OGJ Newsletter

Nigeria agrees to limit future production

The world oil market is making progress toward rebalancing crude oil supply-demand levels, concluded a joint OPEC and non-OPEC Ministerial Monitoring Committee (JMMC). The group met in St. Petersburg, Russia, on July 24.

Libya and Nigeria were exempted from the existing production-cut targets. On July 24, Nigeria voluntarily agreed to submit to production adjustments as soon as its output levels sustainably reach 1.8 million b/d, said a JMMC statement.

“The continued strengthening of the global recovery is under way with stability in the oil market remaining a key determinant,” JMMC said. “The market volatility has been lower in recent weeks and investment flows have visibly started to improve,” for oil and gas activities.

Oil demand is expected to increase during this year’s second half, JMMC said in a statement, adding that major producers have a 98% conformity level with the production-cut targets of 1.8 million b/d through first-quarter 2018.

Those production-cut targets took effect in January and were extended earlier this year to 2018 in efforts to support crude oil prices, which have slumped since 2014.

A joint technical committee estimated the 98% rate for both June and for the first 6 months of 2017. The JMMC recommended keeping the existing production-cut targets beyond first-quarter 2018 as an option if additional action is needed to support oil prices.

The next JMMC meeting is scheduled for September unless the group determines that it needs to meet earlier.

The JMMC also said, “Existing oil-market trends are resulting in moderation of future supply growth with the number of new final investment decisions significantly below historic averages.”

Committee members said US shale oil projects are going through slowing well productivity, accelerating inflation, slowing rig-count growth, and constrained capital market access.

US House approves fresh sanctions against Russia

The US House of Representatives passed a bill that would impose fresh sanctions on Russia, as well as North Korea and Iran, by a 419-3 vote.

The Russia sanctions are like those in a bill the US Senate approved previously and give the Trump administration important leverage to thwart President Vladimir V. Putin’s efforts to profit from the country’s oil wealth, House Foreign Affairs Committee Chairman Edward R. Royce (R-Calif.) said before the July 25 vote.

“To focus their impact, we clarified several provisions that could have inadvertently handed Russian companies control of global energy projects and [affected] pipelines that our European allies rely on in an effort to end their dependence on Russian [natural] gas. This strengthens the bill,” Royce said.

H.R. 3364 also empowers Congress to review and disapprove any sanctions relief, according to Royce, who introduced the measure a day earlier. “This strong oversight is necessary and appropriate,” he said. “After all, it is Congress that the Constitution empowers to regulate commerce with foreign nations.”

US Rep. Marcy Kaptur (D-Ohio) considered it ironic that such a provision would be necessary.

“President [Donald] Trump and his staff regularly question the intelligence that shows Russia interfered in our election,” Kaptur said. “Given the president’s priorities lately, it is imperative that Congress send a clear message and make it more difficult to undercut sanctions without congressional approval.”

But the European Commission’s top official expressed concern in Brussels on July 26 about the measure’s possible impacts on its member countries’ energy independence.

“The US bill could have unintended unilateral effects that impact the EU’s energy security interests,” said EC Pres. Jean-Claude Juncker. “This is why the [EC] concluded today that if our concerns are not taken into account sufficiently, we stand ready to act appropriately within a matter of days. America first cannot mean that Europe’s interests come last.”

Anadarko cuts 2017 spending by $300 million

Anadarko Petroleum Corp., The Woodlands, Tex., plans to reduce its full-year 2017 capital investment by $300 million to $4.2-4.4 billion.

The firm also is lowering its full-year sales-volume guidance by 4 million boe to 231-235 million boe after recent divestitures and the shutting of more than 3,000 wells in the DJ basin in Colorado after a home explosion in April.

Anadarko during the quarter closed on the divestiture of its Eaglebine assets in central Texas for $534 million and the sale of coalbed methane assets in Utah for $70 million. The firm thus far this year has received nearly $3.5 billion in divestiture proceeds, increasing the firm’s cash position to $6 billion at quarter end.

“The current market conditions require lower capital intensity given the volatility of margins realized in this operating environment,” explained Al Walker, Anadarko chairman, president, and chief executive officer.

