OGJ Newsletter

GENERAL INTEREST — Quick Takes

Alberta adds incentives to royalty reform

The government of Alberta has added incentives for enhanced recovery and "emerging resources" to its oil and gas royalty reforms (OGJ Online, Apr. 22, 2016).

The enhanced recovery program sets a flat royalty of 5% on crude oil, natural gas, and natural gas liquids produced by tertiary or secondary recovery for periods, to be set case by case, up to 90 months. After that, normal rates under the new royalty framework apply.

Determination of benefit periods and other program details will differ for tertiary and secondary-recovery projects.

Projects must receive approval from the Alberta Energy Regulator on or after Jan. 1, 2017; involve injection of materials approved by the energy minister; produce more hydrocarbons from a reservoir than could be produced via base recovery; demonstrate that costs are "significantly greater" than those of base-recovery operation; and provide a net royalty benefit to the government over the life of the project.

To qualify for the incentive, projects involving water and gas injection must be in reservoirs not previously subjected to those methods.

The emerging-resources incentive is designed to encourage producers "to open up new oil and gas resources in higher-risk and higher-cost areas that have large resource potential."

Wells receiving benefits under the program will be subject to a royalty rate of 5% until their combined revenue equals combined cost allowances, to be set well by well.

In an approved project, no more than the first 15% of the total projected well inventory can receive benefits.

Time limits will apply.

To receive benefits, a project must be "in the public interest," according to the energy minister, and promise large potential, be early in development, show strong likelihood of commerciality, and provide a net royalty benefit to the government.

Cowen: E&P spending fall revised downward

Following Barclays' downward revisions to its 2016 global and regional exploration and production spending outlook, another investment bank, Cowen & Co., revised lower its E&P spending forecasts last published in January (OGJ Online, Mar. 18, 2016).

In its midyear E&P spending update, Cowen now estimates global expenditures to fall 24% compared with a 16% decline in its January survey. The downward revisions were primarily driven by larger spending cuts from North America-focused E&Ps and major international oil companies (IOC).

In this update, Cowen expects US spending to decline 45%, reflecting oil prices of $40/bbl and natural gas prices of $2.50/MMbtu. This was down from a 22% estimate at the time of January's survey, which was based on $48.5/bbl oil and $2.50/MMbtu gas. Canada spending is expected to fall 33% compared with an earlier estimate of an 18% falloff.

Survey of international spending reveals a 19% decline compared with an initial estimate of 14% in January. The Middle East remains an area of stability while the largest negative revisions come from large IOCs, Latin America, and the Asia Pacific region, excluding China. Latin America is still the weakest region, where spending is expected to decline 30%.

IOCs and independents are projected to have spending declines of 24% this year, while other independents are expected to spend 45% less. This compares with prior decline estimates of 10% and 17%, respectively.

Assuming oil and gas future prices of $50/bbl and $3/MMbtu in 2017, Cowen expects an increase in global spending next year, mainly driven by North America, while international spending will likely remain depressed due to slower recovery in offshore activity and large participants, namely the Middle East and Russia, with little change to budgets over the 2015-18 timeframe.

Harvest in new deal for Venezuelan assets

Harvest Natural Resources Inc. has reached an agreement to sell its Venezuelan interests and continues to seek a buyer for its remaining exploration and production holdings, which are in Gabon (OGJ Online, Mar. 30, 2015).

The company and a wholly owned subsidiary, HNR Energia BV, have entered a complex agreement with private investment firm CT Energy Holding SRL for the transfer of Harvest's Venezuelan properties, held through equity affiliate Petrodelta SA.

Petrodelta produces about 43,000 b/d of oil from six fields in eastern Venezuela.

The new deal settles obligations Harvest incurred in a deal with CT Energy last June that provided funding needed to sustain Petrodelta's operations and made CT Energy a 16.8% shareholder of Harvest.

