OGJ Newsletter

GENERAL INTEREST — Quick Takes

OGUK survey reflects gloomier oil industry outlook

Oil & Gas UK says companies are "increasingly pessimistic" about their business prospects. OGUK's Business Sentiment Index (BSI) for fourth-quarter 2015 indicated that optimism was at its lowest since the index began in 2009.

With a score of -32 on a -50/+50 scale, the index was in negative territory for the sixth quarter in a row (OGJ Online, July 31, 2015). The index surveys representatives from operator and contractor companies.

"The deteriorating market conditions and the scarcity of new business opportunities continue to be major concerns for the industry," said Oonagh Werngren, OGUK's operations director. "Many companies remain deeply apprehensive about the future, with two-thirds reporting activity down further in the fourth quarter of 2015 compared to the previous quarter. For the majority of respondents, job losses continue, with 54% of respondents reporting a reduction in headcount."

Two thirds of respondents noted "intensive" cost reduction and efficiency measures to keep their businesses competitive.

Werngren said fiscal and regulatory reforms "also have a key role to play in transforming the UKCS into a competitive, low-tax, high-activity basin."

Statoil trims budget for 2016 by $1.7 billion

Norway's Statoil ASA is reducing its organic capital expenditure to $13 billion in 2016 from $14.7 billion in 2015. Statoil says it plans to invest "in a radically improved project portfolio, with an average breakeven of [$41/boe]." Exploration spending in 2016 will be about $2 billion.

From 2014 to 2017, the company estimates annual organic production growth of 1% from a rebased equity production level. From 2017 to 2019 Statoil expects 2-4% organic annual production growth.

"Statoil is well-positioned to capture value from an expected upturn in the market," said Statoil Pres. and CEO Eldar Saetre. "We have substantially improved our nonsanctioned project portfolio. More than 80% of the operated projects, with start-up by 2022, have a breakeven oil price below [$50/boe]."

The 2016 budget cut follows 2015 adjusted earnings of $9.01 billion, with adjusted aftertax earnings of $2.3 billion. It reported a full-year loss of $4.4 billion of net income in accordance with international financial reporting standards (IFRS), mainly due to lower short-term price assumptions leading to impairment charges and provisions.

During the fourth quarter, the company saw adjusted earnings of $1.79 billion, with adjusted earnings aftertax of $188 million. It reported a fourth-quarter IFRS net income loss of $1.01 billion.

Oxy's 2016 budget expected at 'no more than $3 billion'

Occidental Petroleum Corp., Houston, said on Feb. 4 that its 2016 capital program is expected to be "no more than $3 billion with production growth of [2-4%] from ongoing operations."

In comparison, total company capital expenditures for the first 6 months of 2015 were $3.2 billion.

It also reported a 2015 net loss of $7.83 billion, compared with earnings of $616 million in 2014. Fourth quarter saw a net loss of $5.18 billion, more than the $3.4 billion loss reported in fourth-quarter 2014.

Companywide oil and gas production volumes in 2015, excluding divested Bakken shale assets (OGJ Online, Oct. 29, 2015), totaled 652,000 boe/d, up from 571,000 boe/d in 2014.

For the fourth quarter, production volumes, excluding the divested assets, were 671,000 boe/d, down slightly from 672,000 boe/d in the third quarter but up from 596,000 boe/d in fourth-quarter 2014.

Gonzalez Anaya appointed Pemex chief executive

Jose Antonio Gonzalez Anaya on Feb. 8 was named chief executive officer of Petroleos Mexicanos (Pemex) by Mexican President Enrique Pena Nieto. He succeeds Emilio Lozoya, who resigned after holding the position since 2012.

Gonzalez Anaya served as head of Mexico's social security institute under the Nieto administration following several years in the nation's finance ministry.

The move follows years of falling production and earnings from the state-owned firm, and during a critical period for the nation's energy sector amid reform and the added challenge of depressed crude oil prices.

During a press conference, Nieto explained, "It will be necessary to adjust the cost structure, revise the spending program, and strengthen the investment processes, making use of the new joint venture and investment schemes provided by the energy reform."

