Wet shale plays, basins power Lower 48 plant, fractionator surge

Warren R. True

Chief Technology Editor—LNG/Gas Processing

Andrew Menger

PennWell MAPSearch

The extraordinary surge in US gas processing and fractionation, in response to the country's development of shale gas plays, began to appear in 2011 capacity figures, as reflected in Oil & Gas Journal's latest plant-by-plant survey of global gas processing as of Jan. 1, 2012.

While global gas processing capacity and throughput outside the US remained flat for 2011, US capacity increased by more than 2.5 bcfd, pushing up global capacity overall by more than 3.2 bcfd. Shale production in Canada has yet to affect its gas processing capacity, but much activity is under way and planned there. This flat pattern in Canada continues from 2009 and 2010 but will likely end when final numbers for 2012 are tallied early next year.

Overall, global natural gas production in 2011, however, gained over production in 2010 (OGJ, Mar. 12, 2012, p. 31). Global production in 2011 rose by nearly 3 tcf, or 2.7%, led by the US and Africa and Middle East countries.

The US last year produced 21% of global natural gas, about even with its 20% share for 2010. US production for 2011 rose more than 7% compared with 2010; Canada's rose less than 1%.

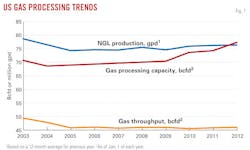

Gas processing capacity in the US in 2011 moved ahead by 3.4%, compared with a growth in 2010 of only 1.5% (Table 1). For the entire world, OGJ data show that global capacity grew by 1.2% in 2011, compared with 0.5% in 2010.

Growth in gas processing capacity in the US in 2011 helped slow a trend that has been evident since 2005: Regions outside the US and Canada have taken over the majority of processing capacity. The share of global capacity between the US and Canada had, in 2010, fallen to slightly less than 49%; for 2011, the two countries recovered to 49.3% of global capacity. And as we shall see, growth in capacity in the US will accelerate in 2012-14.

Strong natural gas production growth, especially in the Middle East and Asia-Pacific, will likely continue to about 2015, requiring even more processing capacity there.

Highlights

For 2011, NGL production in the US and Canada failed to show meaningful growth, a trend that OGJ data have shown for several years. But out to 2014-15, NGL production in the Lower 48 will grow sharply as several gas plants under construction to process wetter shale-gas come on line.

OGJ subscribers can download, free of charge, the 2012 Worldwide Gas Processing Survey tables at www.ogjonline.com: Scroll to "Surveys and Statistics." Click on OGJ Subscriber Surveys, then Worldwide Gas Processing, and choose from the list below May 7, 2012. To purchase spreadsheets of the survey data, please go to https://www.ogj.com/resourcecenter/orc_survey.cfm or email [email protected].

As a subsequent discussion here shows, the US will even find itself expanding its role in the global trade of NGLs, as liquids from several major shale plays search for markets. This trend will continue so long as worldwide crude oil prices remain high, drawing gas liquids prices with them.

But OGJ data for 2011, however, show total NGL production for both North American countries was flat, increasing by only 65,900 gpd over 108.35 million gpd for 2010 and 108.5 million gpd in 2009, retaining about 37% of global NGL production for each year, including 2008.

For 2007, however, the countries' combined production was 130.4 million gpd, or more than 44% of global NGL production. For 2006, the figure was 38.7% of world totals; for 2005, slightly more than 33%.

On Jan. 1, 2012, OGJ data show that US gas processing capacity stood at 77.4 bcfd, up from nearly 74.9 bcfd in 2010, more than 73.7 bcfd for 2009, and more than 72 bcfd for 2008.

Throughput in 2011 increased barely half a percentage point over that for 2010, averaging a bit more than 46 bcfd, up from 45.8 bcfd in 2010. 2011 utilization was nearly 60%, reflecting the slight uptick in capacity with which gas production, and therefore gas throughput, had yet to catch up. NGL production averaged nearly 76.3 million gpd, essentially flat compared with 2010 and 2009 and ahead of about 75.7 million gpd for 2008 (Table 1; Fig. 1).

On Jan. 1, 2012, gas processing capacity outside Canada and the US had grown in a year's time, to a bit more than 134 bcfd, up from more than 133 bcfd for 2010. Throughput outside Canada and the US for 2010 averaged about 80.4 bcfd, nearly identical with 2010 and 2009 and flat compared with 2008.

NGL production in 2011 outside the US and Canada fell off to about 138 million gpd from about 152 million gpd in 2010, down from 182 million gpd in 2009, which was nearly unchanged compared with 2008.

