How Haynesville shale will lift Louisiana's gas production profile

Mark J. Kaiser

Yunke Yu

Louisiana State University

Baton Rouge

Conventional oil and gas production in Louisiana has been in steady decline for 4 decades, but in recent years, new technology and innovation has opened up a new resource play in the Haynesville shale that is expected to play an important role in the state for many years.

In the past 5 years, shale gas has reversed Louisiana's gas production decline and promises significant growth potential in the future.

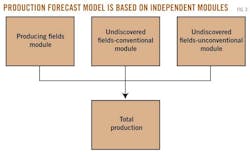

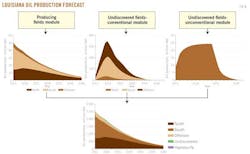

The purpose of this article is to present hydrocarbon production scenarios for Louisiana based on a transparent analytic framework and a well-defined set of assumptions. We disaggregate resource classes into three modules based on producing fields, undiscovered conventional fields, and undiscovered unconventional fields.

We employ a field-level evaluation for producing fields and categorize by primary product, resource category, geographic area, age, and production class. Undiscovered fields have not yet been discovered and are therefore conjectural. Undiscovered fields are classified according to conventional and unconventional categories and are treated using a probabilistic and scenario-based forecast to reflect the uncertainty levels in the resource categories.

In recent years the need for long-term forecasting has become more important for planning purposes and to facilitate efficient regulatory development and incentive programs as the largest oil and gas fields diminish in productivity and the promise of unconventional production is realized.

Louisiana is in the early stage of transitioning to a gas producing state, and the manner in which the Haynesville develops will play a critical role in deliverability and economic prospects in the future.

Historical production

Drilling for oil first took place in Louisiana in 1866, but it was not until the Texas success at Spindletop in 1901 that drillers returned to Louisiana and discovered oil at Jennings.1

In the 1930s and 1940s, exploration moved south into the marsh and swamplands, and in 1955, state offshore production began. In recent years, the Haynesville shale has been the target of enormous capital expenditures and has created great excitement because of the large volume of resources estimated to be economically recoverable in the region.

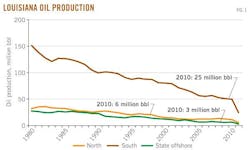

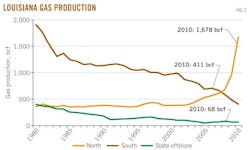

Oil production rose rapidly after World War II and has been in steady decline since peaking in 1970. Today, oil production is 24% of its 1965 peak in North Louisiana, 12% of its 1970 peak in South Louisiana, and 9% of its 1970 peak in state waters. Gas production has followed a broadly similar trend except its decline has been less dramatic, and over the last few years, production from the Haynesville has dramatically reversed the decline.

Most oil is produced in South Louisiana. Offshore production has never exceeded 10% of the state total and comprises the majority of production from state-owned lands (Fig. 1). In North Louisiana, gas production has doubled in the last 3 years while the South and offshore regions continue along a downward decline (Fig. 2).

Proved reserves

Oil and gas production in Louisiana plays an important role in US production and is an important source of state revenue.

In 2009, Louisiana ranked fifth in oil production and fourth in gas production in the US, and according to the Energy Information Administration, Louisiana has proved reserves of 388 million bbl of oil, 11.6 tcf of gas, and 300 million bbl of natural gas liquids—about 2% of US proved oil reserves, 5% of its proved gas reserves, and 3% of its NGL reserves.2 3

The Haynesville shale is one of several unconventional gas plays that have been discovered in the US in the past decade that promise to dramatically change the course of energy development. Technically recoverable resources in the Haynesville have been estimated at 73 to 289 tcf, making the region one of the largest shale plays in the US.

Technically recoverable resources are not proved reserves, because the capital has not been spent to prove up the resource,4 but even if the lower bound estimate was reliable this would essentially quadruple the total hydrocarbon reserves in the state.

Resource categorization

Field definition

A field is defined as the surface area directly above one or more producing reservoirs all related to the same geologic structural feature and-or stratigraphic condition.