Late last year, Moody's Investors Service downgraded Pemex's global foreign currency and local currency ratings to Baa1 from A3, two rungs above the minimum (OGJ Online, Nov. 25, 2015).

At the time, Nymia Almeida, Moody's vice-president, senior credit officer, explained, "Moody's believes that Pemex's credit metrics will deteriorate further in the short to medium term as oil prices remain depressed, production continues to drop, taxes remain high, and the company's capex needs are financed with debt."

Moody's noted that the company during 2012-14 increased debt to fund large outflows for taxes, duties, and capital spending, without achieving sustained increases in production or operating efficiencies.

Even when oil prices were at peak levels in 2014, Moody's said, Pemex's cash flow from operating activities of $9.1 billion fell well-short of covering $15.1 billion in capital spending outlays.

Pemex last week reported companywide crude oil production in 2015 was 2.27 million b/d, down 7% from the 2014 level and 10% from the 2013 level (OGJ Online, Feb. 3, 2016).

Exploration & Development — Quick Takes

QP joins Chevron in Moroccan deepwater leases

Qatar Petroleum has agreed to acquire 30% interest from Chevron Morocco Exploration Ltd., a subsidiary of Chevron Corp., in the Cap Rhir Deep, Cap Cantin Deep, and Cap Walidia Deep leases offshore Morocco.

The three lease areas encompass 29,200 sq km in 100-4,500 m of water, 100-200 km west-northwest of the city of Agadir.

Under the agreement, which was approved by the Moroccan government, Chevron will retain 45% interest and remain operator while Morocco's Office National Des Hydrocarbures Et Des Mines will continue to hold 25%. Chevron entered the licenses in 2013 (OGJ Online, Jan. 22, 2013).

SOCO starts drilling wildcat off Congo (Brazzaville)

SOCO International PLC has commenced drilling of its Baobab Marine-1 (BABM-1) wildcat on the Mer Profonde Sud Block in the Lower Congo basin offshore Congo (Brazzaville). The well is targeting early Miocene channel complexes on the RR Prospect, which are mappable in the seismic data and delineated by stratal discontinuities and variations in seismic amplitudes.

SOCO acquired 60% working interest in the Mer Profonde Sud permit in a farmout from a unit of PA Resources AB, Stockholm (OGJ Online, Nov. 4, 2013). SOCO said the BABM-1 well is unique relative to other wells drilled in and near the block, yet two wells on adjacent blocks along trend provide confirmation that the BABM-1 wildcat is targeting a known oil-bearing section. The well's estimated P50 resources are 330 million bbl.

Noble Corp.'s Noble Globetrotter II drillship is expected to drill the wildcat in 25-30 days to a depth of 3,400 m below sea level. SOCO is carrying 100% of the well cost at $25-30 million. PA Resources Congo holds 25% working interest in the license while state-owned Societe Nationale des Petroles du Congo (SNPC) holds 15%.

Decision looms for gas fields off Poland

Plans to develop two natural gas and condensate fields offshore Poland have advanced with the award of a preliminary contract for an onshore gas plant.

The Baltic Gas joint venture let the contract to Jacobs Engineering Group Inc. for a study of the plant preceding a final investment decision. Jacobs Petroleum & Chemicals Pres. Gary Mandel said FID approval could come in this year's second half.

Baltic Gas, established for development of B4 and B6 fields, comprises CalEnergy Resources Ltd., London, and LOTOS Petrobaltic SA, Gdansk. CalEnergy Resources Poland, a subsidiary of Berkshire Hathaway Energy Co., Des Moines, is operator for project development with 49% interest.

B4 and B6 fields have as much as 149 bcf of gas originally in place, according to CalEnergy.

Development involves a wellhead platform on B4 field connected by a subsea flowline to a central platform on B6. From there, gas would move by subsea flowline to landfall at Wladyslawowo, near the site of the planned treatment and liquids-extraction plant.

Drilling & Production — Quick Takes

Production starts from Laggan-Tormore fields

Total SA has started production from Laggan and Tormore gas-condensate fields in the West of Shetland area. The fields will produce 90,000 boe/d.

