OGJ Newsletter

GENERAL INTEREST — Quick Takes

API: US December petroleum demand highest in 5 years

Total US petroleum deliveries, a measure of consumer demand, averaged 19.7 million b/d in December, a 1.1% increase over December 2014, according to the American Petroleum Institute's latest Monthly Statistical Report. The level reached was the highest December total in 5 years.

"Low prices have helped drive demand for oil and gasoline over the last year," said API Chief Economist Erica Bowman. "In fact, demand for gasoline last month was the highest December in 8 years."

In December, total motor gasoline deliveries rose 2% from a year ago to average just above 9.1 million b/d. Distillate deliveries decreased 12.7% compared with December 2014 to average 3.6 million b/d.

US crude oil production in December averaged just below 9.3 million b/d, down 1.4% compared with December 2014. December crude oil output remains the second highest output level for the month of December in 43 years, since 1972. Natural gas liquids production averaged nearly 3.4 million b/d-6.5% higher than year ago levels and the highest production for the month on December on record.

Total petroleum imports rose from the prior year, up 0.9%, but remain the second-lowest imports for December since 1997, averaging nearly 9.5 million b/d. Meanwhile, crude oil imports were up 4.6% compared with the prior year to 7.6 million b/d.

US gross refinery inputs fell 0.1% from December 2014. At 4.7 million b/d, exports of refined products were down 3.2% from December 2014. The refinery capacity utilization rate averaged 92.4% in December, 1.6 percentage points lower than year-ago levels. Refinery operable capacity reached 18.125 million b/d, up from last year's capacity of 17.811 million b/d.

Crude oil stocks reached their highest inventory level for December since 1930. At nearly 484 million bbl, crude stocks were up 23% or 90.6 million bbl higher than December 2014.

Ratings services issue new E&P warnings

Falling expectations for oil and gas prices have further eroded the producing industry's financial outlook. Moody's Investors Service and Fitch Ratings recently issued new warnings about the upstream oil industry after lowering price assumptions.

Moody's placed about 130 integrated oil, exploration and production, and oil field services and drilling firms on review for downgrade in its investment ratings. In December it had put 36 E&P companies not on the new list on review for downgrade after lowering price expectations (OGJ Online, Dec. 15, 2015).

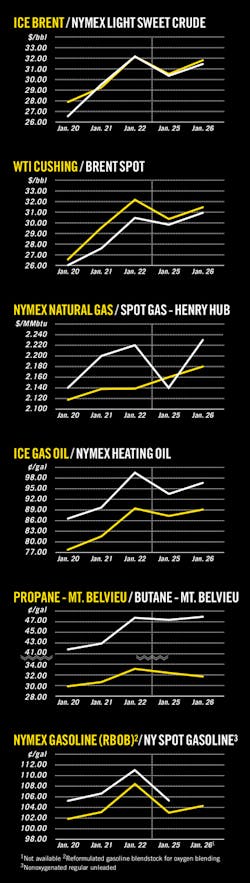

Its new price assumptions eliminate the spread between Brent and West Texas Intermediate crudes to reflect lifting of the US ban on crude exports.

Moody's now assumes prices of both marker crudes will average $33/bbl in 2016, $38/bbl in 2017, and $43/bbl in 2018. For Henry Hub natural gas, the firm assumes $2.25/Mcf this year, $2.50/Mcf next year, and $2.75/Mcf in 2018. And it assumes NGL prices of $12/bbl this year, $13.50/bbl in 2017, and $15/bbl in 2018.

Fitch Ratings changed its 2016 ratings outlook for the US oil and gas industry to "negative" from "stable" and said the lower oil and gas prices it assumes "are likely to increase the number of negative ratings actions seen across the sector."

The firm's base-case assumptions for this year are $45/bbl for crude oil and $2.50/Mcf for natural gas. Its long-term assumptions are $65/bbl for crude and $3.75/Mcf for gas. This year's "stress" level for crude in Fitch analyses is $35/bbl.

Fitch notes that financial strain is spreading from "high-yield oil and gas issuers," which were hit hard last year, to lower-risk, "investment grade" companies.

"While most investment grade names have decent liquidity, cost positions, [capital expenditure] flexibility, and capital-markets access, the current environment has pressured credit metrics enough to put downward pressure on ratings," the firm said.