At closing, CT Energy will deliver to Harvest $80 million in cash and a 6-month note for $12 million. It will cancel $30 million in debt and surrender its Harvest stock, recently worth $4.247 million, and warrants Harvest carries as a liability of 9.564 million.

CT Energy will receive 51% interest in Harvest-Vinccler Dutch Holding BV, through which HNR Energia owns the Venezuelan interests.

Harvest has tried to sell its Venezuelan interest in the past and briefly sought international arbitration last year, saying resistance by the government impeded transactions and contributed to its liquidity problems. At the time, it said it was exploring restructuring options.

In Gabon, Harvest holds 66.667% operated interest in a production sharing contract covering a 680,000-acre offshore block.

If it doesn't find a buyer, the company said, it will "operate and develop those assets in the ordinary course of business."

Exploration & Development — Quick Takes

GeoPark logs Jacana discovery in Colombia

The Jacana 3 appraisal well drilled by GeoPark Ltd. on Colombia's Llanos 34 block flowed 1,650 b/d of 15° gravity oil with 1% water cut through a 43/64-in. choke at 50 psi wellhead pressure during a 7-day test. The well was drilled to 11,008 ft TD and produces from the Cretaceous Guadalupe formation. GeoPark said further production history will determine the stabilized flow rate of the well.

The Jacana 3 was spudded in mid-June (OGJ Online, June 15, 2016). Jacana oil field was opened with Jacana 1, which flowed 1,880 b/d of 14.9° gravity oil with a water cut of 1.9% in September 2015 (OGJ Online, Sept. 2, 2015). The field is currently producing 5,700 b/d of oil from two wells, the company said. Jacana field lies southwest of large Tigana oil field on Llanos 34 block onshore Colombia. The block was erroneously reported as offshore in a previous story.

GeoPark has plans to drill six wells on the block this year, two of which will be exploration wells. The operator holds 45% operating interest in the 82,000-acre Llanos 34 block.

North Sea Brasse sidetrack finds 25-m oil column

The Faroe Petroleum PLC-operated Brasse sidetrack well (31/7-1A) reached a TD of 2,530 m, encountering a 25-m gross oil column and 6-m gross gas column at the Brasse discovery on license PL740 in the Norwegian North Sea.

The objective of the sidetrack was to appraise the southeastern portion of the hydrocarbon-bearing structure previously identified by the main discovery well (OGJ Online, June 16, 2016).

Results based on extensive coring, wireline logging, and sampling show that the well has encountered oil and gas in good quality Jurassic reservoir sandstones, similar to those in the main well, and provide important information about the reservoir distribution in Brasse, the firm says.

The hydrocarbon-bearing interval in the well was found to be at a similar pressure level to the hydrocarbon-bearing interval in the initial discovery well. Total gross volumes of recoverable hydrocarbons are estimated at 28-54 million bbl of oil and 89-158 bcf of gas.

The Brasse discovery is 13 km south of the Brage field platform in which the company holds 14.3% working interest, 13 km to the east of the Oseberg Sor field platform, and 13 km to the southeast of the Oseberg field platform.

Faroe and 50-50 partner Point Resources AS will now begin assessing options for the discovery.

Idemitsu takes development step off Vietnam

Idemitsu Oil & Gas Co. Ltd. has moved toward development of oil and gas discoveries on two blocks offshore Vietnam with the award of a preliminary contract to Aker Solutions (OGJ Online, June 7, 2013).

Aker will provide front-end engineering design for possible developments designated Sao Vang and Dai Nguyet on Blocks 05-1b and 05-1c about 350 km southeast of Ho Chi Minh City.

Idemitsu will use the FEED work to make an investment decision about development. The blocks are in the Nam Con Son basin, which is productive at Dai Hung and Lan Tay/Lan Do natural gas fields.

Idemitsu and partners drilled the first exploratory well on the blocks in 2007 under a production-sharing contract with Vietnam Oil & Gas Group (Petrovietnam).

