Olefin prices steady despite higher feedstock, production costs

Dan Lippe

Petral Consulting Co.

Houston

Olefin prices in the US Gulf Coast market did not reflect the big increases in feedstock prices and production costs during first-half 2016. Between February and May, propane prices were up 18¢/gal (54%), while natural gasoline prices strengthened 28¢/gal (40%). Spot prices for ethylene in Mont Belvieu, Tex., however, increased by only 5.4¢/lb (27.5%), with net transaction prices in May only 4.3¢/lb more than in February. Propylene prices varied within narrow ranges of just 2-3¢/lb.

US ethylene producers posted a third consecutive quarter of nearly perfect operational performance in first-quarter 2016 at an average operating rate of 97%. But as Petral Consulting Co. predicted, industry operating rates fell to 88% during second-quarter 2016 amid a series of planned maintenance turnarounds (OGJ, Mar. 7, 2016, p. 62). Reduced production levels, however, had limited impact on ethylene prices.

Only one new propane dehydrogenation (PDH) plant came online on the Gulf Coast during first-half 2016, but by midyear, propylene supply in reportable Gulf Coast storage was 150-200 million lb higher compared with yearend 2015. With propylene exports remaining at historically high levels during the first 6 months of the year, however, producers were able to avoid the price collapse many feared would accompany startup of new production.

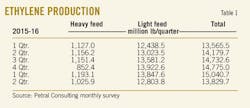

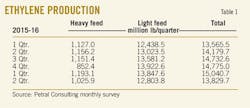

Ethylene production

Petral Consulting tracks US ethylene production via a monthly survey of operating rates and feed slates. Results of the monthly survey show ethylene production was 165.3 million lb/day in first-quarter 2016, up 1.8% from second-quarter 2015. For second-quarter 2016, survey results showed ethylene production at 152.0 million lb/day, 8.1% less from the previous quarter.

Compared with first-half 2015, US ethylene production was 1.48 billion lb (10.9%) higher during first-quarter 2016 but 350 million lb (2.5%) lower in the second quarter.

Production losses in first-quarter 2016 due to turnarounds and unplanned maintenance registered their lowest levels of the previous eight quarters at just 209 million lb.

As Petral Consulting accurately projected in March, however, planned maintenance in second-quarter 2016 at five units with combined capacity of 8 billion lb/year (12.6% of overall nameplate capacity) contributed to production losses of 1.29 billion lb during the period. Planned maintenance downtime alone accounted for 1.16 billion lb (90%) of total production losses for the quarter (Table 1).

Ethylene production from plants in Texas during first-quarter 2016 was 115 million lb/day before falling to 105 million lb/day in the second quarter amid planned maintenance at four plants, which accounted for 70% of production losses during April-June.

Production from ethylene plants in Louisiana averaged 44 million lb/day in first-quarter 2016 but fell to 41 million lb/day during the second quarter, also as a result of scheduled maintenance.

Fig. 1 shows trends in ethylene production.

Feedstock prices

Save for ethane, spot prices for ethylene feedstock in first-half 2016 generally tracked crude oil prices. Spot prices for West Texas Intermediate (WTI) rose from a low of $30.50/bbl in February to nearly $49/bbl in June.

After hitting a low of about 70¢/gal in February, spot prices for natural gasoline (representative of light, paraffinic naphtha feed) averaged 77¢/gal in first-quarter 2016 before tracking rallying crude prices higher during the second quarter to average 97¢/gal. Similarly, propane prices in Mont Belvieu increased from a first-quarter average of 39¢/gal to average 49¢/gal in the second quarter.

Spot prices for purity ethane fell to 16¢/gal in first-quarter 2016 but increased to average 20¢/gal in the second quarter. The dip in purity ethane prices in the first quarter was consistent with the decline in wellhead natural gas prices and shrinkage values.

Although natural gas prices remained near record lows in April-May, purity ethane prices increased to 19-20¢/gal before rising to 22-23¢/gallon in June.

Natural gas storage injection rates were 4-5 bcfd below average during second-quarter 2016, and prices in the Houston Ship Channel increased to $2.50-2.75/MMbtu in late June. Gas-plant ethane recovery costs (basis gas plants in West Texas and New Mexico) in late June were 6¢/gal higher compared with April-May.

