Integration enables Lotte’s chemical expansion plans in Indonesia

Lotte Chemical Corp.’s (LCC) majority held Lotte Chemical Titan Holding Bhd. (LCT) is moving forward with subsidiary PT Lotte Chemical Indonesia’s (LCI) construction of what will become Indonesia’s first naphtha-based cracker for production of olefins at fellow LCT subsidiary PT Lotte Chemical Titan Nusantara’s (LCTN) existing chemical operations in Merak, Cilegon, Banten Province.

Intended to support LCT’s broader plan to strengthen market competitiveness and approved for its integrative design approach, the proposed $3.95-billion PT Indonesia new ethylene (LINE) cracker project comes as part of the operator’s goal to transform LCI’s site into an integrated megacomplex equipped to supply an array of products meeting steadily rising demand for petrochemicals across Indonesia, China, and Southeast Asia.

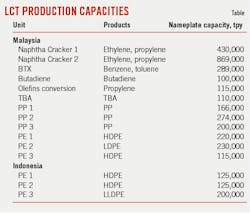

Scheduled for commissioning in 2025, the 1-million tonne/year (tpy) LINE naphtha cracker and associated derivatives units will expand LCT’s nameplate petrochemical production capacity in Indonesia by 513% to 2.76 million tpy, as well as increase the operator’s combined Malaysian and Indonesian production capacity by 65% to 5.878 million tpy.

Operator, project background

Acquired by LCC in 2010, LCT (formerly Titan Chemicals Corp.) is Malaysia’s largest petrochemical company, owning and operating 12 plants integrated across five sites that, together, produce a combined 3.118 million tpy of ethylene, high-density polyethylene (HDPE), low-density polyethylene (LDPE), propylene, polypropylene (PP), tertiary butyl alcohol (TBA), benzene-toluene-xylene (BTX), and butadiene (Fig. 1).

In Indonesia, LCT’s operations include LCTN’s three polyethylene (PE) plants collocated on 76.75 acres in Merak (Fig. 2). Equipped with INEOS AG’s proprietary Innovene and fluidized-bed process technologies, the three PE plants produce a combined 450,000 tpy of HDPE and linear low-density PE (LLDPE) from a feedstock of ethylene LCTN purchases and imports from third-party suppliers.

The accompanying table shows current nameplate production capacities for LCT’s Malaysian and Indonesian plants.

Anticipating ongoing growth potential for petrochemical products in Southeast Asia, LCT (51%) and LCC (49%) jointly formed LCI in June 2016 to develop, own, and operate the LINE project as part of a plan to organically expand the company’s production capacities for olefins, polyolefins, and derivatives in Indonesia by creating a petrochemical megacomplex that could capture benefits of integration with LCTN’s existing PE plants.

Designed primarily to bolster LCT’s business by growing its share of product supply to Indonesia’s domestic market amid projections that rising local consumption will continue exceeding production capacity scheduled for near-term startup, the LINE project is also supported by 2021 external and internal outlooks signaling increased demand for polyolefins across Southeast Asia and China through 2040, LCT said in a December 2021 project circular to shareholders.

Construction timeline

After beginning land preparation and clearing works for the long-planned integrated complex in 2019, LCT initially planned to begin construction in late 2020 or early 2021 for completion in 2023. In a late-April 2020 release, however, LCT confirmed it was deferring start of formal construction amid impacts to global economies and volatility in global crude oil prices caused by the coronavirus (COVID-19) pandemic. Alongside delaying construction, LCT said it also would undertake a strategic review of the project’s original timeline given pandemic-related market uncertainties.

With global economies beginning to show signs of recovery following increased rollouts of COVID-19 vaccinations throughout first-half 2021, LCT’s board informed investors on Oct. 21, 2021, of its decision to proceed with construction of the LINE project in 2022.

As of mid-January 2022, construction of the entire integrated petrochemical complex remains slated for completion by 2025.

Project scope

Following its 2021 strategic review of the LINE project, LCT revised and finalized its official configuration plan for the proposed integrated megacomplex, units of which will be built across a 264.82-acre tract of land adjacent to LCTN’s existing PE plants in Merak (Fig. 3). Approval of the LINE project resulted from its proposed location, which was selected to facilitate seamless integration and capture synergies with the PE plants that—upon commissioning of the new plants—will receive ethylene feedstock directly from the nearby cracker, eliminating the need and cost of importing volumes from third-party suppliers.