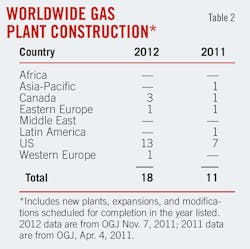

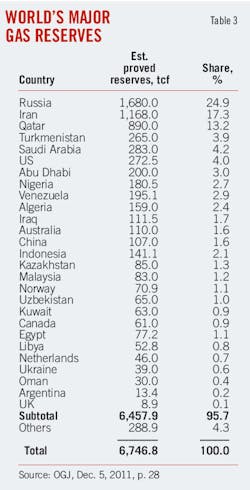

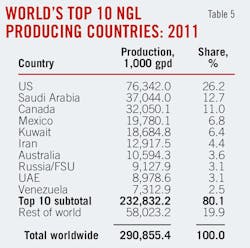

Table 2 presents a snapshot of global gas plant construction; Table 3, a review of global natural gas reserves; Table 4, a list of the world's leading gas producing countries; and Table 5, the leading NGL-producing countries.

Sources

Oil & Gas Journal's exclusive, plant-by-plant, worldwide gas processing survey and its international survey of petroleum-derived sulfur recovery provide industry activity figures.

Canadian data are based on information from Alberta's Energy and Utilities Board that reflect actual figures for gas that moved through the province's plants and are reported monthly to the EUB. For 2000 for the first time, OGJ took these data for all of Alberta and compiled annual figures and thereby created a new baseline for data comparisons thenceforth.

(Effective Jan. 1, 2008, the province realigned the EUB into two separate regulatory bodies: the Energy Resources Conservation Board to regulate the oil and gas industry and the Alberta Utilities Commission to regulate utilities.)

In addition to EUB figures for Alberta and to operators' responses to its annual survey, OGJ has supplemented its Canadian data with information from the British Columbia Ministry of Energy, Mines and Petroleum Resources and the Saskatchewan Ministry of Energy & Resources.

Activity

So dramatic has the growth in US gas plant and fractionation been in the last year—and it promises to continue for at least another 18-24 months—that Oil & Gas Journal is taking the unusual tack this year of focusing solely on activity in the US.

As of the end of first-quarter 2012, OGJ data show more than 10 bcfd of new, planned, or under construction gas plant capacity through mid-2014. For the same period, OGJ data show nearly 1.5 million gpd of NGL fractionation capacity recently commissioned, under construction, or planned.

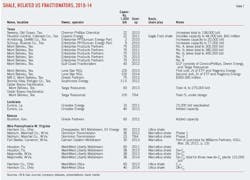

Table 6 presents a list of gas plants built or under way in response to production from the nation's shale plays or from plays that, while not in shales, have been developed with the major techniques used in shale drilling and completions. Table 7 extends the theme with a listing of new and expanded fractionation in roughly 2010-14.

To complement the details below on gas plant and fractionation construction in the US is an accompanying article, which starts on p. 104, that reviews the related NGL pipeline construction related to shale developments.

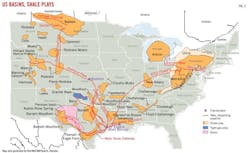

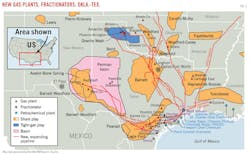

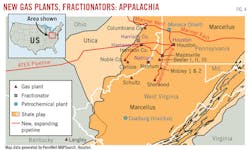

Finally, Figs. 2-5 present maps of the major plant, fractionator, and pipeline locations.

Eagle Ford; Barnett

In April 2011, Copano Energy LLC, Houston, announced plans to expand processing at its Houston Central plant in Colorado County, southwest of Houston, to meet production from the Eagle Ford shale. The expansion consists of a 400-MMcfd cryogenic processing plant that will take total capacity at the plant to 1.1 bcfd.

Copano told OGJ the plant expansion consists of inlet filtration, molecular-sieve dehydration, 6,000-hp electric drive mechanical refrigeration, one cryogenic train, two Solar Mars 100 gas turbine-compressor packages totaling more than 25,000 hp of residue compression, waste-heat recovery units providing all plant heat, and 400 gpm of amine liquid product treating.

Construction started in June 2011 and is to be completed in first-quarter of 2013. Total cost will reach about $145 million.

In May 2011, DCP Midstream LLC, Denver, and Targa Resources Partners LP, Houston, reached agreements to, according to the joint announcement, provide a "long-term anchor commitment" to DCP Midstream's Sand Hills NGL pipeline and an interconnect of the pipeline to a new delivery point with Targa Resources' Cedar Bayou 100,000-b/d fractionator at Mont Belvieu, Tex. (Fig. 3).

The new pipeline will be a 700-mile line to move Y-grade NGLs from gas plants in the Permian basin and South Texas to various fractionators along the Gulf Coast along with the Mont Belvieu NGL hub.

The pipeline will serve NGL transportation needs at Targa's natural gas processing plants, existing DCP gas plants, and the 200-MMcfd DCP Eagle plant in Jackson County, Tex., designed to serve Eagle Ford shale development. The Sand Hills pipeline and Cedar Bayou's Train 4 target first-half 2013 for completion and start-up.