After shooting additional seismic surveys, the group confirmed an oil and gas accumulation with a well drilled in 2010 and made further discoveries with two wells drilled in 2012 and 2014.

Idemitsu is operator with 35% interest. JX Nippon Oil & Gas Exploration Corp. holds 35%, and Teikoku Oil (Con Son) Co. holds 30%.

Drilling & Production — Quick Takes

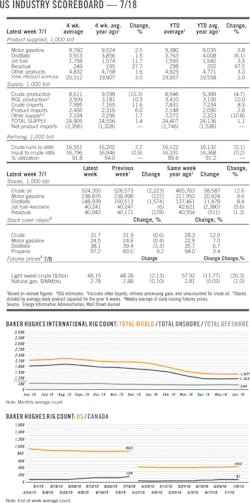

BHI: Global rig count up 2 in June

The worldwide rig count for June averaged 1,407 active units, up 2 month-over-month and down 729 year-over-year, according to Baker Hughes Inc. data. Outside North America, however, drilling activity continued to decline in every region following a May in which all but one region's count increased (OGJ Online, June 10, 2016).

Latin America-that one region-led the way in June with a 10-unit drop 178 rigs working, a year-over-year decline of 136 compared with the region's June 2015 average. Argentina lost 8 units to 63, down 42 year-over-year. Venezuela fell 7 units to 53, down 13 year-over-year. Mexico dropped 2 units to 20, down 31 year-over-year.

The Asia-Pacific region, which jumped 11 units in May, fell 8 units in June to 182, down 33 year-over-year. Indonesia and Thailand each dropped 3 units month-over-month and 7 units year-over-year to respective averages of 16 and 12. Australia also relinquished 3 active rigs, averaging 3, down 12 year-over-year. Offshore China fell 2 units to 29, up 5 year-over-year.

Partially offsetting those losses in Asia-Pacific was India, which jumped 6 units to 108, a 5-unit year-over-year decline.

Europe dropped 4 units to 91, down 22 year-over-year. The only region to record multiple-unit losses was Sakhalin. The large island off eastern mainland Russia decreased 2 units to 8, down 2 from its year-ago average.

Africa also dropped 4 units, settling at an average of 87, down 16 year-over-year. Algeria posted the only multiple-rig loss, falling 2 units to 53, up 2 year-over-year.

The Middle East decreased 2 units to 389, down 12 from the region's June 2015 average. Oman dropped 3 units to 66, down 5 year-over-year. Iraq lost 2 units to 41, down 12 year-over-year. Egypt also decreased 2 units, down 15 year-over-year. Meanwhile, Pakistan rose 3 units to 30, up 13 year-over-year. Saudi Arabia edged up a unit to 124, up 3 from its year-ago average.

Seven Generations to expand Montney acreage

The planned acquisition of "bolt-on" acreage in the Lower Triassic Montney resource play of British Columbia from Paramount Resources Ltd. will enable Seven Generations Energy Ltd. to increase well lengths in an expanded drilling program, the buyer said.

Seven Generations, Grande Prairie, Alta., agreed to buy 99,200 net acres of Montney land from Paramount, Calgary, in a deal worth about $1.9 billion (Can.). The consideration includes $475 million cash, 33.5 million shares of Seven Generations stock, and assumption of $584 million of Paramount's debt.

The acquired land produces about 30,000 boe/d of gas and liquids and holds proved reserves of 199 million boe. When the deal is complete, Seven Generations will hold 517,300 net acres in the Montney area. The acquisition will add 205 proved, undeveloped drilling locations to the 305 Seven Generations reports now and enable the company to expand its liquids-rich Kakwa River Project in a play it calls Nest.

"We now plan to drill longer wells in the Upper and Middle Montney formation," said Marty Proctor, Seven Generation president and chief operating officer. "In addition, we expect to add significant potential resource in shallower and deeper formations across our expanded lands."

The acquisition will add 245 MMcfd of gas processing capacity to the 510 MMcfd of capacity Seven Generations already has and increase its pipeline takeaway capacity to 847 MMcfd from 607 MMcfd.

