US energy demand to stay weak in 2012 amid strong oil, gas production

View Article as Single page

US economy

OGJ forecasts that US gross domestic product will grow by 2% this year, although risks to the downside are high considering persistent high unemployment, continued weakness in the housing marking, growing national debt, and Europe's ongoing financial crisis.

GDP growth last year was 1.6%, OGJ estimates, with the US unemployment rate hovering around 9% for most of the year and then dipping to 8.6% in November, according to figures from the US Bureau of Labor Statistics. The unemployment rate peaked at 10.1% in October of 2009.

After its Dec. 13, 2011, meeting, the Federal Open Market Committee (FOMC) said inflation had moderated since earlier in the year and that data suggested the economy has been expanding moderately. Household spending had picked up, but growth in business investment appeared to have slowed.

FOMC said it would hold the federal funds rate at 0-¼% and anticipated that economic conditions, including low rates of resource utilization and a subdued outlook for inflation over the medium term, are likely to warrant an exceptionally low federal funds rate at least through mid-2013.

Energy in the US

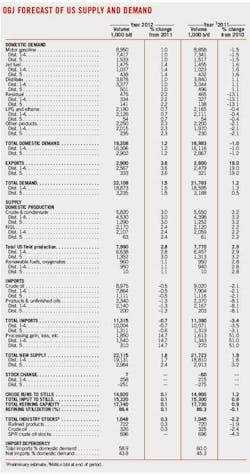

OGJ forecasts that total US energy demand will be 99.44 quadrillion btu (quads) this year, up from an estimated 2010 total of 98.3 quads. While demand for coal will contract, demand for all other major sources of energy will increase modestly from last year.

US energy demand peaked in 2005. Vehicle fuel efficiency, along with the recent economic slump, led to declining demand.

The US will record another gain in energy efficiency this year, as the energy-to-GDP ratio dips to 7.33 quads/$ of GDP from 7.39 quads/$ of GDP a year ago.

Oil demand in the US will rebound from last year's 1% estimated contraction, posting a 1.2% gain. The growth will be spread among petroleum products due to an increase in consumption of transportation fuels, spurred by the small expected recovery in the overall economy.

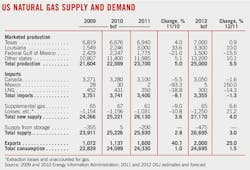

A warmer start to the heating season delayed the usual climb in gas demand, as the number of heating-degree days in the 2011 fourth quarter is estimated to have dipped from the final 2010 quarter.

Displaying 3/7

View Article as Single page