Rystad: Fewer refineries, greater capacity

Key Highlights

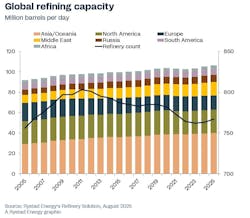

- Global refining capacity has grown by 13.5 million b/d over 20 years, despite a decline in the total number of refineries.

- China, India, and the Middle East are the main drivers of capacity expansion, focusing on large, complex refineries.

- Emissions in Asia and the Middle East have grown with increased capacity, but newer refineries tend to be more energy-efficient per barrel.

Global refining capacity has continued to grow despite a decline in the total number of refineries. Over the past two decades, primary refining capacity worldwide has expanded by about 13.5 million b/d, or roughly 15%, even as the absolute number of refineries peaked in 2011 and has since fallen due to aging infrastructure, shrinking profit margins, and weakening fuel demand from advancing electrification, according to new research from Rystad Energy.

The Middle East and China, alongside India, have emerged as the main engines of growth in global refining capacity. China has nearly doubled its refining capacity to 18.8 million b/d in 2025 from 10.6 million b/d in 2005, reflecting efforts to meet rising domestic consumption, bolster energy security, and strengthen its position as a key exporter of refined products.

India’s capacity has climbed to around 5.2 million b/d this year from 2.9 million b/d in 2005, supported by local demand and investment in new refining infrastructure.

The Middle East has seen similar momentum, expanding capacity to roughly 13 million b/d from nearly 8 million b/d over the past two decades. Saudi Arabia and the UAE have led the charge, building large-scale, complex refineries aimed at capturing more value from crude through downstream integration and serving both domestic and export markets, according to Rystad.

“The Middle East and Asia are driving global refining growth by focusing on large, integrated mega-refineries that secure energy supplies and meet rapidly rising demand. In contrast, Europe and the US are retreating, with older, less efficient plants closing due to high costs and uncertainty over future fuel needs,” said Arne Skjaeveland, vice-president, oil and gas research, Rystad Energy.

“This shift has sparked a wave of rationalization, where smaller, less flexible refineries are being shut down while bigger, more adaptable facilities gain ground through economies of scale. Today, nearly all new projects are larger and more economically viable, so even though the total number of refineries worldwide has declined, overall refining capacity continues to grow significantly," Skjaeveland continued.

Regional split on emissions

Emissions intensity across the sector has held relatively steady, but absolute emissions reveal a sharper regional split. Asia, followed by the Middle East, has seen total refinery emissions increase, driven by rapid growth in capacity and throughput.

The newer, highly complex refineries in Asia and the Middle East tend to consume more energy by design but often achieve greater carbon efficiency per barrel thanks to modern technologies and tighter integration, Rystad said.

While emissions in North America and Europe have remained flat or declined, this is largely influenced by retrofits and refinery closures as opposed to the substantial gains in carbon efficiency seen in Asia and the Middle East. As climate policies tighten and low-carbon expectations rise, the gap between leading and lagging refineries is poised to widen, reshaping competitiveness and steering future investment decisions across the sector.

Refinery strategy divergence

For companies owning and operating major refineries globally, a clear divide emerges between strategies in Europe and North America and those in Asia and the Middle East, particularly in how emissions are managed.

Chevron and TotalEnergies have focused on consolidation and modernization rather than adding new capacity, adapting to stricter regulations and shifting fuel demand. Chevron Corp. invests about $1.5 billion annually in upgrades at its legacy sites like Pascagoula [Mississippi] and Pasadena [Texas], keeping utilization high at 86% despite the age of its assets.

On the other hand, TotalEnergies is positioning for a lower-carbon future, taking the lead in integrating advanced biofuel technologies into its refining portfolio, Rystad said.

National oil companies are taking a different approach by aggressively pursuing opportunities for enhanced downstream integration.

Saudi Aramco has expanded its refining footprint through multibillion-dollar annual investments, developing advanced complexes such as Jazan and forming joint ventures including YASREF and SATORP (OGJ Online, Feb. 22, 2024). While these projects boost capacity and complexity, they also carry higher emissions intensity, reflecting the processing of heavier crudes and the energy demands of large, sophisticated systems.