Quantitative analysis shows natural gas projects' benefits outweigh costs

Joel Zipp

Orrick, Herrington & Sutcliffe LLP

Washington

Gavin Roberts

Weber State University

Ogden, Utah

Credible quantitative evidence exists, applicable under the statutory standards of the Natural Gas Act (NGA) and the National Environmental Policy Act (NEPA), to conclude that the benefits of natural gas transportation and liquefaction projects outweigh their costs. Litigation, however, is challenging the certification of natural gas infrastructure and approval of natural gas exports. Many of the objections underlying this litigation are based on the singular fact that the infrastructure is used to access a fossil fuel—natural gas—for consumption and the accompanying assertion that the environmental costs of natural gas outweigh its benefits.

Until recently these challenges have been unsuccessful. The US Federal Energy Regulatory Commission (FERC) and Department of Energy's (DOE) rejection of such claims largely has been based on the judgement that causal connections between environmental costs and the proposed transportation systems bridging the gap between gas supply areas and the markets was too tenuous to warrant project analysis under NEPA.

This article explores FERC's and DOE's public convenience and necessity-public interest analysis under the NGA and how that analysis could be reinforced by comparing environmental costs with benefits produced by other factors. While there is more work to do on this topic, initial analysis concludes the benefits discussed here outweigh the costs.

Analysis method

In Atlantic Refining Co. v. Public Service Commission 360 US 378 (CATCO), the US Supreme Court held that when considering the public convenience and necessity (PC&N) FERC (then the Federal Power Commission) needed to evaluate and weigh all factors bearing on the public interest.1 "In evaluating certificate applications, FERC employs 'a flexible balancing process, in the course of which all the factors are weighed prior to final determination,'" the Court said.2 In NAACP v. FPC, the Court stated, "[t]he use of the words 'public interest' in the [NGA] . . . is a charge to promote the orderly production of plentiful supplies of . . . natural gas at just and reasonable rates."3 This connection gives FERC the authority to look at, for example, conservation and environmental matters, as well as antitrust questions.4

As FERC has stated, it weighs project economics, operational matters, competitive benefits, market support, and environmental impact when making a determination.5 FERC will "take into account as a factor for its consideration the overall benefits to the environment of natural gas consumption."6 It will only approve an application where "the public benefits outweigh any adverse effect."7

Under a separate statute, NEPA, FERC, and DOE are required to evaluate the environmental impact of each proposed project and issue an Environmental Impact Statement (EIS) or environmental assessment, unless the activity is excluded from review.8 In its review of the Cove Point LNG project, the Court in EarthReports, Inc. v. FERC9 explained what this involves:

"Under regulations promulgated by the Council on Environmental Quality, agencies whose procedures do not require preparation of an EIS must first prepare an environmental assessment. See 40 C.F.R. § 1501.4. An environmental assessment "[b]riefly provide[s] sufficient evidence and analysis for determining whether to prepare an [EIS][,]" including discussion of "the environmental impacts of the proposed action and alternatives." Id. § 1508.9. Such assessments are to include consideration of both "[i]ndirect effects" that are "caused by the action and are later in time or farther removed in distance, but are still reasonably foreseeable," id. § 1508.8(b), and the "[c]umulative impact" that "results from the incremental impact of the action when added to other past, present, and reasonably foreseeable future actions[,]" id. § 1508.7. . . . Congress has designated the [FERC] as "the lead agency for the purposes of coordinating all applicable Federal authorizations and for the purposes of complying with [NEPA]." 15 U.S.C. § 717n(b)(1); see also 42 U.S.C. § 7172(a)(2).

As recently stated in Sierra Club v. FERC (Southeast Market Pipelines Project), the EIS must consider "both the good and the bad" effects.10 While this environmental evaluation requires that a particular process be followed, it does not require a certain result. Notably, "the agency is not constrained by NEPA from deciding that other values outweigh the environmental costs."11 For example, FERC has selected a pipeline project over a competing project that was environmentally superior in order to achieve competition goals.12

It follows that the courts can uphold an agency's decision which approves a project despite a NEPA analysis which concludes that the "no action" alternative is the preferred outcome based on other factors applied by the agency, such as consumer price benefits, the environmental benefits of reducing coal-fired generation, and foreign policy or security dividends.