The Sand Hills pipeline along with CBF's new fractionation expansion, according to the companies' announcement, will allow DCP to handle producers' increased liquid-rich natural gas production from the new Avalon Shale-Bone Springs areas well as the Eagle Ford shale.

In addition, DCP and Targa agreed to DCP's expanding Targa's Train 4 fractionator, which Targa operates and is majority owner. The agreements were to cover increased production of NGLs from West and South Texas. (See the discussion below on fractionator expansions to meet increased NGL production from US shales and related plays.)

In June 2011, Southcross Energy, Dallas, announced plans to build a 200-MMcfd gas plant in Refugio County, Tex., to process liquids-rich production from Eagle Ford. The new plant is near Woodsboro, Tex., about 25 miles northeast of Corpus Christi (Fig. 3). Southcross told OGJ in April it expects the plant to be mechanically complete and on line by July 1.

Also to handle rich gas, Southcross is retrofitting and enhancing its Gregory processing plant in San Patricio County to handle 135 MMcfd of rich-gas feed. In February, Southcross began building a fractionator and NGL and residue-gas pipeline outlets in South Texas to expand service to producers in Eagle Ford.

When elements of the project are operating in July of this year, Southcross will have 335 MMcfd of gas processing capacity and 16,300 b/d of fractionation capacity in the area, the company said.

Also in Refugio County, Southcross is installing its Bonnie View fractionator near the Woodsboro gas plant (OGJ Online, June 14, 2011), the Gregory plant, and its 4,800-b/d fractionator. Bonnie View will have initial capacity of 11,500 b/d of NGLs, which could be expanded to 15,000 b/d, said the company.

As announced last year, Southcross enhanced the Gregory plant to 135 MMcfd (OGJ, June 28, 2010, Newsletter), resulting in increased plant liquids-extraction capacity and full utilization of its fractionator.

Southcross also is building pipelines that will interconnect Woodsboro, Gregory, and Bonnie View, as well as NGL and residue gas outlets.

Also in the Eagle Ford in February, Boardwalk Pipeline Partners LP, Houston, announced plans to add 55 miles of gathering to a system started up on Jan. 1 and to build cryogenic processing to handle 150 MMcfd. When complete the gathering system will consist of about 400 miles of pipeline capable of gathering more than 300 MMcfd of rich gas in Karnes and Dewitt counties. Boardwalk's Flag City gas plant will be built near Edna, Tex.

Boardwalk estimates costs at $180 million with in-service targeting early 2013. The company has a fixed-price contract with Exterran to design, manufacture, and construct the plant. At the time of the announcement, it was backed by long-term fee-based gathering and processing agreements with Statoil Natural Gas LLC and Talisman Energy USA Inc. for about half the capacity.

Energy Transfer Partners LP, Dallas, in February of this year announced it was further expanding its previously announced Rich Eagle Ford mainline and would build more cryogenic processing to provide gas gathering, processing, and liquids services for Eagle Ford shale production.

The Rich Eagle Ford line will include 257 miles of 30-in. and 42-in. OD pipe, with more than 1 bcfd capacity. Its initial phase—consisting of 160 miles of 30-in. OD pipe—entered service in October 2011. Energy Transfer scheduled the first expansion, 60 miles of 42-in. OD pipe, for completion in fourth-quarter 2012 and the second expansion—37 miles of 30-in. OD pipe—by fourth-quarter 2013.

The new cryo plant, in Karnes County, Tex., will provide 200-MMcfd capacity and be completed in fourth quarter. ETP estimated the total cost for the Karnes County plant and the Rich Eagle Ford pipeline expansion at $210 million and said its long-term fee-based Eagle Ford contracts totaled more than 1.1 bcfd.

ETP's previously announced Chisholm and Jackson County processing plants will provide 1.125 bcfd of processing capacity. The 120-MMcfd Chisholm plant started up in first-quarter of this year adjacent Energy Transfer's 215-MMcfd LaGrange plant in Fayette County at an estimated cost of $70-80 million.

The Jackson County processing plant will be able to handle 600 MMcfd when it starts up near yearend 2012 at a cost of $400-435 million. Phase 2 will add 200 MMcfd in third-quarter 2013, and Phase 3 will add another 200 MMcfd in first-quarter 2014.

Near Pettus in South Texas, Teak Midstream LLC is building more than 200 miles of gas gathering and residue-gas delivery pipelines and adjoining 200-MMcfd cryogenic processing to transport and process Eagle Ford shale gas. Teak has executed 10-year firm gathering and processing agreements with Talisman and Statoil supporting the project.