TAEP: Abundant crude supply prolongs pain in Texas

Crude oil production in Texas during 2015 totaled 1.27 billion bbl despite dramatic declines in permitting, drilling, and completions, according to the Texas Petro Index (TPI) from the Texas Alliance of Energy Producers (TAEP).

A composite index based on a comprehensive group of upstream economic indicators, the TPI estimates crude production in Texas in 2015 outpaced that of 2014's total by 11.5%.

While statewide crude output in each month of 2015 exceeded output in the same month a year earlier, the margin of year-over-year growth fell from about 24% in March to 1.9% in December.

Compared with peak levels established in 2014, the rig count is now down 68%, drilling permits are off 70%, and oil and gas well completions have each declined about 60%.

"The pace of production decline in Texas and the US should accelerate in 2016, and when that begins to occur we should start watching for crude oil in storage in the US to decline on a real and sustained basis, not just seasonally," noted Karr Ingham, economist and creator of TPI.

The steep declines in upstream activity resulted in massive layoffs that caused total oil and gas industry employment to sink from a record 306,330 in December 2014 to about 246,150 in December 2015, a total of more than 60,000 jobs lost.

"If indeed over 60,000 industry jobs have been lost since December 2014, we're probably looking at least another 10,000 per quarter in the first half of 2016 for a total of at least 80,000 jobs lost over the 18 months from December 2014 through June 2016," Ingham projects.

"And even that may not be the end of it," he warned. "The last time the price of crude oil was below $30/bbl, statewide direct industry employment was about 135,000. That is more than 110,000 jobs fewer than estimated industry employment at yearend 2015. The last time the rig count was below 300, oil and gas industry employment was below 125,000 jobs."

Southwestern Energy to reduce workforce by 1,100

Southwestern Energy Co., Houston, plans to reduce its workforce by more than 1,100 employees resulting "primarily from anticipated lower drilling activity," the company said in a Jan. 21 filing with the US Securities and Exchange Commission.

The company, whose primary focus is natural gas development in the Fayetteville shale of Arkansas and the Marcellus shale of Pennsylvania, currently has no drilling rigs in operation, but has not finalized its capital budget and operating plan for the year.

Southwestern expects the reduction to be substantially implemented by the end of the first quarter, with a pretax charge to first-quarter earnings ranging $60-70 million.

The 2016 reduction follows a smaller reduction that occurred during third-quarter 2015, the one-time costs of which were immaterial, the company said.

Both reductions are expected to decrease the company's current costs by $150-175 million on an annual basis, exclusive of one-time termination benefits.

Noble cuts 2016 budget in half to $1.5 billion

Noble Energy Inc., Houston, is beginning 2016 with a capital program of $1.5 billion, about 50% lower compared with that of 2015 pro-forma for the Rosetta Resources Inc. merger.

This investment level is expected to deliver 2016 annual sales volumes of 390,000 boe/d, consistent with the full-year 2015 pro-forma amount. The 2016 program remains flexible to changes in the commodity price environment

Exploration & Development — Quick Takes

Kosmos finds gas with Guembeul-1 offshore Senegal

Kosmos Energy Ltd.'s first attempt to delineate the Greater Tortue area offshore Senegal encountered 101 m of net natural gas pay in two reservoirs in the northern part of the St. Louis Offshore Profond license area (OGJ Online, Nov. 12, 2015), the company said.

The Guembeul-1 exploration well was drilled 5 km south of the basin-opening Tortue-1 gas discovery (renamed Ahmeyim)(OGJ Online, Apr. 27, 2015). The well was drilled in 2,700 m of water to a total depth of 5,245 m, encountering 56 m of pay in the Lower Cenomanian and 45 m in the underlying Albain. Neither interval contained water, Kosmos reported, adding the well demonstrated reservoir continuity as well as static pressure communication with the Totue-1 well in the Lower Cenomanian. This suggests a single, large gas accumulation.

Based on the results from Guembeul-1, Kosmos increased its gross resource estimate for the Tortue West structure to 11 tcf from 8 tcf. For the Greater Tortue Complex, estimates have increased to 17 tcf from 14 tcf.

The Atwood Achiever drillship will now proceed to Mauritania to drill the Ahmeyim-2 delineation well in the southern part of Mauritania's Block C-8.

Kosmos holds 60% interest in the Guembeul-1 well. Partners include Timis Corp. Ltd. 30% and Petrosen 10%.

