OGJ Newsletter

Pemex seeks larger budget to offset exchange rate

Mexico’s state-owned Petroleos Mexicanos (Pemex) is negotiating with the government to increase its exploration budget by 20 billion pesos ($1.53 billion) due to the 30% decline of the peso against the US dollar.

“Pemex has an important part of its expenses in dollars—the exchange rate slide that we have seen means that our original budget has distortions,” said Pemex exploration director Carlos Morales Gil.

The requested funds would account for about 20% of Pemex’s exploration budget, said Morales Gil, who expressed optimism the government would grant the additional funds, which he considers essential for the company.

Morales Gil, who noted Pemex’s initial 2009 spending plan projected an exchange rate level of 11.7 pesos per dollar compared with the current 13.1 pesos per dollar, said the state firm is working with the ministry of finance to clarify the situation.

“We believe we are going to manage this in the next few weeks or days even, so we can have a budget set to the exchange rate that is going to be in effect all year,” he said.

Meanwhile he said Pemex estimates Mexico has 53 billion bbl of potential reserves, most of it offshore in the Gulf of Mexico. “That’s where 80% of what we have to look for is. We clearly know where we have to do it,” said Morales Gil.

“These discoveries [in the gulf] were made at a time when we need to replace reserves and try to sustain the level of production,” he said, noting that production in January-April 2009 was 2.66 million b/d or 6.89% lower than in the same period last year.

Nonetheless, he said Pemex this year expects to add 1.05 billion bbl to its reserves, which total more than 14 billion bbl of crude. Last year, he said, the state firm added 1.4 billion bbl to its reserves.

In May, Pemex inaugurated its new board of directors, adding four newly created positions and raising the number of its members to 15 in line with national oil policy reforms enacted last year (OGJ Online, May 19, 2009).

Arkansas high court allows oil, gas lawsuit

The Arkansas Supreme Court agreed that legal questions exist regarding what authority state environmental regulators have over activities associated with oil and gas drilling in the Fayetteville shale.

The state’s high court on May 21 rejected a request by the Arkansas Department of Environmental Quality to throw out a lawsuit that a plaintiffs’ group of Arkansas producers filed against ADEQ in Union County, Ark.

The lawsuit is an attempt to stop ADEQ from issuing two types of general permits. Oil producers claim the Arkansas Oil & Gas Commission and the Arkansas Pollution Control & Ecology Commission have regulatory authority over oil and gas activities.

The general permits involve construction of pits at drillsites and for disposal of wastewater from drilling. Supreme Court Justice Robert L. Brown said it remains unclear whether the ADEQ went beyond its powers.

“Whether [those suing] will prevail on this claim remains to be seen,” Brown said. “In any case, it is clear to this court that the issue of ADEQ’s legal authority to act as it did needs further development before the circuit courts.”

No future hearing dates have been set in Union County Circuit court, an ADEQ spokesman told OGJ. The circuit court previously rejected ADEQ’s request to throw out the lawsuit.

Arkansas Gov. Mike Beebe has said he wants ADEQ to monitor drilling in the Fayetteville shale. A spokesman for the governor’s office said it’s too early to tell what effect the lawsuit might have on ADEQ.

Massachusetts approves offshore wind farm

A Massachusetts state agency granted the state and local permits needed for Cape Wind Associates LLC to construct a wind farm off Massachusetts in Nantucket Sound.

The Massachusetts Energy Facilities Siting Board on May 21 voted 7-0 to grant Cape Wind a certificate of environmental impact and public interest that combines all state and local permits.

Cape Wind Pres. Jim Gordon of Boston said the vote ends a 7-year state regulatory review of the project, which still needs federal authorization to proceed. The $1 billion project involves 130 wind turbines over 24 sq miles in Nantucket Sound within sight of Cape Cod residences.

The project awaits final approval by US Interior Secretary Ken Salazar. The Interior Department has issued guidelines for leasing offshore areas for renewable energy production, opening the door for wind farms.

The US Minerals Management Service issued Cape Wind a favorable final environmental impact statement in January.

