SPECIAL REPORT: Capacity, complexity expansions characterize China's refining industry past, present, future

PetroChina's Lanzhou refinery has since 2008 raised its charge capacity to 320,000 b/d from 210,000 b/d and will likely expand further to 400,000 b/d in the 12th Year Plan. Photo from CNPC.

Kang Wu

East-West Center

Honolulu

China currently has the world's second largest refining sector behind the US. After decades of development, its refining industry has expanded spectacularly, with crude distillation capacity rising to 7.1 million b/d in 2005 from 2.1 million b/d in 1985 and has finally exceeded 11 million b/d since mid-2010.

Capacity; players

China's total refining capacity data are not all reliable. The main reason is the thorny issue of locally owned refineries, dubbed "teapot refineries." This term is not entirely accurate, as some of these refineries are relatively large. While China's CDU capacity has expanded substantially since the late 1990s, small refineries were also shut down through the government crackdown on locally owned refineries as well as adjustments made by Sinopec and CNPC/PetroChina.

Since 1999, more than 1 million b/d of Sinopec, CNPC/PetroChina, and locally owned refineries were shut down and scaled back. Since 2003, however, locally owned refineries have staged a comeback when oil markets have become tight with booming oil demand in China. As of today, total refining capacity of locally owned refineries—some of which have already formed alliances or joint ventures with state oil companies such as CNOOC or Sinochem—is estimated at more than 2.4 million b/d.

The future of these small refineries is uncertain. Under the government's 12th Five-Year Program (FYP), covering 2011-15, locally owned small refineries will be cracked down upon. If history is any guide, however, only a fraction of these locally owned small refineries will be shut down over the coming years.

With all types of refineries included, China's crude distillation capacity had reached 11.4 million b/d at the start of 2011. This is nearly twice as large as the capacity a decade earlier, as shown in Fig. 1, which also provides an overall picture of the total refining capacity where the major players are featured.

Sinopec and CNPC/PetroChina are the dominant refiners in China and have been expanding their CDU capacity continuously. CNOOC has also entered the market with its 100% owned 240,000-b/d Huizhou refinery set up in 2009 in Guangdong Province. Several points are worth noting:

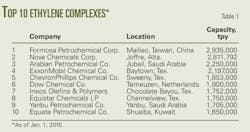

• Sinopec has the largest capacity in China. At the start of 2011, Sinopec had nearly 5.2 million b/d of CDU capacity, accounting for 46% of the national total (Fig. 2). Sinopec's refineries are located mainly in the middle and lower Yangtze regions, the south, and part of the north but with little presence elsewhere (Table 1).

• CNPC/PetroChina has 3.6 million b/d of CDU capacity at present, 32% of the national total. CNPC/PetroChina's assets are concentrated mainly in the northeast, the northwest, the west, the southwest, and part of the north. However, CNPC/PetroChina has been aggressive in penetrating areas under the Sinopec control.

• Other national oil companies, CNOOC and Sinochem, also plan to expand their refining business. CNOOC started its wholly owned 240,000-b/d Huizhou refinery in Guangdong, which is designed to process low-sulfur crudes with high acids in 2009. Both CNOOC and Sinochem have joint ventures with local refineries. The total capacity of CNOOC, Sinochem, and their associated local refineries amounts to some 800,000 b/d at present, accounting for 7% of the nation's total CDU capacity at the start of 2011.

• As for locally owned refineries unrelated to any state oil company, their size as 2011 began we estimate at 1.9 million b/d, accounting for 16% of the national total.

These refineries have some unique characteristics:

1. They are mainly located in areas around oil fields or near ports, with particularly high concentrations in provinces such as Shandong, Shaanxi, Guangdong, Liaoning, Hebei, and Henan.

2. Some of local refineries are not small at all. A good example is refineries owned by the local company Yanchang Group in Shaanxi Province, where their combined crude distillation capacity has exceeded 300,000 b/d. Yanchang is indeed the largest local company in China for both upstream oil production and downstream oil refining.

3. Except for Yanchang Group, which has its own oil fields, crude supply to locally owned refineries is limited.

4. Most of these refineries rely on fuel oil as feedstock one way or another.

5. Facing the continuous cracking down of the government, many of these local refineries that are unwilling to be shut down have chosen to team up with one of the state oil companies or expand their size aggressively so as not to be "small" anymore.

Configurations

China's refining configuration has several distinguishing characteristics.

First of all, it has a huge amount of cracking capacity. In mid 2010, China's ratio of combined cat cracking, hydrocracking, visbreaking, coking, and thermal cracking to CDU was 47%. That is nearly twice the share in Japan, much higher than the Asia-Pacific's average, and only slightly lower than the share in US (Table 2).

