Industry urged to watch for regular oil production peaks, depletion signals

Depletion is an everyday experience: The glass of beer starts full and ends empty. We are born, pass prime, and die. Yet strangely, oil depletion is counterintuitive: Nothing quite like it has happened before. As the Flat-Earth community likes to say: "The Stone Age did not end because we ran out of stone." (It ended because we found that bronze made a stronger tool.)

But this time we do face the decline of a critical resource on which we all depend, and we do so without sight of a better substitute. "Hydrocarbon Man"—now the sole surviving human subspecies—will be extinct this century. It is not too soon to start thinking of a successor.

Did Darwin get it quite right with the "survival of the fittest" as the basis of evolution? Throughout recorded geological history, species have adapted to their environmental niches to become very successful. But when the niche changed for climatic or geological reasons, they died out, leaving simpler stock to continue and in due time to give the next generation of specialized offshoots. The fittest in the long term were not the same as the fittest in the short term. Man will be the former if he uses his claimed superior intellect to find a way to voluntarily move back to greater simplicity.

Depletion also has built a chasm between the Natural Scientist, who observes nature and applies its immutable physical laws, and the Flat-Earth Economist, who thinks that investment creates resources under ineluctable laws of supply and demand.

We need to penetrate the walls of denial, obfuscation, and misunderstanding to try to determine just where we are on the depletion curve. We are not really interested in when oil and gas will finally run out, which won't happen for many decades, but we should be critically interested in knowing when production will peak and begin its terminal decline.

Determining peaks

There are several steps to take in determining production peaks:

- Define what is to be measured. Distinguish the many different types of petroleum, each of which has its own endowment in nature, its own costs and characteristics, and above all its own depletion profile. There is a huge difference between a free-flowing well producing 50,000 b/d, and digging up a tar sand with a shovel.

- Measure it. Penetrate the ambiguous accounting of reserves. The term "proved reserves", which is widely used for financial purposes, means in plain language "proved-so-far." It may or may not represent the best estimate of what the field as a whole contains, depending in part on the degree to which it has been drilled up. Some countries overreport, others underreport, and many leave their estimates implausibly unchanged, sometimes for years. The term, "proved and probable reserves" (or those having a "mean probability") is commonly used for the best estimates of full field reserves.

- Establish discovery dates. Recognize that a field is found by the first wildcat drilled upon it so that, in discovery terms, all the oil and gas ever to be produced from it, under whatever technical or economic conditions, are attributable to the date of that first borehole. The sum of production to date (cumulative production) and the remaining proved & probable reserves on the reference date gives the size of a field, or a country's total.

- Forecast future discovery. With a valid database in hand, we are in a position to forecast future discovery and production. The so-called "creaming curve," which plots cumulative discovery against cumulative wildcats or by date, is a good beginning. The larger fields in any province are normally found first, giving a hyperbolic trend with an asymptote representing the total to be found and produced, subject to a cutoff for fields too small to be economic. Several successive hyperbolic trends are represented in places with more than one cycle of discovery, for example the opening of offshore extensions.

This approach can be supplemented by studying the size distribution of fields, which plot as a parabola when size is set against rank on log-log scales. The early large fields set the parameters for the parabola under a fractal law of self-similarity. The difference between what has been found and the parabola gives what is yet-to-find, again subject to a cutoff. These approaches work best for individual petroleum provinces, but give a useful indication for many countries as well.

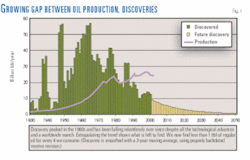

Note in Fig. 1 that discovery peaked in the 1960s and has been falling relentlessly ever since, despite all the technological advances and a worldwide search. Extrapolating the trend shows what is left to find. We now find less than 1 bbl of regular oil for every 4 bbl we consume. (Discovery is smoothed with a 3-year moving average, using properly backdated reserve revision.)

Model the depletion. If we can gather such information by field and geological province, we are in a position to start modeling depletion. In practice, we will find it almost impossible to secure unequivocal data and will have to apply common sense and experience to remove the worst of the anomalies.

It is necessary to take into account the following considerations:

- Theoretical unconstrained production.

- Real-world production as constrained for economic or political reasons.

- The impact of technology, which tends to hold production higher for a longer period without adding significantly to the reserves.

- Fluctuations in demand.

- The uneven distribution of the resource, which may put certain countries in a swing role, making up the difference between world demand and what the other countries can produce.

Other, more-sophisticated approaches may be used, but there is much to be said for simplicity, especially as the input data are rarely cast in stone.

The ASPO model

The Association for the Study of Peak Oil (ASPO)1 has done its best to design a reasonable data-set with which to model regular oil2 depletion under the following scenario:

- Postmidpoint countries. Regular oil production in countries that have produced more than half their total is assumed to decline at the current depletion rate (annual production as a percentage of the reserves + yet-to-find oil).