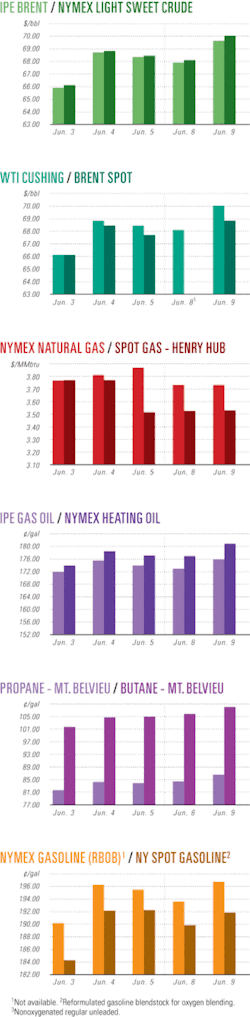

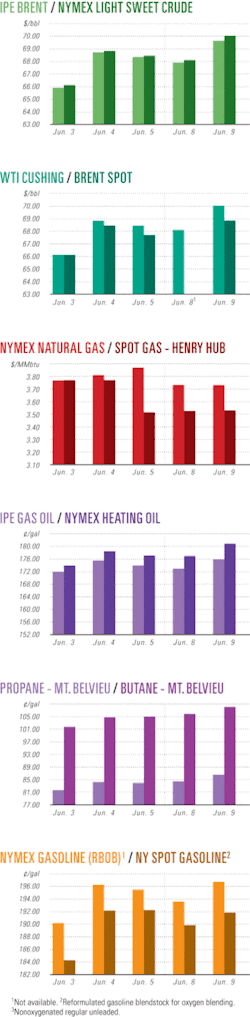

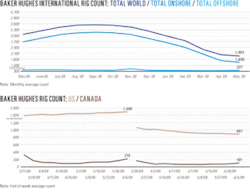

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesBP group has deepwater find off Angola

A group led by BP PLC reported a discovery at Oberon, the 30th discovery on Blocks 31 and 32 off Angola, capable of flowing more than 5,000 b/d of oil.

The well, drilled to 12,300 ft measured depth in 5,300 ft of water 250 miles offshore on Block 31, cut oil-bearing reservoirs in the Oligocene section. It is less than 3 miles northeast of the Dione discovery announced in October 2008.

First production from the group’s PSVM development is targeted in 2012.

BP Exploration (Angola) Ltd. is operator with 26.67% interest. Esso Exploration & Production Angola (Block 31) Ltd. has 25%, Angola’s state Sonangol P&P 20%, Statoil Angola AS 13.33%, Marathon Oil Corp. 10%, and Total’s TEPA (Block 31) Ltd. 5%.

Talisman makes oil discovery in North Sea

Talisman Energy Norge AS plans to drill an appraisal well to determine the size of its oil discovery in the Norwegian North Sea.

On test, wildcat well 15/12-21 flowed an average of 197 cu m/day of gas through a 20/64-in. choke. The well found a 133-m column in Middle Jurassic and Upper Triassic reservoir rocks and is 16 km north of Varg field and 15 km south of Sleipner Ost field.

Extensive data collection and sampling have also been carried out. “The size of the discovery has not yet been clarified because the oil-water contact was not proven,” said Talisman. If profitable resources are proven, the discovery could be tied in to the Varg field.

Talisman drilled the well to a TVD of 3,268 m below the sea surface using the Maersk Guardian drilling rig and it ended in the Skagerrak formation in the Upper Triassic. The well was drilled in 86 m of water.

The discovery is on production license 038, which was awarded in the third licensing round in 1975.

Maersk Guardian will now drill appraisal well 15/12-21 A on the production license.

Prince Edward Island exploration planned

Ardent Resources Canada Ltd., private Pittsburgh operator, will drill two exploration wells on Canada’s Prince Edward Island under an agreement with PetroWorth Resources Inc., Calgary.

By drilling two wells on the eastern part of the island, Ardent Canada will earn a 50% interest in six permits that cover 444,000 acres. The first well is to be drilled by yearend, and the second is due within 6 months after completion of the first.

Ardent, owned by Christopher Robinson and David Copley, operates in Pennsylvania, New York, West Virginia, and Ohio and holds interests in more than 300 wells. The principals also have a good grasp of the geology of the Maritimes basin and its many similarities to that of the Appalachian basin.

PetroWorth shot 304 line-km 2D and 108 sq km of 3D seismic on the lands. In recent months, some of this data underwent a new leading-edge method of interpretation that resulted in the identification of a potentially large natural gas anomaly on one of the PetroWorth licenses.

