US energy demand to stay weak in 2012 amid strong oil, gas production

View Article as Single page

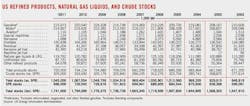

Oil product demand

All major petroleum products will incur muted increases in demand this year. Transportation fuels will get a minimal boost from economic activity and from slowly declining unemployment, while industrial activity will provide momentum to distillate demand.

Motor gasoline demand will average 8.95 million b/d, up from last year's 8.858 million b/d, but still less than during 2009 and 2010. Regular unleaded pump prices in 2011 posted their highest nominal average ever at an estimated $3.55/gal. This compares with $2.788/gal a year earlier, according to EIA figures.

Averaging 1.475 million b/d and up 1.4% from last year, the use of jet fuel will continue to slowly increase from its recent low of 1.393 million b/d in 2009.

Data through September 2011 from the US Department of Transportation's Bureau of Transportation Statistics show the number of passenger miles flown last year was up from 2010, and flights were full, averaging about 82% of capacity over the past 2 years as airlines have reduced flights.

Like jet fuel demand, demand for distillate fuel oil also will climb for the third consecutive year with an increase in industrial and transportation demand. Including renewable diesel fuel, demand for distillate will average 3.878 million b/d this year, an annual increase of 1% and consisting mostly of ultralow sulfur diesel. The use of distillate for home heating and in electricity generation will continue to decline this year.

Consumption of residual fuel oil, used as fuel for large ships, in electricity generation, and for industrial purposes, will rebound a little to average 475,000 b/d in 2012, up from last year's 465,000 b/d. Resid demand has been in a long-term decline in favor of lighter, cleaner-burning fuels.

Demand for liquefied petroleum gases will climb marginally to 2.18 million b/d after posting a small decline last year, with little change in demand by residential, commercial, or industrial users.

Natural gas market

US gas demand in 2012 will increase due to a slightly stronger economy and low gas prices with an abundance of supply amid increased unconventional resource development. Greater demand will occur in electric power generation with both depressed prices for the fuel and more generation capacity, but demand will be tempered somewhat by efficiency gains.

OGJ forecasts that this year's gas demand will total 24.7 tcf, climbing 1.5% this year; last year's increase was 1%.

Marketed gas production in the US will increase by 5.5% to 25 tcf. Last year, gas production jumped by 5%.

Hikes in production in Louisiana, Texas, and other states will more than offset a decline from the offshore federal Gulf of Mexico this year, following a pattern similar to last year's and continuing the proliferation of gas output from shale plays, including the Marcellus in Pennsylvania, the Haynesville in Louisiana, the Barnett in Texas, and others.

EIA estimates show that at 2,222.5 bcf, marketed gas production in Louisiana through September 2011 was nearly as much as for the entire year 2010, when the state's output totaled an estimated 2,246.4 bcf. OGJ estimates that Louisiana's total 2011 gas production climbed by 34% from a year earlier to total 3 tcf.

US gas imports will decline again this year, though by a much smaller margin than during 2011. OGJ forecasts that imports will total 3.355 tcf, down from last year's 3.4 tcf and 3.74 tcf in 2010. Imports of LNG will fall to 300 bcf from last year's 350 bcf, and pipeline gas from Canada and Mexico will decline again.

Meanwhile, the US will post another big increase in gas exports, as this year's total climbs by 25% to 2 tcf. Last year's increase in exports was an estimated 41%, with more gas going to Canada and Mexico by pipeline and to India, Brazil, UK, China, and others as LNG than during 2010, EIA figures show.

The large increase in domestic production combined with strong exports and lower imports will result in an addition to natural gas inventories of 475 bcf for 2012. Last year gas in storage grew by an estimated 200 bcf.

The US wellhead gas price averaged $3.90/Mcf last year, OGJ estimates, down from $4.16/Mcf a year earlier.

Displaying 7/7

View Article as Single page

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com