SPECIAL REPORT: Large upstream projects target world energy needs

Start-up of a host of projects in the next few years will contribute greatly to meeting projected increases in the world’s energy requirements.

Table 1 lists many of the mega and major projects slated to add significant amounts of oil and gas production. Projects listed include individual field developments and the related infrastructure required to bring the fields on stream. These projects involve:

- Development of new discoveries.

- Redevelopment of fields to recover additional resources.

- Stranded-gas projects and projects to eliminate gas flaring, many of which require installation of new infrastructure such as pipelines or facilities for producing LNG and GTL.

- Heavy-oil projects that also may integrate new infrastructure such as pipelines, crude oil upgraders, and mines into the project.

- Deepwater projects, some of which rely on long flowline tiebacks and hub facilities.

- Development of unconventional resources such as tight sands, shale gas, and coalbed methane gas.

Operators, peak production

Although joint ventures operate some of the projects, Table 1 lists one company as operator in the joint venture for simplification, with Table 2 listing the parent firm’s full name.

Table 1 includes the year in which the production from a project may peak or enter a peak production plateau that could last for several years.

Asia-Pacific

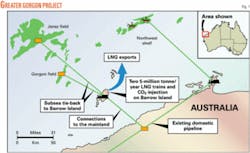

The Greater Gorgon project is Australia’s largest and will produce gas from offshore fields to a planned LNG liquefaction plant on Barrow Island (Fig. 1). The project includes two 5-million tonne/year LNG trains to handle gas produced from subsea completed wells producing Gorgon and Jansz fields. The project also includes carbon dioxide reinjection on Barrow Island. Final development plans for the project are still pending.

Several new projects will develop additional fields off China and produce through pipelines being installed from several large onshore gas fields.

The Sunrise and Troubadour field projects off East Timor will develop about 8 tcf of gas that an expansion of the Bayu Undan LNG plant will process.

Projects in India include development of onshore oil discoveries as well as producing gas from large, deepwater 12-tcf discoveries off India’s eastern coast. The offshore gas likely will be produced from subsea-completed wells producing through long tie-backs to shore.

In Indonesia, several projects will supply gas to existing LNG plants and power stations. A new LNG plant will process gas from the offshore Papua Bintuni Bay fields.

Table 1 also lists a project for developing the stranded 40 tcf of hydrocarbon gas in the Natuna D-Alpha field, which was discovered several decades ago, but development has not proceeded partly because of the high carbon dioxide content in the field.

The Banyu Urip field in the Cepu block on Java is the largest oil field discovered in Indonesia in many years.

The Kikeh projects off Sarawak will be Malaysia’s first deepwater project to start producing.

Development of the gas field in the Southern Highlands of Papua New Guinea includes the laying of a 3,000-km pipeline to Queensland, Australia.

Development of gas fields off Thailand continues.

Western Europe

Off Ireland, the gas from subsea wells in the Corrib field will come ashore through an 83 km, 20-in. flowline.

The Tempa Rossa project, in Italy, will recover an estimated 200 million bbl of heavy oil.

Ormen Lange is the largest project off Norway. The development will produce gas from subsea-completed wells in deep water tied in to shore with 120-km flowlines.

Snøhvit is another large development off Norway that includes gas production from subsea wells tied in to shore with long flowlines that supply gas to a new LNG plant.

Norway also has numerous projects that will tie back subsea-completed wells to existing offshore facilities.

The UK Chestnut development includes a spread-moored cylindrical FPSO.

Eastern Europe and FSU

Azerbaijan will see additional development phases in the Azeri, Chirag, and Gunashli fields, increasing oil production by 700,000 bo/d.

Phased development of the Tengiz field continues in Kazakhstan and the first phase of the 13-billion bbl Kashagan field should start producing in 2008. The latest phase of the Tengiz field to come on stream will reinject sour gas to increase liquid recovery and reduce the required sour-gas processing capacity.

New pipeline projects in Russia will allow the production of several of its stranded gas fields, including the 130-tcf Shtokman field in the Barents Sea.

Middle East

Iran has several large projects slated for developing light to heavy oil, as well as continued phased development of the offshore South Pars gas field, which is an extension of Qatar’s giant North field.