DOE follows a similar approach, considering a range of factors. FERC and DOE both apply NGA Section 3's "public interest" standard when considering exports (or imports) under their respective jurisdictions. FERC applies NGA Section 7's public convenience and necessity standard when assessing proposed natural gas pipeline projects.13 Each standard also includes different statutory presumptions not relevant to this discussion. For gas export proposals, DOE looks at the domestic need for the gas, as well as "economic impacts, international impacts, security of natural gas supply, and environmental impacts, among others."14 None of these differences (if any) are important to the discussion here.

Many in the environmental community have argued that the examination by FERC and DOE of environmental impacts has been inadequate. Their position has been that the agencies should consider the quantitative impacts of a proposed pipeline or gas export project on increasing domestic production of natural gas and the impact the increase in emissions associated with the project (including production, transportation, and consumption of natural gas) has on the climate. The argument essentially asks FERC and DOE to quantify the environmental impact of a project from the wellhead to the burner tip. It has been suggested that one quantitative measure is the social cost of carbon.

As explained during US President Barack Obama's administration, "The purpose of the social cost of carbon (SC-CO2) estimates . . . is to allow agencies to incorporate the social benefits of reducing carbon dioxide (CO2) emissions into cost-benefit analyses of regulatory actions. The SC-CO2 is the monetized damages associated with an incremental increase in carbon emissions in a given year."15 Similarly, his successor Donald Trump's administration has stated that, "[t]he SC-CO2 is a metric that estimates the monetary value of impacts associated with marginal changes in CO2 emissions in a given year. It includes a wide range of anticipated climate impacts, such as net changes in agricultural productivity and human health, property damage from increased flood risk, and changes in energy system costs . . . ."16

FERC and DOE have refused to conduct this analysis under NEPA because the connections between the agencies' actions and the upstream and downstream emissions are too attenuated. FERC has also determined it would not be appropriate to use the social cost of carbon to analyze the greenhouse gas (GHG) emissions from these projects, as explained in Sabine Pass Liquefaction Expansion, LLC:17

"Sierra Club contends that the social cost of carbon tool was developed to address the problem of connecting project-specific GHG emissions with particular changes in the environment. We disagree. The April 6 Order stated that the social cost of carbon tool does not measure the actual incremental impacts of a project on the environment. The tool is intended for estimating the climate costs and benefits of rulemakings and policy alternatives. The tool cannot predict the actual environmental impacts of a project on climate change. It can only present a monetized global value for the economic costs of climate change…. Sierra Club fails to provide any evidence that this tool can be used to predict an individual project action's actual environmental impacts. While Sierra Club suggests that the information the calculation does provide constitutes a useful and informative proxy for the magnitude and importance of the unmeasured physical impacts, we continue to find that this tool is not appropriate for estimating a specific project's impacts or informing our analysis under NEPA."

While DOE's use of the social cost of carbon in a cost-benefit analysis in connection to issuing regulations on appliance efficiency has been upheld by the Courts,18 so far FERC's refusal to follow a similar path also has been upheld.19 By comparison, Canada's National Energy Board (NEB) recently released a list of issues in the Energy East Pipeline Ltd. and TransCanada PipeLines Ltd. pipeline proceedings,20 stating:

"Given increasing public interest in GHG emissions, together with increasing governmental actions and commitments (including the federal government's stated interest in assessing upstream GHG emissions associated with major pipelines), the Board is of the view that it should also consider indirect GHG emissions in its NEB Act public interest determination for each of the Projects."

Recent decisions

In August 2017, the Court issued two decisions regarding the scope of NEPA review by FERC and DOE: Sierra Club v. FERC (Southeast Market Pipelines Project)21 and Sierra Club v. United States Department of Energy (Freeport LNG Export Project).22 In both cases, the Sierra Club argued that the agencies' review should consider the project's impact from the wellhead to the burner tip. While Freeport LNG Export Project was consistent with past Court decisions, affirming DOE's scope of NEPA review, Southeast Market Pipelines Project indicated a change in direction.