Output begins from FPSO at Lula Central off Brazil

Petroleo Brasilierio SA (Petrobras) started oil and gas production on July 7 from the Cidade de Saquarema floating production, storage, and offloading unit as part of the Lula Central project in the presalt Santos basin.

Production well 8-LL-81D-RJS flowed at a stabilized rate of 30,000 b/d on July 11. Anchored in 2,120 m of water, the FPSO can process as much as 150,000 b/d of oil, compress 6 million cu m/day of gas, and store as much as 1.6 million bbl of oil (OGJ Online, Dec. 22, 2015).

The Central Lula project encompasses 18 wells, split evenly between production and injection. Lula field on Block BM-S-11 is operated by Petrobras with 65% interest in partnership with Royal Dutch Shell PLC unit BG E&P Brasil Ltda. 25% and Petrogal Brasil SA 10%.

The Cidade de Saquarema FPSO is the second production system to begin operations in the presalt this year following the February startup of the Cidade de Marica FPSO from the Lula Alto area of Lula field (OGJ Online, Feb. 16, 2016).

Six FPSO vessels are currently operating in Lula field. The other four are Cidade de Angra dos Reis at the Lula field pilot, Cidade de Paraty at the Lula Northeast pilot, Cidade de Mangaratiba at the Iracema South area, and Cidade de Itaguai at the Iracema North area.

Petrobras's presalt oil and gas production recorded a monthly increase of 8% in June to 1.24 million boe/d. Oil production from the area reached 1.087 million b/d on June 30.

PROCESSING — Quick Takes

US shale gas supports Ineos UK plant expansion

Ineos AG, Rolle, Switzerland, is planning a multimillion-pound investment at subsidiary Ineos Oxide's manufacturing site at Saltend, near Hull, UK, to expand production of a specialized solvent to be made from a main feedstock of US shale gas-derived ethylene produced at Ineos' operations in Grangemouth, Scotland.

The proposed expansion will add another 100,000 tonnes/year of capacity at an individual Hull plant dedicated to production of ethyl acetate, a high-demand solvent used in pharmaceuticals, cosmetics, inks, and flexible packaging, Ineos said.

Commissioned in 2001 and purchased from BP Chemicals Ltd. in April 2008, the Hull ethyl acetate plant already is operating at its full-design capacity of 250,000 tpy, Ineos said.

The project is scheduled to be completed, with new capacity on stream, by yearend 2017.

Details regarding the precise capital investment required for the project were not disclosed.

Expansion plans for Hull are supported by Ineos' $1-billion program to import price-advantaged US shale ethane supplies into Scotland as part of its move to revive and sustain its European refining and petrochemical businesses (OGJ Online, Mar. 30, 2016).

The Hull manufacturing plant will receive ethylene shipments from Ineos' Grangemouth petrochemical plant via an existing 151-km ethylene pipeline that runs from Teesside, UK, to Saltend.

Enable Midstream commissions Oklahoma gas plant

Enable Midstream Partners LP, Oklahoma City, has fully commissioned a second cryogenic natural gas processing plant at its Bradley processing complex in Grady County, Okla.

Designed to expand gathering and processing capabilities for customers in central Oklahoma's SCOOP and STACK plays, the 200-MMcfd Bradley II plant is the company's ninth processing plant to be connected to its superheader processing system, a large-diameter pipeline system that has combined capacity to handle about 1.7 bcfd of gas production from the Anadarko basin, Enable said.

Alongside supporting growth along the superheader system, the Bradley II plant also will provide gas supply to Enable's interstate and intrastate transportation pipelines for delivery to the US Midcontinent and Southeast downstream markets, said Rod Sailor, Enable's president and chief executive officer.

A further expansion of the superheader system is to include the 200-MMcfd Wildhorse cryogenic gas processing plant in Garvin County, Okla.

Enable said it expects the Wildhorse plant to be in service sometime in late 2017.