Vegas group tests oil in new Egyptian strike

Vegas Oil & Gas SA tested an average of 2,809 b/d of oil from two pay zones in the Geyad-1X exploration well in Egypt. The company is completing the well as a potential producer.

The well produced 40° gravity oil with 3.04 MMscfd of gas on sustained tests of Miocene Kareem sandstones through a 1-in. choke.

“The lower pay zone in the Kareem Rahmi formation is a net 19 ft thick. The lower Kareem Rahmi formation zone has been tested at a sustained rate of 1,174 b/d and 1.324 MMscfd,” said Circle Oil, a partner in the well.

The upper pay zone in the Kareem Shagar formation is a net 10 ft thick but was not tested separately.

The onshore well is on the 400-sq-km North West Gemsa concession, 300 km southeast of Cairo in the Gulf of Suez basin.

The rig, Mubarak-1, will be moved to drill the SE-3 appraisal well in Al Amir oil field on the same concession, where Vegas began production earlier this year (OGJ Online, Mar. 2, 2009).

The concession agreement includes the right of conversion to a production license of 20 years, plus extensions, in the event of commercial discoveries.

Partners are Vegas Oil & Gas, 50%, Circle Oil PLC, 40%, and Premier Oil PLC, 10%.

Drilling & Production Quick TakesCollaboration needed for N. Sea decommissioning

Operators in the southern UK North Sea must find quick and cost effective means to decommission oil production facilities, according to trade association Oil & Gas UK.

Decommissioning more than 300 platforms, 13,000 km of pipeline, and 800 wells in the UK and Dutch sector of the southern North Sea offers the potential for new technical solutions. Projects are already under way in the area.

Paul Dymond, OGUK’s operations and supply chain director, expects to see a critical mass of decommissioning activity within the next 5 years. Collaboration between asset owners and effective communication with the supply chain is important to underpin smarter and more cost effective decommissioning, he said at a decommissioning conference in Newcastle, UK.

Gunther Newcombe, head of decommissioning at BP PLC, recommended that contracting strategies, simplification, and the transfer of best practice from the Gulf of Mexico would stimulate industry to innovate and drive costs down.

Win Thornton, Chevron Corp.’s manager of international decommissioning, added that a steady stream of projects over 2 decades in the Gulf of Mexico had created a well-developed market for decommissioning. But managing the process is difficult as operators must handle the work breakdown structure, onshore disposal and management, and different contracting strategies.

Protestors force output slow-down in Amazon

Pluspetrol Norte has reduced production at one of two oil blocks in Peru and state energy company Petroperu may have to halt work at its Iquitos refinery in the Amazon due to protests by indigenous people.

“The position in respect to our operations has worsened since we last released information on May 19,” Pluspetrol Norte said.

“We have had to reduce our production due to a lack of storage space, and due to the ongoing situation in which we can’t transport petroleum on the North Peruvian pipeline,” said the company, which produced about 32,000 b/d from the two fields in March: 16,099 b/d from Block 1-AB and 15,511 b/d from Block 8.

“Due to the reduction in production we have been obliged to temporarily suspend the presence of our workers, suppliers, and contract workers in the oil fields,” the company added.

Pluspetrol Norte also warned that continuation of the protests could eventually affect the normal supply of oil to the government-run refinery in Iquitos.

Blocks 1AB and 8 lie in northern Peru, where indigenous communities have been protesting against a series of nine new investment decreed by the government, saying the decrees will lead to a private-sector takeover of their lands, along with their underlying mineral rights.

In addition to the oil pipeline, the 65-member tribes of the Peruvian Jungle Interethnic Development Association have blocked highways and waterways across six jungle provinces since early April.

Apart from seeking repeal of the nine decrees, the tribes also want the government to revise oil concessions in the Amazon jungle and establish reserves for so-called “uncontacted” tribes that live there in voluntary isolation.

Peru President Alan Garcia, who earlier this month declared a state of emergency and suspended some constitutional rights in the four provinces most affected, said his government’s nine decrees are nonnegotiable. “The lands of the Amazon belong to the entire nation, not to the small group that lives there,” Garcia said.

Jackson’s visit includes look at Jonah gas field

US Environmental Protection Agency Administrator Lisa P. Jackson completed a 2-day tour of Wyoming on May 21 that included a stop at the state’s largest developed unconventional natural gas field.

