Greece opens frontier Ionian Sea, south of Crete exploration

Tayvis Dunnahoe

Exploration Editor

Offshore exploration in Greece has been dormant since the 1990s, but new seismic and the industry's renewed interest in carbonate plays such as the recent Zohr discovery in the Eastern Mediterranean are bringing major operators to the region. Within 3 years, the country may have enough data paired with new discoveries to offer a new deepwater bid round.

"As one example, about 70% of the acreage south of Crete and in the Ionian Sea should be under application or awarded, compared to 7% only 6 months ago," Yannis Bassias, President and CEO, Hellenic Hydrocarbons Resources Management SA (HHRM), told OGJ. The country held an offshore bid round in 2014 but has awarded acreage in an open-door fashion since the end of 2016, based on companies' expression of interest. "We redefined our strategies per the Greek petroleum law established in the 1990s," Bassias said.

Previous activity in Greece's offshore occurred in 1997 when the country completed a bid round of three offshore blocks with no awards (OGJ, Oct. 23, 1995, p. 48). "There was exploration activity offshore Greece, but then after 1997 it stopped completely," Bassias said. The country attempted to revitalize its offshore exploration again in 2012, but it wasn't until 2015 that companies began to move onto prospective acreage.

Western Greece offers a geopolitical safe haven for offshore operations compared with other regions in the Mediterranean. Eni SPA's Zohr discovery offshore Egypt, meanwhile, changed the understanding of the larger Eastern Mediterranean with respect to carbonate environments (OGJ Online, Mar. 10, 2016).

The current low oil price has also made technology available at lower prices for use in Greece's frontier offshore prospects. Greek companies have successfully attracted international partners, whileHellenic Petroleum SA (Helpe) and Energean Oil & Gas SA provide technical support in engineering and development of offshore areas. The government holds a 35% share in all blocks.

"By the beginning of 2018 all certifications will be resolved," Bassias said. Operators will begin aggressive exploration with possible discoveries offshore Greece by 2020-21.

Katakolon oil field

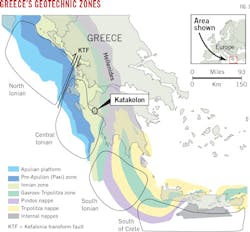

Exploration in the 1980s resulted in discovery of the offshore West Katakolon field, 3.5 km southwest of Katakolon peninsula off western Peloponessus (Fig. 1). The producing horizon is the Eocene-Cretaceous carbonates of a paleostructure, unconformably covered by clastic Neogene sediments.

Water depth is 200-300 m with the reservoir lying at 2,300-2,600 m. The field contains 180 m of sour gas underlain by an oil rim of about 120 m in a large carbonate structure with undrilled deeper potential. Two biogenic gas formations were discovered onshore as part of a drilling campaign undertaken in the 1960s, and the West Katakolon reservoir is believed to be a dual porosity system (matrix, fractures and vugs) with an overlaying gas cap and an underlying aquifer.

An early deviated well confirmed the presence of oil and a higher-positioned sidetrack tested gas and condensate from two zones. A second well on the same structure tested oil from two layers with flow rates of 1,200-1,500 b/d each, confirming a 100-m oil zone.

In November 2016, Energean signed a contract to develop Katakolon from onshore (OGJ Online, Nov. 29, 2016). The exploration block is 545 sq km and is delimited onshore at 60 sq km for use in drilling and production. The West Katakolon discovery contains an estimated 30-40 million bbl of oil with a recovery rate of 30%.

According to Bassias, the area's tourism, wildlife, and algae required a sensitive approach to exploiting the nearshore reserves.

The Ministry has approved a field development plan and environmental and social impact assessments submitted in February 2017. Energean will apply extended reach drilling technology from onshore down to 1,200 m and then drill horizontally for 3,500 m. The reservoir target is a structural closure squeezed and sealed by a salt wedge. The well is scheduled to spud in 2019 with first production in 2020.

The program includes building roads and installing storage, buoys, and onshore dehydration. Total field-development investment is estimated at $50 million.

The offshore Patraikos Gulf (west) block, also in western Greece, will further add to the country's exploration potential. Awarded in October 2014 in an open tender, Hellenic Petroleum (50% as operator) and Italy-based Edison International (50%) plan to spud an exploration well in 2018 (Fig. 2).

The block covers 1,892 sq km. Greece's standard offshore lease period is 8 years divided into three phases. Hellenic completed its first phase by shooting double azimuth 3-D seismic in 2016. It reprocessed 2,000 km of legacy 2-D seismic and acquired 1,822 sq km of 3-D seismic in 34 days.

