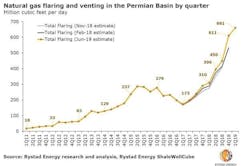

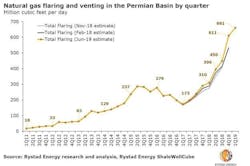

Flaring and venting of natural gas in the Permian basin in Texas and New Mexico has reached an all-time record high in this year’s first quarter, averaging 661 MMcfd, according to research conducted by Rystad Energy. This widespread waste of a valuable commodity is the result of persistent infrastructure challenges, a lack of enough takeaway capacity, and an unexpected outage on a key pipeline in the area.

“We anticipate that basin-wide flaring will stay above 650 MMcfd before the Gulf Coast Express pipeline comes online in the second half of 2019,” says Artem Abramov, head of shale research at Rystad Energy.

To put these volumes into perspective, the most productive gas facility in the US Gulf of Mexico—Royal Dutch Shell PLC’s Mars-Ursa complex—currently produces about 260-270 MMcfd of gross gas, which is only some 40% of the amount of gas flared and vented every day in the Permian.

The estimate of flared and vented gas is based on Rystad Energy’s latest research on lease-level gas disposition reporting, based on data from the Texas Railroad Commission and New Mexico Oil Conservation Division. Raw data from state agencies experience substantial reporting delays—particularly on the Texas side of the basin—and Rystad Energy has therefore developed a model to provide the best possible estimate for flared and vented gas volumes not yet reported.

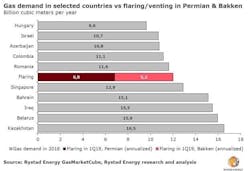

Gas flaring and venting in the US is currently concentrated in two basins: the Permian and the Bakken. Levels in the Bakken, located in North Dakota, were about 500 MMcfd in this year’s first quarter, which brings the collective volumes of flared and vented gas from these two basins up to about 1.15 bcfd. For comparative purposes, that represents 12 billion cu m/year of wasted gas, which exceeds the yearly gas demand of nations such as Israel, Colombia, and Romania.

The largest operators in the Permian flared on average 5.1% of operated gross gas production in fourth-quarter 2018 and in this year’s first quarter.

However, there are substantial regional differences. More than 25% of gross gas production in Howard County in Midland North, Tex., has been flared recently. As of this year’s first quarter, Howard County accounted for only 14% of gross gas production, but as much as 40% of the total flaring in Midland North.

Regulations stipulate that operators must report both flaring and venting as a lump sum. Venting is gas release without combustion, whereas flaring is the burning of excess capacity.

Gross gas production in the Permian surpassed 13 bcfd in December 2018 and is currently approaching 14 bcfd.

“While oil production in the Permian dipped at the beginning of the year, gas production in the basin has remained healthy, with steadily increasing production as the driving force behind increased venting and flaring,” Abramov said.