Strong crude prices perk up 2Q earnings

Marilyn Radler

Senior Editor-Economics

Laura Bell

Statistics Editor

Oil and gas producers and refiners posted healthy earnings increases during this year's second quarter and first half compared with the same periods in 2010. Producers gained on sharply higher oil prices, while refiners benefited from higher throughput rates and improved margins.

Oil prices during the recent quarter were sharply higher than during the corresponding period in 2010. The front-month futures price of West Texas Intermediate on the New York Mercantile Exchange averaged $102.34/bbl in the recent period, up from the second-quarter 2010 average of $78.05/bbl.

Meanwhile, natural gas prices were nearly unchanged. The front-month futures price of gas averaged $4.38/MMbtu in this year's second quarter vs. $4.35/MMbtu a year earlier.

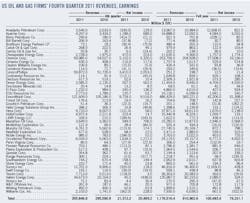

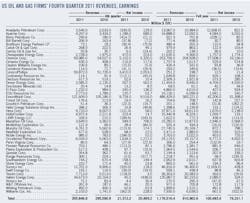

A sample of US-based producers and refiners reported a collective 47% jump in second-quarter earnings on 36% higher revenues. For this year's first half, earnings climbed 37% from a year earlier as revenues moved up by 30%.

US oil, gas producers

Most of the US-based integrated companies and independent producers posted earnings increases from the 2010 second quarter.

ExxonMobil Corp. reported that it earned $10.68 billion in this year's second quarter, a 41% increase from the 2010 second quarter. Higher oil and gas price realizations and improved downstream results boosted the results. The company said its production volumes increased by 10% from a year earlier, led by its assets in Qatar and its growing unconventional gas operations.

Chevron Corp.'s second-quarter earnings surged to $7.76 billion in the most recent quarter, up from $5.44 billion a year earlier. Higher oil and products prices drove the company's revenues to $69 billion for the 3 months ended June 30, up from $53 billion in revenue in last year's second quarter.

The company's average sales price of oil and natural gas liquids was $104/bbl in the US and $107/bbl elsewhere in the second quarter, compared with $71/bbl worldwide a year ago. The average sales price of gas was $4.35/Mcf, up from $4.01/Mcf in the US in last year's second quarter, and elsewhere Chevron's average gas price during the second quarter was $5.49/Mcf, up from $4.40/Mcf a year earlier.

Downstream earnings climbed 7% from a year ago to $1 billion, Chevron reported. The company has received government approval to sell its refining and marketing assets in the UK and Ireland; the sale is expected to close during the third quarter.

On June 30, Marathon Oil Corp. completed the spinoff of its refining, marketing, and transportation business, which is now reported as discontinued operations. As a result, comparisons to year-ago figures are best using figures of income from continuing operations.

Marathon reported that for this year's second quarter, adjusted income from continuing operations was $689 million compared with $440 million a year earlier. The resulting net income was $996 million in the 2011 second quarter, up from $709 million a year earlier.

Marathon's exploration and production segment income climbed 39% from last year's second quarter primarily as a result of higher liquid hydrocarbon price realizations, partially offset by decreased sales volumes in Libya and Europe and increased depreciation, depletion, and amortization, the company said.

Exploration expenses were $145 million for the 2011 second quarter, including $62 million of dry well costs, compared with $125 million in the 2010 second quarter, which included $57 million in dry wells, Marathon said. Dry well costs during this year's second quarter included $38 million related to the Earb exploration well in the Norwegian North Sea and $22 million incurred subsequent to this year's first quarter related to the Romeo well on the Pasangkayu block off Indonesia.

Independent oil and gas producers also fared better than during last year's second quarter, as fewer companies in the sample posted a loss than did so a year ago.

Chesapeake Energy Corp. turned around a first-quarter loss, posting $510 million in net income for the most recent quarter and doubling its earnings from a year earlier. While the company's gas production and realized gas prices were down from the first quarter following asset sales, its oil and NGLs production and average realized liquids price climbed from this year's first quarter.

As a result of continued strong drilling results—particularly in the Haynesville and Marcellus shales—Chesapeake announced that it has increased its production forecast for 2011 and 2012. And due to "persistent and significant oil field service inflation" and a more accelerated drilling program in the Utica shale play, the company said it has increased its planned drilling and completion capital expenditure budget for 2011 and 2012 by $500 million to a range of $6-6.5 billion in each year.

Refiners' results

Refining margins improved from last year's second quarter in most US refining regions. The average US East Coast cash refining margin during the period was negative, though, at –35¢/bbl vs. $2.19/bbl a year earlier, according to Muse, Stancil & Co.

US Midwest cash refining margins surged to average $23.40/bbl during this year's second quarter compared with $8.45/bbl a year earlier.

Valero Energy Corp. reported an improvement in earnings. The San Antonio-based refiner said its second-quarter 2011 operating income was $1.3 billion vs. second-quarter 2010 operating income of $904 million. The company attributed the increase in operating income to a $1.84/bbl increase in refining-throughput margin combined with an increase of 136,000 b/d in throughput volumes.

The increase in the throughput margin was primarily due to higher margins for gasoline, diesel, and jet fuel plus wider discounts for heavy-sour feedstocks on the Gulf Coast and light-sweet crude oil in the Midcontinent, Valero reported. The increase in throughput volumes was mainly due to operating the company's Aruba refinery, which was not in operation during second-quarter 2010.

Tesoro Corp. also reported higher refinery throughput rates—which climbed to 87% of capacity from 84% a year earlier—as well as a crude-cost advantage and improved margins. The company's revenues climbed 55% from the 2010 second quarter to $8 billion, and net income increased to $222 million from $67 million a year earlier.

Sunoco Inc. posted a $71 million second-quarter net loss due to lower production volumes and weak refining margins on the US East Coast as well a $174 million after-tax writedown of assets primarily in its chemicals business.

Canadian firms

A sample of companies based in Canada combined for a 57% increase in second-quarter net income from the 2010 second quarter. For the first half of the year, though, earnings climbed by just 3% from a year earlier due to relatively weak results in this year's first quarter.

Gas producer EnCana Corp. recorded net income of $170 million (Can.) for this year's second quarter vs. a year-earlier net loss of $441 million (Can.) that was mostly due to hedging losses.

The company's total second-quarter gas and liquids production climbed 3% from a year earlier, but its realized gas price was $5.09/Mcf, down from $5.50/Mcf a year ago. Randy Eresman, EnCana president and chief executive officer, noted that gas prices remain at levels that the company believes are unsustainably low in the long term.

Meanwhile, Cenovus Energy Inc. reported that excellent refining results and higher oil prices led to strong financial performance in this year's second quarter. The Calgary-based producer and refiner posted a 30% increase in revenue and a 258% increase in net income from second-quarter 2010.

Cenovus recorded an overall second-quarter oil production decline of 5%, though. Turnarounds at the company's two producing oil sands properties as well as flooding in Saskatchewan and a pipeline disruption caused by wildfires in northern Alberta caused the production decline. The company's gas production was down 13% from a year earlier, mostly due to the sale of properties and the company's shifting of capital to oil development.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com