The federal official also toured a wind farm near Cheyenne and a coal mine near Gillette and flew over a number of coalbed methane developments. Wyoming is currently the nation’s largest net exporter of energy, the EPA noted.

Jackson visited Wyoming at the invitation of Gov. Dave Freudenthal (D). “I appreciate her willingness to take the time to visit our state and see on the ground how coal, natural gas, and wind power are produced here,” he said as the visit concluded.

“This was an important opportunity for us to discuss issues including carbon sequestration, the management of water produced in coalbed methane development, and the technologies used to recover natural gas in unconventional fields in Wyoming,” Freudenthal added.

Jackson stopped at the Jonah field, which contains an estimated 10.5 tcf of tight sand gas, on the second day of her visit. “Wyoming is a place where economic possibilities, environmental and human health concerns, and the pursuit of energy independence all come together.

“As a home of wind, coal, and natural gas, Wyoming is at the heart of America’s energy future,” she said before returning to Washington.

Processing Quick TakesIran to help Uganda construct refinery

Uganda President Yoweri Museveni, siding with officials of his government against plans by international oil companies, said his country will build a domestic refinery with Iranian assistance.

“We are more inclined to building a refinery than exporting unprocessed crude oil,” he said, coming down against Tullow Oil and its partner Heritage Oil, which prefer construction of an oil pipeline from their fields in Uganda to the Kenyan port of Mombasa to export crude.

Iran and Uganda reached an agreement concerning the refinery project, as well as other oil and gas developments, during a 3-day visit by Museveni to Tehran, where he held talks with Iran’s President Mahmoud Ahmadinejad.

A communique issued at the end of Museveni’s visit said Iran had signed a cooperation agreement that included funding for the entire “value chain” of Uganda’s oil production.

“Regarding the field of energy in particular, the two leaders agreed to consider cooperation in building an oil refinery in Uganda,” the communique said, adding, “Iran also expressed its readiness to invest in the entire value chain of Uganda’s petroleum industry.”

Ugandan officials have long disagreed with the views of Tullow and its partner Heritage Oil over the need to construct an oil refinery versus an export pipeline.

“Our objective is to process the oil. We don’t want to export it. Our aim is to get an economic return, to get jobs (and) investment. We don’t want anything raw to get out,” said Uganda’s energy minister Hillary Onek at the recent East African Petroleum Conference in Mombasa.

But Heritage vice-president for exploration and production, Brian Smith, demurred on the idea of a full-scale refinery for Uganda, saying that estimated production was not high enough to justify the 100,000 b/d, $1.3 billion plant the Ugandans were reported to be considering (OGJ, Mar. 16, 2009, p. 40).

Gassco briefly closed Kollsnes gas plant

Gassco AS briefly shut its 143 MMscmd Kollsnes gas processing plant on the Norwegian North Sea coast because of a condensate leak.

The production disruption temporarily increased British gas prices. No personnel were injured during the incident.

“The point of leakage has been identified, and preparations for repair work have started,” said StatoilHydro, which provides technical services to the plant. A company spokeswoman told OGJ that the cause of the leak remained unknown.

StatoilHydro is providing gas from other sources for its customers while repairs are under way.

The processing plant at Kollsnes, west of Bergen, treats gas from Troll, Kvitebjorn, and Visund fields. Installation of a sixth export compressor in 2005 expanded the plant’s capacity from the original 120 MMscmd.

New resid FCC unit in Taiwan due CO boiler

CTCI Corp., Taipei, has let a contract to subsidiaries of Foster Wheeler AG for supply of a carbon monoxide boiler for a new 80,000-b/d residual FCC unit at CPC Corp.’s Talin refinery in Kaohsiung, Taiwan.

CTCI is the engineering, procurement, and construction contractor for the resid FCC unit. The 300,000-b/d Talin refinery is near to but independent from CPC’s 220,000-b/d Kaohsiung refinery and petrochemical complex.

Foster Wheeler will provide an incinerator to destroy CO in the RFCC waste-gas stream, a boiler section to recover heat from the resulting flue gas, and a selective catalytic reduction flue-gas treating system to reduce emissions of nitrogen oxides.

Transportation Quick TakesAbu Dhabi crude export pipeline progresses

Germanischer Lloyd (GL) announced it will provide technical assurance and certification of the 400-km, 48-in. OD Abu Dhabi Crude Oil Pipeline (ADCOP). The line will transport 1-1.5 million b/d of oil to the main oil terminal (MOT) at Fujairah, UAE, from Habshan, Abu Dhabi, bypassing the Straits of Hormuz in the process. The 1.5 million b/d figure represents roughly 60% of the UAE’s crude exports.