The Laggan-Tormore development lies in 600 m of water and consists of a 140-km tie-back of four subsea wells to the new 500-MMscfd onshore Shetland gas plant. After treatment, gas is exported to the mainland through the Shetland Island Regional Gas Export System (SIRGE) while condensate is exported through the Sullom Voe terminal.

Total E&P UK operates Laggan-Tormore with 60% interest alongside partners DONG E&P (UK) Ltd. and SSE E&P UK Ltd., each of which holds 20%. SSE E&P UK in 2015 joined the Total and Dong partnership at Laggan-Tormore as well as nearby Edradour and Glenlivet fields (OGJ Online, July 29, 2015).

Edradour and Glenlivet will tie into Laggan-Tormore's infrastructure (OGJ Online, Oct. 30, 2014; Feb. 24, 2015). The Edradour discovery is 75 km northwest of Shetland in 300 m of water and the Glenlivet discovery is north of Edradour in 400 m of water. Edradour is expected to start up in 2017, followed by Glenlivet in 2018.

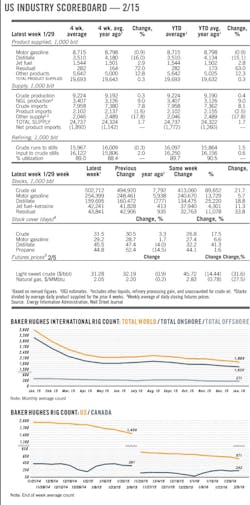

EIA: US shale oil output to shed 92,000 b/d in March

Crude oil production in March from seven major US shale plays is expected to fall 92,000 b/d to 4.92 million b/d, according to the US Energy Information Administration's latest Drilling Productivity Report (DPR).

The DPR focuses on the Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian, and Utica, which altogether accounted for 95% of US crude oil production increases and all US natural gas production increases during 2011-13.

Output from the Eagle Ford in March is forecast to decline 50,000 b/d to 1.22 million b/d, followed by a 25,000-b/d drop in the Bakken to 1.1 million b/d and a 15,000-b/d loss in the Niobrara to 389,000 b/d.

The Permian is seen rising by 1,000 b/d to 2.04 million b/d.

New-well oil production/rig across the seven plays in March is expected to increase by a rig-weighted average of 4 b/d to 504 b/d. Expected to lead the way is the Utica, up 13 b/d to 308 b/d; with the Niobrara closely behind at a 12-b/d rise to 741 b/d. The Eagle Ford is seen gaining 8 b/d to 812 b/d.

EIA projects natural gas production in March from the seven plays to fall 451 MMcfd to 44.26 bcfd, mostly reflecting a 202-MMcfd drop in the Marcellus to 15.7 bcfd, 158-MMcfd loss in the Eagle Ford to 6.44 bcfd, and 70-MMcfd decline in the Niobrara to 4.15 bcfd.

The Utica, meanwhile, is expected to rise 32 MMcfd to 3.28 bcfd.

Pemex's steady output declines continued in 2015

Petroleos Mexicanos (Pemex) reported liquid hydrocarbons production in 2015 of 2.59 million b/d, down 7% compared with the 2014 total and 10% compared with the 2013 total.

Offshore production accounted for 68% of the overall 2015 total. The total included 2.27 million b/d of oil, also down 7% from the 2014 level and 10% from the 2013 level. Heavy oil comprised slightly more than half of Pemex's 2015 production.

Companywide natural gas production totaled 6.4 bcfd, a drop off of 2% from the 2014 level but up slightly from the 2013 level. Production of refined petroleum products totaled 1.27 million b/d, a decrease of 9% vs. the 2014 total and 13% vs. the 2013 total.

Petrochemical output in 2015 was 9.89 million tonnes, down 13% vs. the 2014 level and 14% vs. the 2013 level.

Pemex in December said it plans to spend $23 billion on projects designed to modernize and reduce greenhouse gas emissions from Mexico's six refineries.

