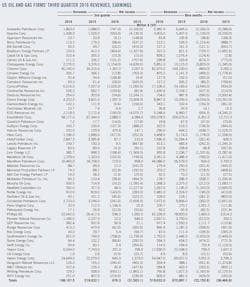

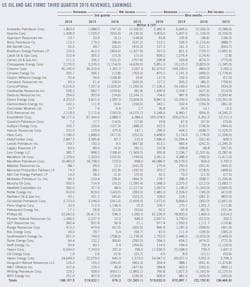

Oil, gas firms' third-quarter earnings improved from a year ago

Conglin Xu

Senior Editor-Economics

Laura Bell

Statistics Editor

A sample of 57 US-based oil and gas producers and refiners posted a combined net income of $676.3 million for this year's third quarter compared with a combined net loss of $31.5 billion for the same period in 2015. The group's collective losses for the first 9 months ended Sept. 30 were $22.15 billion compared with a collective $36.46-billion loss for the first 3 quarters of 2015.

ICE Brent crude's third-quarter price reached $46.99/bbl, which was down 4¢ from the previous quarter. The New York Mercantile Exchange West Texas Intermediate crude-oil price for the third quarter also fell, down 70¢ to $44.94/bbl compared with last quarter. Compared with the same period last year, ICE Brent was down $4.18, while NYMEX WTI declined $1.55.

Cash flow in the quarter was still negatively impacted by lower commodity prices. However, most oil and gas producers' losses were narrowed dramatically compared with those from a year ago. Some companies reported the first quarterly profit from upstream production since fourth-quarter 2014. The improvements reflected less-significant impairments, well productivity improvements, and lower operating expenses. According to an analysis from the US Energy Information Administration, asset write-downs have declined 80% year-over-year.

US drilling activity also showed signs of recovery during the most recent quarter. The number of rigs drilling for oil in the US rose by 95 since late June to 425 rigs at the end of September, according to data from Baker Hughes Inc. Much of the increase was in the Permian basin.

Meanwhile, refiners' profits declined from a year ago due to much weaker refining margins and higher costs for the purchase of renewable identification numbers, or RINs. According to Muse, Stancil & Co, refining cash margins in this year's third quarter averaged $13.25/bbl for Midwest refiners, $14.61/bbl for West Coast refiners, $8.54/bbl for Gulf Coast refiners, and $3.31/bbl for East Coast refiners. In the same quarter of the previous year, these refining margins were $24.12/bbl, $25.68/bbl, $12.62/bbl, and $6.88/bbl, respectively.

A sample of 11 oil and gas producers and pipeline companies with headquarters in Canada, meanwhile, posted a combined net earnings of $1.94 billion (Can.) in this year's third quarter compared with a combined net loss of $5.68 billion in the prior year quarter. The group reported earnings of $438 million for the first 9 months of this year compared with a loss of $9.42 billion for the first 3 quarters of 2015.

US producers

ExxonMobil Corp. reported earnings of $2.89 billion for this year's third quarter, down 34% from the same quarter in 2015. Revenues were $58.17 billion, down from $67.34 billion a year ago. Capital and exploration expenditures were reduced by 45% to $4.2 billion.

ExxonMobil's upstream earnings were $620 million in the most recent quarter, down $738 million from third-quarter 2015. The decrease was primarily caused by lower liquids and gas realizations, partially offset by favorable volume mix effects and other items. Earnings from US upstream operations declined $35 million from third-quarter 2015 to a loss of $477 million in this year's third quarter.

On an oil-equivalent basis, production decreased 120,000 b/d from a year ago to 2.2 million b/d. Higher downtime-mainly in Nigeria-and field declines were partly offset by project start-ups. Third-quarter natural gas production was 9.6 bcfd, up 77 MMcfd over 2015.

ExxonMobil's downstream earnings were $1.2 billion, down $804 million from third-quarter 2015. Weaker margins, primarily refining, decreased earnings by $1.6 billion.

ConocoPhillips announced a third-quarter loss of $1.02 billion compared with third-quarter 2015 losses of $1.05 billion. It is worth noting that during the third quarter, operating cash flows covered capital spending and dividends. Third-quarter production averaged 1.56 million boe/d, which exceeded the high end of guidance.

ConocoPhillips further reduced its 2016 capital expenditures guidance to $5.2 billion from $5.5 billion, with capital shifting from major projects to unconventional plays in the US Lower 48.

Murphy Oil Corp. incurred a net loss of $16.2 million for this year's third quarter. The comparative result from the same quarter in 2015 was a net loss of $1.6 billion. The prior-year quarter included a pretax impairment charge of $2.3 billion associated with oil prices that were weakening a year ago.

