Petrobras warns of possible delay in proposed sale of REMAN refinery

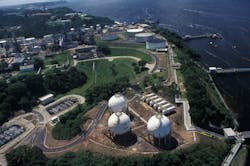

Petróleo Brasileiro SA (Petrobras) must await completion of additional diligence works before gaining government approval to finalize the previously proposed sale of its 46,000-b/d Isaac Sabbá refinery (REMAN)—including a storage terminal—in Manaus, Amazonas, to Atem's Distribuidora de Petróleo SA (Atem) subsidiary Ream Participações SA (OGJ Online, Aug. 26, 2021).

In a dispatch issued on Mar. 8, Brazil’s competition authority Administrative Council for Economic Defense (CADE) declaring the proposed transaction to be complex, CADE has ordered execution of unspecified diligence activities involving further analyses of REMAN’s operations, including the refinery’s effects and possibly competitive impacts on the downstream refining market, Petrobras said on Mar. 10.

Since the Mar. 8 declaration of complexity by statute allows CADE to request an extension of up to 90 days to the general 240-day diligence process, the required period of operational analyses could take up to 330 days, potentially further delaying the REMAN sale.

While Petrobras said it plans to collaborate with CADE to gain requisite approval of the REMAN sale within the legal deadline as stipulated in its agreement with Atem, the operator indicated completion of the sale still remains subject to other normal closing conditions.

If approved, the proposed sale would include Ream Participações’ purchase all of Petrobras’s ownership interest in the REMAN refinery and associated logistics assets for $189.5 million, $28.4 million of which is to be immediately paid as a security deposit, with the remaining $161.1 million to be collected a closing subject to adjustments.

Petrobras—which will continue operating REMAN and its associated assets until the transaction closes—also agreed to offer ongoing support to Atem for a transitional period following the sale as part of a service agreement to ensure the safety and uninterrupted operation of the assets.

Petrobras most recently completed the sale of its former 333,000-b/d Refinaria Landulpho Alves (RLAM) refinery—now renamed Refinaria de Mataripe—in São Francisco do Conde in the Recôncavo Baiano region of Bahia, Brazil, to Mubadala Capital (MC), an arm of Abu Dhabi-based Mubadala Investment Co. (OGJ Online, Dec. 1, 2021).

About the Author

Robert Brelsford

Downstream Editor

Robert Brelsford joined Oil & Gas Journal in October 2013 as downstream technology editor after 8 years as a crude oil price and news reporter on spot crude transactions at the US Gulf Coast, West Coast, Canadian, and Latin American markets. He holds a BA (2000) in English from Rice University and an MS (2003) in education and social policy from Northwestern University.