In addition to the primary cracker that will produce 1 million tpy of ethylene and 520,000 tpy of propylene from a feedstock of naphtha and LPG, official LINE project documents published in December 2021 and early-January 2022 show the complex will include the following plants :

- PP; 250,000 tpy.

- Butadiene; 140,000 tpy.

- BTX; 400,000 tpy.

The naphtha cracker also will be equipped to produce mixed C4-olefins and pyrolysis gasoline, according to the operator.

While LCT deferred construction of an additional PE plant and TBA plant included as part of its original project-development plan following strategic review, both plants remain under consideration for future incorporation. In December 2021, the operator confirmed it will reassess feasibility of developing the two deferred plants based on market demand once it wraps construction of the revised plan in 2025.

Contract awards

In early January 2022, LCI let contracts covering major engineering and procurement (EP) as well as engineering, construction, and procurement (EPC) activities for the LINE project’s three development packages (Group A, Group B, Group C).

As part of the Group A onshore-Indonesia construction package, LCI awarded a $273.1-million contract to PT Hein Global Utama—a joint venture of PT Hans Enjiniring dan Konstruksi and Hyundai Engineering Co. Ltd. (Hyundai)—to deliver EPC services for the complex’s main cracker. The JV’s scope of work under the onshore portion of the Group A EPC package also will include precommissioning, commissioning assistance, testing, startup, and other unspecified services for the naphtha cracking plant.

For LINE’s Group A offshore-Indonesia work package, LCT let a separate $484.1-million EP contract exclusively to Hyundai to provide engineering and supply of equipment, materials, supplies, and other systems and spare parts procured from non-Indonesian providers required to enable onshore construction. Hyundai will also be responsible for procurement, engineering, design, fabrication, and other related services and materials acquired from abroad to complete the cracking plant.

LCI separately let $1.65-billion worth of contracts in early January to affiliate Lotte Engineering & Construction Co. Ltd. (LEC) of South Korea for EPC services related to construction of the LINE project’s downstream units included under the Group B and C development packages, according to regulatory filings by LCT dated Jan. 7 and Jan. 10, 2022.

LEC’s commitment for the Group B development package covers the entire scope of onshore and offshore EPC activities required to ensure construction of the complex’s PP, BTX, and butadiene plants, as well as associated structures including an administration building, canteen, prayer room, laboratory, chemical storage shelter, and materials warehouse.

Under the Group C onshore and offshore work packages, LEC will be responsible for all EPC services related to ensuring completion of the LINE project’s associated utility units, including the wastewater treatment system, flare system, seawater desalination treatment system, storage tanks, and jetty and seawater intake and outfall installations.

Works under all of the recently awarded contracts are scheduled to begin this year to meet LCT’s goal of completing construction by 2025.

Project benefits

Alongside strengthening LCT’s global business by expanding its regional production slate to help satisfy rising demand for petrochemical products across Southeast Asia, the operator anticipates the integration-based approach to development of the LINE project will contribute to securing its long-term competitiveness.

According to official documents detailing the operator’s rationale for the project, commissioning of the integrated megacomplex will enable LCT to:

- Eliminate its reliance on and costs of ethylene feedstock imports from third-party providers.

- Increase its overall control of feedstock supply for its regional production sites.

- Extend greater control over its production processes.

- Reduce current transportation and logistics costs associated with plant feedstock and production.

- Sell any excess ethylene supplies produced by the complex to third-party buyers at market prices.

- More effectively control its overall costs to achieve greater economies of scale.

- Help elevate Indonesia’s status from a country dependent on polymer imports to that of a polymer producer.

In December 2021, LCT said it plans to use potential profits resulting from the integrated LINE project to support further growth of its Indonesian operations by expanding its downstream supply chain via capacity additions. LCT has yet to reveal specific details of future development plans for its Indonesian production sites.

About the Author

Robert Brelsford

Downstream Editor

Robert Brelsford joined Oil & Gas Journal in October 2013 as downstream technology editor after 8 years as a crude oil price and news reporter on spot crude transactions at the US Gulf Coast, West Coast, Canadian, and Latin American markets. He holds a BA (2000) in English from Rice University and an MS (2003) in education and social policy from Northwestern University.