NGSA: Neutral price pressure on gas market expected this summer

The Natural Gas Supply Association’s 2018 Summer Outlook for Natural Gas expects neutral or flat price pressure on the market this summer compared with last summer, as record production enables industry to easily match record demand.

NGSA’s expectation is based on an analysis of the weather, economy, consumer demand, production, and storage. According to NGSA’s analysis, increased demand from the power sector, for LNG exports, and to build storage inventories all place upward pressure on prices that are counterbalanced by tremendous growth in production—ultimately resulting in a forecast for neutral pressure on prices vs. summer of 2017.

Weather, economy

According to the National Oceanic and Atmospheric Administration’s current predictions, the continental US will on average experience a summer that will be 5% cooler than last summer, but 2% warmer than the 30-year average. Compared summer-over-summer, the total number of cooling degree days (CDD) is less than in summer 2017, leading to a projection that weather will place downward pressure on demand and prices.

Meantime, the US economy will expand at a slightly stronger rate that it did last summer. According to IHS Economics, the nation’s gross domestic product is expected to increase by a solid 2.8% compared with summer of 2017, when GDP expanded by 2.3%. Since the growth is similar enough to summer 2017, NGSA believes that it translates to neutral pressure on gas prices.

Overall demand

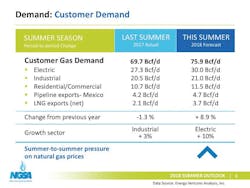

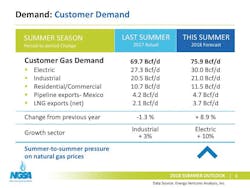

NGSA forecasts overall 2018 summer demand for gas at 75.9 bcfd, a 9% increase from 69.7 bcfd last summer.

Marked growth in gas demand from the electric sector this summer is accounting for the largest increase in summer-over-summer customer demand. Several factors explain the increase, including new natural gas-fired power plants added to the generation fleet since last summer, an expectation for low availability of hydro-generation in the Southwest, and current low prices for gas.

The second-largest expected increase in demand is to come from exports of LNG this summer, which are forecast to increase to 3.7 bcfd in summer 2018 from 2.1 bcfd in summer 2017, driven by the addition of Sabine Pass Train 4 and Dominion’s Cove Point projects to the preexisting Trains 1-3 at Sabine Pass. In addition to the increase in LNG exports, US exports to Mexico are expected to increase by 0.5 bcfd to a total of 4.7 bcfd this summer. The primary factor behind this steady increase is the building of new pipeline capacity on both sides of the border, particularly the Mexican side.

The residential-commercial sector is expected to account for the third-largest increase in demand for gas for the April-October summer cooling season, although some of this growth is attributable to high demand this April when unseasonably cold weather kept furnaces and water heaters blasting longer than normal.

The industrial sector is expected to slightly increase its summer consumption of gas to average out at 21 bcfd—an increase of only 0.5 bcfd over last summer. Industrial demand is spurred mainly by newbuilds and expansions in petrochemicals, fertilizers, and steel.

Storage

Heading into the winter heating season, it is projected that 3,507 bcf of gas will be in storage by yearend, which would require an average weekly injection of 70 bcf. This level of injection is robust and larger than last summer’s average weekly injections of 57 bcf, but much less than the summer of 2014’s average weekly injections of 89 Bcf.

The difference in the size of the weekly injections between the summers of 2017 and 2018 is expected to place upward pressure on natural gas prices this summer.

Production, supply

US gas production this summer will reach 80.4 bcfd, a sizeable increase over last summer’s 72.5 bcfd, according to the US Energy Information Administration’s forecasts.

Among the reasons that summer production is expected to increase so dramatically are strong production from the Marcellus and Permian basins and associated gas plays, strong production from shale gas plays as previously drilled but uncompleted wells come online, increased efficiencies in gas extraction techniques, and improved takeaway capacity in the form of pipelines and processing plants in areas such as the Marcellus.

This record-high production will place downward pressure on gas prices compared with last summer.

The 2018 Summer Outlookalso projects a moderately sized but important contribution to supply from low-cost Canadian imports, including supply from TransCanada’s two NGTL expansion projects.