Weaker demand outlook, heightened regulations create uncertainty for Chinese refiners

Kangyin Dong

Renjin Sun

Hui Li

China University of Petroleum

Beijing, China

Susong Zheng

Bo Yuan

Keng H. Chung

North Huanjin Chemical

Industries Group Corp.

Panjin, China

Rising oil and gas production and processing capacity over the past decade has been strongly influenced by China's rapidly growing economy. Many forecasts using the country's recent industrialization and urbanization plans as well as its annual gross domestic product (GDP) growth-rate data to gauge future demand suggest an uncertain future for the country's refining sector.

On Nov. 10, 2015, the International Energy Agency (IEA) published its World Energy Outlook 2015 (WEO-2015),1 which provided projections for China's future energy consumption through 2040. While informed by preliminary Chinese statistical data for 2014 and a draft version of the 13th Five-Year Development Plan (FYP) for 2016-20, these predictions relied mostly on statistical data for 2013 and the 12th FYP for 2011-15.

Subsequent revisions to preliminary data by the National Bureau of Statistics of China and additional clarifications regarding economic development plans, improved energy efficiency policies, and aggressive environmental targets under the 13th FYP following its official ratification by China's National People's Congress in March 2016, however, left many in the country's petroleum processing sector seeking a revised outlook for China's future oil and gas demand.

Using a bottom-up accounting framework, the authors of this article ran a long-range energy alternatives planning (LEAP) model2 based on China's revised statistical data for 20153 and recently announced economic and environmental targets under the 13th FYP to provide an updated oil-and-gas demand outlook and its corresponding implications for the nation's refining industry.

Though tracking similar trends as WEO-2015's outlook, results of the authors' analysis show China's actual oil and gas consumption through 2030 may not be as robust as that predicted by WEO-2015, pointing to a future of increasingly stringent regulations on Chinese refiners to reduce capacity in line with the country's softer demand and government targets for lowering emis-sions.

Background

Since the Economic Reform Program initiated in 1978, China has experienced tremendous social transformation and rapid economic growth, with energy consumption becoming an essential component of the country's objectives for social and economic development.

In 1978, China consumed 91 million tonnes of oil primarily for agricultural and industrial applications. By 2015, however, oil consumption had risen to 550 million tonnes, 61% of which was imported to supply energy demands of the transportation and manufacturing sectors in an effort to stimulate employment opportunities for the country's quickly growing middle-class population.

Like many developing countries, China has accelerated its replacement of coal with natural gas as a source of power generation. The gradual shift comes despite higher costs for using natural gas relative to those associated with using the country's abundant coal supplies. In 2015, China's natural gas consumption rose to 205 billion cu m from 31 billion cu m in 2001, an average annual growth rate of 13.4%.

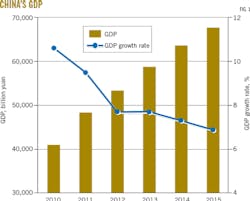

While China's annual GDP increased to 67,670 billion yuan in 2015 vs. 40,890 billion yuan in 2010, its annual GDP growth rate fell to 6.9% from 10.6% during the same period.

Fig. 1 shows China's annual GDP and GDP growth rate between 2010-15.

Prediction variations

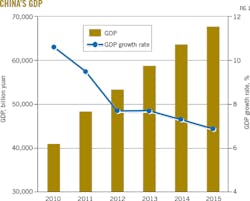

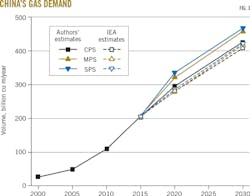

WEO-2015 provided China's energy consumption outlook for the next two decades under three scenarios: the current-policies scenario (CPS), a moderate-policies scenario (MPS), and a strong-policies scenario (SPS).

While WEO-2015's predictions for Chinese future oil and gas consumption under the various scenarios were in line with those presented in this article, our predictions using the latest data resulted in lower values for all three scenarios. The discrepancies between the authors' and WEO-2015's predictions can be attributed the following:

• WEO-2015's predictions relied heavily on the 12th FYP, which underestimated the rigorous measures undertaken in 2015 by the Chinese government for improving energy efficiency and reducing environmental impacts.

