IEA: Global refinery capacity increases gather pace in 2023

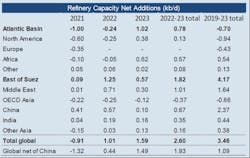

After posting its first decline in 30 years during 2021, global refining capacity will increase 1 million b/d this year and a further 1.6 million b/d in 2023, the International Energy Agency (IEA) said. This is a result of 4.1 million b/d of new capacity coming online, offset by 1.6 million b/d of permanent shutdowns.

The closures are front-loaded, with 1.1 million b/d set to shut in 2022. Still, the pace of capacity shutdowns is slowing somewhat, compared to 1.8 million b/d in 2021. Over 2022 and 2023, net capacity growth is slightly less than in 2019, but is among the fastest rates for net additions observed over the last two decades, according to IEA data.

East of Suez delivers 70% of global net additions in 2022-23, led by major projects in the Middle East and China. After 4 years of capacity decline, the Atlantic Basin will finally see net growth, thanks to African and North American projects.

“When looking at a 5-year period of 2019-23, the role of East of Suez is even more prominent – it delivers all the growth globally, offsetting the net 700,000 b/d decline in the Atlantic Basin. China alone accounts for almost 70% of global net additions in 2019-2023, even as the rate of the capacity additions in the country slows in 2022-23. Excluding China, global capacity additions during 2019-2023 amount to just 1 million b/d,” IEA said.

Among additions, 2.8 million b/d are greenfield sites, while the rest is expansion projects at existing refineries. Five projects, including mega-refineries in Nigeria and Kuwait and large sites in China and Mexico, contribute 2.3 million b/d, which is just over half of total gross additions.

“Assumed start-up dates for these particularly big projects mostly reflect the initial launch of the first train where the projects consist of several trains. There is also the usual degree of uncertainty around the start-up dates due to operational issues, logistical challenges, and supply chain disruptions, among other various unforeseen circumstances affecting the planned timing of projects,” IEA said.

IEA has not included the recent announcement of Japanese refiner Idemitsu Kosan on shutting the 120,000 b/d Yamaguchi refinery by the end of the 2023 fiscal year, as the timeline extends into 2024, due to the Japanese fiscal year ending in March.