OGJ Newsletter

GENERAL INTEREST Quick Takes

Petrobras enters three asset-sale pacts

Petrobras has entered three agreements to sell pipeline and oil and gas producing interests in deals worth a total of $10.3 billion as part of a divestment program.

The agreements cover:

• Ninety percent of the company’s stake in Transportadora Associada de Gas SA (TAG) to a combine of Engie and Caisse de Depot et Placement du Quebec for $8.6 billion. TAG operates 4,500 km of natural gas pipelines with throughput capacity of 74 million cu m/day in North, Northeast, and Southeast Brazil.

• A 50% working interest in deepwater Tartaruga Verde oil and gas field and nearby Module III of Espadarte oil field in the Campos basin to Petronas Petroleo Brasil Ltda. for $1.2935 billion. Tartaruga Verde produces 103,000 b/d of oil and 1.2 million cu m/day of gas through a floating production, storage, and offloading vessel 127 km off Rio de Janeiro state. Development of Module III of Espadarte field is to be integrated with Tartaruga Verde, with production expected to begin in 2021. Petrobras retains 50% of and will continue to operate the fields.

• All Petrobras interests in 34 producing onshore fields in Rio Grande do Norte state to Potiguar E&P SA, a subsidiary of Petroreconcavo SA, for $384.2 million.

Iraq gas production set to triple

Gas developments in Iraq will overtake oil projects in 2019, measured in resources sanctioned for development, according to analysis from Rystad Energy.

New developments are on track to triple the country’s gas production from just over 1 bcfd in 2017 to about 3 bcfd in 2022, Rystad Energy said.

“This will allow the country to satisfy its own growing domestic demand for gas and possibly even launch Iraq into the global market as a gas exporter for the first time,” said Rystad Energy upstream analyst Aditya Saraswat.

The shift is driven by more favorable investment conditions in the Kurdistan Region of Iraq (KRI), combined with consistent export revenues and improved regional security, boosting international oil companies’ appetite for investment in the region. Upcoming final investment decisions (FIDs) on new projects are dominated by gas developments in KRI, standing in stark contrast to the oil projects that have typically reigned supreme in Federal Iraq (FI).

Previously, inadequate infrastructure and weak incentives meant that most produced gas in Iraq was simply flared, with just a small portion feeding power plants for commercial use. Upstream developments in the past were also generally oil fields under the jurisdiction of Federal Iraq, and domestic gas demand was addressed primarily through imports from Iran. Pacified by output in FI, IOCs were also largely uninterested in exploring options in KRI due to the political instability in the region. However, much has changed in recent years as gas imports have grown more expensive and the political situation in KRI has calmed.

CAPP ‘encouraged’ by Alberta premier-elect

The Canadian Association of Petroleum Producers greeted the United Conservative Party’s Apr. 16 election victory in Alberta by saying it is “encouraged by Premier-elect Jason Kenney’s commitment to the oil and natural gas industry.”

At this writing, the UCP was leading in or had won 63 seats in the Legislative Assembly. The incumbent National Democratic Party, led by Premier Rachel Notley, had won the remaining 24 seats.

Notley’s government in 2015 introduced a carbon tax and cap on greenhouse-gas emissions from oil sands work in hope of winning support for pipelines needed to accommodate Alberta’s growing production of bitumen. But pipeline construction and expansion projects have not progressed, and consequently depressed bitumen prices have hurt oil-field investment and damaged the province’s economy (OGJ Online, Mar. 20, 2019).

“During its campaign, the UCP committed to making regulatory and economic and fiscal policy reforms aimed at enhancing the competitiveness of Alberta’s oil and natural gas sector,” the CAPP said.

“Among its many commitments, the UCP said it will decrease the corporate tax rate to 8% from 12%, develop a robust natural gas strategy, reduce regulatory red tape, increase regulatory efficiencies, and complete a review of the Alberta Energy Regulator within the first 180 days. The UCP has also pledged to spend up to $30 million to combat misleading news reports about the industry and to create a ‘war room’ to examine foreign-funded campaigns aimed at discrediting the province’s oil and natural gas sector.”