Lundin completes exploration well offshore Malaysia

Lundin Malaysia BV, a wholly owned subsidiary of Swedish independent Lundin Petroleum AB of Stockholm, has completed drilling the Bambazon exploration well on Block SB307/SB308 offshore eastern Malaysia.

The Bambazon well, which was drilled by Seadrill Ltd.'s West Prospero jack up rig to a total depth of 1,380 m, encountered 15 m of net logged reservoir pay with oil shows over three main reservoir intervals. The well has been plugged and will be expensed in this year's first quarter, Lundin said.

Lundin Malaysia holds 85% working interest in SB 307/308. Partners are Petronas Carigali Sdn. Bhd. with 15% working interest. Lundin Malaysia operates six blocks in Malaysia: PM307, PM319, PM308A, PM328, SB303, and SB307/308.

Second flow test begins at Antelope-5 in PNG

Total E&P PNG Ltd. has begun the second planned extended well test at Antelope-5 on its operated petroleum retention license 15 (PRL15) in the Gulf Province of Papua New Guinea.

The extended well test will flow Antelope-5 at about 50 MMscfd for 2 weeks before being shut-in to record the subsequent pressure build-up. Pressure gauges have been placed in Antelope-1 as an observer well. The test is expected to last 1 month.

Michael Hession, CEO of partner InterOil Corp., said the initial flow test conducted in June 2015 provided a good indication of the minimum connected volume in Antelope, and the second test aims to further support those findings.

"In order to improve the certainty of the minimum connected volume, we have added additional pressure gauges and we plan to flow five times more gas than we did in our initial test last year," he said.

The Antelope-5 appraisal well last year intersected the top reservoir at 1,534 m, 230-m higher than operator Total's reference case (OGJ Online, Feb. 16, 2015).

Meanwhile, the Antelope-6 appraisal well, 2 km east-south-east to the Antelope-3 well (OGJ Online, Jan. 2, 2013), has been preparing to drill ahead at 1,120-m TVD subsea (OGJ Online, Oct. 20, 2015). Antelope-6 spudded on Dec. 23, 2015, and has a proposed total depth of 2,464 m TVD subsea.

The PRL15 joint venturers are discussing an additional appraisal well to the west of Antelope-5. The decision whether or not to drill a further appraisal well will follow the evaluation of the Antelope-6 appraisal well and the results of the latest flow test at Antelope-5.

Drilling & Production — Quick Takes

Gas flow starts from Chuandongbei in China

Unocal East China Sea Ltd., a wholly owned subsidiary of Chevron Corp., has started natural gas production from the first stage of the Chuandongbei project in southwest China.

The startup of the first train commences Stage 1 of the project, which covers more than 800 sq km in Sichuan Province and the Chongqing municipality.

Production is planned to ramp up over coming months as all three trains come on line. The three trains have a combined design outlet capacity of 258 MMcfd of gas.

The Chuandongbei project, estimated to contain potentially recoverable gas resources of 3 tcf, is one of the largest onshore gas projects developed by an international oil company and a national oil company in China, Chevron says.

Unocal East China Sea operates the Chuandongbei project with 49% interest. China National Petroleum Corp. holds 51% interest. In 2007 the firms signed a 30-year production-sharing contract to develop the area (OGJ Online, Dec. 18, 2007).

Oil production begins at Kenli 10-4 in Bohai Bay

China National Offshore Oil Corp. Ltd. started oil production at Kenli 10-4 field in southern Bohai Bay. Current production from six wells totals 6,540 b/d, and CNOOC expects output to rise to 9,600 b/d later this year.

The development in 15 m of water includes one wellhead platform and use of existing facilities at Kenli 10-1 (OGJ Online, Apr. 23, 2015).

CNOOC is operator with 100% interest.

Malaysian firm to buy Lundin's Bertam FPSO

M3nergy Investment Ltd., a wholly owned subsidiary of M3nergy Bhd. of Malaysia, has agreed to acquire the Bertam floating production, storage, and offloading vessel from Lundin Petroleum AB for $265 million.

The two firms entered an agreement under which M3nergy will buy the 100% issued share capital of Lundin Services Ltd., owner of the FPSO. The deal is expected to close during the first quarter.

