Worldwide drilling surges ahead

Contractors are increasing capacity and operators are collaborating in the increasingly tight drilling markets. Rig losses due to fires and hurricanes exacerbate the shortage of qualified drilling units.

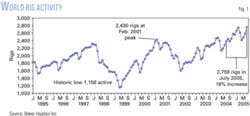

World drilling activity is strong and has increased over the last 3 years. The worldwide rig count peaked in July 2005 at 2,759, a 16% increase in 15 months (Fig. 1).

Market prices for oil and natural gas are the main drivers for the drilling expansion, but rig capacity and labor remain major limiting factors. Operators have been expanding their capital expenditure programs but the rig supply is inelastic, leading to impressive day rate gains in most drilling sectors.

Broad operator cooperation may ease the demand slightly and lead to new efficiencies in rig mobilization and scheduling.

Major operators with large drilling programs are comfortable with long-term leases of desirable drilling units (often advance contracts that secure financing for newbuilds). To secure rig availability for future drilling programs, some operators are forming long-term rig sharing agreements.

Statoil recently chartered three rigs for 10 years of collective drilling on behalf of a partnership that includes Eni Norge AS, Norsk Hydro ASA, and Norske Shell ASA. The four partners will employ Smedvig ASA’s West Alpha submersible drilling tender for 3 years from first-quarter 2006; the Transocean Arctic for 4 years beginning second-half 2006; and Transocean’s Polar Pioneer for 3 years starting second-quarter 2006.

According to ODS-Petrodata1, at least two separate groups are working on rig share agreements to bring MODUs into the Gulf of Mexico. Oklahoma City’s Kerr McGee Corp., Dominion Exploration & Production Inc., and Anadarko Petroleum Corp. want to bring a drill ship up from Brazil.

Houston’s Spinnaker Exploration Co. LLC and Nexen Petroleum Offshore USA Inc. mobilized the GlobalSantaFe Arctic I semisub from Venezuela for 8-12 months of work.

Worldwide activity

Baker Hughes Inc.’s international rig count (excluding North America) reached a historic high of 932 rigs in June 2005 (Fig. 2). The North American rig count has trended upward since early 2002 and reached 1,869 in July, surpassing the historic high of 1,698 rigs in February 2001, (Fig. 2).

The highest rig counts outside of North America are in Latin America, which averaged 319 rigs active January-July 2005, with a high of 330 in May (Fig. 3). Latin American drilling has been increasing at the fastest rate in the world since early 2002.

The Middle East has the next largest, steadily increasing rig market, averaging 243 rigs working January-July 2005, with a high of 248 in June. Rig use in the Far East is also increasing, with an average of 218 rigs working in 2005, up from 197 rigs working in 2004.

In Europe, the rig count averaged 68 in 2005 but reached a peak of 80 rigs in July, compared with an average of 70 throughout 2004.

Drilling activity in Africa is flat, year-to-year, with about 50 rigs working.

Lehman Bros. analysts Jim Crandell and Lisa R. Hackett said in late August, “After experiencing several years of moderate growth, the oil service industry is entering a ‘boom’ phase. We expect global E&P spending growth to approach 20% this year and perhaps exceed 20% in 2006.”2

US activity

Many operators expand their drilling programs through the year, as price increases make more capital available and more prospects become economically attractive. There is an increasing focus on deep gas drilling and deep shelf prospects. Onshore, operators have found success drilling intricate lateral wellbore patterns and hydraulically fracturing tight-gas formations.

The top 50 US operators drilled 20,722 wells through Aug. 24 of this year, all deeper than 2,500 ft, totaling more than 147 million ft (Table 1). Only eight operators drilled 100 or more directional wells through the year:

• EnCana Oil & Gas USA Inc. (235).

• XTO Energy Inc. and Devon Energy Production Co. LP (140 wells each).

• Williams Production RMT Co. (133).

• EOG Resources Inc. (132).

• Chesapeake Operating Inc. and Burlington Resources Oil & Gas Co. LP (113 each).

• Atlas America Inc. (102).

Rig utilization continues to improve for the top 25 drilling contractors in the US, to an average of 82% in August from 79% in January (Table 2).

Patterson-UTI Drilling Co and Nabors Drilling USA LP each averaged more than 200 rigs working through the year. The next largest drillers, Unit Drilling Co., Grey Wolf Drilling Co. LP, and Helmerich & Payne Inc., each had more than 100 rigs working on average in 2005.

The North American land rig market is operating at capacity. For the week ending Aug. 26, 2005, the Baker Hughes rig count listed 1,317 land rigs working in the US, while RigZone counted 1,739 (Table 3). There were 25 rigs working in inland waters according to BHI and 40 according to RigZone. BHI counted 100 rigs for the US offshore, while RigZone counted 137.