Propylene prices during first-half 2016 held even more stable than ethylene, with spot prices for polymer-grade propylene seemingly immune to large swings in crude and motor gasoline prices. Spot prices for polymer-grade propylene averaged 29¢/lb during the first quarter and 30¢/lb in the second quarter, while refinery-grade propylene spot prices averaged 19¢/lb in the first quarter and 20¢/lb in the subsequent quarter, according to PetroChem Wire's daily olefin price reports.

Contract settlements for purity butadiene fell to 26¢/lb in first-quarter 2016 but increased to 33¢/lb in the second quarter. Spot prices for aromatics also tracked swings in crude prices during first-half 2016, with prices for toluene falling to 196¢/gal in the first quarter before rising to 222¢/gal during the second quarter.

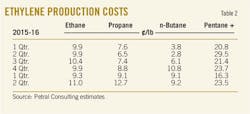

Ethylene production costs based on purity ethane feeds during the first two quarters of 2016 averaged 9¢/lb and 11¢/lb, respectively. Purity ethane provided producers with a cost savings of 7¢/lb vs. natural gasoline in first-quarter 2016 and 12¢/lb during the second quarter. While production costs for purity ethane and propane were equal in the first quarter, purity ethane production costs were 1.5-2.0¢/lb lower vs. propane in the second quarter.

Production costs for purity propane averaged 9¢/lb during first-quarter 2016 before increasing to 13¢/lb in the second quarter to yield ethylene producers a cost savings of 7¢/lb vs. natural gasoline for the first quarter and 10-12¢/lb in the second quarter.

Despite dropping to 14-15¢/lb in January-February alongside weaker pricing for crude and unleaded regular gasoline, production costs for natural gasoline during the second quarter increased to 20¢/lb in March, and by second-quarter's end, averaged 22-24¢/lb (Table 2).

Ethylene pricing, profit margins

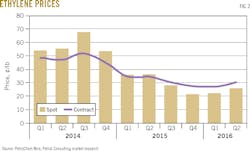

After rallying in response to rising feedstock costs in the first 3 months of 2016, spot prices for ethylene eased before stabilizing within a narrow range during the second quarter. PetroChem Wire daily reports showed spot prices for ethylene in Mont Belvieu averaged 17-18¢/lb in January before jumping to 27-28¢/lb in March. During second-quarter 2016, spot prices remained in a range of 24-26¢/lb.

With all ethylene pipelines in service and production rates in Louisiana and Texas at near record-high levels in first-quarter 2016, spot prices for ethylene at Choctaw Dome maintained premiums of 1.5-2.5¢/lb vs. Williams Hub in January-February and averaged 1.66¢/lb for the 3-month period. Although Louisiana's ethylene production in second-quarter 2016 was 3 million lb/day (7%) lower compared with the previous quarter, ethylene spot prices at Choctaw Dome fell to a discount of 1.1¢/lb vs. Williams Hub in April before recovering to a premium of 1.3¢/lb in June.

Consistent with the declining feedstock costs, net transaction prices (NTP) fell to 24-26¢/lb in January-February to hit their lowest levels since January 2003. Market expectations of an impending production decline during second-quarter 2016 as a result of heavy planned maintenance prompted producers to increase NTP to 29.75¢/lb in March for a first-quarter average of 26.75¢/lb. April NTP was 30.5¢/lb. After dipping to 30¢/lb in May, NTP rebounded in June to average 30.25¢/lb in the second quarter.

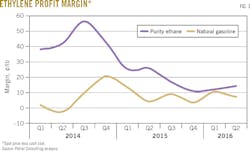

Margins based on NTP for purity ethane averaged 17.4¢/lb in the first quarter (vs.19.8¢/lb in third-quarter 2015) and 19.2¢/lb for the second quarter (vs. 17.6¢/lb in fourth-quarter 2015). Margins vs. propane also barely changed in first-half 2016, averaging 17.6¢/lb and 17.5¢/lb in the first and second quarters, respectively. Margins for natural gasoline and light naphtha of similar quality improved to 11¢/lb in first-quarter 2016 but fell to 6-7¢/lb in the second quarter.

Fig. 2 shows historic trends in ethylene prices (spot prices and NTP). Fig. 3 shows profit margins based on spot ethylene prices and variable production costs.