The high cracking/CDU ratio is attributable to the country's long history of using mainly domestic crudes, which are heavy and waxy with high pour points, as refinery feedstock. Of the cracking plants, however, fluid catalytic cracking and resid catalytic cracking (FCC/RCC) outweigh the others. As 2011 began, China had 2.6 million b/d of FCC/RCC capacity, accounting for 50% of total cracking capacity.

In addition to FCC/RCC, China's coking and hydrocracking capacity are also large. Coking capacity has been expanded at a rapid pace since 2004, reaching 1.3 million b/d at the start of 2011. Hydrocracking capacity is even more dramatic. Before 2004, China only had 270,000 b/d of hydrocracking capacity. By early 2011, China's hydrocracking capacity has topped 1 million b/d (Fig. 3).

The second characteristic of China's refinery configuration is that its cat reforming capacity (nearly 800,000 b/d at the start of 2011, or 7% of CDU capacity) is still lower than the shares of cat reformers in Japan (17%) and the US (20%). China's reformer/CDU ratio is also less than the average ratio of 11% for the Asia-Pacific region. This difference is again partly due to China's historical crude slate, of which the naphtha yield is low and insufficient to support a large reformer capacity. Cat reforming capacity in China at present, however, is already more than double the capacity of 316,000 b/d at the start of 2001.

Thirdly, China has sharply increased its hydrotreating/hydrorefining capacity in recent years to address the tightening specification for gas oil and to a lesser extent, gasoline. At the start of 2011, China had 3.2 million b/d of hydrotreating/hydrorefining capacity, a jump from less than 800,000 b/d at the start of 2001. One issue of caution is that since Chinese data do not separate treating of gasoline, kerosine, and diesel/middle distillates, the capacity number reported here appears to be inflated in comparison with hydrotreating capacities of other countries.

Fourthly, China's capability for handling sour crudes has increased substantially since the mid-1990s, especially for Sinopec. China has increased its capability to handle heavy oil as well as fuel oil as feedstock. This is an area that is penetrated deeply by locally owned refineries, new ventures of state oil companies other than Sinopec and CNPC/PetroChina, such as CNOOC and Sinochem, and to a lesser extent, by CNPC/PetroChina itself whose crudes produced in aging fields in the northeast have become increasingly heavy.

Finally, the utilization rate of China's refining capacity was historically low but has increased since the early 2000s. Before 1986, the government's policy of maximizing oil exports reduced the availability of feedstock to domestic refineries. Although more crude oil was diverted to domestic refineries thereafter, declining crude production, rapid expansion of refining capacity, and continued existence of small and very small refineries had kept utilization rates low during most of the 1990s. The situation has improved since the 2000s, more on which later.

China's capability and experience in handing sour crudes deserve a special note. With some exceptions, such as crudes from Oman, Yemen, part of Abu Dhabi, as well as Arab Extra Light from Saudi Arabia, Middle East crudes all have high sulfur content, while many Chinese refineries, until the mid-1990s, were unable to process such crudes. China has since moved to raise its sour-crude handling capability.

In the mid-1990s, in anticipation of rising Middle East oil imports, Sinopec started revamping, upgrading, and expanding its refineries to add sour-crude processing capabilities. These efforts have produced some notable results. At the start of 2011, Sinopec and CNPC/PetroChina together had at least 3.3 million b/d of processing capacity for imported sour crudes. This also means China has about 7 million b/d of refining capacity that can process only sweet crudes, a fact that severely limits China's choice of imported crudes and prompts China to seek sweet crudes from sources such as Africa and Latin America.

Throughput; utilization

Crude runs have been growing vigorously but also unevenly from year to year. For instance, the growth of crude runs reached more than 750,000 b/d in 2004, but it was negative in 1994 and 1998, or as little as 31,000 b/d in 2001. In 2010, crude runs reached 8.5 million b/d, up from 2.2 million b/d in 1990 and 4.1 million b/d in 2000 (Fig. 4). In other words, in a decade China's refining crude runs quadrupled. In fact, 2010 was a year of historical significance in which the increment of 1 million b/d in crude runs was the highest ever for the country.

With stagnated domestic production, accompanying the fast growth of refining crude runs are rapidly rising crude imports. In 2010, China imported 4.8 million b/d of crude oil, 710,000 b/d higher than imports of 2009, which set another record for growth. Compared to 2000, China's crude imports in 2010 were more than two and half times higher. Of the 4.8 million b/d of crude oil imports in 2010 by China, African supplies accounted for 30%, or 1.4 million b/d. This reflects the strong appetite of Chinese refineries for heavy sweet crudes.

Based on the national crude runs and refining capacity reported here, Fig. 5 shows the changing utilization rate for Chinese refineries. Both overestimation and underestimation may occur in the numbers. On the one hand, because certain small refineries are not included in the capacity, the calculated rate might have been slightly inflated. On the other hand, the national average rates tend to be underestimated due to the presence of large capacity held by locally owned refineries, which lack access to crude supply.