Pigott named Laredo Petroleum president

Mikell J. Pigott has been named president and a director of Laredo Petroleum Inc., Tulsa, and will succeed Randy A. Foutch, chairman, as chief executive officer in the fourth quarter.

Pigott has more than 20 years of experience in exploration and production, most recently as executive vice-president—operations and technical services for Chesapeake Energy. Before joining Chesapeake in 2013, he worked with Anadarko Petroleum for 14 years.

Exploration & DevelopmentQuick Takes

Shell, partners make Blacktip oil discovery

Shell Offshore Inc. announced an oil discovery at the Blacktip prospect in the deepwater US Gulf of Mexico offshore Texas. Shell operates Blacktip with 52.375% interest. Partners are Chevron USA Inc. 20%, Equinor Gulf of Mexico LLC 19.125%, and Repsol E&P USA Inc. 8.5%.

The Blacktip exploration well encountered more than 400 ft net oil pay on the Alaminos Canyon Block 380, about 250 miles south of Houston. Drilling continues to deepen the well and assess the structure’s potential.

Blacktip is in 6,200 ft of water and is part of the Perdido thrust belt about 30 miles from the Perdido platform. Shell said Blacktip could add to existing production in the Perdido area where Great White, Silvertip, and Tobago fields already are producing.

“Blacktip is Shell’s second material discovery in the Perdido corridor,” said Andy Brown, Royal Dutch Shell upstream director.

ExxonMobil acquires acreage offshore Namibia

ExxonMobil Corp. announced it acquired 7 million net acres to expand its exploration acreage offshore Namibia through an agreement with the government of Namibia and the National Petroleum Corp. (NAMCOR). ExxonMobil and NAMCOR together will explore the frontier Namibe basin.

The new acreage includes Blocks 1710 and 1810 as well as farm-in agreements with NAMCOR for Blocks 1711 and 1811A (OGJ Online, Jan. 13, 2010). The blocks extend about 135 miles offshore Namibia in up to 13,000 ft of water.

On Blocks 1710 and 1810, ExxonMobil will be the operator with 90% interest while NAMCOR will hold 10% interest. ExxonMobil said it will assign 5% of its interest to a local Namibian company.

ExxonMobil will operate Blocks 1711 and 1811A with 85% interest. NAMCOR will retain 15% interest.

In addition, ExxonMobil holds 40% interest in PEL 82 license offshore Namibia covering 2.8 million gross acres.

Eni to operate block off Ras Al Khaimah

Eni has signed an exploration and production sharing agreement for Block A offshore Ras Al Khaimah. The block covers 2,412 sq km in 10-90 m of water.

Eni is operator with a 90% participating interest. State-owned RAK Gas holds 10%.

Drilling & ProductionQuick Takes

ADC to buy Schlumberger’s Middle East drilling rigs

Saudi Arabia’s Industrialization and Energy Service Co. (TAQA) said its drilling unit, Arabian Drilling Co. (ADC), agreed to acquire Schlumberger Ltd.’s Middle East onshore drilling rigs business in Kuwait, Oman, Iraq, and Pakistan for $415 million.

TAQA is moving forward in its 2021 strategy to become a leading regional services and equipment company. The deal also promotes the Saudi Vision 2030.

Closing is anticipated in the second half of the year after which ADC will have the largest Middle East rig fleet. ADC, a rig partnership between TAQA and Schlumberger, was established in 1964.

After the transaction closes, ADC will have 58 onshore rigs and 9 offshore rigs. The combined company will have more than 5,900 employees.

ACG partners approve $6-billion platform

Partners in the Azeri-Chirag-Deepwater Gunashli (ACG) complex in the Caspian Sea offshore Azerbaijan have approved the investment of $6-billion in a new platform able to process as much as 100,000 b/d of oil.

BP, operator of the ACG production-sharing agreement, said production from the Azeri Central East (ACE) platform will start in 2023 and total up to 300 million bbl over its lifetime (OGJ Online, Jan. 16, 2018).