The Court in Southeast Market Pipelines Project stated that, at least in certain cases, FERC must discuss in its NEPA analysis the indirect effects associated with a proposed project if such effects are reasonably foreseeable. The Court stated that, "[t]he phrase 'reasonably foreseeable' is the key" determination in its analysis.23 The Court explained that effects are reasonably foreseeable if they are "'sufficiently likely to occur that a person of ordinary prudence would take [them] into account in reaching a decision.'"24 The Court determined that the downstream effects of natural gas delivered by interstate pipelines were reasonably foreseeable and should be considered.

This decision raises the question of whether FERC, DOE, or other Courts will now adopt or encourage a more quantitative approach to analyzing both the downstream and upstream impacts of potential projects. On this point, the Court also asked FERC to determine whether its position on the social cost of carbon, previously upheld in EarthReports, continues to apply,25 opening the questions of whether the Courts also will begin to require the agencies to look at upstream effects and what quantitative analyses might look like.

In response to the Court's decision in Southeast Market Pipelines Project, FERC staff prepared and issued a draft supplemental EIS (SEIS) to address downstream GHG emissions of three power plants to be served by natural gas carried on the pipeline project at issue.26 The draft SEIS quantifies these incremental downstream emissions, as well as the reductions in GHG emissions attributed to the conversion of the three power plants from coal to natural gas.27

Although the draft SEIS shows a net increase in GHG emissions, it concludes that overall, with the application of the mitigation and other measures described in the EIS, the pipeline project would not result in a significant impact on the environment.28 The draft SEIS also reiterated the FERC's earlier position on quantifying the social cost of carbon, concluding:

"We could not find a suitable method to attribute discrete environmental effects to GHG emissions. . . . We could not identify a reliable, less complex model for this task and we are not aware of a tool to meaningfully attribute specific increases in global CO2 concentrations, heat forcing, or similar global impacts to [the project pipelines'] GHG emissions. Similarly, the ability to determine localized or regional impacts from GHGs by use of these models is not possible at this time.29

The Sierra Club and others, however, have asked the FERC to reopen the record in two other pipeline projects pending its approval to supplement the EIS in each to address GHG emissions and climate impacts.30 According to the Sierra Club's reading of the Court's decision in Southeast Market Pipelines Project, FERC must now quantify the GHG emission and climate impacts of a specific project, recommending the social cost of carbon as the appropriate method of evaluation.

Externalities

Generally, a lack of markets creates externalities. An externality is an action, event, or consequence for which no compensation is given or received. Externalities can be positive or negative depending on whether the social value of the action, event, or consequence, is less than or exceeds the private value. Negative externalities may result from a project's negative environmental impacts. Positive externalities, meanwhile, may result from saving consumers money through lower fuel costs, better supply security, or a project's positive environmental impacts. Both positive and negative externalities can be reflected in a regulator's benefit-cost analysis and subsequent decision.31

The authors have reviewed more than 50 studies, reports, articles, and analyses addressing the costs and benefits of the shale-gas revolution. Two recent economic analyses have attempted to quantify annual benefits and costs associated with increased natural gas production related to shale gas's rapid growth. The first is a Brookings paper by Catherine Hausman and Ryan Kellogg (HK).32 The second was published in the academic journal Ecological Economics by Michelle Haefele and John Loomis (HL).33 These papers are the most comprehensive studies in accounting for both the market and non-market benefits and costs associated with the shale-gas revolution.

Both papers find that the benefits outweigh the costs on an annualized basis even under worst-case scenarios. HL only quantifies benefits associated with gas production, while including natural gas and crude oil in the estimation of environmental and other costs. Inclusion of the economic benefits related to crude oil production would increase the benefits side of the equation, or conversely removing costs related to hydraulically-fractured oil wells would decrease the cost side of the equation.