Baker Hughes’ data undercount the actual number of drilling rigs, as it does not include rigs that are in transit or rigging up or down.

US well completions are up significantly for all types of wells from mid-2004 to mid-2005 (Table 4).

Bad weather

Drilling activities in the Gulf of Mexico are hampered by hurricane activity nearly every summer. The 2005 season has proven especially devastating to the industry, as recent news reports have shown.

Hurricane Dennis rattled the gulf in July, damaging BP’s Thunder Horse semisubmersible platform. Hurricane Katrina swept through the central gulf on Aug. 27-29 and led to the evacuation and later, mangling of many rigs and platforms.

The US Coast Guard reported on Aug. 31 that 20 rigs had not been located and were thought capsized, including the Rowan New Orleans slot jack up which had been working in Main Pass Block 185.

Diamond Offshore Drilling Inc.’s Ocean Warwick jack up drifted 66 miles northeast from Main Pass 299 and was found aground on Dauphine Island, off Alabama, with significant damage.

Helmerich & Payne’s platform Rig 201 was smashed on the Mars TLP in Mississippi Canyon Block 807.

Many semisubmersible rigs broke their moorings and drifted off location, including Diamond’s Ocean Voyager, GlobalSantaFe Corp.’s Arctic I, Noble Corp.’s Jim Thompson, and Transocean Inc.’s Deepwater Nautilus, among others.

Some contractors, such as Transocean, were able to monitor their rigs’ locations remotely using onboard transponder beacons.

Significant damage to the MODU fleet will disrupt drilling programs and probably drive day rates even higher.

According to the MMS’ deepwater activity report issued Aug. 22, the Deepwater Nautilus semisub was drilling the Pathfinder prospect in 3,448-ft water in Green Canyon Block 434 for Shell Offshore Inc. when Hurricane Katrina came through. The rig had been under contract to Shell since June 2000 for $195,100/day. The rate was to increase to $220,000/day under a new contract with Shell beginning in September.

Setting records?

GTS Drilling Services Inc., a subsidiary of General Turbine Systems of Conroe, Tex., has brought the first Chinese-made drilling rig to the US and is operating it in the Piceance basin for independent Presco Inc., based in The Woodlands, Tex.

GTS President and CEO Sajjad Chaudhry told OGJ that the rig arrived in Houston on June 5 and began drilling in western Colorado on Aug. 5. It has a zero-discharge mud system.

The 1,300-hp GTS rig is working at the highest altitude drill site in the US (9,300 ft), near Parachute, Colo. Just south of Battlement mesa, the rig is visible from Interstate 70. HongHua Manufacturing Co. in Sichuan province, China built the electric rig (OGJ, July 18, 2005, p. 37).

The Scooter Yeargain jack up, the first Tarzan rig built by Rowan Cos. Inc., is drilling the Blackbeard West prospect for ExxonMobil in South Timbalier Block 168. The Blackbeard West well was spud in early February in 67 ft of water and is estimated to take 350 days to drill to about 32,000 ft and may drill even deeper.

ExxonMobil is operator (25%) with partners Newfield Exploration Co. (23%), BP PLC (20%), Petrobras (20%), Dominion Exploration and Production Inc. (7%), and BHP Billiton Ltd. (5%).

Bill Provine, Rowan’s vice-president of investor relations, told analysts at the A.G. Edwards Energy Conference in Boston on Mar. 15 that Rowan stands to earn $28-35 million for the job. He also said that ExxonMobil plans to drill four of these deep wells in the Gulf of Mexico, although Rowan only has a contract for this first well.

Additional wells may be drilled in Newfield’s Treasure Island project, encompassing the Treasure Bay, Treasure Chest, and Treasure Ship areas on the shelf.

New offshore construction

At mid-year, more than $4 billion had been committed for the construction of new mobile offshore drilling units (OGJ, July 4, 2005, p. 55). More than 50 MODU’s are under construction around the world, predominantly in Singapore (Table 5).

Notable exceptions are the JU-2000 enhanced jack ups under construction for China Oilfield Services Ltd. in Dalian, China. Construction began on the first rig, COSL 941, in March 2004, and it will be delivered in 2006.

In June 2005, the company contracted for the construction of the second jack up with Dalian New Shipbuilding Heavy Industry Co. Ltd., a subsidiary of China Shipbuilding Industry Corp. The second rig cost $147 million and will be delivered December 2007.

