Permian operators increase processing capacity via acquisitions, relocations

Operators in the Permian basin are increasing their cryogenic natural gas processing capacity through a series of acquisitions and plant relocations or expansions to accommodate steadily rising production as global oil prices rebound following the height of the coronavirus (COVID-19) pandemic.

While some previously announced new plant construction activity remains under way, operators’ strategy of growing their businesses through mergers and smaller-scale, incremental plant relocations and expansions comes as part of broader corporate efforts to monitor spending amid potential fluctuations in market economics due to ongoing health and political crises.

This article examines recent consolidation moves among Permian gas processors and provides an overview of impacts these acquisitions will have on operators’ processing footprint in the region.

Targa expands portfolio

In mid-June 2022, Targa Resources Corp. announced it would acquire Lucid Energy Delaware LLC from Riverstone Holdings LLC and Goldman Sachs Asset Management in a $3.55-billion cash deal scheduled to close third-quarter 2022, pending regulatory approvals (OGJ Online, June 17, 2022).

Targa said the proposed Lucid acquisition forms part of the operator’s integrated strategy of expanding and diversifying its Permian basin footprint, specifically in terms of extending its Permian gathering and processing position into the active and prolifically producing Delaware basin.

The 90 rigs operating in northern Delaware basin—predominantly in New Mexico’s Lea and Eddie counties—with more anticipated to come online, represent 55% of total Delaware basin activity and 30% of overall Permian activity, Targa told investors in a June 16 presentation.

Targa noted current rig activity supports more than 20 years of drilling inventory on Lucid’s 600,000 dedicated acres, further supplemented by volumes subject to minimum commitments. Half of the acquired assets’ dedicated acres are on federal land already under lease, with the vast majority already producing.

Under terms of the transaction, Targa would acquire all of Lucid’s Delaware basin assets, including about 1,050 miles of natural gas pipelines and 1.4 bcfd of cryogenic natural gas processing capacity spread across six existing plants (Figs. 1-2). The acquisition also would include Lucid’s 230-MMcfd Red Hills VI plant, under construction and scheduled for September-2022 commissioning in Lea County, NM, as well as 29 compressor stations with about 180,000 hp.

Table 1 shows Lucid’s current processing assets in the Delaware basin.

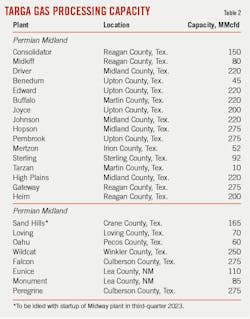

The Lucid assets would complement Targa’s existing Permian Delaware system in West Texas and southeastern New Mexico, consisting of about 6,100 miles of natural gas gathering pipelines and eight processing plants with an aggregate capacity of 1.29 bcfd (Table 2).

Announcement of the proposed Lucid acquisition follows Targa’s third-quarter 2021 startup of its 200-MMcfd Heim plant in Regan County, Tex.—formerly known as the Longhorn plant—which the operator relocated from its North Texas system to its Permian Midland system.

Targa is also adding incremental gas processing capacity in the Permian’s Delaware and Midland basins by commissioning three new plants between fourth-quarter 2022 and third-quarter 2023 (Table 3).

Matador acquires new plant

Earlier in June, Matador Resources Co. revealed its definitive agreement with Summit Midstream Partners LP to purchase Summit’s Lane gathering and processing system (Lane G&P) in the northern Delaware basin of New Mexico, for $75 million, according to separate June 9 releases from the companies.

As part of the deal, Matador would acquire Summit Midstream Permian LLC, which owns the Lane G&P system, gathering and processing services on which are provided pursuant to long-term, fee-based gathering agreements with producers that are primarily targeting crude oil production from the Bone Spring and Wolfcamp shale formations. Residue natural gas is primarily delivered to the Summit-operated, 1.35-bcfd Double E Pipeline for transport from Delaware basin in southeast New Mexico and West Texas to delivery points near Waha in Reeves and Pecos Counties, Tex. (OGJ Online, Oct. 16, 2020).