Anadarko reported a second-quarter net loss attributable to common stockholders of $415 million compared with a $692-million loss in second-quarter 2016.

ExxonMobil finds more oil off Guyana

ExxonMobil Corp.’s Payara-2 well offshore Guyana, drilled to 5,812 m in 2,135 m of water, encountered 18 m of “high-quality, oil-bearing sandstone,” the operator said.

The result increases the total Payara discovery to 500 million boe and the estimated gross recoverable resource for the 26,800-sq-km Stabroek block to 2.25-2.75 billion boe, the company said.

ExxonMobil in January reported that the Payara-1 well encountered 29 m of “high-quality, oil-bearing sandstone reservoirs” as it was drilled to 5,512 m in 2,030 m of water.

Payara-2 lies 20 km northwest of the Liza Phase 1 project, which received a final investment decision in June.

“Payara-2 confirms the second giant field discovered in Guyana,” said Steve Greenlee, president of ExxonMobil Exploration Co. “Payara, Liza, and the adjacent satellite discoveries at Snoek and Liza Deep will provide the foundation for world-class oil developments and deliver substantial benefits to Guyana. We are committed to continue to evaluate the full potential of the Stabroek block.”

ExxonMobil in March found 25 m of “high-quality, oil-bearing sandstone reservoirs” with its Snoek well in the southern portion of Stabroek.

Esso Exploration & Production Guyana Ltd. is operator and has 45% interest in Stabroek. Hess Guyana Exploration Ltd. holds 30% and CNOOC Nexen Petroleum Guyana Ltd. holds 25%.

Senex finds oil in Cooper basin’s western flank

Senex Energy Ltd., Brisbane, has made an oil discovery on the western flank of South Australia’s Cooper basin with its Marauder-1 exploration well, which flowed 655 b/d of oil on a drillstem test.

The Marauder-1 well was drilled in EX PEL 104 about 2 km north of Senex’s producing Growler and Spitfire oil fields.

Senex operates the field with 60% interest while Beach Energy Ltd. of Adelaide holds the remainder.

The well was identified from the Mollichuta 3D seismic survey and was designed to evaluate the production potential of the Birkhead formation, Senex said.

Marauder-1 encountered good oil shows within well-developed Birkhead sands and evaluation of logs indicate net pay of as much as 8.6 m within a 17½-m gross oil column.

A DST over the Birkhead formation, at 1,744.2-1,764.6 m, recovered 83.7 bbl of 48° API gravity oil. Oil flowed to surface after 79 min and continued to flow for the full 184-min flow period through a ½-in. choke. The flow rate was calculated with no indications of formation water throughout the DST.

The well will be cased and suspended and is expected to be placed on production in the coming months via a flowline to connect the well to existing systems on producing western flank fields.

UK OGA launches 30th offshore licensing round

The UK Oil & Gas Authority (OGA) has opened the 120-day offer period for its 30th offshore licensing round, which will close on Nov. 21. Award decisions are expected in second-quarter 2018.

This latest round follows the supplementary round held in July that awarded 12 licenses to 10 companies. The 29th offshore licensing round, held in March, awarded 25 licenses for 111 blocks to 17 companies in UK Continental Shelf (UKCS) frontier areas.

OGA’s 30th round offers 813 blocks or part blocks in mature areas of the UKCS, covering 114,426 sq km. Blocks are on offer in the southern, central, and northern North Sea, the West of Shetland, and the East Irish Sea. The round features a large inventory of new prospects and undeveloped discoveries. Mature areas of the UKCS were last on offer in the 28th offshore licensing round in 2014.

OGA released 140 datapacks on undeveloped discoveries, which are included in the latest round offering. OGA released maps covering the central North Sea and Moray Firth on July 19.

Some of the acreage in the 30th round has been unavailable since 1965, and OGA Chief Executive Andy Samuel said companies are being encouraged to “take a fresh look at large areas of acreage.”

OGA’s 31st offshore licensing round will follow the current offering and will once again focus on frontier areas of UKCS, including those covered by the UK-government funded seismic acquisition project in southwest Britain and the East Shetland platform. The acquisition included 13,500 km of new seismic data and 20,000 km of reprocessed legacy data. OGA has said it will release this data to the industry after the 30th round closes in November.