The new facilities will consist of two separate high-pressure gas gathering systems: One will use 125 miles of 24-in. OD pipeline to transport 600 MMcfd of gas; the other, 20 miles of 20-in. OD pipeline to move about 400 MMcfd.

The 125-mile system will start on acreage jointly owned by Talisman and Statoil in La Salle County, Tex., and will move rich-gas production to Teak's 200-MMcfd Silver Oak processing plant under construction in Bee County, Tex.

Teak will own the first 50-mile segment of this system, the La Salle lateral. The remaining 75 miles of the line, the Bee Express, will be jointly owned by Teak and TexStar Midstream Services LP and travel through McMullen, Live Oak, and Bee counties to the Silver Oak plant.

The Teak-owned, 20-mile Karnes lateral will also start on acreage jointly owned by Talisman and Statoil, moving rich-gas production from Karnes County to Silver Oak.

Teak will also build 3 miles of 12-in. OD NGL pipeline to move liquids recovered at Silver Oak to DCP's Sand Hills NGL pipeline (described earlier) for ultimate delivery to Mont Belvieu fractionation and other Gulf Coast fractionation connected to the Sand Hills pipeline (OGJ Online, Feb. 16, 2012).

In North Texas in October 2011, Targa Resources ordered a 200-MMcfd cryogenic gas plant for its North Texas System to meet increasing gas production from liquids-rich areas of the Barnett shale. Targa expects the plant, in Wise County, Tex., to begin operations mid-2013 and cost $150 million.

Permian basin; Panhandle

In July last year, Crosstex Energy LP and Crosstex Energy Inc., Dallas, joined with Apache Corp., Houston, in a joint venture to spend $85 million on the new Deadwood gas plant in the Permian basin (Fig. 3).

The initial phase of the project will provide processing, compression, and residue-gas takeaway for Apache's Deadwood development in Glasscock County. Crosstex and Apache are funding the project equally and each holds a 50% working interest. Crosstex estimated it would invest $12 million in the project.

By fourth-quarter 2011, Crosstex and Apache had installed a 20-MMcfd refrigeration plant as interim processing and handling. By second-quarter 2012, Crosstex expected to be operating 50-MMcfd of cryogenic gas processing.

In addition, Crosstex bought and upgraded the abandoned Patriot fractionator in Midland County, initially to serve as a rail terminal for Apache raw-make NGL. Crosstex will then move NGL via rail to fractionation and sales at its Eunice, La., plant.

In December, Regency Energy Partners LP, Dallas, announced it would build a $100 million processing complex in Ward County, Tex., to process natural gas from the liquids-rich Bone Spring and Avalon shales in West Texas.

It is being built via a joint venture with Anadarko Pecos Midstream LLC, a unit of Anadarko Petroleum Corp., and an affiliate of Chesapeake Energy Corp., Oklahoma City

The $100 million complex will consist of a 25-MMcfd refrigeration plant and a 100-MMcfd cryogenic plant. The refrigeration unit was to have been in service by second quarter this year with both plants fully up and running by fourth quarter.

Southern Union Co., Houston, is building a $235 million, 200-MMcfd gas plant and associated facilities at Orla, Tex., in the Permian basin. The Red Bluff project is being built by SUG's Southern Union Gas Services unit for production from the Avalon shale, Bone Spring, and Wolfcamp plays in the Permian and in southeast New Mexico.

Southern Union Gas Services is also building about 60 miles of pipeline to deliver up to 20,000 b/d of NGL into Lone Star NGL's under-construction Permian-to-Mont Belvieu pipeline expansion. The project is to be completed by the middle of next year.

In February, DCP Midstream announced plans to build a 75-MMcfd gas processing plant, dubbed Rawhide, in Glasscock County, Tex., along with associated low-pressure gathering to handle Wolfberry production in the Permian. Rawhide and gathering systems are to be in operation by mid-2013.

The plant is the second phase of DCP's expansion for the liquids-rich Permian. That expansion began with plans to build the Sand Hills NGL pipeline, discussed earlier (OGJ Online, June 13, 2011).

The plant and the gathering systems will expand DCP's footprint in the Permian, where it already owns and operates 17 processing plants with total capacity of 1.25 bcfd and produces more than 135,000 b/d of NGLs.

In action in the Texas and Oklahoma panhandles, Enbridge Energy Partners LP announced in August 2011 it would build a 150-MMcfd cryogenic gas plant on its Anadarko gas gathering system near Wheeler, Tex.

The $230 million Ajax plant, located to serve the Granite Wash play, will be in service by early 2013. The new plant will bring total Anadarko system processing capacity to 1.2 bcfd.

In late third-quarter 2011, Eagle Rock Energy amended an NGL agreement with Oneok Hydrocarbon LP to increase Oneok's takeaway from processing plants in the Texas Panhandle.