An integrated service provider to the oil and gas industry in Southeast Asia, M3nergy is a wholly owned subsidiary of Sabah Development Bank Bhd. in Malaysia, which is in turn wholly owned by the Ministry of Finance of the State of Sabah, part of the Federation of Malaysia.

Alex Schneiter, Lundin's president and CEO, explained the move from his company's perspective: "Owning infrastructure assets is not part of Lundin Petroleum's core strategy and this transaction will allow us to redeploy this capital into other areas of our business to fund our value driven growth."

Lundin in 2015 completed an extensive upgrade and life extension program on the FPSO, which has been operating since last spring's production startup from Bertam field on Block PM307 offshore peninsular Malaysia.

Lundin operates Bertam field with 75% working interest. Petronas Carigali Sdn. Bhd. holds the remaining 25%.

API: Fourth-quarter US completions down 51%

US oil and gas well completions in the fourth quarter of 2015 fell 51% from the total of the comparable quarter a year earlier, reports American Petroleum Institute.

Estimated development oil well completions were down 55%, and development gas well completions, down 37%.

For 2015 relative to 2014 levels, total well completions were down 35%. Oil well completions were down 37%, and gas well completions, down 28%.

Total footage drilled was down 27% in 2015.

API also reported that spending on US drilling in 2014 totaled $168.7 billion, according to the Joint Association Survey on Drilling Costs. The expenditure was for an estimated 46,488 oil and gas wells, up 3.22% from the 2013 total.

Spending on wells targeting oil accounted for 71.4% of the 2014 outlay, compared with 65.1% in 2013. Drilling on gas wells represented 21.7% of drilling expenditure in 2014, compared with 29.1% in 2013.

Spending on development wells totaled $138.4 billion in 2014. Exploratory well expenditures totaled $5.3 billion.

Shale drilling accounted for 48.6% of the 2014 total, compared with 63.5% in 2013.

Spending on offshore production dropped to 0.6% of total oil and gas production expenditure in 2014 from 4% in 2013.

PROCESSING — Quick Takes

Nigeria shutters two refineries after pipeline attacks

Nigerian National Petroleum Corp. has stopped production at two of its three major refineries amid disruptions to feedstock availability following mid-January attacks by Nigerian militants on crude oil pipelines that supply the processing sites.

NNPC simultaneously suspended operations on Jan. 17 at subsidiaries Kaduna Refining Co.'s 110,000-b/d refinery, Kaduna state, and Port Harcourt Refining Co.'s 210,000-b/d two-plant refining complex, Rivers state, after the Escravos-Warri crude supply line to the Kaduna refinery and Bonny-Okrika crude pipeline to the Port Harcourt complex suffered breaches as a result of the attacks, NNPC said in a series of recent posts to its social media accounts.

"In response to the unexpected setback, we have activated comprehensive remedial measures to sustain the prevailing stability in the supply and distribution of petroleum products across the country," the state oil corporation said.

NNPC additionally confirmed that subsidiary Warri Refining and Petrochemicals Co.'s 125,000-b/d refinery in eastern Nigeria's Delta state remains operational at a current fuel production rate of about 1.4 million l./day.

Prior to the Jan. 17 plant shutdowns, fuel production at the Port Harcourt and Kaduna refineries averaged about 4.1 million l./day and 1.3 million l./day, respectively, NNPC said.

The company did not disclose details regarding timelines for repairs to the pipelines or the possible restart of production at the refineries.

In December, NNPC achieved technical restarts of all three refineries following a series of prolonged operational and maintenance issues that left much of Nigeria's nameplate refining capacity idled, according to the company's monthly newsletter for December 2015.

As of early January, combined fuel production from the Port Harcourt, Kaduna, and Warri refineries averaged about 6.8 million l./day, which at the time, was projected to rise more than 10 million l./day by the month's end, NNPC said.

ExxonMobil joins cellulosic biofuel research

ExxonMobil Research & Engineering Co. and Renewable Energy Group Inc.'s Life Sciences subsidiary have agreed to study the production of biodiesel via fermentation of renewable cellulosic sugars.

Renewable Energy Group, Ames, Iowa, has a patented technology that uses microbes to convert sugars to biodiesel in a one-step process similar to ethanol production.

In the US, commercial production of renewable fuel from cellulose has fallen short of statutory requirements. Ahdi field gas plant starting in Pakistan

Pakistani government officials have inaugurated a third natural gas processing plant at Adhi oil and gas field operated by Pakistan Petroleum Ltd. about 70 km south of Islamabad.

