US chemical investments linked to affordable gas surpass $200 billion

US chemical and plastics industry investments linked to plentiful and affordable supplies of natural gas and natural gas liquids from shale formations has surpassed $200 billion, the American Chemistry Council said. “This is an exciting milestone for American chemistry and further evidence that shale gas is a powerful engine of manufacturing growth,” said ACC Pres. Cal Dooley on Sept. 11.

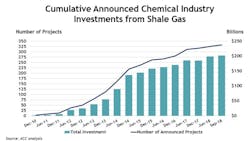

Since 2010, 333 chemical industry projects cumulatively valued at $202.4 billion have been announced, with 53% of the investment completed or under construction and 41% in the planning phase, ACC said. Fully 68% of the total is foreign direct investment or includes a foreign partner. Project types include new facilities and capacity expansions.

“The US remains the most attractive place in the world to invest in chemical manufacturing. We look forward to continuing to transform energy into a stronger economy and new jobs,” Dooley said.

ACC said that its analysis showed that $202.4 billion in capital spending could lead to $292 billion/year in new chemical and plastics industry output and support 786,000 jobs across the US economy by 2025. These include 79,000 chemical industry jobs, 352,000 positions in supplier industries, and 355,000 jobs in communities where workers spend their wages. Additional, temporary jobs could be created during the capital investment phase, it said.

Robust supplies of NGLs, especially ethane, are key to the US chemical industry’s being able to compete globally, ACC said. NGLs are the main feedstock for basic petrochemicals and plastics in the US, while companies overseas mostly use oil-based naphtha. Since feedstock comprises about 75% of the cost of ethylene production, lower prices favor US chemical manufacturers in the global market, it said.

A note of caution is in order, ACC said. “US manufacturers often rely on inputs that are not available or made [domestically] to create products that cost less yet perform at the high level our downstream customers have come to expect from us. Protectionist trade policies such as tariffs and quotas unnecessarily raise the costs of those inputs, deter innovation and economic growth, and could ultimately weaken our country’s competitive advantage,” it warned.

Contact Nick Snow at [email protected].

About the Author

Nick Snow

NICK SNOW covered oil and gas in Washington for more than 30 years. He worked in several capacities for The Oil Daily and was founding editor of Petroleum Finance Week before joining OGJ as its Washington correspondent in September 2005 and becoming its full-time Washington editor in October 2007. He retired from OGJ in January 2020.