• China, while an association country, is not one of IEA's official 28-member countries. Data sources for WEO-2015 likely came from third parties and may not have reflected China's most up-to-date data.

• Alongside this article's use of China's 2015 energy consumption as a baseline vs. WEO-2015's use of a 2013 baseline, assumptions used for calculations in this study differ from those used by IEA under the three scenarios (Table 1).

Oil, gas demand

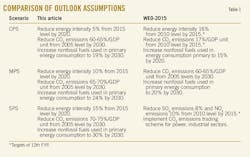

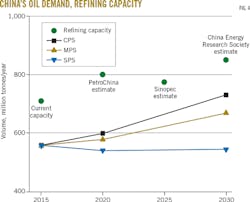

Based on the most currently available data, China's oil demand by 2030 will continue to increase under CPS and MPS to 722 million tonnes and 661 million tonnes, respectively, vs. a 2015 demand of 550 million tonnes.

Under SPS, however, Chinese oil demand will remain relatively constant to the 2015 level, dropping only slightly to 538 million tonnes by 2030. The possible decline results from potentially rigorous implementation of alternative energies (gas, renewables, and nuclear) as replacements for oil to achieve the government's ambitious target for reducing greenhouse gas emissions.

Fig. 2 shows predictions by the authors and WEO-2015 for Chinese oil demand by 2030 under the three scenarios.

This article's revised outlook indicates China's gas demand also will continue to rise by 2030 from a level of 205 billion cu m in 2015 under all three scenarios. Under the CPS scenario, gas demand will climb to 426 billion cu m, with demand under the MPS scenario predicted to be 457 bil-lion cu m. Under the SPS scenario of high-energy efficiency, China's gas demand will rise to its highest level of all three scenarios at 468 billion cu m.

In addition to previously mentioned factors contributing to discrepancies between the authors' and WEO-2015's demand predictions, our outlook for rising gas demand under SPS considers the increased substitution of oil with gas in certain applications as a route to meeting regulatory targets for high-energy efficiency.4

Fig. 3 shows our and WEO-2015's predictions for gas demands in China by 2030 for the various scenarios.

Refining sector

Between 2005-14, China's refining industry undertook an aggressive expansion of crude processing capacities to meet sharply rising demand for transportation fuels and petrochemical products. The spike in capacity occurred largely as a result of state-owned enterprises (SOE) such as PetroChina Co. Ltd. and China Petrochemical Corp. (Sinopec) executing massive upgrading programs at most of their existing plants, as well as building several new and highly complex refineries. By 2014, China's overall processing capacity reached 721 million tonnes.

In 2015, however, China initiated a series of steps aimed at reforming its refining sector, particularly with the introduction of cleanfuel specifications as well as a loosening of restrictions on the country's smaller, non-SOE teapot refineries.5

The government's mandate for implementation of Euro 5-grade transportation fuels in major cities in early 2015 forced some poorly equipped refineries to shut down or operate at reduced rates. By yearend 2015, China's overall refining capacity had fallen to 710 million tonnes, a combined 74% of which belongs to SOEs and the remaining 26% to independent teapot refiners.

At the same time, however, the government's relaxed restrictions on teapots (including granting some teapots licenses to import crude and export refined products) have encouraged some teapots to revamp and upgrade their aging refineries to produce high-quality fuels.

Whereas SOEs struggle to compete with each other for market share amid reduced national demand and processing restrictions, teapot refiners have increased capacity utilization as well as their market share of refined product sales. This is especially true in Shandong Province, where 89% of China's teapot refineries are located.

While it has contributed to a rise in crude imports into China, this surge in capacity utilization at teapot refineries is likely to be short-lived, as many of these independent refiners are not financially equipped to retool to produce Euro 5-grade transportation fuels that will be required across the country by 2017. Recently launched investigations by Chinese government agencies into allegations of tax fraud committed by these smaller refiners will further limit their ability to compete with SOEs.

Despite China's heightened regulations, China's future refining capacity is poised to increase slightly to 800-850 million tonnes, according to data from several petrochemical information agencies.6

Fig. 4 shows predictions for future Chinese oil demand and refining capacity.

In 2030, under our high (720 million tonnes) and low-(540 million tonnes) demand scenarios, China's refining capacity utilization will be 85% and 64%, respectively.