The plant will support production from eight development wells planned after a reservoir study indicated further potential from the field. Six of the wells have been drilled.

The plant has capacities of 25 MMscfd of gas, 150 tonnes/day of LPG, and 5,500 b/d of crude oil and condensate.

Average Ahdi production from 16 wells is 50 MMscfd of gas, 2,000 b/d of NGL, 4,500 b/d of NGL, and 155 tonnes/day of LPG. Pakistan Petroleum's partners in the field are Oil & Gas Development Co. Ltd. and Pakistan Oilfields Ltd.

TRANSPORTATION — Quick Takes

Contract let for hook-up services for Ichthys LNG

Samsung Heavy Industries Co. has let a contract to Perth-based engineering firm Clough Ltd. for hook-up services on the Ichthys LNG project's central processing facility (CPF) offshore Western Australia.

Partners in the Inpex Corp.-operated Ichthys LNG-condensate project last year reported a 9-month delay to start of production from the project, which will have a pipeline connection to an LNG plant in Darwin (OGJ Online, Sept. 14, 2015). Inpex said the project will now come on stream in third-quarter 2017. Inpex also reported a 10% cost overrun over original estimates.

Clough's contract includes preparation and execution of the offshore hook-up activities and assistance to commissioning programs. The CPF will be the world's largest semisubmersible platform with topsides weighing 70,000 tonnes. The unit will be stationed near Ichthys gas-condensate field about 200 km offshore Kimberley.

Clough's work will begin in the next 2 months with the mobilization of engineering and technical teams to the Samsung fabrication yard in Geoje, South Korea, where the CPF is being built.

Cough has already been involved with the Ichthys project, having delivered the LNG jetty contract in Darwin and a module offloading facility. The company also is executing an integrated project management services contract for the development.

Shell Australia lets contract for Prelude FLNG project

Shell Australia Pty. Ltd. let a 3-year contract to Wood Group Kenny, Perth, for the Prelude floating LNG (FLNG) project to be located 475 km north-northeast of Broome in Western Australia. Wood Group Kenny will provide specialist consultancy services for flexible riser integrity management prior to and during operation of Prelude FLNG.

The contract's focus will be the development and implementation of the flexible riser integrity management plan and inspection, monitoring, testing, and on-call engineering support.

Flint Hills building Texas ethanol terminal

Flint Hills Resources will start construction this month on an ethanol terminal at Buda, Tex.

The privately held refiner and chemical manufacturer operates seven ethanol plants in Iowa, Nebraska, and Georgia with capacities totaling 820 million gal/year. Its two Texas refineries, in Corpus Christi, have combined capacities of 300,000 b/d.

The Buda terminal will have a rail spur, two storage tanks, a truck-loading rack, water storage, and an operations building.

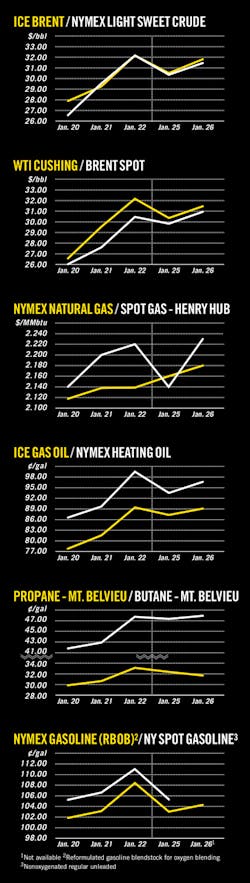

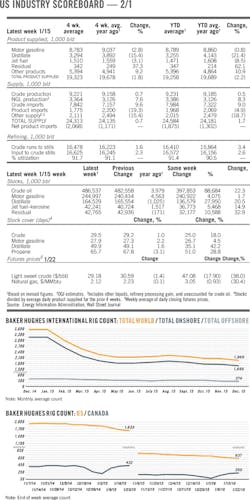

US industry scoreboard - 2/1

4 wk. 4 wk. avg. Change, YTD YTD avg. Change,

Latest week 1/15 average year ago1 % average1 year ago1 %

Product supplied, 1,000 b/d

Latest Previous Same week Change,

Latest week 1/15 week week1 Change year ago1 Change %

Stocks, 1,000 bbl

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com