The Hz San Andres - one year later

Roth Capital Partners' John White revisits one of the strongest plays in the Permian Basin

JOHN WHITE, ROTH CAPITAL PARTNERS, HOUSTON

IT'S BEEN JUST OVER A YEAR since we published our industry report titled "The Hz San Andres: Likely at a Pivot Point, In our View," and detailed findings in a previous article for OGFJ (OGFJ, July 2016). In our opinion, the pivot has been successful based on strong well completions recorded over the last 12 months, as detailed in this article. The play has been very active, with about 130 wells drilled over the last 12 months, according to data from IHS Markit.

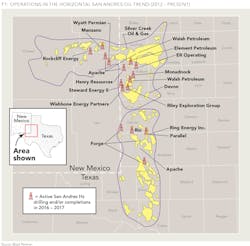

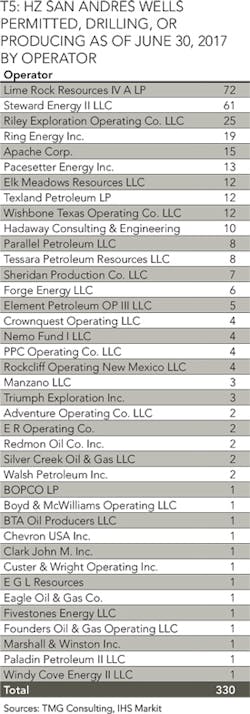

The Horizontal (Hz) San Andres play on the Central Basin Platform (CBP) of the Permian Basin is actually properly categorized as two plays. On the map in Figure 1, if you draw an east-west line that divides Gaines County in half, the play to the north is focused on the Lower San Andres and the play to the south is focused on the Upper San Andres. As of June 30, there were 330 wells that were permitted, drilling, or completed in both plays, with approximately 136 wells permitted, drilling, or completed in the northern play and 193 wells permitted, drilling, or completed in the southern play, per IHS Markit data.

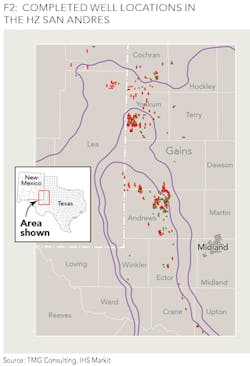

In Figure 2, the red markers are Hz San Andres completed wells and the green markers are Hz San Andres completed wells that have been on production for 15 months or more as of Jan. 30. This map is courtesy of Ted Mowers, independent consulting geologist with TMG Consulting in Midland, Texas.

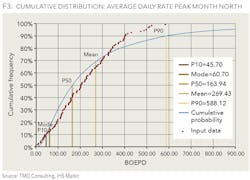

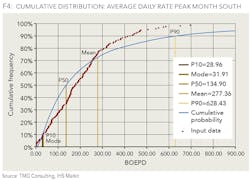

Mowers undertook a detailed analysis of the wells completed in both the northern and southern plays which centered on the average daily rate in the peak month of production. This metric was chosen for its consistency and objectivity. When companies report successful wells and cite a production rate, there can be wide variation between what rates companies cite, i.e. 24-hour peak rate, IP30 rate, etc. Mowers then created a database of average daily rate in the peak month of production of the wells in the northern play and the southern play and performed a statistical analysis, as shown in Figures 3 and 4.

The northern play wells had a mean 269 barrels oil equivalent (BOE) per day average daily rate in the peak month and the southern play wells had a mean of 277 BOE per day average daily rate in the peak month. We found it very surprising that the mean of these two data sets are so similar, as did Mowers.

It was surprising for the following reasons: 1) there is considerable geographic distance between each play, it's approximately 140 miles from northern Cochran County to southern Ector County, 2) the geologic setting and depositional environment of the San Andres in each play is vastly different, 3) the completion method and the production profile of each play is very different, as explained further herein.

The data was then sorted by year of completion and mean and median of the average daily rate in the peak month were calculated. The progression of yearly means and medians of the average daily rate in the peak month in the southern play was as we expected, trending upward each year, likely reflecting the industry's learning curve with selecting higher quality well locations and improvements in drilling and completion procedures.

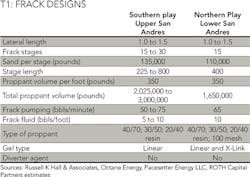

In the southern play, well completions and the production profile are similar to other unconventional resource plays, even though the Upper San Andres is a conventional reservoir. These wells are drilled with a lateral wellbore section of between one to one-and-one-half miles in length with a frack program generally in-line as shown in Table 1. These wells then display strong production together with high decline rates in the initial months following completion. The production decline is hyperbolic with first year decline rate on the order of 80% to 90%.