Drilling & Production — Quick TakesBLM proposes to rescind its 2015 frac rule

The US Bureau of Land Management proposes to rescind its 2015 rule on hydraulic fracturing of oil and gas wells on federal and Indian land.

The action responds to a late-March executive order calling for review of the Clean Power Plan adopted in the administration of former President Barack Obama and calling for review of several other environmental initiatives, including the frac rule.

BLM issued the final rule in March 2015 but never fully implemented it.

For wells to be hydraulically fractured, the final rule imposed new layers of permitting and reporting, added requirements for water handling and storage, and mandated new disclosures of chemicals in frac fluids.

In a July 25 Federal Register notice, BLM said the rule “is unnecessarily duplicative of state and some tribal regulations and imposes burdensome reporting requirements and other unjustified costs on the oil and gas industry.”

It opened a 60-day comment period on the proposal.

Karoon advances Echidna development off Brazil

Karoon Gas Australia Ltd., Melbourne, has begun the front-end engineering and design phase for its wholly owned Echidna oil field in the Santos basin offshore Brazil.

The company has received approval from the Brazilian government for a revised development plan that comprises a leased floating production, storage, and offloading vessel initially supplied from two extended horizontal production wells at the field. A third well will be a gas injector.

The infrastructure will handle an expected peak production rate of 28,000 b/d of oil. Echidna is tentatively scheduled to be brought on stream in 2020.

The field, in permit S-M-1102, lies 112 km off Santa Catarina in 400 m of water. It was found in March 2015 and contains an estimated 75 million bbl of 39.5° gravity oil.

Earlier this year, Karoon let a multiyear contract to Wood Group for engineering services in support of full field development of Echidna.

Development of Karoon’s nearby Kangaroo oil discovery, made in 2013 in permit S-M-1165, is planned as a tie-back to the Echidna facilities at a later date.

TAQA lets contract for Otter field in North Sea

Abu Dhabi National Energy Co. PJSC (TAQA) has let an engineering, procurement, construction, installation, and commissioning (EPCIC) contract to OneSubsea, a Schlumberger company, for a subsea multiphase boosting system for Otter field in the UK North Sea. Otter is a subsea development in 183 m of water of Blocks 210/15a and 210/20d.

OneSubsea and Subsea 7 will deliver a turnkey integrated project from design through supply, installation, and commissioning. The EPCIC contract calls for installation of a subsea multiphase boosting system, including topside and subsea controls and associated life-of-field services. The project involves a 30-km subsea tieback to the North Cormorant platform, operated by TAQA.

Schlumberger said Otter will involve the longest subsea multiphase boosting tieback in the UK North Sea to date.

PROCESSING — Quick TakesEthanol bill stalls in US Senate committee

The US Senate will not vote soon on legislation opposed by oil industry groups that would have permitted elevated concentrations of ethanol in gasoline.

Officials of the Environment and Public Works Committee said S. 517 lacked votes needed for movement to the Senate floor for a vote before the August recess.

Whether work on the bill will resume after that is unclear.

The bill would extend volatility waivers for gasoline containing more than 10 vol % ethanol, enabling sales of gasoline with 15% ethanol, or E15.

The American Petroleum Institute and other industry associations oppose the introduction of E15, which they say threatens to damage engines in some vehicles and equipment.

The ethanol industry promotes E15 to enlarge the market for its product. With sales of E85 for flexible-fuel vehicles low, ethanol-market growth depends on gasoline demand at the 10% blending limit.

Oil industry associations have called for repeal or major reform of the Renewable Fuel Standard, which includes mandates for sale of grain ethanol in vehicle fuel.

Gazprom Neft breaks ground on unit at Omsk refinery

PJSC Gazprom Neft has started construction of a grassroots delayed coking unit (DCU) as part of a second phase of ongoing modernization works under way to reduce environmental impacts and improve processing capacities, conversion rates, energy efficiency, and production qualities at its 21.4 million-tonne/year Omsk refinery in Western Siberia.