Olefin-plant feed slate trends

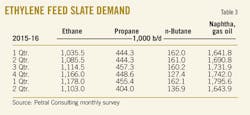

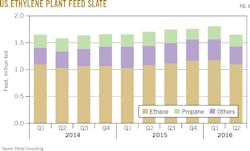

Petral Consulting's monthly survey of plant operating rates and feed slates showed ethylene industry demand for fresh feed increased to a new record high of 1.8 million b/d in first-quarter 2016 before receding to 1.64 million b/d during the second quarter alongside a decline in ethylene production rates. Demand for fresh feed in first-quarter 2016 was 41,800 b/d (2.4%) more than fourth-quarter 2015, while demand in the second quarter was 151,800 b/d less than the previous quarter.

Demand for NGL feeds (ethane, propane, and normal butane) was 1.63 million b/d in first-quarter 2016 and 1.51 million b/d in the second quarter. Demand for NGL feed in first-quarter 2016 was almost unchanged vs. fourth-quarter 2015, but demand in the second quarter of 2016 was 126,500 b/d lower compared with the first quarter of the year. NGL feeds accounted for 91-92% of fresh feed during first-half 2016 (Table 3).

Fig. 4 shows historical trends in ethylene feed.

US propylene production

Coproduct propylene supply depends primarily on the use of propane, normal butane, naphtha, and other heavy feeds. The monthly survey shows demand in first-quarter 2016 was 455,500 b/d for LPG feeds (propane and normal butane) and 162,100 b/d for heavy feeds. In second-quarter 2016, demand for LPG feeds declined by about 40,000 b/d to 414,000 b/d, while demand for heavy feeds fell by 25,000 b/d from the first quarter to 137,000 b/d.

Total demand during first-quarter 2016 for feeds with high-propylene yield was 617,600 b/d, or 29,800 b/d (5.1%) higher vs. fourth-quarter 2015. Demand for LPG and heavy feeds in second-quarter 2016 was down by 66,500 b/d (10.8%) from the first quarter to 551,000 b/d.

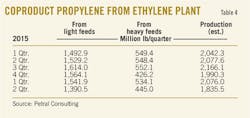

Petral Consulting estimates overall coproduct supply increased 1.2 million lb/day in first-quarter 2016 to 22.8 million lb/day. Although ethylene production reached a new record high in first-quarter 2016, demand for LPG and heavy feeds was 16,000 b/d less than in fourth-quarter 2015, with coproduct supply also 0.7 million lb/day lower vs. the last quarter of 2015. Coproduct supply during first-quarter 2016 was 87 million lb (4.4%) higher compared with fourth-quarter 2015, but declining ethylene production rates during second-quarter 2016 reduced coproduct supply by 240 million lb (13%) from the first quarter to 20.0-20.5 million, its lowest level since second-quarter 2012.

Coproduct supply from NGL feeds accounted for about 75% of overall coproduct supply for first-half 2016, averaging 17 million lb/day during the first quarter before falling to 15.0-15.5 million lb/day in the second quarter. Production from NGL feeds in first-quarter 2016 was only 22 million lb (1.4%) less vs. fourth-quarter 2015, while second-quarter production was 150 million lb (9.8%) lower from the preceding quarter (Table 4).

PDH plants, refineries

Based on PetroChem Wire's daily reports, Petral Consulting estimates propylene production from PDH plants at the US Gulf Coast was 6 million lb/day in first-quarter 2016 but dropped to 4.5 million lb/day in the second quarter, with an overall available production capacity of 8.4 mllion lb/day for first-half 2016.

Production in first-quarter 2016 was 250 million lb (2.75 million lb/day, or 85%) more than in fourth-quarter 2015, with production during the second quarter 130 million lb (1.44 million lb/day, or 24%) less compared with the previous quarter. The decline in propylene production from PDH plants reinforced the drop in coproduct supply from ethylene plants to result in an overall decline of coproduct and PDH supply during second-quarter 2016 of 370 million lb (4 million lb/day).

Refinery propylene sales into the merchant market are a function of:

• Fluid catalytic cracking unit (FCCU) feed rates (most important variable).

• FCCU operating severity (important but not directly measurable).

• Economic incentive to sell propylene rather than use it as alkylate feed.

Economic factors affect operating severity and are generally of secondary importance.

Statistics from the US energy Information Administration (EIA) indicate US refineries operated FCCUs at 4.9 million b/d in first-quarter 2016, an increase of 133,700 b/d (2.8%) from fourth-quarter 2015. FCCU feed rates increased during the first quarter despite a 246,000-b/d drop in crude runs compared with the last quarter of 2015.

