Aramco seals partnership deal for Jafurah gas development

Key Highlights

- Aramco secures $11.1-b Jafurah midstream investment for gas processing, fractionation plants.

- Jafurah Phase 1 on track for Q4 2025 startup.

- Tanajib, Fadhili projects also to expand gas capacity to 2030.

Saudi Aramco has finalized an agreement with a consortium of global investors led by BlackRock Investment Management (UK) Ltd.’s Global Infrastructure Partners (GIP) to advance completion of the operator’s natural gas processing and Rygas NGL fractionation plants at Jafurah unconventional gas field in Saudi Arabia’s Eastern Province by yearend.

As part of deal concluded in late October, newly formed Aramco subsidiary Jafurah Midstream Gas Company (JMGC) has received upfront-sales proceeds of $11.1 billion from the GIP-headed consortium to secure development and usage rights for the Jafurah gas and Rygas NGL fractionation plants, which JMGC will lease back to Aramco for a 20-year period, Aramco confirmed in its Nov. 4 third-quarter 2025 earnings report to investors.

Per terms of the agreement, Aramco is granted the exclusive right to process and treat raw gas during the 20-year term from Jafurah field, Saudi Arabia’s largest non-associated gas development and a cornerstone of Aramco’s strategic gas expansion to meet domestic gas-demand growth and invest in global LNG markets.

In exchange for granting exclusive rights to receive, process, and treat raw gas at the plants, JMGC will collect quarterly volume-based tariff payments from Aramco backed by minimum-volume commitments, according to the operator.

The deal also granted Green Palm Bidco S.à r.l.—the official name of the GIP-managed consortium that, in addition to GIP, includes Hassana Investment Co., the Arab Energy Fund, and Aberdeen Investcorp Infrastructure Partners, among other unidentified institutional investors from the Asia Pacific and Middle East—a 49% equity interest in JMGC.

Aramco—which will retain its 51% ownership in the development—said the final agreement with Green Palm imposes no restrictions on production volumes from the Jafurah midstream project.

Production details, additional projects

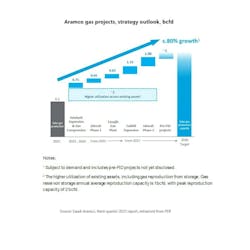

On Nov. 4, Aramco said construction activities on Phase 1 of Jafurah development—which began in November 2021—remain on track for the project’s initial start-up during fourth-quarter 2025 for targeted ramp-up by 2030 to production rates of:

- 2 bcfd of sales gas.

- 420 MMcfd of ethane.

- 630,000 b/d of other high-value liquids.

In addition to Jafurah Phase 2, Aramco confirmed progress on additional gas processing developments in the region.

Under development since 2019 to accommodate production volumes from the operator’s offshore Marjan and Berri fields, the Tanajib onshore gas plant—which includes capabilities for gas treatment and processing, NGL recovery and fractionation, and gas compression—is set to reach completion by yearend and anticipated to add 2.6 bcfd of raw gas processing capacity for volumes produced by Marjan and Zuluf fields.

Combined, Aramco said it expects the Jafurah Phase 1 and Tanajib gas plant projects to add 1.3 bcfd combined sales gas production capacity by yearend 2025 (see figure).

The operator also told investors engineering, procurement, and construction activities continued to advance during third-quarter 2025 on the major expansion of its Fadhili gas plant in the Eastern province, about 350 km northeast of Riyadh.

Scheduled for completion by 2027, the expansion will increase raw gas processing capacity of the existing 2.5-bcfd Fadhili plant by 1.5 bcfd to 4 bcfd, Aramco said.

The three gas projects collectively form part of Aramco’s broader 2030 strategy that, for gas, aims to grow production rates specifically for sales volumes by more than 60% by 2030, compared to 2021 levels.

“Jafurah kickstarts our plan to expand our overall sales gas-production capacity, which will contribute to Saudi Arabia’s growth ambitions across multiple sectors including energy, artificial intelligence, and major industries such as petrochemicals,” said Amin H. Nasser, Aramco’s president and chief executive officer.

About the Author

Robert Brelsford

Downstream Editor

Robert Brelsford joined Oil & Gas Journal in October 2013 as downstream technology editor after 8 years as a crude oil price and news reporter on spot crude transactions at the US Gulf Coast, West Coast, Canadian, and Latin American markets. He holds a BA (2000) in English from Rice University and an MS (2003) in education and social policy from Northwestern University.