The action increased Eagle Rock's NGL transportation and fractionation capacity by about 58%, said the company, to occur in phases that coincide with the 30-MMcfd expansion of its Phoenix-Arrington Ranch plant and installation of its Woodall plant, both in Hemphill County. Both serve the Granite Wash play in Hemphill and Wheeler counties. The new capacity of Phoenix-Arrington Ranch will be 80 MMcfd.

Completed in first-quarter 2012, the $67 million Woodall plant has an initial inlet capacity of 60 MMcfd (OGJ Online, Aug. 1, 2011). Eagle Rock's capacity serving the Granite Wash rose to 190 MMcfd, according to the company.

About the same time, Eagle Rock Energy began building a 125-MMcfd high-efficiency cryogenic gas plant in Wheeler County. Company plans call for construction of the Wheeler plant and associated systems to be completed in early fourth-quarter 2012. Construction of the plant and associated gathering and compression is to cost about $100 million.

In the eastern Oklahoma portion of the Woodford shale, Devon Gas Services LP, Norman, Okla., in February awarded a construction contract to KBR, Houston, to expand Devon's 200-MMcfd gas processing plant in Canadian County (OGJ Online, Feb. 17, 2012).

KBR is providing preconstruction services and installation to expand the cryogenic plant by 150 MMcfd, which Devon told OGJ will start up in second-quarter 2013.

The Devon expansion promises yet more liquids moving to Mont Belvieu where 200,000 b/d of fractionation capacity is under construction, specifically to handle increased liquids from the Woodford and Eagle Ford shales and the Permian basin.

Also in the Cana-Woodford, Oneok Partners LP, Tulsa, will invest $340-360 million through first-quarter 2014 to expand natural gas gathering and build new processing in the Cana-Woodford shale in Oklahoma, the company announced today (OGJ Online, Apr. 20, 2012).

Included will be about $190 million for construction of the new 200-MMcfd Canadian Valley natural gas processing plant in Canadian County, Okla. It is to be in service first-quarter 2014.

When completed, the plant will be the company's largest gas processing plant in Oklahoma and increase its total gas processing capacity in the state to 690 MMcfd.

Marcellus, Utica

Late last summer, the US Geological Survey announced the Marcellus Shale contains about 40 times more gas reserves than was estimated 9 years earlier. The Appalachian play holds 84 tcf of undiscovered, technically recoverable gas and 3.4 billion bbl of undiscovered, technically recoverable gas liquids, said the USGS.

The estimates were far greater than in the last, 2002 USGS assessment of Marcellus shale, which estimated a mean of about 2 tcf of gas and 10 million bbl of NGL. The USGS attributed the sharp increases to new geologic information and engineering data.

Most Marcellus gas lies in Pennsylvania, but the USGS assessment covered parts of West Virginia, Kentucky, and Ohio, as well as Maryland, New York, Tennessee, and Virginia (Fig. 4).

Late in 2011, units of Magnum Hunter Resources Corp., Houston, agreed to provide new processing and transportation for Marcellus shale gas production in northwestern West Virginia (OGJ, Oct. 17, 2011, p. 25).

Eureka Hunter Pipeline LLC and Triad Hunter LLC signed the agreements with MarkWest Liberty Midstream & Resources LLC, a partnership of MarkWest Energy Partners LP, Denver, and Energy & Minerals Group, Houston.

The agreements provided for gas processing and related services in the Marcellus shale, including production in northwestern West Virginia that is gathered through Eureka Hunter's pipeline and including equity production for Triad Hunter and other third-party producers.

Under the agreements, Eureka Hunter sold its 200-MMcfd capacity Thomas Russell cryogenic gas plant, then under construction, to MarkWest Liberty, which has subsequently installed it as Mobley 2, next to MarkWest's 120-MMcfd plant, Mobley 1. Mobley 1 is to be operating second-quarter 2012; Mobley 2 in third quarter (Table 6).

Completion of both plants will increase MarkWest Liberty's total gas processing capacity by 320 MMcfd. NGL services also will be provided by MarkWest Liberty, with fractionation at its Houston, Pa., processing and fractionation complex.

In February, MarkWest Energy Partners announced it would add more than 600 MMcfd of processing capacity for Marcellus and Utica shales, as well as 140,000 b/d of fractionation.

For Marcellus producers, additional processing will include a 400-MMcfd expansion of MarkWest's Majorsville, W.Va., processing plant, bringing total cryogenic processing there to 670 MMcfd. The expansion includes two, 200-MMcfd trains expected to come on line in 2013 and supported by long-term agreements with Consol Energy, Noble Energy, and Range Resources.

NGLs recovered at Majorsville and all other MarkWest processing in the Marcellus move via NGL gathering to the company's Houston, Pa., fractionation, storage, and marketing complex.

When the Majorsville and other expansions come on line, said the company, it will operate more than 1.5 bcfd of processing capacity in the rich-gas part of the Marcellus.