The Louisiana Office of Conservation reviews producing leases and production information submitted by operators, logs, geophysical records, and other data to establish the existence of a new field or the extension of an existing field.5 In Louisiana, fields are described in terms of lease unit well (LUW) administrative codes.

Development status

Oil and gas resources are divided into three categories according to development status and project maturity: producing fields, discovered undeveloped fields, and undiscovered fields.

Producing fields are fields that produce any amount of oil or gas in the year of analysis. Producing fields are "hard" assets because they have been developed through capital investment; their physical existence is established; and reserves are believed to be known to a reasonable degree of certainty.

Undiscovered fields are those fields that are expected to be discovered and produced in the future. The existence of undiscovered fields is speculative and depends upon geologic prospectivity, capital investment, technology development, and various other factors. Typically, a regional assessment is performed to determine potential, and with a discovery model future production is assessed. Discovery models range from the simple to complex and attempt, based on statistical outcomes and geologic conditions, to reflect the uncertainty of future production pathways.

Discovered undeveloped fields lie between producing fields and undiscovered fields. Most are discoveries that have been announced or known to exist but are not currently producing. Undeveloped reserves are those reserves of any category that are expected to be recovered from new wells on undrilled average, or from existing wells where a major expenditure is required for recompletion.

Discovered undeveloped fields require major investment to produce and are categorized separately from proved developed producing reserves. A common example of undeveloped fields are those reserves that underlie undrilled portions of a property adjacent to current producers and are, based on engineering and geological evaluation, reasonably likely to produce hydrocarbons.

Some areas of the US such as offshore California, Alaska, and the Eastern Gulf of Mexico have significant discovered undeveloped fields but because of regulatory constraints and-or public opposition, drilling is not permitted. Louisiana is a mature petroleum region and the inventory of undeveloped fields is expected to be small.

Technology status

A conventional field is a discrete accumulation or set of accumulations that are bounded by a downdip water contact from which hydrocarbons in liquid or gaseous forms are extracted. Unconventional reservoir systems are often synonymous with "continuous" accumulations and include tight gas sands, shale gas, shale oil, and coalbed methane reservoirs.

Unconventional fields are more expensive to develop than conventional fields and are more difficult to characterize, and require novel or new technologies to produce. Once market penetration exceeds a certain threshold and cost/risk decline and are "comparable" to other technologies, the demarcation between "unconventional" and "conventional" becomes less clear.

Product type

Fields are classified as oil or gas fields based on the volume of produced gas (measured in cubic feet) per unit of produced oil (measured in barrels) and described through the gas-oil ratio (GOR).

Cumulative GOR (CGOR) is the aggregate oil and gas production ratio at the time of evaluation. A field with cumulative gas-oil ratio CGOR < 5,000 cu ft/bbl is labeled an oil field and a field with CGOR > 5,000 cu ft/bbl corresponds to a gas field.

Production forecast modules

Oil and gas production is modeled using three independent modules as shown in Fig. 3. State production arises from the contribution of existing assets (producing fields) and new fields (conventional and unconventional) that are brought into production in the future.

Producing fields include both conventional and unconventional production, while undiscovered fields represent fields that may be discovered and produced in the future. Forecasting future production from producing fields is less uncertain than undiscovered field production, and our choice of models reflects this level of uncertainty.

Undiscovered fields represent production potential and are uncertain in terms of their size, timing, and contribution. Undiscovered conventional fields are modeled using historic discovery rates and the production of analog reservoirs of conventional oil and gas fields. Undiscovered unconventional fields are modeled using a scenario-based approach.

Producing fields module

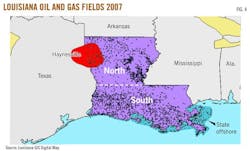

A total of 1,684 fields has been discovered and produced in Louisiana, and in 2008, a total of 994 fields (398 oil fields and 596 gas fields) was producing (Fig. 4).

The majority of field discoveries were made before 1977 and most active fields as well as the majority of oil production are from pre-1977 discoveries. Over 80% of Louisiana's oil production is derived from fields discovered prior to 1977, while 60% of gas production derives from fields discovered over the past 5 years.

