P. 6 ~ Continued - How Haynesville shale will lift Louisiana's gas production profile

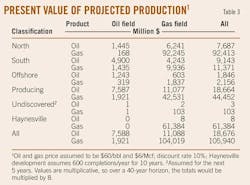

The valuations only consider commodity price and discount rate; they do not include royalties, taxes, operating and capital cost, or transportation expenses. High commodity prices lift fields above their economic threshold and make uneconomic production viable.

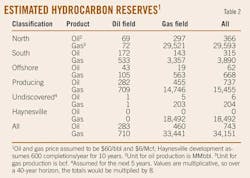

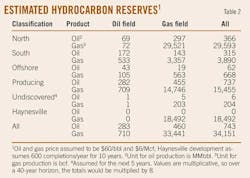

Net worth is correlated with the amount of reserves but is also affected by the timing of production. The total expected present value for oil reserves and gas reserves are $18.7 billion and $105.9 billion, respectively.

Present values are presented based upon future prices that vary from $40/bbl to $120/bbl and $4/Mcf to $12/Mcf (Table 4). Oil and gas prices are independent, and if future oil prices are assumed to average $80/bbl and gas prices $4/Mcf, total present value would be $25 billion from liquids production and $71 billion from gas production, or $96 billion total.

Remaining oil and gas reserves are valued at $12-38 billion and $71-212 billion, respectively. In the North, oil reserves represent about half of the production total, and gas contributes nearly 90% of the total value. South Louisiana has significant remaining oil reserves and smaller quantities of gas.

The Haynesville shale is expected to be a significant contributor to state gas production and the manner in which the Haynesville develops will play a critical role in the state's future.

References

1. "Jennings Field—The birthplace of Louisiana oil industry," Public Information Series No. 9, Louisiana Geological Survey, Baton Rouge, September 2001.

2. US Department of Energy, Energy Information Administration, Crude Oil Production, Washington, DC, 2010 (http://tonto.eia.doe.gov/dnav/pet/pet_crd_crpdn_adc_mbbl_m.htm).

3. US Department of Energy, Energy Information Administration, Natural Gas Gross Withdrawals and Production, Washington, DC, 2010 (http://tonto.eia.doe.gov/dnav/ng/ng_prod_sum_dcu_rusf_a.htm).

4. SPE/WPC/AAPG/SPEE, "Petroleum Resources Management System," 2007 (http://www.spe.org).

5. Strategic Online Natural Resources Information System, Louisiana Department of Natural Resources (http://sonris-www.dnr.state.la.us/www_root/sonris_portal_1.htm).

6. Kaiser, M.J., "Hydrocarbon production forecast for committed assets in the shallow water Outer Continental Shelf of the Gulf of Mexico," Energy—The International Journal, Vol. 34, No. 11, 2009, pp. 1,813-25.

7. Kaiser, M.J., "Hydrocarbon production forecast for Louisiana—producing fields module," Mathematical and Computer Modeling, 2011, available on line.

8. SPE, "Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information," approved by SPE board of directors, June 2001, Article 5.7, "Estimating Reserves by Analogy to Comparable Reservoirs."

The authors

Displaying 6/6

View Article as Single page

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com