The largest benefit associated with expanded natural gas production has been the increase in consumer surplus associated with lower natural gas prices. Consumers gain surplus when a good is priced below the highest price they would be willing to pay for that good. The difference between the high natural gas prices of the early-2000's and the low prices prevailing in recent year represents surplus to consumers. HK estimates that the total gain to the US economy associated with consumer surplus is $75 billion/year with a range of $45-93 billion. HL provides a nearly identical estimate of $74 billion/year with a range of $46-95 billion.

The shale-gas revolution has also affected natural gas producers' profits (producer surplus, in economic jargon). Some producers lost surplus, having drilled expensive wells in locations such as the deepwater Gulf of Mexico in anticipation of continued high natural gas prices. Some of these investments turned into losses when natural gas prices fell. On the other hand, some producers, especially small and agile companies, gained producer surplus by becoming the experts in hydraulic-fracturing technology, increasing market share.

HK estimates that net producer surplus fell $26 billion/year due to lower prices associated with increasing shale gas supplies, with a range of $8-37 billion. HL, however, finds that producer surplus actually increased by about $7.25 billion/year.

HL includes two markets costs in its estimates left out of HK: decreased property values associated with properties near hydraulically fractured well sites and value of the water used in hydraulic fracturing. HL estimates the former to be $258 million with a range of $148-325 million and the latter to be $21.85 million.

This article will apply $0.5 billion to capture these additional market costs.

Both analyses also quantify nonmarket benefits. HK limits its analysis to the shale-gas revolution's net impact on greenhouse gas emissions, specifically net changes in CO2 and CH4 emissions. Applying the Interagency Working Group on the Social Cost of Carbon's (IWG) cost of $40/ton and multiplying this by 34 (the global warming potential of methane) for incremental methane emissions associated with shale gas, HK came up with an upper bound on emissions-related environmental costs of $28 billion. Importantly, this upper bound does not reflect shale gas displacing coal in electricity production, assuming that even if this displacement occurs in the US the coal will be exported and burned elsewhere.

HK also calculated a lower bound case in which it assumed that a lot of coal generation is displaced by shale gas. In this case, the benefits of displacing coal outweigh the costs associated with increased shale gas, yielding a net benefit of $700 million/year. The midpoint between these two cases is a net cost of $13.7 billion/year.

HL considered a wider array of environmental costs in its analysis. Nitrous oxide, particulate, and volatile organic compounds are included in its air emissions analysis in addition to carbon dioxide and methane. HL also included estimates of the environmental costs of water pollution and habitat fragmentation associated with drilling new wells. Accounting for offset emissions related to coal generation, HL arrived at a midpoint cost estimate of $17.75 billion/year for air emissions, with a range of $9.75-26 billion/year. They estimate a midpoint cost estimate of $1 billion/year for water contamination, with a range of $0.5-1.6 billion, and estimate a midpoint cost related to habitat fragmentation of $4.1 billion/year with a range of $3.5-4.5 billion.

The cost estimates from these two economic analyses allow estimating worst-case and midpoint scenarios within each study and across both studies. Aggregating these benefit and cost estimates shows that the net benefits of shale are positive even in the worst-case scenario.

The worst-case scenarios within each study take the low-end estimates of net surplus, and subtract the high-end estimates of environmental costs. The low-end estimates use net surplus because consumer and producer surplus are not independent. Lower prices lead to larger consumer surplus but smaller producer surplus and vice versa. Even applying the most pessimistic view of the shale gas revolution, it continues to lead to positive net benefits to the economy.

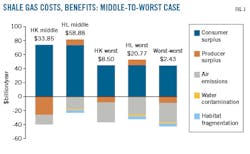

Fig. 1 shows the midpoint and worst-case scenarios with colored bars representing different benefit and cost categories. The worst-case scenario from HK yields a net benefit of $8.5 billion/year, while the midpoint estimate produces a net benefit of about $34 billion/year. The worst-case scenario from HL gives a net benefit of roughly $21 billion/year, while the midpoint scenario generates a much larger net benefit of $59 billion/year. The worst-worst case scenario calculation subtracts the highest costs estimates across the papers—the HK low estimate net surplus of $37 billion, the HK air emissions high-cost of $28 billion, and the water contamination and habitat fragmentation high costs from the HL paper of $1.6 billion and $4.5 billion, respectively— and still results in positive net benefits of about $2.5 billion/year.