Producing fields exhibit a variety of complex behavior reflecting geologic conditions and investment and management intervention. The preferred unit for performance analysis is individual wells, but in Louisiana, production is often only available for a multiwell lease or a production unit.

Production may show a continual decline after peak production, but more often, trends exhibit short-term spikes, long periods of inactivity, multiple production peaks, and related characteristics that are not well-suited to traditional decline curve analysis. Varying levels of growth activity occur over time, related to recompletions, offset drilling, and similar activity.

A combination of heuristic and analytic techniques previously applied to structures in federal waters6 was modified and adapted for Louisiana's producing fields. A discussion of the flowcharts and details of the methods and procedures can be found in Kaiser.7 The main result of the algorithms is shown in Fig. 5.

Undiscovered conventional fields module

Field discoveries

The number of fields remaining to be discovered and developed in a geographic region is unknown and uncertain.

Large fields are generally found early in exploration, and field sizes and the number of discoveries tend to decrease over time unless a new exploration concept develops or new areas are opened to exploration. Statistical models are region-specific to account for each areas unique geologic history, prospectivity, and cost structure.

The number of new field discoveries in Louisiana has been relatively stable over the past 2 decades with fewer than 15 new fields/year identified. The average number of fields discovered by region and primary product are shown in Table 1 over a 5, 10, and 20-year horizon. In recent years the number of field discoveries has been relatively small, less than two or three discoveries per year per region.

Discovery model

We adopt historic discovery rates to estimate the number, location, and size of future conventional field discoveries.

We assume that over the next 5 years the average number of fields discovered will be similar to the number of conventional fields discovered in the past 5 years and the size and production profiles of these new fields will be analogous to previous discoveries in each region.

Engineers and geologists rely upon the use of analogies to estimate reservoir parameters and performance expectations during the early development stages of a field when no production and geologic data are available. Areal proximity is one of the most important features when establishing proof of analogy: "If performance trends have not been established with respect to oil and gas production, future production rates and reserves may be established by analogy to reservoirs in the same geologic area having similar characteristics and established performance trends."8

In North Louisiana, two gas fields and one oil field are assumed to be discovered and brought on line each year, and in the South, two gas fields, one oil field, and two offshore gas fields will come into production each year over the next 5-year period.

Production model

The expected production from future undiscovered fields is a function of the number of new discoveries made during the year and the average production expected to be achieved per discovery.

Production arises from discoveries made during the year that start producing, as well as fields that previously came online. For each year the process repeats, with previous year discoveries contributing to production along with new discoveries.

Average production profiles for oil and gas fields are from a sample set that includes 59 gas and 45 oil fields in North Louisiana and 72 gas and 39 oil fields in South Louisiana. The standard deviation envelope indicates profile variability, and because of the diversity of field production, the envelopes are large and only a fraction (in this case one-fourth) of the standard deviation is presented. Standard deviation is maximum at peak production and declines with age as production declines.

The contribution of undiscovered conventional fields to total production is expected to be negligible relative to current producing fields, and we estimate the range of production potential at 1.9% to 2.4% of total production in their peak year.

As the largest oil and gas fields in Louisiana diminish in productivity, there is little prospect that the loss of their capacity will be offset by new conventional discoveries. New conventional oil and gas field discoveries have not kept up with the depletion of these fields and historical trends are believed to be a reliable guide to the future.

Undiscovered unconventional fields module

Haynesville shale

The Haynesville shale covers about 9,000 sq miles across East Texas and Northwest Louisiana, and its contribution to future gas production in the state is expected to be large and significant, but how large and how significant is unknown and speculative.

Haynesville is in the early stages of development and is subject to evolving environmental, technical, regulatory, and market uncertainty. Complex geological and petrophysical systems with heterogeneities occur at all scales.