Approved by Russia’s federal building standards and quality-control agency Glavgosekspertiza based on a unit design by TechnipFMC PLC-JSC Rustechexport joint venture RusTechnip, the 2 million-tpy DCU will be equipped with process technology licensed by Amec Foster Wheeler PLC increase the refinery’s production of gasoline, diesel, and petroleum coke using a feedstock of heavy fuel oil from other process units at the site, Gazprom Neft said.

Alongside the DCU—which will include sections for coking, gas fractionation, gas scrubbing, and amine regeneration—the project also will involve construction of new systems, including installations for dehydration, storage, and the transportation-shipment of coke to railway cars.

Gazprom Neft said it expects to complete construction of the DCU by 2020.

The operator, however, did not disclose details regarding a firm timeline for full commissioning of the complex.

Start of construction on the DCU follows Gazprom Neft’s final installation of major equipment in mid-July for the 2 million-tpy advanced oil refining complex (AORC) at Omsk, another key project in the refinery’s second-phase modernization program.

Novokuibyshev refinery due hydrocracking plant

PJSC Rosneft has completed delivery of major process equipment as part of the ongoing construction of a grassroots hydrocracking plant and methyldiethanolamine (MDEA) regeneration unit at its 8.8-million tonne/year refinery at Novokuibyshev, Samara Oblast, in southeastern Russia.

Nine processing columns ranging from 18 to 58 m high and weighing a total of 1,500 tonnes arrived at the refinery in mid-July, in line with the project’s construction schedule, Rosneft said.

The hydrocracking plant and MDEA regeneration unit come as part of Rosneft’s site-specific implementation of upgrades at Novokuibyshev under the company’s broader modernization plan for its domestic refineries, which specifically aims to further improve the overall refining depth, environmental performance, and yield of light-end petroleum products.

Launched in 2008, the ongoing modernization program in its entirety will include construction of 30 units and reconstruction of more than 20 units at Rosneft’s nine Russian refineries.

To date at Novokuibyshev, Rosneft already has completed construction of a continuous catalytic reforming unit as well as the combined upgrade-construction of the refinery’s isomerization unit as part of the modernization effort, the company said.

Alongside the hydrocracking plant, Rosneft’s plans at Novokuibyshev include construction of a second crude distillation unit (AVT-2), a hydrotreating unit, and reconstruction of the refinery’s delayed coking unit to expand capacity to 1.5 million tpy.

While Rosneft said in early 2017 that Novokuibyshev’s hydrocracking, AVT-2, hydrotreating, and delayed coking projects could be completed as soon as yearend, the company told investors on May 10 that overall progress on the site’s modernization program remained at 60%.

TRANSPORTATION — Quick TakesPetronas scraps Pacific NorthWest LNG project

Malaysia’s Petronas and its partners have opted not to proceed with the Pacific NorthWest LNG project at Port Edward, BC. “The decision was made after a careful and total review of the project amid changes in market conditions,” the company said.

“We are disappointed that the extremely challenging environment brought about by the prolonged depressed prices and shifts in the energy industry have led us to this decision,” noted Anuar Taib, Petronas executive vice-president and chief executive officer, upstream.

Pacific NorthWest LNG was a proposed LNG export facility to be built on Lelu Island in the district of Port Edward in northwest British Columbia.

Canada gave its approval to Pacific NorthWest LNG last year contingent on 190 legally binding conditions aimed at lessening the project’s environmental impacts.

EnergyQuest: Australia achieves record LNG exports

Australia exported a record volume of 51.4 million tonnes of LNG during the 2016-17 financial year, according to figures just released by energy consultancy EnergyQuest, Adelaide.

It is the first time the country has broken the 50-million-tonne export barrier.

The figure also is a 37% increase on the 2015-16 LNG export volume of 37.5 million tonnes.

EnergyQuest forecasts higher-still exports in the next financial year, 2017-18, suggesting that the volume will reach 63 million tonnes by midyear 2018 with increases expected from Gorgon and the start of Wheatstone next month, plus Ichthys coming on stream in 2018.

Sales for the 2017-18 year have been estimated at $22.3 billion (Aus.), which is a 29% increase on the $16.6 billion for the previous year.