The northern play is very different from the southern play with regard to formation characteristics and production profile. The wells in the northern play require patience and persistence and high capacity water handling ability.

"These wells initially produce 100% water for a number of weeks, then they start producing small amounts of oil, about one to three barrels per day, then the oil cut increases with the wells reaching a peak rate of between 200 to 300 barrels of oil per day," said Russell Hall, president of Russell K. Hall and Associates, a petroleum engineering firm in Midland, Texas, that has performed extensive analyses of the play. "The water cut remains high, at about 80%," said Hall.

We note that there is disagreement in the industry, and we have witnessed lively discussion of this subject, about the production process of how the Lower San Andres reservoir functions and the naming of the process. Some industry participants refer to the Lower San Andres in the northern play as the "residual oil zone" (ROZ) and define its location as beneath the oil/water contact in the formation. Others refer to the play as a "de-watering" play, because after certain volumes of water are produced, the oil production commences. Still others call the play a "de-pressuring" play, because the removal of the water stimulates the oil production by reducing the reservoir pressure below the bubblepoint, or the level where the natural gas dissolved in the oil escapes from the oil solution and expands, thus driving the oil production.

Companies active in the northern play include ER Operating, Monadnock Resources, Riley Exploration, Rockcliff Energy, ROZ Resources, Silver Creek Oil & Gas, Steward Energy II, Wishbone Energy, and Wyatt Permian.

Wells in both the northern and southern plays produce large amounts of water and as such operators need high-capacity equipment, water disposal wells, water-handling equipment, and water-handling expertise.

Hall, of Russell K. Hall & Associates, told us, "We are seeing operators experiment with lower rate fracks and smaller volumes in an attempt to stay out of deeper wet intervals. Therefore, I expect to see the stage size getting shorter, the volume decreasing, and the pump in rate decreasing."

Octane Energy assisted with the frack designs. Jared Blong is Octane's founder and CEO. Octane is a Midland-based drilling and completions consulting firm that works throughout the Permian Basin for a variety of operators both private and public.

Table 2 shows a single well Hz San Andres economic analysis and related assumptions. The major changes versus our analysis approximately one year ago are the higher IP and estimated ultimate recovery (EUR). Last year we ran an IP of 400 BOE per day and net EUR of 292,000 BOE. This year, based on recent activity we used a 650 BOE per day IP and a net EUR of 515 BOE. The improvement in the internal rate of return using a $45/bbl WTI oil price is impressive, at 83% versus last year's 26%.

We then began to ratchet the oil price lower in search of a breakeven oil price. At $32/bbl, the IRR is 18%, which we believe many in the industry would regard as breakeven. Many companies use an IRR in a range of 10% to 20% as a breakeven point. We note these are economics at the well level and thus are not burdened by G&A expenses.

UPPER SAN ANDRES-SOUTHERN PLAY

RING ENERGY INC. (REI - Buy, $12.97 as of 7/28/17)

We cover REI and we recently increased our target price from $18.50 to $20.00, primarily due to the Hz San Andres drilling program outperforming our expectations. Until recently, to our knowledge, REI and Apache Corp. (APA-NC) were the only publicly-traded E&P companies active in this play.

For 2017 REI has been pursuing the drilling of 22 Hz San Andres wells, six vertical San Andres development wells, and continued upgrading of existing infrastructure on its CBP asset. The 2017 capital expenditure budget is $70 million.

In our view, REI's drilling program is showing strong results. In its operations update on April 5, REI provided information on five recently completed wells that had 24-hour initial production (IP) rates ranging from 377 BOE per day to over 800 BOE per day with an average of 660 BOE per day. These wells compare very favorably with the first three REI horizontal wells drilled in late 2016 and exceeded our expectations.

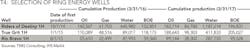

This time last year we highlighted the Riders of Destiny 1H, the True Grit 1H, and the Rio Bravo 1H, all of which were completed in the Upper San Andres in Andrews County. At that time, these were the best wells in the Upper San Andres play, based on data available to us. These wells appear to be performing well and in-line with EUR at that time of 400,000 BOE. As shown in Table 4, the Riders of Destiny and the True Grit wells continue to demonstrate strong performance, and according to the data we have seen, are some of the strongest performing wells.