The low-demand scenario, along with its implication for low-capacity utilization, has created a great deal of uncertainty for Chinese refiners, which already are facing heightened government intervention with the introduction of policies and corrective efforts designed to address the nation's overcapacity.

In the near term, China's refiners must focus on a strategy to meet the government's recently announced policies, which-while likely to expand further in scope-presently include the following:

• Align refining capacity with oil demand by 2025. This will phase out obsolete, inefficient, and small-to-medium sized refineries in preference of optimizing large and advanced petrochemical projects. Newer and more advanced technologies will be required to improve processing efficiency as well as quality of refined products to comply with targets of the 13th FYP, particularly those related to emissions reductions (Table 2).

• Integrate the refining industry into China's Belt and Road Initiative for foreign policy, which allows export of refined products and will help alleviate the need for excess processing capacity as a pathway to accelerate modernization of domestic refineries in preparation for increased competition abroad. This will impact future refinery development in China as well as planned investments in developing refineries across the Asia-Pacific region.

• Impose stringent environmental regulations on the domestic refining industry. Alongside improving the quality of refined products, this will result in increased energy efficiency and reduced emissions at Chinese refineries.

• Restructure and transform the refining sector into a green manufacturing industry in the sense that it operates with little impact to the environment as a result of limiting its use of natural resources, recycling and reusing water and other produced forms of energy from processing activities, and limiting its emissions. This aims to spur domestic refiners into adopting innovative technologies that will lead to efficient operations of large petrochemical complexes.

References

1. "World Energy Outlook 2015," International Energy Agency, Nov. 10, 2015.

2. Bilgen, S., "Structure and Environmental Impact of Global Energy Consumption," Renewable and Sustainable Energy Reviews, Vol. 38, No. 10, pp. 890-902.

3. "China Statistical Yearbook 2015," China Statistics Press.

4. Dong, K. Y., Sun, R. J., and Li, H., "Present Situation and Countermeasures of Social Capital Investment in Shale Gas Development in China," Natural Gas and Oil, Vol. 33, No. 6, June 24, 2015, pp. 100-104.

5. Peng, Y. Z., and Dong, X. C., "Development analysis and prospect report for China's oil and gas industry," China Petrochemical Press, 2016, pp. 102-110.

6. "Development Report of World Oil & Gas Industry 2015," CNPC Economics & Technology Research Institute, 2016.

The authors

Kangyin Dong ([email protected]) is a PhD candidate in management science and engineering at China University of Petroleum, Beijing. He holds a BS in electronic packaging technology as well as a BA in business administration, both from Beijing Institute of Technology.

Renjin Sun ([email protected]) is a professor at China University of Petroleum, Beijing, and a former visiting scholar at Natural Resources Canada's CANMET Western Research center at Devon, south of Edmonton, Alta. He is a consultant for major oil companies in China as well as energy information service companies elsewhere in the Asia Pacific region. Sun holds a BS in applied chem-istry, an MS in management engineering, a PhD in chemical engineering, all from China University of Petroleum.

Hui Li ([email protected]) is a PhD candidate in management science and engineering at China University of Petroleum, Beijing, and currently serves as a visiting scholar at University of Texas at Arlington. She holds a BS in international business and trade from Hunan Technology Institute and an MS in management science and engineering from China University of Petroleum.

Susong Zheng ([email protected]) is a research engineer at North Huajin Chemicals Industries Group Corp.'s technology research and development center. He holds a BS in chemical engineering from North East University, China, and has more than 20-years experience in petroleum product development and market studies.

Bo Yuan ([email protected]) is director of Technology Research and Development Centre at North Huajin Chemicals Industries Group Corp. He has held various senior technical and executive positions in petrochemical operations for 30 years. He holds a BS in chemical technology from Dalian University of Science and Technology, China.

Keng H. Chung ([email protected]) serves as refinery advisor for North Huajin Chemical Industries Group Corp. He also acts as a process troubleshooting expert for petroleum operations and is involved in developing sustainable heavy oil technologies. Chung holds a BS and MS in chemical engineering from Queen's University, Kingston, Ont., and a PhD in chemical and petroleum engineering from the University of Calgary. He is a registered professional engineer in Alberta, Canada.