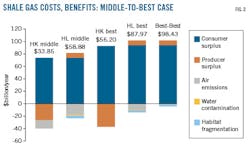

Fig. 2 displays the best-case scenarios from the HL and HK analyses for purposes of comparison, as well as the best-best case scenario which uses the best-case scenarios across both studies. The best-best case scenario would result in net benefits associated with shale gas reaching almost $100 billion/year.

Both the HK and HL analyses point out that regulators and natural gas producers increasingly account for negative externalities associated with shale-gas production, implying that they will decrease in the future.

Increases in both market and nonmarket benefits are also expected in the future. For example, there may be a large foreign policy premium or dividend associated with exporting natural gas from the US, as there has been for crude oil exports and decreasing crude oil imports. According to a RAND Corp. study34 about $83 billion of the US defense budget is dedicated to ensuring the transit of oil. The North Atlantic Treaty Organization (NATO) says35 the US spends roughly $200 billion to keep energy flowing to the global economy. The NATO report explains this savings for the US: "In the future, gas is likely to assume greater strategic importance as a result of the technologically driven changes in that market and soaring global demand for energy. It goes without saying that the shale gas and oil boom in the United States will alter the way it looks at the Middle East and particularly the Persian Gulf. Although that region will remain a critical supplier of energy to world markets, its importance to the United States will inevitably diminish as the United States reduces its dependence on imported energy. Although few American leaders speak openly about this eventuality, the strategic community is beginning to think through the implications. It is a worthwhile exercise because a tectonic shift may be underway."

References

1. "Atlantic Refining Co. v. Public Service Commission of New York," 360 US 378, 391, 1959.

2. "Midcoast Interstate Transmission Inc. v. FERC," 198 F.3d 960, 964, DC Circuit Court, 2000 (citing "FPC v. Transcontinental Gas Pipe Line Corp.," 365 US 1, 23, 1961).

3. 425 US 662, 670, 1976.

4. 425 US 662, 670 n.6, 1976.

5. "Certification of New Interstate Natural Gas Pipeline Facilities," Statement of Policy, 88 FERC ¶ 61,227, at 61,743,1999, Order Clarifying Statement of Policy, 90 FERC ¶ 61,128, 2000, Order Further Clarifying Statement of Policy, 92 FERC ¶ 61,094, 2000.

6. 90 FERC 61,128 at 61,398.

7. 92 FERC 61,094 at 61,373.

8. 42 USC § 4332(2)(C).

9. 828 F.3d 949, 953, DC Circuit Court, 2016.

10. "Sierra Club v. FERC," No. 16-1329, slip op. at 25-26, DC Circuit Court, Aug. 22, 2017.

11. "Roberston v. Methow Valley Citizens Council," 490 US 332, 350, 1989.

12. "Midcoast Interstate Transmission Inc. v. FERC," 198 F.3d 967-8 DC Circuit Court, 2000.

13. EarthReports Inc., 828 F.3d at 952-3, DC Circuit Court, 2016.

14. "Freeport LNG Expansion LP, et al.," FE Docket No. 11-161-LNG DOE/FE Order No. 3357-B, at 8-10, Nov. 14, 2014.

15. Interagency Working Group on Social Cost of Greenhouse Gases, US Government, "Technical Support Document: Technical Update of the Social Cost of Carbon for Regulatory Impact Analysis Under Executive Order 12866," Executive Summary, at 3, August 2016; withdrawn by Executive Order 13783, Mar. 28, 2017. Exec. Order No. 13783, 82 Fed. Reg. 16,093, Mar. 31, 2017.

16. US Environmental Protection Agency, Office of Air and Radiation, Office of Air Quality Planning and Standards, "Regulatory Impact Analysis for the Review of the Clean Power Plan: Proposal," at 42, October 2017.