This prospect was located by and these wells were planned, drilled and completed by the management and technical team at privately owned Parallel Petroleum, primarily Larry Oldham, Don Tiffin, Brian McCurry, Ted Mowers, and Tom Hanna. These individuals then departed Parallel with Oldham forming Oldham Properties Ltd. and Gateway Royalty LLC, while Tiffin, McCurry, and Hanna formed Talon Resources with backing from the private equity firm Mountain Capital. Mowers runs TMG Consulting and is active in the Hz San Andres plays. Oldham and Talon are also actively seeking opportunities in both plays. Other companies active in the southern play include Ring Energy Inc., Apache Corp. (APA-NC), Elk Meadows, LimeRock, Parallel Petroleum, Sheridan Production Company, and Windy Cove Energy.

WATER AND SCALE ISSUES

Again, at our 29th Annual ROTH Conference, during our Hz San Andres expert panel, Larry Oldham, Partner, Oldham Properties Ltd./Gateway Royalty LLC, brought up an operations issue, cautioning operators on the risk of scaling issues in Hz San Andres wells. Scale is a deposit or coating formed on the surface of well equipment. Scale is caused by a precipitation due to a chemical reaction with the surface.

From the data we have reviewed, one of the larger and more successful companies in the northern region of the Lower San Andres play is Steward Energy II. The company recently made a presentation at an industry conference that detailed its scale workover program.

In August 2012, Steward Energy LLC (Steward I) partnered with Natural Gas Partners and built a 10,000-acre position in the Southern Delaware Basin, targeting the Wolfbone resource play. A drilling program of appraisal wells identified over 10 potential horizontal drilling targets in the 3,500' vertical oil column across largely contiguous acreage. Steward I marketed and sold its position in late 2014.

Following the exit of Steward I, founder Lance Taylor and an enhanced team formed Steward Energy II LLC (Steward II), backed again by Natural Gas Partners. Taylor and his team have targeted drilling horizontal wells in the Lower San Andres, primarily in western Yoakum County, Texas, and eastern Lea County, New Mexico. The flagship field is at its Bronco prospect, where Steward owns approximately 17,370 net acres with an 88% working interest. In June 2017, production at Bronco was about 5,600 BOE per day, net to Steward. Companywide, Steward owns approximately 80,200 net acres in the play and production from the Lower San Andres was about 6,000 BOE per day during June 2017.

At its Bronco property, Steward identified 24 wells with lower than expected oil and gas production due to scale, specifically calcium sulfate (CaSO4). Steward then planned a well cleanout procedure, as follows: 1) Evaluate the electric submersible pump (ESP) for scale deposition, usually in the gas separator and pumps, 2) run a drill bit to mechanically cleanout scale from the entire horizontal section of the wellbore, typically without the return of drilling fluids, 3) pump a scale converter across each set of perforations mixed with water and let soak for 24 hours, this process converts CaSO4 to an acid dispersible byproduct, 4) acidize each set of perforations with 10,500 gals 15% NEFE HCl and and let soak for six to 12 hours, 5) spot scale inhibitor (polyacrylate/deta phosphonate blend) across each set of perforations and let soak for 48 hours. Finally, install the ESP and put back on production.

Steward informs that the average cost of this workover procedure was about $250,000. And looking at the results provided by the company it appears well worth it. At the inception of the workover program, Steward forecast the 28 affected wells would be producing about 2,000 BOE per day after the conclusion of the program. Steward performed 24 workovers for scale cleanouts, etc, and performed artificial lift upgrades for the other four wells. The gross cost was $6.8 million. Recently, these 28 wells were significantly outperforming expectations and were producing approximately 3,650 BOE per day.

ABOUT THE AUTHOR

John White is a senior research analyst in ROTH Capital Partners' Houston office. Previously, he was a portfolio manager and analyst with Triple Double Advisors. Prior, he was an E&P equity analyst with Natixis Bleichroeder and Next Generation Equity Research. From 1996 to 2003 he served as an energy high yield fixed income analyst for BMO Capital and John S. Herold Inc. His experience also includes banking and credit analysis responsibilities with Scotia Capital. His industry background includes working in acquisitions and divestitures and exploration and production, primarily with BP. White received a BBA from the University of Oklahoma and an MBA from the University of St. Thomas (Houston). He serves on the OGFJ Editorial Advisory Board.

ROTH makes a market in shares of Ring Energy Inc. and as such, buys and sells from customers on a principal basis. Within the last 12 months, ROTH has managed or co-managed a public offering for Ring Energy Inc. Within the last 12 months, ROTH has received compensation for investment banking services from Ring Energy Inc.