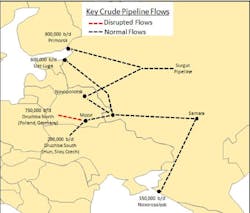

Russian production fell by 170,000 b/d from April to May as the disruption to oil exports caused output to fall to 60,000 b/d less than the production-cut commitment. The last hurdle is restoring 750,000 b/d via the northern leg of Druzhba.

However, thanks to the restoration of some pipeline flows and spare capacity in ports, Russian production will recover in June after falling to 11.1 million b/d in May, according to an analysis from ESAI Energy.

In May, the disruption to oil exports via Druzhba and Ust-Luga caused Russian production to fall more than it would have under the pledge with the Organization of Petroleum Exporting Countries and other producers (OPEC+). Russia produced 11.25 million b/d in April and was on the path to cutting production by another 110,000 b/d to 11.14 million b/d. Instead, output fell by 170,000 b/d, according to preliminary data through May 26.

According to ESAI’s analysis, deliveries of 360,000 b/d to Belarus are fully restored. Additionally, 300,000 b/d of exports via the southern leg of Druzhba restarted as of May 29. Meanwhile, exports of 750,000 b/d via the northern leg will restart no earlier than June 9 and could be postponed further. Beside the logistics of removing contaminated crude from the pipeline and restoring the flow of uncontaminated crude, disputes over Transneft compensation to European refiners threaten to delay the restart.

“We understand that there are no longer disruptions to seaborne exports from Ust-Luga and that waterborne exports have risen to partially compensate for the disruption to Druzhba exports. Based on preliminary reports for loading out of Novorossiysk, Ust-Luga, and Primorsk, we believe waterborne exports are at multiyear highs from both Black and Baltic seas,” ESAI said.

“If Transneft needed to, the pipeline operator could compensate for the continued northern Druzhba outage by increasing seaborne exports by at least 750,000 b/d and probably much more. We estimate Russia can export at least 1.8 million b/d combined from Ust-Luga [and] Primorsk, 400,000 b/d more than the 6-month rolling average of those exports through April. It may be that this is how much Russia exported in May. We estimate Russia can export 1.5 million b/d from Novorossiysk, or more than double recent volumes. According to available information, Russia has increased these exports, albeit not anywhere near full capacity.” ESAI said.

In addition to using spare seaborne capacity in Europe, Russia increased eastbound exports. For example, May and June exports from Kozmino Bay are scheduled at 700,000 b/d, up from 640,000 b/d in the period through April. Russia may have simultaneously increased pipeline deliveries to China.

Since Russian output has fallen since April, Russia does not need to increase seaborne exports by 750,000 b/d to compensate for the continued Druzhba outage. Higher domestic crude processing also provides an additional outlet for crude producers.

Consequently, ESAI believes that Russia has more than enough spare export capacity for production to recover compared with the May level of 11.1 million b/d.