EIA weekly reports show refinery crude runs increased to 16.4-16.5 million b/d in second-quarter 2016, during which period Petral Consulting estimates fresh feed to FCC units increased to 4.9-5.1 million b/d.

Regionally, EIA statistics showed feed rates for FCC units in the US Gulf Coast and Midcontinent at 3.46 million b/d in first-quarter 2016, 28,300 b/d (0.8%) higher than fourth-quarter 2015. Petral Consulting estimates feed rates for these FCC units were 3.55-3.65 million b/d in second-quarter 2016, or about 150,000 b/d (4.3%) more than in the previous quarter.

While spot prices for refinery-grade propylene in the Houston Ship Channel market fell below unleaded regular gasoline prices in April 2015 and remained discounted through yearend 2015, spot prices were unchanged in first-quarter 2016 (19¢/lb) despite a drop in unleaded regular gasoline prices in the Gulf Coast pipeline market to 15-17¢/lb in January and February. Spot prices for refinery-grade propylene increased to 20¢/lb in second-quarter 2016 but gasoline prices increased to 23-24¢/lb in May and June.

Even though refinery-grade propylene prices remained at discounts to motor gasoline prices in the Gulf Coast pipeline market, refineries maintained propylene supply at high ratios vs. FCCU feed rates.

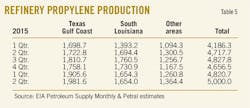

Before 2015 some refineries curtailed refinery-grade propylene supply when prices fell below gasoline prices. During the second and third quarters of 2015, refinery-grade propylene supply from refineries in the Gulf Coast and Midcontinent was 8.36 billion lb, 332 million lb (4.1%) more than the same period in 2014. While spot prices for refinery-grade propylene were again discounted 3-4¢/lb vs. motor gasoline in May-June 2016, Petral Consulting estimates refinery-grade propylene supply from Gulf Coast and Midcontinent refineries was 48-49 million lb in second-quarter 2016, some 3.0-3.5 million lb/day (316 million lb, or 7.7%) more than in 2015 (Table 5).

Propylene economics, pricing

EIA statistics for refinery-grade propylene and Petral Consulting's estimates for coproduct supply and PDH plant production indicate total US propylene production of 82 million lb/day in first-quarter 2016, declining to 79-80 million lb/day in second-quarter 2016. The most significant changes in US propylene supply for first-half 2016 vs. 2015 resulted from increases in refinery supply and PDH plant production.

Fig. 5 shows trends in coproduct and refinery merchant propylene sales, as reported by EIA.

Two factors greatly influence propylene pricing. Refinery-grade propylene supply tracks seasonal variations in refinery crude runs and FCCU feed rates. Seasonal variations in refinery crude runs and FCCU feed rates are reasonably predictable, and propylene supply-demand balances are usually tighter in winter than in summer.

Propylene price relationships vs. unleaded regular gasoline vary directly with seasonal variations in the propylene supply-demand balance.

Under normal market conditions, propylene in reportable US Gulf Coast storage varies by ±25% of the midrange of long-term historic inventory levels. Occasionally, however, inventory levels fall outside the historic range. When inventory in reportable storage at the Gulf Coast increases to more than 770 million lb, spot prices for refinery-grade propylene tend to decline and premiums vs. unleaded regular gasoline weaken.

On January 1, propylene inventory in reportable Gulf Coast storage was 544 million lb, 20% below the 3-yr average, according to EIA. On May 1, however, inventory in reportable Gulf Coast storage increased to 691 million lb, 1.8% above the 3-yr average.

The inventory swell was short-lived, however, as operating problems and planned maintenance work on PDH plants as well as ethylene plant turnarounds during second-quarter 2016 reduced polymer-grade propylene supply by almost 400 million lb. During the same quarter, Gulf Coast and Midcontinent producers increased refinery-grade propylene supply by only 140 million lb. Propylene inventory in reportable Gulf Coast storage varied within a narrow range of 600-750 million lb from the start of May through late June, according to EIA weekly statistics.