The 48-slot production, drilling, and production platform will be installed in 140 m of water midway between the existing Central Azeri and East Azeri platforms. New infield pipelines will connect the facility to ACG Phase 2 oil and gas pipelines that carry production to the Sangachal Terminal.

The project also includes installation of a water-injection pipeline between the East Azeri and ACE platforms to supply water from the Central Azeri compression and water-injection platform.

Average ACG production last year was 584,000 b/d of oil and about 6.4 million cu m/day of associated gas, according to BP.

Oil production, by platform, was Chirag, 46,000 b/d; Central Azeri, 154,000 b/d; West Azeri, 126,000 b/d; East Azeri, 97,000 b/d; Deepwater Gunashli, 105,000 b/d; and West Chirag, 57,000 b/d. Sanction of the ACE platform is the first major investment decision by the ACG partners since extension in 2017 of the production-sharing agreement to 2049 (OGJ Online, Sept. 14, 2017).

BP holds a 30.37% interest in the agreement. Other interests are State Oil Co. of the Azerbaijan Republic/AzACG, 25%; Chevron, 9.57%; INPEX, 9.31%; Equinor, 7.27%; ExxonMobil, 6.79%; Turkish Petroleum, 5.73%; Itochu, 3.65%; and ONGC Videsh Ltd., 2.31%.

Leon drilling due under LLOG-Repsol swap

LLOG Exploration Offshore LLC will participate in the drilling of a well to delineate Repsol E&P USA Inc.’s 2014 Leon oil discovery in the Lower Tertiary play of the deepwater Gulf of Mexico (OGJ Online, Oct. 28, 2014).

Under an asset exchange and new joint operating agreement, LLOG will operate the well on Keathley Canyon Block 642 with a 33% working interest.

The Leon discovery well was drilled to 32,000 ft TD in 6,000 ft of water, encountering nearly 500 ft of net oil pay.

Repsol will acquire a 30% interest from LLOG in the 2011 Moccasin discovery on Keathley Canyon Block 736. The discovery well, drilled by Chevron Corp. to deeper than 31,000 ft in more than 6,500 ft of water, found nearly 400 ft of net oil pay (OGJ Online, Sept. 6, 2011).

LLOG acquired the license in 2017 and is operator. It retains a 31.35% working interest in Moccasin, which is less than 20 miles from Leon.

Leon is 31 miles northwest of Repsol’s 2009 Buckskin discovery, now operated by LLOG, in 6,800 ft of water on Keathley Canyon blocks 785, 828, 829, 830, 871, and 872 (OGJ Online, Feb. 6, 2009). LLOG said Buckskin production will begin in mid-2019 after initial development involving two wells drilled to about 29,000 ft into Lower Tertiary pay.

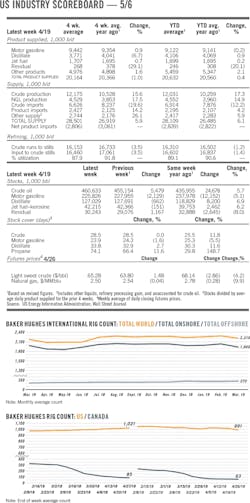

US shale production to hit 8.46 million b/d in May

The US Energy Information Administration forecasts crude oil production from seven major shale formations will climb 80,000 b/d in May to a record 8.46 million b/d, EIA said in its Monthly Drilling Productivity Report.

The Permian basin of Texas and New Mexico is expected to experience the biggest boost with production forecast to climb by 42,000 b/d to 4.136 million b/d in May.

EIA forecasts North Dakota’s Bakken formation production will rise 11,000 b/d to 1.39 million b/d, which would be down from a record 1.41 million b/d reported in January.

Separately, US natural gas production from the seven shale formations was forecast to increase to a record 79.8 bcfd in May, up 0.9 bcfd over the April forecast.

EIA forecasts gas production from Appalachia will rise 353 MMcfd to a record 32.2 bcfd in May. Records showed Appalachia production at 27.1 bcfd for May 2018.