Matador’s acquisition specifically would include:

- The 60-MMcfd Lane cryogenic processing plant—commissioned in December 2018—on the border of Eddy and Lea Counties, NM.

- 45 miles of low- and high-pressure gathering pipeline.

- Three compressor stations.

- Summit Midstream Marketing LLC’s take-or-pay firm capacity on the Double E Pipeline associated with the Lane G&P system.

Following projected close of the transaction by end second-quarter 2022, Matador—which holds nearly 125,000 net acres in Eddy and Lea Counties, NM—will have two gas processing complexes connected to Double E. The operator already holds 51% interest alongside joint-venture partner Five Point Energy LLC (49%) in San Mateo Midstream LLC’s 460-MMcfd Black River cryogenic natural gas processing plant in Eddy County, NM. The plant processes gas from Matador’s regional Rustler Breaks, Stateline, Stebbins, and Arrowhead asset areas, as well as volumes from third parties (Fig. 3).

Matador’s proposed acquisition further extends the company’s strategy of controlling and growing its midstream operations, including plans to expand the Lane G&P system to support Matador’s exploration and production efforts in northern Eddy and Lea Counties, NM, said Joseph Wm. Foran, the company’s chairman and chief executive officer.

Crestwood adds plant, logistics

In late May 2022, Crestwood Equity Partners LP agreed to acquire Sendero Midstream Partners LP’s Delaware basin gas processing and logistics assets for $600 million in cash (OGJ Online, May 25, 2022).

Slated to close early in third-quarter 2022, Crestwood’s proposed acquisition involves Sendero’s assets in Eddy County, NM, including the 350-MMcfd Carlsbad processing plant, about 140 miles of natural gas gathering lines, and over 53,000 hp of field gathering compression in the Permian Delaware basin.

Acquisition of Sendero Midstream would add more than 75,000 dedicated acres featuring more than 1,200 Tier 1 drilling locations and long-term fixed fee contracts with commodity price upside. Crestwood described the assets are complementary to the existing Willow Lake footprint and integrable with minimal capital investment.

Following the transaction’s close, Crestwood said its Permian Delaware system would include a total processing capacity of 550 MMcfd, including about 100 MMcfd of unutilized space which would reduce the capital needed to expand its existing 200-MMcfd Orla cryogenic gas processing plant in Reeves County, Tex.

Processing capacity crunch

In its latest monthly drilling productivity report, the US Energy Information Administration (EIA) estimated Permian oil production increased 84,000 b/d to a record high of 5.316 million b/d in July 2022 from 5.232 million b/d in June, with July gas output from the basin set to reach 20.392 bcfd, up 165 MMcfd from the previous month’s output of 20.227 bcfd.

Record oil and gas production levels from the region follow projections by IHS Markit in February 2022 that anticipated increases in output will require 5.2 bcfd of additional Permian gas processing capacity by 2026; more than announced new capacity additions, including plant relocations.1

While various organizations have estimated current gas processing capacity within the Permian at about 20 bcfd, actual capacity remains undiscoverable amid lags in reporting to regulatory officials. The EIA, which was set to issue an update of its official US Natural Gas Processing Plant Survey—last published in January 2019 for year-ending 2017—in September 2021, now says the survey’s release remains on standby.

References

- Covas, F., Rao, P., and Mehta, V., “Permian gas processing capacity additions needed to catch up with increasing production,” IHS Markit, Feb. 10, 2022.

About the Author

Robert Brelsford

Downstream Editor

Robert Brelsford joined Oil & Gas Journal in October 2013 as downstream technology editor after 8 years as a crude oil price and news reporter on spot crude transactions at the US Gulf Coast, West Coast, Canadian, and Latin American markets. He holds a BA (2000) in English from Rice University and an MS (2003) in education and social policy from Northwestern University.