Unconventional reservoirs are characterized by more significant capital expenditures relative to conventional development and profit windows that are more sensitive to operating conditions. Concerns over water requirements have led to stricter environmental reviews and regulatory changes that may impact growth trends in the short run but are unlikely to have significant long-term impacts because the issues appear manageable. The US economic recovery and demand for gas will also play an important role in the pace of shale gas development in Louisiana and in other states.

Type curves

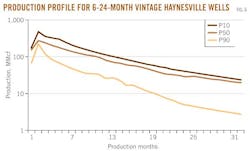

The average monthly production profile P50 for Haynesville wells of 6-24 month vintage through December 2010 is depicted in Fig. 6. The data set consists of 683 single-well LUWs; multiple-well LUWs are excluded because of normalization requirements.

In addition to the average production profile, we also present P10 and P90 curves. P10 represents the production profile of the well where 10% of the category wells exceed its cumulative production at the beginning of 6 months; P90 represents the well where 90% of the category wells exceed its 6-month cumulative production. Prolific wells produce more and longer; less prolific wells produce less and are plugged earlier.

Scenario description

For unknown uncertainties, the best way to forecast future production is to present scenarios that illustrate the range of production potential.

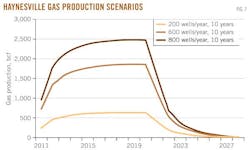

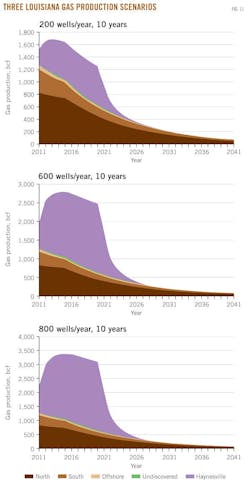

From 2008 through 2010, 66 wells (2008), 349 wells (2009), and 601 wells (2010) were drilled and completed in the Haynesville (in 2011, 374 wells have been drilled through September). We use historic data to bound future outcomes and assume that future activity will range between 200 to 600 to 800 wells/year.

We adopt three drilling scenarios and apply the P50 type curve to determine the potential impact of shale gas output to state production.

We assume future wells will follow P50 type curves, a constant level of drilling activity for each of the next 10 years, and no pipeline infrastructure constraints in the region that would curtail or limit production. Market prices are assumed to remain above $4/Mcf to avoid significant curtailment and reduction of drilling activity. A price floor between $4 and $5/Mcf will continue to support drilling activity in the region because a portion of wells remain profitable.

Under these assumptions, the production forecasts yield a cumulative build-out ranging between 6.3 and 24.8 tcf by 2028 (Fig. 7).

Production forecast

Oil production

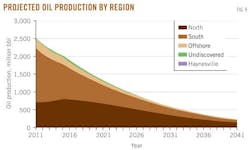

Oil and condensate production for the producing and undiscovered fields modules are combined as shown in Fig. 8.

Producing fields play the dominant role in state production and undiscovered fields are about two orders-of-magnitude smaller in relative terms. Liquids production arising from Haynesville shale gas is negligible. Production decline and capital investment in existing producing fields is the primary determinant of future state production.

Oil production by region is shown in Fig. 9. High oil prices will flatten out the curve and will likely lead to a greater number of new discoveries, as more fields would be expected to be discovered and existing fields will have new wells drilled, but the chance to rebound long term and increase production seems unlikely.

Unless new unconventional plays appear on the horizon, which by some accounts may already be occurring in the Tuscaloosa marine shale and the Smackover brown dolomite, oil production is expected to continue its steady downward decline.

Gas production

Unconventional production is expected to be large and significant and the manner of its development will have a large impact on the fortunes of the state.

Unconventional production is the dominant contributor to state gas output and is expected to remain a significant factor for several decades (Fig. 10). Conventional gas fields in the North still contribute a significant amount to state production but are in decline similar to oil fields. Undiscovered conventional production is not expected to play a large role in future production if historic discovery rates are a reliable guide to future performance.

Under modest assumptions on drilling and recovery rates, gas production in the Haynesville is expected to continue to increase and provide a larger percentage of state production. Three scenarios represent potential production pathways over the next decade (Fig. 11).