PROCESSINGQuick Takes

Chinese operator lets contract for integrated complex

Shenghong Refining & Chemical (Lianyungang) Co. Ltd. (SRCLC), a subsidiary of Shenghong Petrochemical Group Co. Ltd., has let a contract to Axens to provide residue hydrocracking process technology to boost naphtha production at its integrated complex in Lianyungang City in China’s province of Jiangsu.

As part of the contract for key units of SRCLC’s residue valorization project at the complex, Axens will deliver its proprietary ebullated-bed residue hydrocracking technology H-Oil for a 3.2 million-tonnes/year unit in combination with a 3.45 million-tpy distillates hydrocracking technology HyK unit, Axens said on Apr. 24.

The H-Oil unit will apply supported catalysts from Shell Catalysts & Technologies in conjunction with HTI’s HCAT hydrocracking technology to maximize performances, with the high-quality unconverted residue to feed the complex’s existing coking unit.

The maxi-naphtha distillate HyK unit will apply advanced catalytic solution in combination with high-efficiency heat integration provided by spiraled-tube heat exchangers technology from Zhenhai Petrochemical Jianan Engineering Co. Ltd., according to Axens.

Alongside vacuum residue, Axens’ solution for the project also will handle py-oil from the steam cracker as feed to the H-Oil unit and effluents from the coker to the HyK unit.

The routing optimization between the distillate hydrocracking HyK unit and the H-Oil unit will enable delivery of superior naphtha yields as well as improve the coker’s feed quality, the service provider said.

Axens’ scope of work under the contract will include supply of HyK catalysts, equipment, and other services from plant personnel training to plant startup services.

Axens said SRCLC’s residue valorization project aims to increase naphtha production capacity at the site by 3.6 million tpy in single-train units.

The service provider disclosed neither a value of the contract nor a timeframe for the project’s completion.

Oman-Kuwait JV lets contracts for Duqm refinery

Duqm Refinery & Petrochemical Industries Co. LLC (DRPIC), Muscat—a joint venture of state-owned Oman Oil Co. and Kuwait Petroleum Corp. subsidiary Kuwait Petroleum International Ltd.—through contractors, has let two separate contracts to Douglas OHI—a JV of Interserve Group Ltd. and Oman Holdings International Co. SOAG—for work on DRPIC’s long-planned 230,000-b/d refinery and petrochemical complex to be built in the Duqm Special Economic Zone (SEZAD) in Duqm, Al Wusta Governate, on the southeastern coast of Oman (OGJ Online, Oct. 8, 2018; Apr. 4, 2017).

As part of a £32.2-million contract awarded by a JV of Tecnicas Reunidas SA and Daewoo Engineering & Construction Co. Ltd. (TRD), Douglas OHI will deliver unidentified process units at the new Duqm refinery, including civil and underground piping to support installation of equipment, pipe racks, and specialist structures and networks across the project’s packages 1 and 2, Interserve said.

The TRD JV also awarded a £7-million contract to Douglas OHI to provide building integration work at the project site, the scope of which includes construction and coordination of 23 buildings with a total area of 18, 328 sq m, according to Interserve.

In June 2018, DRPIC issued main contractors a formal notice to proceed (NTP) with work on three previously awarded contracts for engineering, procurement, and construction of the refinery, which is due to be completed and ready for startup in 42 months from the NTP’s early June issuance (OGJ Online, June 6, 2018).

With a combined value of $5.75 billion, the three EPC packages include:

• EPC Package 1, the largest of the project’s three packages, covering EPC and commissioning of all main process units at the refinery by the TRD JV.

• EPC Package 2, covering delivery of EPC as well as commissioning, training, and other startup services for the refinery’s utilities and offsites by a consortium of Petrofac International Ltd. and Samsung Engineering Co. Ltd.

• EPC Package 3, covering EPC, commissioning, and operation services for the project’s associated off-site installations, including a product storage and export terminal at Duqm Port, a crude tank farm at Ras Markaz, and an 80-km crude oil pipeline from Ras Markaz to the refinery complex by a consortium of Saipem SPA of Italy and McDermott International Inc. (formerly CB&I) (OGJ Online, Feb. 15, 2018; Sept. 18, 2017; Aug. 7, 2017).