EnergyQuest says that production volumes increased in virtually every Australian LNG export project. The exceptions were Darwin LNG, which was down 900,000 tonnes, and BG Group’s Queensland Curtis LNG at Gladstone, which was down 700,000 tonnes compared with the previous financial year.

Japan, China, and South Korea remain the main destinations for Australian LNG, comprising 91% of deliveries in June. During May, Australia supplied 44% of China’s LNG imports, 31% of Japanese imports, and 21% of South Korean imports.

In related figures, the International Gas Union (IGU) says that world LNG exports reached a peak of 258 million tonnes in 2016—a 13 million-tonne increase on the figure for 2015. Qatar produced 77.2 million tonnes, 30% of the global total; Australia was second; Malaysia was third with 25.9 million tonnes; and Nigeria was fourth with 18.6 million tonnes.

IGU forecasts that Australia will surpass Qatar as the world’s largest LNG producer in 2018. This differs from the Australian government’s more-conservative estimate, which sees Australia not likely to reach full capacity of 77 million tonnes until 2021, by which time Qatar’s output will have dropped to 75 million tonnes.

Prelude floating LNG facility arrives in Australia

The Prelude floating LNG (FLNG) facility has arrived in Australian waters, Shell Australia confirmed July 25.

The Prelude FLNG facility started its 5,800-km journey to Western Australia late last month from its construction site in South Korea.

Prelude is the first deployment of Shell’s FLNG technology, which will comprise a 488-m long floating facility extracting and liquefying gas at sea before exported it worldwide. The project lies 475 km north-northeast of Broome in Western Australia.

Shell Australia Chairman Zoe Yujnovich said the company has let a majority of Prelude contracts to Australian contractors, including the $200-million contract let to Australian engineering company Monadelphous for maintenance and modification services.

July 31, 2017

Oil & Gas Journal | July 31, 2017

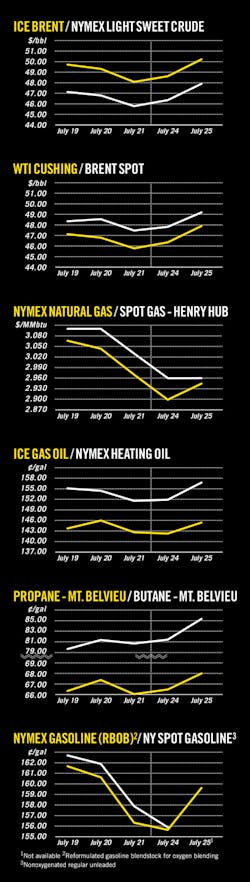

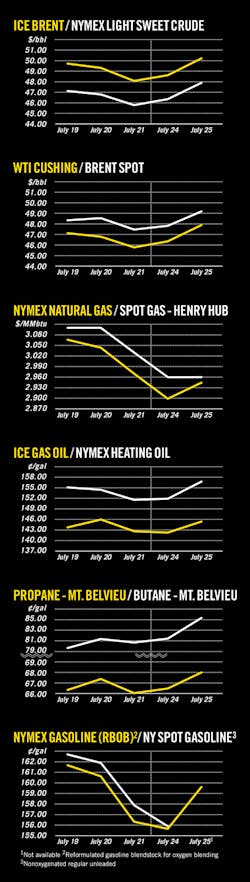

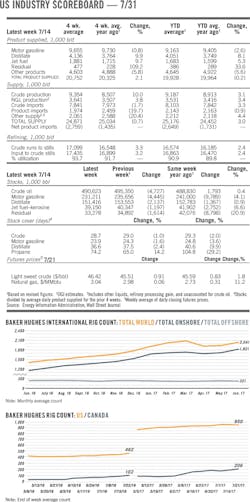

US industry scoreboard — 7/31

4 wk. 4 wk. avg. Change, YTD YTD avg. Change,

Latest week 7/14 average year ago1 % average1 year ago1 %

Product supplied, 1,000 b/d

Latest Previous Same week Change,

Latest week 7/14 week week1 Change year ago1 Change %

Stocks, 1,000 bbl

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com