The company previously let a contract to CB&I, Houston, to provide engineering and procurement of equipment and process modules for Bradley II, which also is equipped with CB&I's proprietary NGL-MAX gas processing technology (OGJ Online, Sept. 16, 2014).

Enable commissioned the 200-MMcfd Bradley I plant during first-quarter 2015, according the company's latest annual report.

Gas plant serves Oklahoma STACK producers

Kingfisher Midstream LLC, a venture of Houston-based Asset Risk Management LLC (ARM Energy) subsidiary ARM Midstream and HPS Investment Partners LLC, New York, has commissioned a natural gas processing plant in Lincoln, Okla., as part of the Phase-1 development of its processing-and-gathering system for producers in Oklahoma's STACK play.

Designed to help alleviate production bottlenecks in the region, the 60-MMcfd cryogenic gas processing plant entered full commercial operation in early July, ARM Energy said.

Alongside the Lincoln processing plant, Phase 1 of the system features more than 100 miles of high and low-pressure gas gathering pipeline; more than 100 miles of crude gathering lines; 50,000 bbl of crude oil storage; condensate stabilization; six crude oil truck-loading stations; and 15,000 hp of compression.

Still in the development stage, Phase 2 of the project will include an additional 200 MMcfd of gas processing capacity, incremental gas and crude-gathering capability, and expanded market connectivity.

Phase 1 of Kingfisher Midstream system's design is configured to serve STACK producers in Oklahoma's Kingfisher County, and via additional plant expansions, producers in Blaine, Logan, Garfield, and Canadian counties, according to a Sept. 8, 2015, release from ARM Energy.

Upon announcing the project, which is anchored by a long-term commitment of more than 100,000 net acres dedicated to Kingfisher Midstream, ARM Energy said it would make an initial capital investment of about $180 million.

The company has yet to disclose details regarding either costs or startup timeframes for future phases of the project.

TRANSPORTATION — Quick Takes

LNG Canada postpones FID for Kitimat project

The LNG Canada joint venture has elected to delay a final investment decision (FID) for the project to be built near Kitimat, BC, citing "global industry challenges, including capital constraints." A decision had been planned for yearend.

Andy Calitz, LNG Canada chief executive officer, said the partners are examining "a range of options to move the project forward towards a positive FID." However, they cannot confirm when a decision will be made, and in the coming weeks, will continue key site preparation activities while working together with participants, stakeholders, and First Nations to define a revised path forward to FID.

"LNG Canada remains a promising opportunity," the JV partners said. "It has strong stakeholder and First Nations' support, has achieved critical regulatory approvals, has important commercial and engineering contracts in place to design and build the project, and through its pipeline partner Coastal Gas Link, has received necessary environmental approvals and First Nations support along the pipeline right-of-way."

The LNG Canada group comprises Royal Dutch Shell PLC with 50% interest, PetroChina Co. Ltd. 20%, Mitsubishi Corp. 15%, and Korea Gas Corp. 15%.

Southern Co. buys half of SNG pipeline from KMI

Southern Co. has acquired a 50% equity interest in the Southern Natural Gas (SNG) pipeline system from Kinder Morgan Inc., which will continue to operate the system.

SNG is a 7,600-mile pipeline system connecting supply basins in Texas, Louisiana, Mississippi, Alabama, and the Gulf of Mexico to Louisiana, Mississippi, Alabama, Florida, Georgia, South Carolina, and Tennessee. SNG is a principal transporter of gas to Alabama, Georgia, and South Carolina, which are part of one of the fastest-growing gas demand regions in the US, the companies said.

The agreement also commits the companies to cooperatively pursue specific growth opportunities to develop gas systems for the venture.

Inclusive of existing SNG debt, the transaction equates to an SNG total enterprise value of about $4.15 billion, implying a value of $1.47 billion for Southern Co.'s 50% share. The companies expect to complete the transaction in this year's third quarter or early in the fourth quarter.