Primarily designed to produce and recover naphtha, jet fuel, diesel, and LPG, the Duqm refinery will include units for hydrocracking, hydrotreating, delayed coking, sulfur recovery, hydrogen generation, and Merox treating.

DRPIC has yet to confirm a definitive commissioning date for the new development, which remains under construction.

Hess to expand North Dakota gas processing capacity

Hess Midstream Partners LP is expanding natural gas processing capacity at its 250-MMcfd Tioga gas plant in North Dakota, north of the Missouri River.

The planned 150-MMcfd expansion will add residue and y-grade liquids processing capacity to the existing full-fractionation and ethane-extraction capability of the current plant, Hess Midstream said.

The expansion—for which product takeaway has been secured and which will raise total gas processing capacity at Tioga to 400 MMcfd—is scheduled to enter service in mid-2021 at a total cost of about $150 million.

Following completion of its 100-MMcfd Little Missouri 4 gas processing plant in McKenzie County, ND—a joint venture with Targa Resources Corp.—scheduled for some time in third-quarter 2019 and the Tioga expansion, Hess Midstream said it will have 500 MMcfd of net gas processing capacity in the Bakken region.

The Tioga expansion comes amid continued Bakken growth from Hess and third parties that has created additional demand for processing capacity north of the Missouri River, said John Gatling, Hess Midstream’s chief operating officer.

TRANSPORTATIONQuick Takes

AIE gets sanction for Port Kembla LNG terminal

Sydney-based Australian Industrial Energy Group (AIE) has received development consent from the New South Wales Government for its plan to import LNG into Port Kembla on the NSW coast.

The aim is to begin deliveries of gas into the Australian east coast grid by late 2020.

AIE says construction of the terminal is expected to take 12-14 months from a final investment decision which is scheduled for the middle of this year. Capital investment will be A$200-300 million.

Discussions for gas supply agreements are taking place with 22 potential customers.

Last year AIE signed a deal with Hoegh LNG of Norway for the use of a floating storage and regasification unit for the proposed Port Kembla terminal.

The plan is for the FSRU to be moored at Berth 101 in Port Kembla’s inner harbor and accept cargos of LNG from incoming LNG carriers, store the LNG and convert it onboard from liquid back to gas for transfer onshore and piping into the gas transmission network.

The facility is expected to have a capacity to supply around 100 petajoules a year. This would require an LNG shipment every 2 weeks. There will be potential to expand to 140 petajoules a year with a slight increase in the LNG delivery schedule and upgrades to the pipeline networks.

The AIE consortium comprises Squadon Energy (established by Australian mining magnate Andrew Forrest), Marubeni and Jera of Japan.

The Port Kembla import project is one of five currently being contemplated, including AGL’s Crib Point project and ExxonMobil’s proposal, both in Victoria, EPIK’s Newcastle LNG in New South Wales and Venice Energy’s plan for Port Adelaide in South Australia.

Port Arthur LNG gains FERC authorization

Port Arthur LNG LLC, a subsidiary of Sempra Energy, received authorization from the US Federal Energy Regulatory Commission to site, construct, and operate the Sempra-led Port Arthur LNG liquefaction-export facility under development in Jefferson County, Tex., moving the project closer to a final investment decision.

The liquefaction-export facility is proposed to include two natural gas liquefaction trains capable of processing 11 million tonnes per year of LNG; up to three LNG storage tanks; two marine berths, and associated facilities.

The FERC order also approved the construction of the Texas and Louisiana connector pipeline projects that will provide natural gas transportation for the new liquefaction facilities.

In December 2018, Port Arthur LNG and the Polish Oil & Gas Company (PGNiG) signed a definitive 20-year sale-and-purchase agreement for 2 million tpy of LNG from the Port Arthur LNG project (OGJ Online, Dec. 19, 2018).

Earlier in the year, Bechtel was selected to serve as the engineering, procurement, construction and commissioning contractor for the facility, subject to reaching a definitive agreement.