The company is also expanding its Marcellus NGL infrastructure with new de-ethanization at Houston and Majorsville and installation of a large purity-ethane pipeline between the two sites.

In 2011, MarkWest announced plans to build two de-ethanization plants with capacity to produce up to 75,000 b/d of purity ethane by mid-2013. To accommodate increasing liquids-rich production, MarkWest will build a third de-ethanization plant that will increase production capacity of purity ethane to 115,000 b/d by 2014.

This will bring its total NGL fractionation capacity in the Marcellus to 175,000 b/d (Table 7).

The first phase of ethane production capacity of 75,000 b/d and the purity-ethane pipeline are to come on line in mid-2013 with completion of Mariner West, a pipeline project jointly developed by MarkWest and Sunoco Logistics LP to deliver Marcellus ethane to petrochemical markets in Sarnia, Ont. (OGJ Online, Sept. 12, 2011).

MarkWest's de-ethanization processing and ethane pipeline will also serve other ethane transportation projects, said the company, including Mariner East and Enterprise Product Partners' ATEX Express ethane pipeline (OGJ Online, Jan. 4, 2011), to transport Marcellus ethane to US Gulf Coast and international markets.

In December of last year, MarkWest joined with the Energy & Minerals Group to form MarkWest Utica EMG LLC and develop gas processing and NGL fractionation, transportation, and marketing in the Utica in eastern Ohio.

In January of this year, MarkWest Utica and MarkWest Liberty announced the first phase of that Utica development plan, including two new processing plants in Harrison and Monroe counties and 100,000 b/d of fractionation, storage, and marketing in Harrison County.

The processing and fractionation will provide rich-gas processing and NGL fractionation, storage, and marketing for several eastern Ohio counties that comprise most of the liquids-rich Utica. The Harrison plant will include 200 MMcfd of cryogenic processing and is to begin operations in mid-2013.

MarkWest said at the time it was finalizing design capacity of the Monroe County complex, which was also to begin operations in 2013. Both processing complexes will be connected via NGL gathering to the Harrison County fractionation plant that will begin operating next year.

In March of this year, MarkWest Utica announced a letter of intent with Gulfport Energy Corp., Oklahoma City, to provide gathering, processing, fractionation, and marketing in the Utica.

Under terms of the letter, MarkWest Utica will develop gas gathering with Gulfport and other producers mainly in Harrison, Guernsey, and Belmont counties that is to come on line beginning in later this year.

MarkWest Utica will process gas at its Harrison County complex and provide NGL fractionation and marketing services at the Harrison County fractionator, where NGL purity products will be marketed by truck, rail, and pipeline.

Also earlier this year, Chesapeake Midstream Development LP, M3 Midstream LLC, and EV Energy Partners LP formed a venture to build a midstream services complex with capacity to process 600 MMcfd of natural gas for the Utica shale in eastern Ohio (OGJ Online, Feb. 29, 2012).

Under the agreements, Chesapeake will build and operate natural gas gathering and compression, and M3 Midstream will build and operate processing, NGL fractionation, loading, and terminal equipment. The cryogenic plant will be in Columbiana County, southwest of Youngstown.

NGLs will move from there south to a central NGL hub in adjacent Harrison County with initial storage capacity of 870,000 bbl, fractionation capacity of 90,000 b/d, and rail loading. Gas processing and fractionation are to start in second-quarter 2013.

Chesapeake Energy Corp. said the partnership plans to invest $900 million over 5 years, most of it in the first 2 years. Chesapeake Midstream affiliates own 59% of the group, M3 Midstream 33%, and EV Energy Partners 8%.

Total E&P USA Inc., a 25% partner with Chesapeake in Utica shale wet gas acreage, has an option to participate in the midstream project (OGJ Online, Jan. 3, 2012). Exercise of the option would lower Chesapeake's interest to 44% and EV Energy's to 6%.

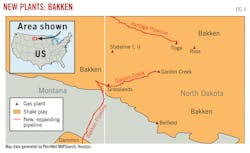

Bakken

In May last year, Hess Corp., Houston, awarded a contract for detailed design and procurement to Mustang Engineering, Houston, for expansion of Hess's Tioga natural gas plant in the Bakken oil play in northwestern North Dakota (Fig. 5).

The project is expanding plant capacity to 250 MMcfd from about 110 MMcfd and installing cryogenic capacity for ethane recovery, full fractionation, and NGL sales, according to the Mustang announcement. Engineering design was to be completed in second quarter this year.

In January this year, Oneok Partners reported that its 100-MMcfd Garden Creek processing plant in eastern McKenzie County, ND, was receiving production from the Bakken shale.

