Is it possible to maximize return on efficiency?

Last year, one of my colleagues published an article on social media asking about efficiency and how it impacted our work. We spend a lot of time thinking and talking about efficiency in our industry, and we were curious about the kinds of returns the most recent efficiency programs were delivering.

Were we ever surprised by the comments we got!

While almost everyone agreed that efficiency was a priority for their companies, nearly an equal number confessed to something I hadn’t really considered: there’s a real hidden cost in implementing efficiency programs. And as long as we fail to recognize them, we can never achieve the returns on efficiency that we all want.

Some of the respondents described making short-term decisions to minimize CAPEX, for example, only to learn that the short-term, cost-cutting prescription just led to problems that increased OPEX. Others warned of the dangers of interpreting efficiency as “speed” – and learning the hard way that this approach can introduce risk or lead to incidents with unintended and unwanted consequences.

But the most interesting thing was this: those who were able to overcome the challenges from the hidden costs pointed back to a few key factors that impacted their success – ways that they were able to bypass the hidden costs to make efficiency real and vibrant within their organizations.

And that got me thinking…not just about the return on efficiency, but about how to use those key factors to maximize it.

We generally make small, incremental changes that increase efficiency, but can we introduce step changes to maximize the gains?

I think we can – but we have to look at things differently. We have to realize that perfect execution alone won’t do the trick. It will take a combination of factors and an approach that looks at efficiency over the life of the well to deliver real gains.

At its core, this approach depends on three things:

- First, we need collaborative and creative teams of service companies, suppliers, operators, and technology partners. We depend on their expertise in subsurface evaluation, drilling, completions, and production optimization to properly identify areas of opportunity and develop the effective workflows to deliver the most efficient solutions. Let’s call it expertise.

- We also need a complete, expansive portfolio that includes proven tools across the entire life cycle, including those for well construction, completions, and intervention; new technologies and integrated solutions; and digital advances in AI, automation, and analytics. These are all absolutely critical to drive greater efficiency, safety, and value. Let’s call it design

- And finally, perfect execution relies on safe, predictable, and consistent service delivery – and that requires highly trained people who know how to leverage the right tools from a global asset footprint, as well as a supply chain that maximizes equipment availability with minimal lead times. A global execution model is a must and has to be based on standard, streamlined processes to ensure that every job in every region of the world drives improved productivity, enhanced collaboration, and lessons learned. Let’s call it execution.

Measuring the impact

A fourth, and possibly just as critical, element is an ability to measure the return on efficiency and then determine if we’re maximizing it.

A unique approach with a side-by-side comparison of options is a great way to look at it. At Baker Hughes, we calculate the return on incremental investment and the associated net present value (NPV) of the operating cost and/or production revenue improvement. These measurements help us demonstrate that our well construction, completions, and intervention teams are doing the right things in the right ways to drive the greatest long-term value for the operator and the asset.

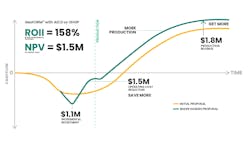

In the early stages of drilling and completion, the operator will be cash-negative by investing money to build the asset. Once the asset is producing, it starts to generate revenue, which allows the operator to become cash-positive. Here’s an example, which shows cash flow over time for a representative well.

The orange curve represents the outcome of an initial completion concept being considered for a well. Wanting to maximize return on efficiency, the operator asked Baker Hughes to propose an alternative concept, which is shown as the blue curve. We proposed a solution that included the GeoFORM™ conformable sand management system as an alternative to an openhole gravel pack. Compared to the operator’s initial completion concept, the Baker Hughes approach maximized return on efficiency. It required higher up-front investment in completion equipment but delivered a significant reduction in operating costs through rig efficiency and resulted in greater production revenue.

The bottom line: a return on incremental investment (ROII on the chart) of 158% and net present value (NPV on the chart) of cost savings and production improvement of $1.5 million dollars.

The comparison clearly shows that, while the initial option may have saved costs in the short run, it would have been more expensive to operate the well and deliver less revenue. By maximizing return on efficiency, the operator was able to obtain greater value from the asset.

Leading the way

As you may have figured out by now, I think about efficiency a lot. When you’re focused on delivering cleaner, safer, more efficient energy to the planet – like all of us at Baker Hughes – efficiency has to be part of your thinking.

And not just thinking about today, but about efficiency over the life of the well. How each job impacts the next. About making sure that you get the results you need to maximize return on efficiency.

If you want to take your return on efficiency to the next level, contact one of our completions and well intervention specialists today.