The largest project in Kuwait will redevelop several fields to increase production by 450,000 bo/d.

In Oman, a steamflood will develop the estimated 1 billion bbl of heavy-oil resources in the Mukhaizna field.

Phased development of the 900-tcf North field off Qatar continues with additional LNG trains and new GTL plants.

Saudi Arabia’s projects will add more than 3 million bo/d. The largest is the Khurais expansion that will reach a peak production of 1.2 million bo/d in 2009.

Expansions and redevelopments in the UAE will increase production by more than 500,000 bo/d.

Africa

Several projects in Algeria will redevelop fields that have produced for many years including Rhounde El Baguel field, one of the largest oil fields in Algeria, which went on stream in 1962. Sonatrach expects production from this redevelopment to peak at 100,000 bo/d in 2009.

New projects in Angola will add 1.5 million bo/d. These projects mostly depend on floating production, storage, and offloading (FPSO) vessels and subsea wells for production. The Benguela and Belize fields, however, started producing through a compliant tower in late 2005 and will reach a peak production of about 200,000 bo/d in 2008 after the subsea tie-in of the Lobito and Tomboco fields and installation of another processing module. Tombua and Landana fields may produce through a compliant tower set in 400-m water.

A barge-based facility moored in deepwater off Congo (Brazzaville) will produce oil from the Moho and Bilondo field.

Production of gas from off Equatorial Guinea will increase after completion of an LNG liquefaction plant on Bioko Island.

The first offshore project off Libya since Bouri will transport gas to Italy.

The Chinguetti field is Mauritania’s first offshore development. The field started producing in February 2006.

Nigeria has several LNG projects on tap for monetizing primarily associated gas, some of which is gas that was flared. Development of deepwater resources also continues, adding more than 1 million bo/d production in the next few years.

A new 1,350-km pipeline will allow the increase in production from the Melut basin in Sudan.

Western Hemisphere

Petrobras dominates production off Brazil and continues its phased development of its giant fields in the Campos basin with the completion of more subsea wells tied in to new floating production systems. The company also has large new gas and oil projects in other basins including the Santos and Espirito Santo basins.

In the next few years units of El Paso Corp., Chevron Corp., and Devon Energy Corp. will join Shell Group as the only other companies, besides Petrobras, producing off Brazil.

New projects in Canada will add more that 2 million bo/d. Most of these are for recovering the vast bitumen resources in Alberta through mining or steam injection, such as the steam-assisted gravity drainage (SAGD) or steam-and-soak methods.

Completion of the proposed $6-billion (Can.), 760-mile MacKenzie Delta pipeline will allow the large stranded gas resources in the Northwest Territories finally to come on stream.

Although not listed in Table 1, Alberta also has many coalbed-methane development projects.

The Ku-Maloob-Zaap development off Mexico will produce 450,000 bo/d after 2008. Mexico also has plans for boosting recovery through the injection of nitrogen in several fields, including the onshore Jujo-Tecominacan field.

In Peru, further development of the Camisea gas fields complex includes the construction of an LNG plant.

In the US, the development of deepwater fields will add much new oil production as well as gas. These projects include installation in the Gulf of Mexico of semisubmersible production units, spars, tension-leg platforms (TLPs), and tie-backs of subsea completed wells. One deepwater development is the Independence Hub that will handle gas produced from 10 or more fields completed with subsea wells, some of which are in water deeper than 8,000 ft.

The proposed $20 billion Alaska gas pipeline will allow companies to start producing the estimated 40 tcf of gas currently stranded on the North Slope of Alaska.

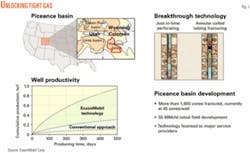

Technological advances in the US as well as higher gas prices have made many tight gas, shale gas, and coalbed gas developments feasible, such as the Piceance tight-gas projects in Colorado (Fig. 2).

Venezuela development projects listed include several large gas fields off Venezuela.

Venezuela also plans additional development of its vast heavy oil resources in the Orinoco area, although specific projects have not been announced. These would likely include new heavy-oil upgraders.