Oneok Partners had previously announced plans to invest $1.5-1.8 billion in the Bakken during 2012-14 in gas gathering and processing and NGL businesses. In addition to Garden Creek, these investments include building a 500-mile Bakken pipeline and two additional 100-MMcfd gas plants: Stateline I and Stateline II in western Williams County, ND.

The Bakken pipeline is to be completed by first-half 2013; Stateline I and Stateline II plants are to be completed by third-quarter 2012 and first-half 2013, respectively.

In December 2011, Whiting Oil and Gas Corp. and Westcon Inc. built a $90 million, 30-MMcfd gas plant south of Belfield, Stark County, ND.

Earlier this year, Plains All American Pipeline LP's wholly owned subsidiary Plains Gas Solutions LLC announced plans to build cryogenic gas processing with deep cut ethane plus recoveries and specification product fractionation capability at its multiproduct complex near Ross, ND.

Plains Gas said it expects the Ross gas plant to process 50-75 MMcfd of natural gas starting second-quarter 2013. The plant will produce stabilized condensate, purity ethane, specification propane, as well as a butane plus raw-make NGL stream, delivering pipeline-quality residue gas into Williston Basin Interstate Pipeline Co.'s transmission system at the tailgate of the plant.

Fractionation

Late last year, Enterprise Products Partners began operating its fifth NGL fractionator at Mont Belvieu, east of Houston. Initial volumes, it said, exceeded the unit's 75,000-b/d nameplate capacity (Table 7; Fig. 3).

The new unit increased total nameplate capacity at the partnership's site to 380,000 b/d. Under long-term contracts, it provides fractionation for increasing NGL production from US shale plays, including Texas's Eagle Ford, and those in the Rocky Mountains and Midcontinent.

Enterprise believes US petrochemical producers have increased their demand for NGLs, particularly ethane, which reached up to 1 million b/d during third-quarter 2011.

With petrochemical companies announcing more conversions, expansions, and new construction that will consume additional ethane (see discussion below) and gas producers announcing more discoveries of shale plays with NGL-rich reserves, Enterprise is now building a sixth fractionator at Mont Belvieu, also with 75,000-b/d nameplate capacity.

Upon its completion, total nameplate capacity of Enterprise's Mont Belvieu NGL fractionation complex will surpass 450,000 b/d. Enterprise anticipates the sixth fractionator starting up in early 2013, when it will be fully contracted.

The additional capacity provided by the fifth and sixth fractionators, said Enterprise, is allowing it to process mixed NGLs at Mont Belvieu that were being diverted to Louisiana, as well as incremental volumes from the partnership's new Yoakum gas plant in Lavaca County, Tex. (west of Houston and north of Corpus Christi), which will start up later this year.

Based on industry announcements, company research, and other reports, said the company, conversions and expansions of existing petrochemical plants could result in 135,000 b/d of new ethane demand. In addition, construction of new ethylene crackers could generate another 330,000 b/d of ethane demand.

In March 2012, therefore, Enterprise announced plans for yet more fractionation at Mont Belvieu: two NGL fractionators—Nos. 7 and 8—to add a combined 150,000 b/d of capacity. Service at both plants is to begin in fourth-quarter 2013.

The two 75,000-b/d units will allow EPP to fractionate more than 610,000 b/d at Mont Belvieu. They will "facilitate the continued growth of NGL production from various Rocky Mountain producing basins and the Eagle Ford shale play in South Texas," said the company.

In the Eagle Ford shale, Enterprise is completing several infrastructure projects and expansions to deliver NGLs that will "underpin the increased fractionation capacity at Mont Belvieu," the company also said in March.

Specifically, the partnership is working with Anadarko Energy Services to support construction of a 173-mile extension of EPP's recently completed 20-24-in. Eagle Ford NGL pipeline to Western Gas Partners LP's gas processing plant in LaSalle County. The new NGL pipeline already links the Yoakum plant to Mont Belvieu and can carry up to 450,000 b/d of mixed NGL.

Through a connection with the new NGL pipeline near Falls City, Tex., the company's seven other integrated South Texas processing plants will have access to markets served by Mont Belvieu. Consisting of 16-in. OD pipeline, the extension from LaSalle County will be able to move 140,000 b/d and begin service in second-quarter 2013.

As EPP previously announced, it is building its Eagle Ford rich-gas mainline and associated laterals. In March, it had completed about 375 miles of 16-36-in. natural gas pipeline. When the remaining 66 miles are completed, EPP's Eagle Ford mainline will be able to deliver 900 MMcfd of rich gas to the Yoakum cryogenic plant.

The first 300-MMcfd train at Yoakum is to begin operating this month, the second train in July, and the third in first-quarter 2013. The Yoakum plant will then be able to process up to 900 MMcfd and produce up to about 111,000 b/d of NGL.

Including EPP's seven other integrated South Texas processing plants and a fully operating Yoakum plant, the company will offer the region about 2.4 bcfd of processing.