Ionian Sea, south of Crete

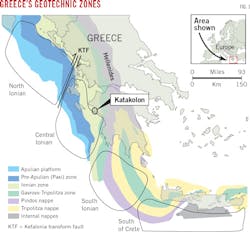

Greece's Ionian Sea and the south of Crete region are unexplored. The prospective basins consist of carbonate platforms and transition zones to the east toward continental Greece (Fig. 3). Play types include both stratigraphic and structural carbonate reefs, some of which are shallow with eroded buildups generating a transition between calcite turbidites that pass to clastic zones.

Among the most interesting features, many of which only recently have been imaged are the sub-Messinian anticlines and large anticlines within Miocene sediments. Three main play types include fold-and-thrust belts, anticlines related to strike-slip movements together with fault blocks related to normal fault activity, and the Mediterranean Ridge backthrust play. Identified hydrocarbon indicators include mud volcanoes and bottom simulating reflectors, the latter indicating the presence of gas hydrates.

Recent interest by Total SA, ExxonMobil Corp., and Helpe in south of Crete and in the Ionian Sea has placed most of Greece's available offshore acreage under contract or in close negotiations. "There's only a small portion remaining for further applications," Bassias said. "The approval of the Crete expression of interest will open a 90-day competition window during which other interested companies can also apply," Bassias said. He added that this 90-day window begins with publication of the invitiation for applications in the European and Greek Gazettes per Greece's petroleum law.

Exploration in this frontier region will be assisted by ports in Igoumenitsa, Astakos, and Patras. Entrepreneurs in Greece are also involved in secondary and tertiary service during this exploration phase, according to Bassias.

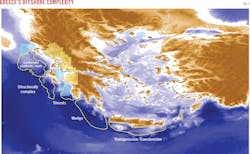

In 2013, a tender for blocks offshore Crete received no bids, but subsequent discovery of the giant Zohr field in offshore Egypt increased interest in the area. Similar geological structures were identified in nearby Cyprus and Crete. The Zohr discovery consists of mostly carbonate reefs, different than the Nile Delta's clastic deposits. "The existence of two petroleum systems-clastic Nile Delta and carbonate reefs-has changed the view of these types of plays in Greece's deepwater areas," Bassias said.

The Ionian Sea contains a vast amount of carbonate reefs. Traditionally, these play types require a lot of surface to offer large reservoirs. But Greece offers a compacted, highly folded carbonate environment with potentially high reserves, according to Bassias

Frontier acreage in the Ionian is in 1,900-2,500 m of water with 1,200 m of prospective formations. "The bathymetry is rough," Bassias said. Highly folded layers can have important differences in just 200 m of distance. "When you have bathymetric differences at 500, 800, or 1,000 m, it makes the target more complex." Highly compacted bathymetry can introduce walls of folds where deeper sediments and rock formations can exist undiscovered without extensive seismic and exploration drilling.

Moving south, the carbonate subsurface is primarily below salt in 1,200-2,500 m of water. This is the case west and south of Crete in the southern Ionian Sea and to the west of Peloponnesus. Bassias describes this deepwater region as high-risk and high-reward, no wells having been drilled in the area.

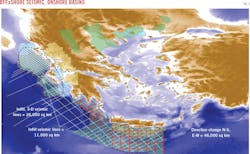

The Ministry contracted Petroleum Geo-Services (PGS) to acquire more than 13,000 km of 2-D seismic in the southern Ionian Sea in 2012-13 and combined this with legacy data from previous years. HHRM and PGS have recently extended their current agreement to shoot additional seismic (Fig. 5). Additional seismic will include more intense infill data and a change in direction of 2-D seismic south of Crete. Additional 3-D seismic will be added in the Ionian Sea north to Korfu. HHRM and PGS have reprocessed legacy 2-D seismic from 2013 to provide a complete prestack depth migration package, which is also associated with the Technical University of Crete in Chania.

Near-term development

Operators hold six offshore blocks in Greece. According to Bassias, the first successful exploration could be conducted in the next 2 years, with up to three wells drilled by 2020 (Fig. 4).

Greece lies in the westernmost portion of the East Mediterranean but is hoping discoveries there will mirror some of the more recent giant discoveries to the east. With giant discoveries such as Leviathan and Zohr in the East Mediterranean coming onstream, the market for new gas discoveries is yet unknown. The strenght of this market will shape both the pipeline projects needed to bring production to market and the export terms for the gas itself.

All offshore areas will be awarded and ratified by the parliament, according to Bassias, with most of the 8-year licenses beginning in 2018. After the first 3-year phase of the license, companies will relinquish 20, 25, or 50% of their acreage to the Greek government according to the project guidelines.

HHRM has successfully operated on an open-door basis since 2015 to bring major operators into the frontier region without the expense typically associated with developing an initial bid round. As a result, Repsol, Total, ExxonMobil, Edison, Helpe, and Energean, have signed on to test Greece's offshore potential. "The next 3 years will be active," Bassias said. "After that, new seismic data, possibly new discoveries, and updated reservoir models will allow us to run an actual bid round by 2021-22."