- Premidpoint countries. Production in premidpoint countries is assumed to be flat to the midpoint, unless local circumstances indicate otherwise, to be followed by decline at the midpoint depletion rate.

- Swing countries. The major producers of the Middle East, namely Saudi Arabia, Iran, Iraq, Kuwait, and Abu Dhabi, together holding about the half the world's remaining regular oil, are assumed to exercise a swing role around peak, making up the difference between world demand and what the other countries can produce under the model.

- Regular oil scenario. Demand is assumed to be, on average, flat to 2010 due to recurring recessions and price spikes as capacity limits are breached. The Middle East swing role is assumed to end in 2010 when the demands upon those countries will exceed their practical capacity. World production is thereafter assumed to start its terminal decline at the (then) depletion rate.

There are, of course, other scenarios that would modify the model, but it seems to be a good point of departure.

In addition to the foregoing regular oil reserves, it is necessary also to model the other categories:

- Oil from coal and shale.

- Bitumen (and derived synthetics).

- Extra-heavy oil (<10° API).

- Heavy oil (10-17.5° API or as otherwise defined).

- Deepwater oil and gas (500 m of water).

- Polar oil and gas.

- Nonconventional gas: coalbed methane, gas from tight reservoirs, and such..

Natural gas liquids pose a particular problem. It makes sense to include condensate from oil fields with crude oil but to distinguish natural gas liquids that come from gas fields and are produced by gas plants. That is a good deal easier said than done, however.

Capacity and price

A coal deposit covers a wide area, but only the places with thick seams and ease of access are mined. If prices rise or costs fall, lower concentrations become viable, which has given rise to the notion of the resource pyramid. The huge deposits of degraded oil in Venezuela, Siberia, and western Canada are like conventional minerals insofar as extraction is substantially a mining process. But regular oil behaves differently because it is a liquid, not an ore. It is either there in profitable abundance, or it is not there at all. The oil-water contact is abrupt, leaving virtually no possibility of tapping lower concentrations.

This natural polarity affects both capacity and price. Throughout its history, the oil industry has been affected by an environment of "boom or bust," which called for control beyond the open market as administered in turn by Standard Oil Co., the Texas Railroad Commission, the hegemony of the major companies, and finally, the Organization of Petroleum Exporting Countries.

In earlier years, the major companies did produce large fields at below their capacity to match their markets, but those days are almost over, with most now producing flat out, especially in the case of costly small offshore fields. State entities that control production in the main OPEC countries have no incentive to build spare capacity simply to provide a comforting cushion for the consumers.

In the past, they have had to cut production to support price in order to offset uncontrolled production elsewhere, especially as the offshore was opened up by private companies. But those days are substantially over, as nonswing countries have already peaked and gone into decline. These factors have had much impact on the price of oil, which is set on the marginal barrel in a short-term market. Small shortages or surpluses have had quite disproportionate effects in relation to the underlying trends of depletion. But as shortages appear after global peak, oil price will be increasingly determined by the cost of substitute energies.3

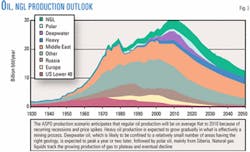

In Fig. 2, the ASPO production scenario anticipates that regular oil production will be, on average, flat to 2010 because of recurring recessions and price spikes. Heavy oil production is expected to grow gradually in what is effectively a mining process. Deepwater oil, which is likely to be confined to a relatively small number of areas having the right geology, is expected to peak a year or two later, followed by polar oil, mainly from Siberia.

Natural gas liquids track the growing production of gas to plateau and eventual decline.

Gas depletion

Natural gas behaves very differently from oil due to its higher molecular mobility. More gas was generated in nature than was oil, but that is offset by the fact that more has escaped over geological time, as no geological seal has perfect integrity. More is also recoverable from the reservoir, with 70-80% being normal, compared with an average for oil of about 40%. This mobility means that an uncontrolled gas well would deplete an accumulation very quickly.

In practice therefore, production is normally set at far below the natural capacity to provide a long plateau rather than a short peak. In an open market, such as in the US, gas is traded on a daily basis through a pipeline network, as the various suppliers vie with each other in drawing down their inbuilt spare capacity, eventually supporting production with the help of compressors. Generally, prices have fallen—attracting new customers—as the original investments were written off. The end of the production plateau, however, comes abruptly and without market signals, as now appears to be happening.

Although the oil market is global due to ready transport by tankers, the gas market is regional, with three main hubs: North America, Siberia, and the Middle East-Central Asian region. There are also local markets, and substantial amounts of stranded gas in remote locations. These circumstances make it difficult to model gas depletion.