At the end of June 2005, COSL was leasing one jack up and owned and operated 10 jack ups (Bohai IV, V, VII-X, XII; Nanhai I, IV; COSL 931, 935) and three semisubmersible drilling rigs (Nanhai II, V, and VI). All of COSL’s rigs have top drives, enabling them to run 90-ft triples.3

The JU-2000 design originates from Houston-based Friede & Goldman Ltd. The rig can work in water as deep as 400 ft, and drill to 30,000 ft from a 75-ft cantilever.

In late August, F&G announced contracts to build seven new rigs, including four JU-2000 enhanced jack ups (delivery in 2007) and three ExD semisubs. The ExD is a sixth-generation design capable of working in water up to 10,000 ft deep (OGJ, Nov. 22, 2004, p. 51).

The first ExD’s built were the GSF Development Driller I and II. They were commissioned in April 2001, built in SembCorp’s Jurong Shipyard, and delivered in second-quarter 2005.

In July, LeTourneau Inc. announced that it would supply the design and components for two Super 116 Class jack ups ordered by Houston-based Scorpion Offshore Ltd. Rowan Cos. will deliver the LeTourneau kits to the Keppel AmFELS yard in Brownsville, where the rigs will be constructed. Keppel announced on July 5 that Scorpion would pay about $174 million for the two rigs. Scorpion has an option for a third rig.

According to Marine Money, newly formed and privately held Scorpion sought financing in Oslo.4

Two other LeTourneau Super 116 design jack ups were previously constructed at the AmFELS yard and are working in the Gulf of Mexico: the Chiles Columbus and Chiles Magellan (renamed ENSCO 74 and ENSCO 75).

One of the newest additions to the fleet is the Bob Keller (Tarzan II) jack up rig, christened on Aug. 27. It was built by Rowan Cos. in Vicksburg, Miss., and towed to the company’s yard in Sabine Pass, Tex. to have legs and derrick installed. The jack up has a 2-million-lb hook load capacity and can drill to 40,000 ft, working in water up to 400 ft deep.

In October, the Bob Keller will begin a 200-day contract with McMoRan Oil & Gas Co. LLC for a deep shelf well in the Gulf of Mexico. The McMoRan contract rate is $95,000/day.

Aberdeen’s Stena Drilling Ltd. announced in August that it ordered a new deepwater drillship from South Korea’s Samsung Heavy Industries Corp., for $600 million. The Stena Drill Max drillship will be dynamically positioned and displace 105,822 tons (OGJ, Aug. 22, 2005, p. 9).

National Oilwell and KCA Deutag launched a new 4,600-hp platform rig in January. The rig was assembled in National Oilwell’s Galena Park, Tex., yard before shipping to Angola for Cabinda Gulf Oil Co. Ltd., a ChevronTexaco subsidiary (OGJ, July 25, 2005, p. 43). The rig was installed on CABGOC’s Benguela Belize compliant piled tower in May.

Land rig construction

In July, Richard J. Mason estimated that 300 additional land rigs would be needed for the US market by mid-2007.5 A new 1,500-hp rig with top drive and drill pipe costs about $10.5 million, he said, easily supported by current day rates. Refurbishing a rig costs $3-7 million but the cost can be recaptured in a 2-3 year term contract. However, components are backlogged up to 12-months.5

Nabors Industries announced a 100-rig newbuild program with a potential cost of $1 billion, with rigs under construction in the US and China. Nabors has ordered 25 land rigs from China’s HongHua, with options for more. Nearly all will probably be put into service outside the US.

In March 2005, Tulsa’s Helmerich and Payne Inc. announced plans to construct 10 new FlexRig4-design rigs (smaller than previous FlexRigs). H&P will operate the new rigs under 3-year contracts with Williams Cos. in the Piceance basin. The FlexRig4 can drill 6-12,000 ft and costs about $11 million (15% less than previous generations of FlexRigs). According to Angie’s Contract Drilling Weekly, the implied rate for the contract is about $18,265/day; current leading edge rates in the Piceance basin are about $16-$17,000/day.6

In July, H&P announced orders for four more FlexRigs at $10.5 million each.

Houston-based Blast Energy Services Inc. (renamed in June 2005 from Verdisys Inc.) is building a new generation coiled-tubing drilling rig that will utilize abrasive fluid jetting.7 Earlier this year, Verdisys sold its master license for Landers lateral drilling technology and two Landers rigs to Maxim TEP Inc., based in The Woodlands, Tex., for $1.2 million and a perpetual sublicense.

The new rig incorporates Verdisys’ radial drill optimization (RDO) technology, which can be used for casing milling, ultra-short radius lateral drilling, and long reach perforations. The reel carries 8,500 ft of coiled tubing.