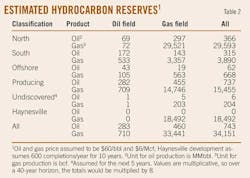

Reserves

We estimate remaining reserves from producing fields at 737 million bbl of oil and 15.5 tcf of gas which is slightly larger than EIA estimates described previously. Our estimates of volumes are associated with a probability of 50%, meaning that the actual volume has a 50% chance of being less than the estimate and a 50% chance of exceeding the estimate.

Conventional fields are not expected to contribute a significant amount to total hydrocarbons, and over the next 5 years, 6 million bbl of oil and 204 bcf of gas are expected to be discovered and produced.

In the Haynesville region, if 600 wells/year are drilled on average over the next decade, shale gas is expected to contribute 18.5 tcf, an amount exceeding current conventional gas reserves; if only 200 wells/year are drilled over the next decade, shale gas is expected to contribute 6.2 tcf.

North Louisiana is expected to contribute 87% of total gas production in the state; South Louisiana and offshore 11% and 2%, respectively. For oil reserves, South and North Louisiana are expected to capture 49% and 42% shares, respectively, with offshore contributing 9%.

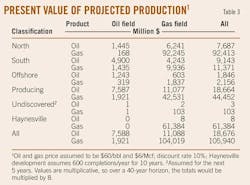

Valuation

Table 3 summarizes the discounted gross revenue of the reserves data in Table 2 under constant future prices of $60/bbl oil and $6/Mcf gas and a 10% discount rate.

The valuations only consider commodity price and discount rate; they do not include royalties, taxes, operating and capital cost, or transportation expenses. High commodity prices lift fields above their economic threshold and make uneconomic production viable.

Net worth is correlated with the amount of reserves but is also affected by the timing of production. The total expected present value for oil reserves and gas reserves are $18.7 billion and $105.9 billion, respectively.

Present values are presented based upon future prices that vary from $40/bbl to $120/bbl and $4/Mcf to $12/Mcf (Table 4). Oil and gas prices are independent, and if future oil prices are assumed to average $80/bbl and gas prices $4/Mcf, total present value would be $25 billion from liquids production and $71 billion from gas production, or $96 billion total.

Remaining oil and gas reserves are valued at $12-38 billion and $71-212 billion, respectively. In the North, oil reserves represent about half of the production total, and gas contributes nearly 90% of the total value. South Louisiana has significant remaining oil reserves and smaller quantities of gas.

The Haynesville shale is expected to be a significant contributor to state gas production and the manner in which the Haynesville develops will play a critical role in the state's future.

References

1. "Jennings Field—The birthplace of Louisiana oil industry," Public Information Series No. 9, Louisiana Geological Survey, Baton Rouge, September 2001.

2. US Department of Energy, Energy Information Administration, Crude Oil Production, Washington, DC, 2010 (http://tonto.eia.doe.gov/dnav/pet/pet_crd_crpdn_adc_mbbl_m.htm).

3. US Department of Energy, Energy Information Administration, Natural Gas Gross Withdrawals and Production, Washington, DC, 2010 (http://tonto.eia.doe.gov/dnav/ng/ng_prod_sum_dcu_rusf_a.htm).

4. SPE/WPC/AAPG/SPEE, "Petroleum Resources Management System," 2007 (http://www.spe.org).

5. Strategic Online Natural Resources Information System, Louisiana Department of Natural Resources (http://sonris-www.dnr.state.la.us/www_root/sonris_portal_1.htm).

6. Kaiser, M.J., "Hydrocarbon production forecast for committed assets in the shallow water Outer Continental Shelf of the Gulf of Mexico," Energy—The International Journal, Vol. 34, No. 11, 2009, pp. 1,813-25.

7. Kaiser, M.J., "Hydrocarbon production forecast for Louisiana—producing fields module," Mathematical and Computer Modeling, 2011, available on line.

8. SPE, "Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information," approved by SPE board of directors, June 2001, Article 5.7, "Estimating Reserves by Analogy to Comparable Reservoirs."

The authors

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com