At Mont Belvieu, as stated above, Targa Resources' 100,000-b/d expansion of its majority-owned Cedar Bayou fractionator (CBF Train 4) at Mont Belvieu is on schedule for first-quarter 2013 completion. Targa has reported CBF Train 4 is substantially contracted with long-term, use-or-pay, firm-capacity fractionation agreements. Targa expects CBF Train 4 to cost $360 million.

The company is evaluating an additional 100,000-b/d fractionation expansion (CBF Train 5), based on announced NGL pipeline expansions to Mont Belvieu expected to be completed in 2013. Targa has reached agreements to buy the necessary land for CBF Train 5 and has begun engineering design, permitting, and discussions with potential customers regarding term fractionation agreements.

Targa and DCP Midstream earlier in 2011 reached long-term agreements regarding DCP's 700-mile Sand Hills NGL pipeline and fractionation at CBF Train 4 (OGJ Online, May 10, 2011).

In March 2011, Energy Transfer Partners and Regency Energy Partners announced their Lone Star NGL LLC joint venture would build a $350-375 million, 100,000-b/d NGL fractionator at Mont Belvieu. That plant will begin operating in first-quarter 2013 (OGJ, June 6, 2011, p. 88).

Lone Star NGL is now building a second 100,000-b/d NGL fractionator, also at Mont Belvieu, to begin operating in first-quarter 2014. Supported by multiple long-term contracts, said Energy Transfer, the second fractionator is necessary to handle increasing NGL barrels from ETP's Woodford shale, Eagle Ford shale, and Permian basin infrastructure, including Lone Star's 570-mile West Texas Gateway NGL pipeline.

Energy Transfer estimates the cost of the second fractionator at $350 million.

In March, Chevron Phillips Chemical Co. LP, Houston, announced it will expand NGL fractionation at its Sweeny, Tex., plant in Old Ocean, Tex., southwest of Houston. Construction has started and will be completed in February 2013.

With the expansion, the NGL fractionator will be able to accommodate an additional 22,000 b/d, or a 19% increase over current capacity, said the company.

"One of the main drivers for the project is the rapid development of natural gas, crude oil, and NGLs from the shale formations in the region," said Martin Dale, feedstock procurement manager for Chevron Phillips Chemical.

The fractionator at Sweeny was built in the 1960s and consists of two trains currently with a capacity of 116,000 b/d.

Petchem response

Based on the Marcellus or Utica:

• Shell Chemical LP in March of this year signed a land agreement with Horsehead Corp. to evaluate a site in Beaver County near Monaca, Pa., for a petrochemical plant to upgrade locally produced ethane from shale gas production (Fig. 4; OGJ Online, Mar. 15, 2012).

• In January, Process Engineering Associates LLC, Oak Ridge, Tenn., said it was performing feasibility studies and preliminary process design for Invictus LLC, which plans an ethylene cracker to produce ethylene and other products in West Virginia.

The plant would use wet shale gas reserves that are part of both Marcellus and Utica fields.

Based on Eagle Ford or regional shales:

• In September 2011, Williams Cos.' board of directors approved a $350-400 million expansion of its Geismar, La., olefins plant (Fig. 3; OGJ Online, Apr. 10, 2012), increasing the plant's ethylene production capacity by 600 million lb/year to 1.95 billion lb/year.

The announcement placed an in-service date of third-quarter 2013.

• In March 2012, Formosa Plastics Corp. USA, Livingston, NJ, announced plans for a $1.7 billion expansion of its plastics and petrochemicals plant at Point Comfort, Tex., citing new natural gas supplies as the reason.

The expansion will include a new 660-million-lb/year low-density polyethylene plant, a 1.8-billion-lb/year olefins cracker, and a 1.3-billion-lb/year propane dehydrogenation unit. The new capacity is to start up in 2016.

• In April, Dow Chemical Co. announced plans to build a 1.5-million tonne/year (tpy) ethylene plant at Freeport, Tex., under a strategy of integrating operations with feed from natural gas from shales (Fig. 3; OGJ Online, Apr. 19, 2012). Start-up is planned for 2017.

Dow also plans to restart an ethylene plant and enhance ethane flexibility of a second cracker in Louisiana.

• Also last month, INEOS Olefins & Polymers USA let a contract to KBR for a new ethylene furnace at its 3.86-billion-lb/year Chocolate Bayou ethylene plant near Alvin, Tex., south of Houston (OGJ Online, Apr. 10, 2012). The furnace will add 465 million lb/year of furnace production capacity.

• And Chevron Phillips Chemical Co. LP is studying the feasibility of building a 1.5-million-tpy ethane cracker at Cedar Bayou in Baytown, Tex., and two related polyethylene plants with capacities of 500,000 tpy each at either Cedar Bayou or Sweeny, Tex. (OGJ Online, Mar. 29, 2011).