Metro Energy Group Inc. has drilled two wells in the Caddo Pine Island field north of Shreveport, La. using RDO technology. The first well (Glassell F-6) was drilled in September 2003.

Verdisys drilled Metro’s second well (Glassell F-5) in May 2005, with 10 horizontal laterals, six of which extended more than 300 ft from the well bore, into the Annona Chalk formation at 1,433 to 1,550 ft deep.

The merger of National Oilwell Varco created a streamlined one-stop shop for on- and offshore rig construction. NOV is building dozens of land rigs in both the US and Canada.

In addition to rigs sourced by many smaller companies, behemoth Rowan may provide land rig packages. Rowan runs a fleet of 18 deep drilling land rigs.

Parker Drilling fleet

Parker Drilling Co. reported second-quarter 2005 results on Aug. 4.

The company’s average utilization of international land rigs was 71%, up from 48% a year earlier. As of Aug. 4, utilization was 79%. Average utilization for Gulf of Mexico barge rigs was 79%, up from 67% a year earlier, and rates were about $4,500/day higher than during second-quarter 2004.

President and CEO Robert L. Parker Jr. said the company is receiving, “record day rates for barge rigs in the Gulf of Mexico.”

In June 2005, Parker reported that it sold four land rigs in Colombia and Peru to Saxon Energy Services Inc. for $23 million. Saxon will also buy three other land rigs from Parker. A year earlier, in August 2004, Parker sold five jack ups and four platform rigs in the Gulf of Mexico to Hercules Assets LLC. Following the Hercules sale, Parker listed 51 marketed rigs, down from 65 a year earlier.

Parker Drilling USA was ranked 19 among American drillers in 2005 based on footage drilled through Aug. 10 (Table 2).

In late June, Parker lost Rig 255 in a blowout and subsequent fire while operating for Niko Resources (Bangladesh) Ltd. in Bangladesh. In March, a third-party contractor died in New Iberia, La. while working on Parker barge Rig 72, the company reported.

Tubulars

St. Louis, Mo.-based Maverick Tube Corp. is one of the largest manufacturers of oil country tubular goods in North America. The company posted its second-quarter results on July 25, 2005. Chairman and CEO C. Robert Bunch anticipates continued robust global drilling activity and a continued heavy demand for OCTG.

He noted that steel costs have fallen significantly over the past several months and “currently appear to be stabilizing at attractive levels” which he said would expand Maverick’s margins “into next year.”

Maverick expects to double its capacity to produce OCTG by the end of this year, partly through its second-quarter acquisition of Tubos del Caribe, SA, a low-cost supplier of premium OCTG and line pipe. The Tubos acquisition also gives Maverick a much larger presence in the Latin American energy marketplace.

Looking ahead

Most analysts believe rig activity will continue to increase and day rates will move still higher. Perhaps we will also see further consolidation in the drilling industry.

Longdley Zephirin, of the Zephirin Group Inc. suggested in June that a merger between Noble Corp. and ENSCO International would create a solid worldwide “’A’ class offshore drilling company” with a large market share in the Gulf of Mexico, Middle East, West Africa, and the North Sea.8

Zephirin noted that the last major acquisition was ENSCO’s purchase of Chiles Offshore in May 2002 for $578 million.

There are still hulls available for conversions or upgrades. Diamond has already begun upgrades on the last few Victory-class hulls. Noble has two Bingo 9000 hulls to upgrade at the Dalian yard (OGJ, May 2, 2005, p.62).

Thule Drilling ASA may convert one its two newest semisubs to drilling units in 2008. Thule announced its acquisition of the two rigs in late August for $27 million but is contractually forbidden from maintaining or upgrading them as drilling units:

• Gulfdrill 7 (formerly Sedco 708) - previously owned by Momentum Engineering, Dubai. The restrictions on using this rig for drilling expire in 2008.

•Seascout - previously owned by Atwood Oceanic Inc., Houston.

With oil and natural gas prices creeping ever higher, the drilling market has a very solid year ahead.✦

References

1.ODS-Petrodata, Gulf of Mexico Rig Report, April 2005.

2.Lehman Oil Service and Drilling, The Original Oil Service Monthly, August 2005.

3.www.cosl.com.cn/Bus_Seg/Off_Dri/

4.Marine Money, July-August 2005, www.marinemoney.com

5. Mason, R.J., Land Rig Newsletter, July 31, 2005.

6.Angie’s Contract Drilling Weekly, Mar. 29, 2005.

7. Blast Energy Service Update, August 2005, www.blastenergyservices.com

8.ZGI Research, June 16, 2005.