OPEC, markets complacent in face of impending Iraqi 'train wreck'

Oil markets are entering an oddly complacent mode while remaining somewhat oblivious to the train hurtling down the tracks toward them.

Oil prices softened a bit this week, amid reports that Iraq and the United Nations soon may hammer out an agreement allowing for a resumption of Iraqi oil sales under the oil-for-aid accord, plus continuing evidence of growing oil stocks, and word from OPEC that nothing is likely to change at the group's July 3 meeting.

However, the third quarter may prove to be a train wreck for oil markets regardless of what Iraq does.

There's a lot of political posturing over the nature and design of new "smart sanctions" (France in particular seems to be pretzling itself into a particularly ignominious position in trying to appease Baghdad while fashioning an accord palatable to the US and UK). But all of this is irrelevant to the Iraqis, who insist on a complete and unqualified lifting of all sanctions-which just isn't going to happen.

In addition, Saddam has no incentive to restart oil exports. In fact, it is in his best interest to keep Iraq's oil off the market. Saddam isn't allowed to touch any of the proceeds from the oil-for-aid sales; proceeds are administered by the UN, and the purchases of food and medicine and other humanitarian aid they fund are also monitored by the UN. But Saddam sells several hundred thousand barrels per day of crude oil illegally, plus a small sanctioned volume to Jordan, and he earns about $1 billion/year from these oil sales. The longer appoved Iraqi oil supplies remain off the market, the more valuable his illegal volumes become-in part because of the related upward price pressure and by virtue of their availability when comparable Iraqi crude volumes are withheld; conversely, a resumption of legal Iraqi oil exports will only depress oil prices again, devaluing even further his already-discounted illegal supplies. The fact that the resulting high oil prices serves to further undermine western economies-particularly that of the US-is just icing on the cake for Saddam.

So that's the case for Iraq keeping its legal oil exports off the market. Then why the apparent willingness to strike a deal with the UN for another 6-month rollover? This could be pure Iraqi public relations (if that isn't an oxymoron), as Baghdad wants to be seen as the victim of US "aggression," "designs on its sovereignty," etc. It wouldn't be surprising to see Iraq agree initially to the rollover, only to use that occasion to rail against the US and then storm off in a huff when some provision of the new accord isn't to its liking. "Hey, we're trying to cooperate here, but the Great Satan US just won't stop making life impossible for us," Iraq seems to be saying, especially when it comes up with preposterous claims, such as this week's charge that US jets bombed a soccer field. It isn't too much of a stretch to believe that Iraq could lull markets into complacency, letting the rollover kick in and take hold for a couple of months, before demand ramps up in the late third quarter, only to pull its supplies off the market at a time when the market needs those supplies the most.

OPEC oil needed

That view has been detailed in this space before, and London's Centre for Global Energy Studies continues to raise the warning flag about a need for more oil from OPEC during the third quarter.

"Whatever the uncertainties caused by the suspension of Iraq's oil exports and the impact of the global economic slowdown on oil demand, there is no doubt that the world will need more oil from OPEC in third quarter 2001," the think tank said. "Refinery runs in Europe and Asia are set to rise by over 2 million b/d by the fourth quarter, putting increasing pressure on crude oil prices unless supplies are increased soon."

CGES estimates the Iraq has taken 2.1 million b/d off the market, and another 350,000 b/d could come off the market if Baghdad's border trade ends. If this suspension lasts the rest of the year, then OPEC needs to act promptly by raising output to replace this crude.

"[OPEC} can always make room for Iraq if it does return, but it will run up against capacity constraints later in the year, if it does not increase output soon enough," the analyst said.

OPEC's complacency seems to stem from the improving position on stock cover in the US, according to CGES: "While the stock position in the US has improved during second quarter 2001, this has been achieved at the expense of the rest of the world. High US crude oil prices have sucked in every available barrel of oil, with crude oil imports running at 9.5 million b/d during March, April, and May."

CGES noted that European crude stocks fell in May even despite low refinery runs, but demand in that region will rebound as more refineries there and in Asia come out of maintenance turnarounds. It pegs the increase in refinery runs in Europe and Asia at 2.0-2.5 million b/d by the fourth quarter, with crude oil buying increasing ahead of that.

"OPEC has become complacent, anticipating a 1.6 million b/d stockbuild in second quarter 2001 with no loss of Iraqi oil," it said. "This interpretation of the market is similar to IEA figures, which we believe persistently underestimate demadn in the former centrally planned economies of the FSU and China.

"The IEA's supply-demand balance leaves an average of 1 million b/d of supply unaccounted for, which OPEC thinks should be added to stocks somewhere in the world. With oil prices as strong as they are, the CGES believes this is not sensible."

The think tank contends that OPEC should begin ramping up output without delay: "If Iraq's exports remain suspended until the end of the year, the other members of OPEC need to boost output close to capacity levels just to prevent a repeat of last year's damaging price spike, unless the US draws on the SPR-in a big way."

That's an intriguing scenario. President George W. Bush has repeatedly stated that the SPR should not be drawn down to mitigate oil prices but only to offset a genuine supply crisis. Given the rising furor over gasoline prices-and energy prices in general-in the US, we are likely to see a fairly liberal interpretation of what constitutes a supply crisis vs. a mere price "crisis."

With Iraqi oil off the market and without more OPEC oil or a big SPR draw, CGES projects that oil prices could readily average over $33/bbl (dated Brent) through the fourth quarter. Even with an immediate hike in OPEC output, the loss of Iraqi supplies for the rest of the year could keep Brent above $28.50/bbl on average for the second half.

But if the ensuing high prices also trigger increased OPEC output-in response to its price-band policy as well as a bit more quota cheating-while also squelching demand and spurring industrial fuel-switching back to natural gas, the markets could see another stock overhang shaping up by late winter. And if normal winter temperatures fail to materialize (as they did for much of the last winter season despite a frigid beginning), the pressure on oil prices could shift downward.

Forget the hurtling train analogy. It's beginning to look like another rollercoaster ride.

OGJ Hotline Market Pulse

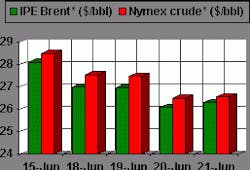

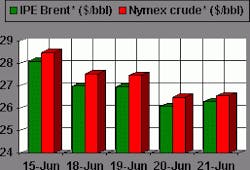

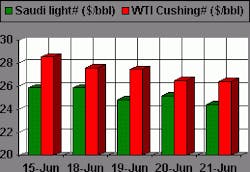

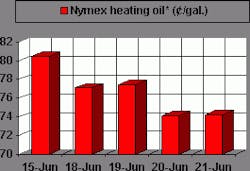

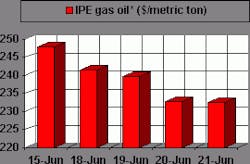

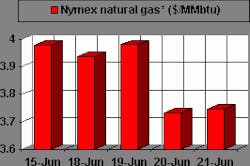

Latest Prices as of June 22, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null