Three killed in platform fire in Bay of Campeche

Three workers were killed after a fire struck the compression unit of the Abkatun A platform in the Bay of Campeche over the weekend, Petroleos Mexicanos (Pemex) said on Feb. 7.

The fire was controlled and the rest of the platform was not evacuated. Several other workers, both for Pemex and contractors, were injured.

Seven workers were killed on the same platform in April 2015 following an explosion and subsequent fire (OGJ Online, Apr. 2, 2015).

Abkatun A is part of the Abkatun-Pol-Chuc complex.

PROCESSING — Quick Takes

Flint Hills' Minnesota refinery due overhaul

Flint Hills Resources LLC (FHR), Wichita, Kan., plans to invest $750 million to execute projects that would further improve both energy efficiency as well as clean fuels production at its 339,000-b/d Pine Bend refinery at Rosemount, Minn.

Designed to improve the refinery's environmental performance to meet heightened regulations, the projects involve a series of technology and efficiency upgrades that would enable a 500-tonne/year drop in overall permitted emissions, including additional cuts to nitrous oxide emissions, FHR said.

The proposed upgrades also would improve finished product production yields, boosting its output of diesel and gasoline without associated increases in emissions levels.

Specific projects of the proposed upgrading program, which would utilize best-available control technology throughout, includes the following:

• Replacement of two 1960s-era delayed coking units with a single energy-efficient unit equipped with the latest emissions-reduction technology.

• Installation of a gas oil fractionator.

• Technology upgrade of a hydrogen unit.

• Process improvements to enhance flexibility to adjust clean-diesel fuel production in line with market demand.

• Improvements to gasoline-blendstock processing to enable greater flexibility in production of ultralow-sulfur gasoline without increasing emissions.

Pending requisite regulatory review, state permitting, and final approval by management, construction on the Pine Bend projects would begin as early as 2017, the company said.

The newly announced upgrading plans for Pine Bend follows FHR's recently completed investment of more than $400 million on earlier projects to improved reliability and reduce key emissions at the refinery (OGJ Online, Mar. 19, 2014).

Since 1997, the Pine Bend refinery has lowered emissions of criteria air pollutants by about 65% since 1997, with its current emissions/bbl lower by about 21% compared with the industry average, according to FHR.

The company said it has invested a total of about $1.7 billion on upgrades and improvements at Pine Bend since 2010.

BOC commissions plant at NZ's sole refinery

BOC Ltd., an industrial gases subsidiary of Germany's Linde Group, has commissioned a plant that will capture carbon dioxide emissions from operations at New Zealand Refining Co. Ltd.'s (NZRC) 107,000-b/d Marsden Point refinery at Northland on the North Island's east coast.

The $40-million (NZ) plant began operations in early February, BOC said.

Located at the Marsden Point manufacturing site, the plant will trap as much as 50,000 tonnes/year of the refinery's CO2 byproduct and purify it for use across a range of New Zealand's industries, including food and beverage, wine, dairy, horticulture, and pulp and paper.

In addition to improving the refinery's environmental performance, the CO2 capture and purification plant will create a revenue stream for NZRC independent of refining margins and exchange rates, said Sjoerd Post, NZRC's chief executive.

Part of a more than 15-year operating agreement between BOC and NZRC, the CO2 plant previously was scheduled for startup by yearend 2015 (OGJ Online, June 26, 2014).

PRL doubles gasoline output at Karachi refinery

Pakistan Refinery Ltd. (PRL) has commissioned an isomerization plant at its 47,110-b/d hydroskimming refinery along the coastal belt of Karachi, Pakistan.

Equipped with Honeywell's UOP LLC's Penex process, the unit is now fully operational and has helped to double the refinery's output of high-octane gasoline to 24,000 tonnes/month in an effort to help meet Pakistan's growing demand for cleaner transportation fuels, Honeywell said. Commissioning of the isomerization plant began in late-June 2015, according to a notice on PRL's web site.

The unit startup follows PRL's March 2014 contract award to UOP to provide its modular equipment and proprietary Penex process technology for the project (OGJ Online, Mar. 18, 2014).