Propylene buyers and sellers anticipate predictable changes in supply due to plant turnarounds and seasonal variations in refinery-grade propylene supply. While inventory was a neutral consideration in first-quarter 2016, sellers anticipated a decline in refinery-grade propylene supply. Contrary to normal seasonal patterns, refinery-grade propylene supply was steady in first-quarter 2016, moving spot prices lower to 16.5-17.5¢/lb in February vs. 18-19¢/lb in fourth-quarter 2015. Unleaded regular gasoline prices, however, fell by even more, leaving refinery-grade propylene prices at premiums of 1-3¢/lb.

While refinery-grade propylene inventory in reportable Gulf Coast storage easily could have declined by 300 million lb during second-quarter 2016 to hit a historic low, supply remained steady, falling below the 3-yr average only occasionally. As a result, spot prices for refinery-grade propylene during the second quarter held within a range of 19-20¢/lb but remained at discounts of 2-5¢/lb vs. unleaded regular gasoline prices.

In first-quarter 2016, contract benchmark pricing for polymer-grade propylene averaged 30.0-31.5¢/lb, unchanged vs. fourth-quarter 2015. The decline in coproduct supply and PDH production during second-quarter 2016, however, provided support for stronger contract price settlements across the period, with contract prices settling at 32.5¢/lb for April and May before increasing to 33¢/lb for June.

Polymer exports

The most important end-use markets for ethylene and propylene are production of polyethylene and polypropylene. US production of polyethylene and polypropylene has exceeded domestic demand for at least 30 years, and export markets have always absorbed the surplus in US supplies.

During 2017-20, petrochemical companies in North America will start up 20 billion lb/year of new ethylene and polyethylene capacity. Since polyethylene demand in domestic markets is stagnant, US exports of ethylene-based products such as polyethylene and ethylene glycol will become increasingly important. Recognizing the need to prepare for the surge, producers and chemical industry marketing firms began increasing exports of key derivative products in second-half 2015. Exports of polyethylene, in particular, continued to increase during first-half 2016.

US chemical companies also plan to increase PDH capacity by 4 billion lb/year (12 million lb/day). In contrast to equivalent expansion of ethylene-derivatives capacity for new ethylene plants, most projects to expand PDH capacity do not include any equivalent expansion of propylene-derivatives capacity. PDH producers instead will export polymer-grade propylene as necessary to maintain a balanced market at the US Gulf Coast.

Polyethylene

According to US International Trade Commission (ITC) statistics, US exports of polyethylene (high-density polyethylene, low-density polyethylene, and linear low-density polyethylene) during 2010-14 were relatively constant at 18-20 million lb/day, 45-50% of which moved to Canada and Mexico. US polyethylene exports remained within this range during first-half 2015 before rising to 20-25 million lb/day in second-half 2015 and 24-27 million lb/day for most of first-half 2016, averaging 25.3 million lb/day January-May. Exports in first-half 2016 were up 2.3 million lb/day (10%) from second-half 2015.

In January-May, combined polyethylene exports to Canada and Mexico averaged 11.5 million lb/day but accounted for only 41% of total exports.

As Petral Consulting previously forecast, destinations other than Canada and Mexico have become important outlets for US polyethylene exports. In first-half 2016, exports to rest-of-world (ROW) destinations averaged 15 million lb/day, 2.3 million lb/day (18%) up from second-half 2015. Northeast Asia and Northwest Europe were important destinations for these increased ROW shipments.

Propylene, polypropylene

ITC statistics show US exports of propylene monomer were 2.1 million lb/day in 2007 but declined steadily 2008-14 to only 0.6 million lb/day in 2014 and 0.3 million lb/day in first-quarter 2015.

Propylene exports emerged as an important balancing mechanism for the US Gulf Coast market. During the balance of 2015, propylene monomer exports averaged 2.1 million lb/day, 1.1 million lb/day (384 million lb) up from 2014. If exports had remained at 2014 levels, inventory in second-half 2015 would have increased to more than 900 million lb on January 1 and would have continued to increase in first-half 2016.

In January-May 2016, exports of propylene monomer were 2.0-2.4 million lb/day, up 221 million lb from the same period in 2015.

ITC statistics show 2014-15 US exports of polypropylene averaged 5.9 million lb/day. Similar to the geographic disposition of US polyethylene exports, Mexico and Canada were the primary destinations for these shipments.

US polypropylene exports to all destinations averaged 5.80-5.85 million lb/day in second-half 2015 before falling to 4.96 million lb/day in first-quarter 2016. Exports to Mexico and Canada decreased to 4.13 million lb/day, accounting for about 83% of total exports during the period.