Because of the rise in refining capacity from vigorous expansion of both CNPC and Sinopec, plus the flourishing of small refineries, China's overall refining utilization rate, defined as the share of throughput in total capacity, was low in the 1990s. In 1998, the overall refinery utilization rate was only 64%, thanks to stagnation in the refining industry.

The situation has since improved, however. In 2010, the overall utilization rate reached 76%, down from the recent high of 86% in 2004 but up from 73% in 2009. Among different players, the utilization rate was more than 88% for Sinopec's and CNPC/PetroChina's refineries but less than 50% for the rest.

Growth

2011 is the first year of China's 12th FYP. The preliminary plan shows that China is expected to add some 2 million b/d of new refining capacity during the 5 years ending in 2015. We believe China will exceed this target, which means a higher growth in capacity is likely.

Despite the fact that China may be long in refining capacity, the Chinese government, led by the National Development Reform Commission, is determined that expansion is needed to keep up with the product demand growth. Achieving self-sufficiency of certain petroleum products, such as diesel, means that China is set to continue the structural imbalances among different refined products, in which some are in surplus and some are short.

China's refining expansions over the next 5 years are led by Sinopec and CNPC/PetroChina, although CNOOC and Sinochem are also trying very hard to expand their bases. Sinopec's refining expansion plans are in part associated with its continuous drive to build more sour-crude handling capability. By the end of 2015, China is likely to have at least 5.3 million b/d of sour crude handling capacity, where two-thirds will be owned by Sinopec. More specifically, Sinopec's expansion is likely to include the following major projects by 2015:

• Sinopec will expand the Chang refinery to 160,000 b/d at the end of 2011 and 200,000 b/d by 2015 from 100,000 b/d at present.

• Yangzi refinery will be expanded to 250,000 b/d from 160,000 b/d during the 12th FYP.

• Total capacity of the Maoming refinery will be expanded to 510,000 b/d by 2012 from 270,000 b/d at present through completion of the new refinery with the size of 240,000 b/d.

• Beihai refinery will be a grassroots refinery of 200,000 b/d on the basis of the existing 12,000-b/d plant, located at a new site. The project will be completed by the end of 2011.

• The Sinopec/KPC Zhanjiang refinery is a 300,000-b/d grassroots refinery through a joint venture between KPC and Sinopec. We expect this project to be completed by 2015.

• Lanzhou refinery: This 320,000-b/d refinery will likely expand to 400,000 b/d during the 12th Year Plan.

• Caofeidian refinery is a new 200,000-b/d refinery and is likely to be built by 2015.

Despite its concentration in the northeast, the northwest, and the west, CNPC/PetroChina is taking advantage of its secured crude oil supply (particularly through its overseas investment projects or by building international oil pipelines such as those from Russia and Myanmar) to expand into the southwest as well as areas that considered Sinopec's turf. Over the next 5 years, CNPC/PetroChina's refining projects include mainly:

• Qinzhou refinery: After its completion in late 2010, this 200,000-b/d refinery is likely to be expanded by another 200,000 b/d by 2015.

• Lanzhou refinery: This 320,000-b/d refinery is likely to be expanded to 400,000 b/d during the 12th FYP.

• Pengzhou refinery: By end 2011, PetroChina is also likely to start its new 200,000 b/d Pengzhou refinery in Sichuan, although delay to 2012 is also likely.

• Huludao refinery: This 200,000 b/d refinery with a local partner is likely to be completed by 2014.

• PetroChina/Rosneft Tianjin refinery: Construction for this 300,000 b/d refinery started in 2010, and it is expected to be completed by 2015.

• PetroChina/PDVSA Jieyang refinery: This joint-venture refinery of 400,000 b/d using Venezuelan crudes is likely to be up and running by 2015.

• PetroChina is likely to add a 200,000-b/d refinery in Yunnan by 2015.

As mentioned, beyond CNPC/PetroChina and Sinopec, both CNOOC and Sinochem are active in pursuing their refining ambitions and have acquired local refineries through joint ventures. As for CNOOC's 240,000-b/d Huizhou refinery, the expansion of it by another 200,000 b/d has been delayed but it may be completed by 2015. Sinochem is determined to have its own 240,000-b/d refinery in Quanzhou and strives to complete the project by 2014. These two state oil companies continue to target local refineries for further expansions.

Beyond 2015, China is set to build more refineries and have more expansions of existing ones, with huge implications for the country's oil imports. On the crude side, China is set to become a larger importer. We expect China's crude imports to reach 7.3 million b/d in 2015 and 9.5 million b/d in 2020 (Fig. 6).

For refined products, the situation is more complicated. China may overbuild the refining sector. If that happens, China is likely to be a sizable exporter of gasoline and diesel although its deficits of fuel oil and naphtha will continue.

The author

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com