In addition to technology licensing and modular equipment, UOP delivered catalyst, adsorbent, engineering, technical support, and a drier regeneration control system for extended catalyst life for the Penex unit, which processes 5,000 b/d of light naphtha PRL previously exported into isomerate used for gasoline blending.

LyondellBasell closes sale of Argentinian assets

LyondellBasell, Houston, has completed the sale of its wholly owned subsidiary Petroken Petroquimica Ensenada SA (Petroken), which operates a 180,000-tonne/year polypropylene plant in the port city of Ensenada, 50 km southeast of Buenos Aires.

Grupo Inversor Petroquimica SL (GIP), Madrid, purchased LyondellBasell's 100% interest in Petroken for $184 million, LyondellBasell said on Feb. 5. Upon announcing the proposed transaction last year, LyondellBasell initially planned to sell Petroken to both GIP and YPF SA for about $162 million.

YPF's role in the deal, however, ended in December 2015, the firm said in filings to the Buenos Aires Stock Exchange and US Securities and Exchange Commission on Dec. 2, 2015.

TRANSPORTATION — Quick Takes

Stampede Lateral crude line starts flow in N. Dakota

Summit Midstream Partners LP (SMLP), The Woodlands, Tex., reported the start of operations of the Stampede Lateral crude oil transmission pipeline in North Dakota. SMLP is currently in the final stages of completing the nearby Little Muddy crude oil pipeline, which includes an interconnect with Enbridge Inc.'s North Dakota Pipeline System (OGJ Online, Jan. 13, 2015).

These crude oil development projects provide customers on the Polar & Divide gathering system with two new delivery points and access to additional downstream markets via rail and pipeline. Prior to the commissioning these projects, crude oil on the Polar & Divide system was delivered exclusively to the Colt Hub rail terminal in Epping, ND.

The Stampede Lateral connects SMLP's Polar & Divide crude oil gathering system with Global Partners LP's Basin Transload rail terminal near Columbus, ND. The Stampede Lateral provides Global and other producers in the region with as much as 60,000 b/d of oil throughput capacity. The 46-mile, 10-in. transmission line originates at SMLP's newly built Divide Station, which offers truck unloading capabilities and 75,000 bbl of oil storage capacity. The Stampede Lateral is underpinned by a long-term, fee-based contract with Global, including minimum volume commitments. Crude oil on the Stampede Lateral is delivered to Global's Basin Transload rail terminal, which offers single line haul rail access to Global's Albany, NY, terminal.

The Little Muddy pipeline will connect SMLP's Polar & Divide crude oil gathering system with Enbridge's North Dakota Pipeline System in Williams County, ND, via Enbridge's Little Muddy Facility near Marmon, ND. This development project includes 14-miles of 10-in. oil transmission pipeline with throughput capacity of 27,000 b/d. Crude oil delivered to the Little Muddy Interconnect will gain pipeline access to various downstream markets including Chicago, Patoka, Cushing, eastern Canada, and the Gulf Coast.

Kinder Morgan, Zenith Energy buy BP terminals

Kinder Morgan Inc. closed an acquisition of 15 products terminals in North America from BP PLC as Zenith Energy Management LLC signed an agreement to buy the oil company's products terminal in Amsterdam. The KMI transaction is valued at about $350 million and covers storage capacity totaling 9.5 million bbl and associated infrastructure.

KMI will operate 14 of the acquired terminals owned by a joint venture it has formed with BP Products North America. KMI owns 75% of the JV. The BP unit owns the balance. KMI owns all of the 15th terminal.

Zenith Energy of Houston expects to take ownership of the Amsterdam terminal by the end of the first quarter. Storage capacity there exceeds 6 million bbl of gasoline, ethanol, middle distillates, biodiesel, kerosine, and LPG.

CNPC delivers engineering package for Yamal LNG

A unit of China National Petroleum Corp. has delivered the first of more than 20 engineering packages for the Yamal LNG project in northern Russia.

CNPC Offshore Engineering Co. said the FWP5 package was officially delivered to its owner as it was loaded Feb. 3 in Qingdao City, Shandong Province, after a year of construction.

CNPC said it has been awarded the bidding for three other engineering packages.