Second-half 2016

The outlook for ethylene during second-half 2016 depends on trends in production costs and demand for derivatives. Additionally, production always depends on downtime for turnarounds and unplanned maintenance problems.

Three of five ethylene plants (with a combined capacity of about 7 billion lb/year, or 19 million lb/day) that were offline in April and May for planned maintenance returned to service by end-June and early July. While maintenance at two of the plants has carried over, work likely is to be completed and the plants back in operation by end-September.

One or two plants are likely to shut down for planned maintenance in third-quarter 2016 but total capacity offine will be less than in May, which was the peak month for planned maintenance in second-quarter 2016. Petral Consulting expects US ethylene production will rebound in second-half 2016 to average 158-162 million lb/day in the third quarter and 162-166 million lb/day in the final quarter.

The economic outlook for ethylene is a function of feedstock and coproduct prices, with trends in crude oil prices determining price trends for both feedstock and coproducts. After a brief rally in May-June, crude prices fell $3-5/bbl in July and will likely remain weak. Prices for Dated Brent and WTI should average $40-45/bbl in second-half 2016 vs. $46-51/bbl in May and June.

Ethane prices, however, are likely to be weaker in third-quarter 2016 compared with the previous quarter. Ethane inventory in US Gulf Coast storage increased for 6 consecutive months (November 2015-April 2016) to reach 33 million bbl on May 1 (8.3 million bbl up from November 1 and nearly 10 million bbl above the historic inventory midrange). Unless purity ethane prices fall to 15-16¢/gal in third-quarter 2016, inventory probably will continue to increase. If ethane prices are consistently 15-16¢/gal in the third quarter, profit margins for most ethylene producers will be 2-3¢/lb more than if ethane prices hold steady at 18-20¢/gal.

In sharp contrast, propane-inventory build rates in US Gulf Coast storage during second-quarter 2016 remained consistently less than the 3-yr average. Prices rallied to 48-51¢/gal in the second quarter alongside a 12-13¢/lb rise in production costs. Propane prices in Mont Belvieu are likely to hold steady at 48-50¢/gal unless waterborne exports from US Gulf Coast terminals fall sharply in third-quarter 2016.

Prices for natural gasoline and refinery-sourced light naphtha of similar quality will average 95-100¢/gal in second-half 2016, 40-45¢/gal below spot prices for unleaded regular gasoline in the Gulf Coast pipeline market during the third quarter and 30-35¢/gal less in the fourth quarter.

Spot prices for ethylene in second-half 2016 will average 24-28¢/lb. Prices in this range provide break-even margins based on production costs for natural gasoline and light naphtha feeds.

The outlook for propylene is based on a rebound in coproduct supply as ethylene production rates rebound in second-half 2016. Refinery-grade propylene supply will remain near its seasonal peak in third-quarter 2016 but production in the fourth quarter likely will decline by 2 million lb/day. Production from PDH plants will remain an unpredictable variable. As long as exports of propylene monomer remain steady, or increase as necessary to maintain the supply-demand balance, propylene prices will remain within the ranges established during first-half 2016.

Feedstock prices, coproduct values, and ethylene plant yields determine ethylene production costs. Petral Consulting maintains direct contact with the olefin industry and tracks historic trends in spot prices for ethylene and propylene. We use a variety of sources to track trends in feedstock prices. Some ethylene plants have the necessary process units to convert all coproducts to purity streams. Some ethylene plants, however, do not have the capability to upgrade mixed or crude streams of various coproducts and sell some or all their coproducts at discounted prices. We evaluate ethylene production costs in this article based on all coproducts valued at spot prices.

The author

Daniel L. Lippe ([email protected]) is president of Petral Consulting Co., which he founded in 1988. He has expertise in economic analysis of a broad spectrum of petroleum products including crude oil and refined products, natural gas, natural gas liquids, other ethylene feedstocks, and primary petrochemicals.

Lippe began his professional career in 1974 with Diamond Shamrock Chemical Co., moved into professional consulting in 1979, and has served petroleum, midstream, and petrochemical industry clients since. He holds a BS (1974) in chemical engineering from Texas A&M University and an MBA (1981) from Houston Baptist University. He is an active member of the Gas Processors Suppliers Association.