The global endowment seems to be about 10,000 tcf, of which about one quarter has been produced. The US increasingly relies on Canadian imports and will tap arctic sources when costly new pipelines are built. Europe is in a similar position, with its indigenous supply set to decline steeply, but it has the advantage of being able to access supplies in Siberia, North Africa, and eventually the Middle East and Caspian Sea regions, although competing there with the demands of Southeast Asia. It would be reasonable to contemplate a global plateau at about 130 tcf/year during 2015-40, followed by a steep decline.

Various nonconventional gases, mainly coalbed methane, will become more important in the future. They already are meeting about 10% of US needs. Methane hydrates occur as solids in the form of disseminated granules and laminae, meaning that the methane cannot migrate to accumulate in commercial quantities. They are well described as "the fuel of the future" and likely to remain so.

Conclusions

The first obvious conclusion is that we are not about to run out of oil, having slightly more left than we have used so far. But what we do face is an imminent peak and the onset of decline from resource constraints. The precise date of peak depends very much on the level of demand, which is hard to predict. It may have been passed in 2000 if wars and deep recessions curb demand and in any case is unlikely to be delayed much beyond 2010. It will be an historic discontinuity as the economic growth and prosperity that the world has enjoyed—thanks to an abundant supply of cheap, oil-based energy over the past century—gives way to a corresponding decline.

Individual societies in the past have gone into decline when they exceeded the capacity of their resources, but this time we face a global challenge of unprecedented proportions. The world's population has expanded six-fold exactly in parallel with oil, which underlines the critical role of petroleum in agriculture, fuelling the tractor and providing essential nutrients and pesticides.

But there is much that could be done to ameliorate the tensions of the transition. An imperative is to reduce waste, for which there is great scope, through better traffic management, better public transport, and new building standards. Renewable energy from wind, tide, sun, biomass, and nuclear sources can be tapped, albeit at a price.

The oil industry itself has a good future applying its great experience and technological prowess to the production of what remains during the second half of the oil age. It inevitably will have to tackle smaller, more-hostile, and more-difficult fields.

Oil price is a serious issue. Higher prices will be needed to make the remaining projects viable. At the same time, higher prices give rise to destabilizing influences from the mammoth transfers to the Middle East, which by 2010 would be supplying 40% of the world's oil. Most of it would be revenue, as production costs are unlikely to rise significantly. It provides another argument for the consumers to do everything possible to cut their demand.

Perhaps the greatest challenge of all is the adoption of a new mindset to match the changed environment. The rampant consumerism, globalism, and market economies that have marked at least the last half of the 20th Century will have to be replaced by new ways that do recognize resource constraints. That speaks of nothing less than a radical overhaul of economic principles that were built in the Industrial Revolution when Man perceived himself to be master of his environment on a planet of limitless resource. One silver lining from falling production may be that the fears of climate change could evaporate in parallel with the reduced emissions.

Governments face particular challenges. Some may take a short-term view and try to secure access to oil and gas by military conquest, notwithstanding that no prize can evade the iron grip of depletion for long. Other governments will accept the constraints imposed by nature, and work diligently to come to terms with them.

There is a pressing need for the dissemination of better information on the resource base and the essential nature of depletion. Some tough decisions will be necessary, and the general public needs to understand the reality of its predicament if it is to give governments a mandate for action.

References

1. See www.asponews.org

2. The term "regular oil" is preferred to "conventional oil," which is confusing because it is used in widely differing senses, as there is no standard definition.

3. According to Rex Tillerson, senior vice-president, ExxonMobil Corp.—speaking at the Institute of Petroleum in London, February 2003— substitute energies from renewable sources cost more than the equivalent of $100/bbl.

The author: Colin J. Campbell has more than 40 years experience in the oil industry. After receiving his PhD in geology from Oxford in 1957, he worked as exploration geologist for Texaco Inc. Since then, he has worked for BP Group LLC and Amoco Production Co. as Amoco's regional geologist for Latin America and later chief geologist for Amoco Ecuador. He was general manager for Shenandoah Oil Corp. in Britain responsible for creating new ventures in the North Sea, Ireland, Portugal, Turkey, and the Netherlands, then rejoined Amoco in London in 1979 and was appointed exploration manager in Norway the following year. During 1984-89, he was executive vice-president of Fina Oil & Chemical Co. in Norway. In retirement, Campbell serves as consultant to governments and major oil companies and is a trustee of the Oil Depletion Analysis Center, London. He has authored two books and numerous papers. In 2001, he founded the Association for the Study of Peak Oil and Gas, of which he is honorary chairman. Campbell is a member of the American Association of Petroleum Geologists; the Geological Society, London; and the Institute of Petroleum, London.