Excluding impairments in the previous year, Murphy Oil's operating results in the most recent quarter were improved vs. 2015 because of lower operating expenses and administrative expenses that more than offset lower oil and gas sales prices.

The company's capital program for 2016 is maintaining $620 million. However, there's a change in allocation as more capital is being allocated toward the Eagle Ford shale at yearend where additional wells have been placed online.

Devon Energy Corp. posted a net income of $1 billion for this year's third quarter compared with its third-quarter 2015 net loss of $3.9 billion. Over the third quarter, Devon completed a $3.2-billion asset divestiture program and repurchased $1.2 billion of debt. The company also achieved record-setting well results in its US resource plays.

EOG Resources Inc. reported a net loss of $190 million, compared to its net loss of $4 billion in third-quarter 2015. In the third quarter, EOG's total crude oil production increased 1% vs. the same prior-year period, while exploration and development expenditures-excluding property acquisitions-decreased 32%. Natural gas liquids production increased 5%, while total gas production for this year's third quarter decreased 10% vs. the same period in 2015.

Refiners

Valero Energy Corp. reported net income of $645 million for this year's third quarter, which was down from $1.4 billion for third-quarter 2015. The refining segment reported $990 million of operating income for this year's third quarter compared with $2.3 billion of operating income for the same quarter in 2015.

The decline was primarily attributable to weaker gasoline and distillate margins. Other factors included narrower discounts for most sweet and sour crude oil relative to the Brent benchmark and higher costs for the purchase of RINs.

Valero's refineries achieved 95% throughput capacity utilization and averaged 2.9 million b/d of throughput volume in the most recent quarter, in line with third-quarter 2015.

Tesoro Corp. reported third-quarter net income of $201 million compared with a net income of $799 million for the same quarter in 2015. Refining operating income was $52 million for this year's third quarter compared with $899 million in 2015. Third-quarter operating income included a pretax benefit of $20 million related to a lower of cost or market inventory adjustment offset by a $14-million charge related to a contract dispute with a supplier.

The Tesoro Index was $12.45/bbl for the third quarter with a gross refining margin of $9.08/bbl or 73% capture of the Tesoro Index. For the year ago period, the Tesoro Index was $23.09/bbl with a gross refining margin of $19.43/bbl or 84% capture of the Tesoro Index.

Refining margins in the third quarter 2016 were negatively impacted by rising RIN prices and the resulting transfer price to marketing, as well as by a reduction of inventory during the quarter. Total refinery throughput for the quarter was 873,000 b/d or 98% utilization.

HollyFrontier posted net income of $87.7 million for the quarter ended Sept. 30 compared with $210.6 million for the same quarter a year ago, principally reflecting lower refining margins.

Canadian firms

All financial figures in this section are presented in Canadian dollars unless noted otherwise.

Suncor Energy Inc. incurred net earnings of $392 million for this year's third quarter compared with a net loss of $376 million for the same quarter in 2015. Net earnings for the most recent quarter included a $180-million deferred tax recovery related to a tax-rate reduction on oil and gas profits in the UK and an unrealized aftertax foreign exchange loss of $112 million on the revaluation of US dollar-denominated debt. The net loss in the prior year quarter included an unrealized aftertax foreign exchange loss of $786 million on the revaluation of US dollar denominated debt.

Suncor's highlights of the quarter included an increased share of Syncrude operating earnings, attributed to improved upgrader reliability and lower per unit operating costs combined with the acquisition of additional working interests in 2016, lower operating costs at oil sands operations, record refinery crude throughput and higher production from both oil sands operations and exploration and production. These factors more than offset the unfavorable impact of both lower benchmark crack spreads and crude pricing in this year's third quarter. Operating earnings also included a charge for a noncommercial exploration well off the east coast of Canada.

Imperial Oil Ltd.'s third-quarter earnings were $1 billion, including a gain of $716 million from the sale of retail sites. This compares to earnings of $479 million in the third quarter of 2015. The sale of the company-owned Esso retail sites for $2.8 billion, announced in the first quarter, is expected to be complete by yearend.

According to Rich Kruger, chairman, president, and chief executive officer, Imperial Oil's upstream unit cash costs are averaging less than $20/bbl year-to-date, a decline of more than 35% since 2014 when global crude prices began their descent. Third-quarter capital and exploration expenditures were $205 million, down $937 million from 2015, reflecting the completion of major upstream growth projects and an ongoing focus on capital selectivity.