17. 151 FERC ¶ 61,253, at P 48, 2015.

18. "Zero Zone Inc. v. US Department of Energy, 832 F.3d 654, 7th Circuit Court, 2016.

19. EarthReports Inc., 828 F.3d at 956, DC Circuit Court, 2016.

20. Energy East Pipeline Ltd. and TransCanada PipeLines Ltd., Energy East Project and Asset Transfer, and Eastern Mainline Project, Lists of Issues and Factors and Scope of the Factors for the Environmental Assessments pursuant to the Canadian Environmental Assessment Act, 2012, File OF-Fac-Oil-E266-2014-01 02, Section 1.2.1, Aug. 23, 2017.

21 "Sierra Club v. FERC," No. 16-1329, DC Circuit Court, Aug. 22, 2017.

22. "Sierra Club v. US Department of Energy," No. 15-1489, DC Circuit Court, Aug. 15, 2017.

23. "Sierra Club v. FERC," No. 16-1329, slip op. at 19, DC Circuit Court, Aug. 22, 2017.

24. "Sierra Club v. FERC," No. 16-1329, slip op. at 19, DC Circuit Court, citing EarthReports Inc., 828 F.3d at 955, Aug. 22, 2017.

25 "Sierra Club v. FERC," No. 16-1329, slip op. at 27, DC Circuit Court, Aug. 22, 2017.

26. "Florida Southeast Connection, LLC, et al.," Docket Nos. CP14-554-002, et al., Southeast Market Pipelines Project, Draft Supplemental Environmental Impact Statement, Sept. 27, 2017.

27. "Florida Southeast Connection, LLC, et al.," Docket Nos. CP14-554-002, et al., Southeast Market Pipelines Project, Draft Supplemental Environmental Impact Statement, at 3-4, Sept. 27, 2017.

28. "Florida Southeast Connection, LLC, et al.," Docket Nos. CP14-554-002, et al., Southeast Market Pipelines Project, Draft Supplemental Environmental Impact Statement, at 2, Sept. 27, 2017.

29. "Florida Southeast Connection, LLC, et al.," Docket Nos. CP14-554-002, et al., Southeast Market Pipelines Project, Draft Supplemental Environmental Impact Statement, at 4-5, Sept. 27, 2017.

30. Sierra Club, et al., Notice of New Authority and Request for Supplemental Environmental Impact Statement for the Atlantic Coast Pipeline and Supply Header Project, Docket Nos. CP15-554-000, et al., Sept. 18, 2017; Sierra Club, et al., Notice of New Authority and Request for Supplemental Environmental Impact Statement for the Mountain Valley Project and Equitrans Expansion Project, Docket Nos. CP16-10-000, et al., Sept. 18, 2017.

31. Hanley, N., Shogren, J., and White, B., "Environmental Economics: In Theory and Practice," 2nd Ed., Palgrave Macmillan, Basingstoke, UK, 2006, pp. 49-57.

32. Hausman, C. and Kellogg, R., "Welfare and Distributional Implications of Shale Gas," Brookings Papers on Economic Activity, Spring 2015, pp. 71-125.

33. Loomis, J. and Haefele, M., "Quantifying Market and Non-market Benefits and Costs of Hydraulic Fracturing in the United States: A Summary of the Literature," Ecological Economics, Vol. 138, August 2017, pp. 160-167.

34. Crane, K., Goldthau, G, Toman, M., Light, T., Johnson, S., Nader, A., Rabasa, A., and Dogo, H., "Imported Oil and US National Security," RAND Corp., 2009, p. 72; and Kobek, M.L.P., Ugarte, A., and Aguilar, G.C., "Shale Gas in the United States: Transforming Energy Security in the Twenty-first Century," Norteamérica, Vol. 10, No. 1, January-June 2015, pp. 7-38.

35. Kofod, J., "The Economic and Strategic Implications of the Unconventional Oil and Gas Revolution," NATO Parliamentary Assembly, Economics and Security Committee, Draft General Report, Mar. 11, 2013.