26-in. pipe option that were not acceptable.” Further, “a domestic pipe mill chief executive, who acknowledged he was not aware of any US mill capable of creating 26-in. pipe with the HFW manufacturing technique…reiterated the same point in a letter of objection to our 232 exclusion request,” he said. Shipments of the ordered steel began arriving in July and will continue through yearend.

In August, DOC granted a tariff exemption for Chevron Corp. to import the 4½-in. steel tubes from Japan it uses for oil exploration. Questions about the review process and decisions amid the tremendous workload remain.

“It appears that the exemption route is falling on deaf ears, at least right now,” Thummel told OGJ about PAA’s effort. “Most of these tariffs are going to be placed on any steel that’s coming in for new pipelines or new wells,” and companies will have to suffer the brunt of the higher costs, he said.

“I’m not sure that there’s enough capacity in the US to handle the growing need for steel from the energy industry and other industries. You’re going to need global sources of steel to supply the demand,” Thummel said. In the short term, that’ll result in higher prices. Can US steel companies boost capacity in the longer-term? “Probably,” he said, “but I’m not sure that everybody believes these tariffs are going to be in place for the long term.”

The duration of the tariffs will be the biggest factor. “If it’s a long-term game, it’s going to result in higher costs for the US energy sector and those costs will have to be consumed…more than likely by the consumer,” Thummel said.