ADCOP also includes construction of 12 million bbl of storage at MOT, three subsea pipelines, a main pumping station, intermediate pump station, and three single-point mooring buoys for deepwater tanker loading at Fujairah on the Indian Ocean coast. Construction is scheduled to be completed in August 2011.

GL’s services on the project include third-party inspection both during and after construction, nondestructive testing, and issuing a certificate of compliance for the entire project. China Petroleum Engineering & Construction Corp. (CPECC), ADCOP’s main engineering, procurement, and construction contractor, awarded the technical assurance, risk and safety, asset management, and industrial inspection contract to GL.

CPECC awarded detailed engineering on ADCOP to Penspen in 2008.

Pakistan, Iran sign gas pipeline agreements

Pakistan President Asif Ali Zardari and Iran President Mahmood Ahmadinejad signed an intergovernmental declaration May 24 to support within the framework of their respective laws and regulations the gas deal between the oil ministries of both countries.

Zardari is in Tehran for a three-way summit with Ahmadinejad and Afghanistan President Hamid Karzai.

A gas sale purchase agreement was signed earlier by managing directors of the National Iranian Oil Co. and the Pakistan Interstate Gas System, set up by the Pakistan government for the project.

The 2,100-km pipeline is to transfer Iranian gas to Pakistan. About 1,100 km of pipeline would be laid in Iran and 1,000 km in Pakistan. The project is to transfer about 750 MMcfd of gas. Construction of the pipeline is to be completed in 5 years.

Pakistan and Iran will sign the formal agreement for the multibillion dollar gas pipeline project in a third country within the next 15 days, according to Asim Hussain, top energy adviser to Islamabad, capital of Pakistan, and Pakistan leader on the pipeline project.

UPI wire service reported Iran and Pakistan are set to sign formal agreements on the Iran-Pakistan-India pipeline by June. In that deal, it said, Pakistan would take 2.6 bcfd from Iran’s South Pars gas field over the next 25 years.

Second Chinese LNG terminal begins operations

China National Offshore Oil Corp. received the first LNG commercial cargo at its Fujian terminal earlier this month.

Unconfirmed reports said the cargo arrived aboard the 145,700-cu m Tangguh Towuti from Indonesia’s Bontang liquefaction plant. BP’s Tangguh project is contracted to deliver cargoes to Fujian but its opening has been repeatedly delayed. Fujian is to receive 2.6 million tonnes/year from Tangguh once the plant is operating.

Fujian is China’s second terminal to begin operating. BP has operated the 6.2 million tpy Dapeng LNG terminal in neighboring Guangdong Province since 2006. The Fujian terminal was commissioned last year.

Later in 2009, CNOOC expects to open a third terminal, at Shanghai, that initially will be able to import 3 million tpy with expansion of another 3 million tpy on tap.

PNG signs landholder deal for LNG project

The government of Papua New Guinea has signed a benefits-sharing agreement with landowners concerning the ExxonMobil Corp.-led Papua New Guinea LNG (PNG LNG) project.

The agreement is worth about 20 billion kina, or about $9.5 million (Aus.), over the life of the project and gives provincial governments and landholders a 7% stake in PNG LNG. The central government will retain 12.5% interest.

The government has also committed to a number of infrastructure projects, including the construction of a sealed major highway linking the Gulf of Papua to the country’s north coast. It will also seal the Gulf-Southern Highlands highway and put 100 million kina towards building the first phase of a Hela city development.

Meanwhile, it was reported that China’ Sinopec is negotiating to buy 2 million tonnes/year of LNG from the project.

The project comprises a two-train, 6.3 million tpy liquefaction plant near Port Moresby with gas sourced from various gas fields in the highlands including Hides and possibly Juha.

ExxonMobil has 41.6% and operatorship of the project, Oil Search 34.1%, Santos 17.7%, and Nippon Oil 5.4%. Landholder interests hold the remaining 1.2%.

Papua New Guinea’s state-owned Independent Public Business Corp. is using its 17.56% stake in Oil Search to raise $1.68 billion to fund the government’s 19.4% share of the project which will then reduce the interests pro rata held by the other partners.