Modeling enables Thai refining, petrochemicals plant integration

Andrew McIntee

KBC-A Yokogawa Co.

Manchester, UK

Uncertainty regarding a timeline for recovery in demand for petroleum-derived products during the coronavirus (COVID-19) pandemic is forcing many downstream operators to confront the need for business and digitalization strategies that enable sufficient resilience and flexibility to maintain profitable operations during prolonged atypical market conditions.

While the petrochemical industry is faring slightly better than the refining sector to date, the shared COVID-19 experience has heightened both groups’ awareness of flaws in existing business models, as well as limitations to the digital technologies used to support them. As industry now looks to slow investment and preserve cash amid predictions of a lower-for-longer oil price scenario due to the health crisis, refining and petrochemical operators, to survive, will need to accelerate digitalization initiatives that support more granular optimization and alignment of feedstocks, production, and operating integration to reflect volatile market demand and prices.

Before onset of the COVID-19 pandemic, PTT PCL of Thailand enlisted KBC-A Yokogawa Co. to help evaluate potential benefits of merging two of its downstream subsidiaries—one a refiner, the other a petrochemicals producer—into a single operating unit. To complete the project, KBC used its Petro-SIM process simulation software to create a value chain optimization-based integrated model of both operators’ sites that provided a detailed, unified representation of post-merger operations. Creation of the digital model allowed PTT to identify various low or no-cost investment opportunities, as well as immediately available savings, that would result in cash benefits of between $80-154 million/year following the proposed merger.

In addition to presenting results of PTT’s use of KBC’s digital model in the asset-integration decision process, this article examines the rationale behind refining-petrochemicals integration, the use of digitalization tools in achieving that integration, and the necessary role digital twins will play in maintaining future integrated operations.

Profitability in integration

While the concept of value chain optimization is hardly new, the refining and petrochemical industries have struggled to fully embrace the strategy. Unlike the industries’ more traditional use of supply chain optimization-based modeling—which concentrates on the internal organization and focuses on individual processing assets, often in isolation from each other and market needs—value chain optimization involves pursuing demand-pull business models, in which the market determines the use value of the product, requiring alignment of supply of premium products as closely as possible to market demand, with sufficient resilience or operational flexibility to readily adjust production when needed and exploit market opportunities (Fig. 1).

For traditional oil refiners, value-chain optimization entails alignment of crude feedstock supply with refinery operating constraints and market demand for transportation fuels. The same is true for petrochemical manufacturers, who must also align feedstock supply (e.g., ethane, naphtha, heavy oil) with manufacturing plant constraints and market demand.

Although longer-term demand growth for transportation fuels is predicted to slow through 2040 before moving negative, demand growth for petrochemical feedstocks is anticipated to rise steadily alongside growing populations to become the largest driver—accounting for nearly half—of global oil consumption by 2050, according to International Energy Agency forecasts.

Increasing levels of refinery-petrochemical integration alongside changes to operating modes and shifts to more sophisticated technologies will be necessary to expand production of naphtha and other chemical feedstocks to accommodate this projected demand growth and contraction for petrochemicals and transportation fuels, respectively. Ultimately, then, the downstream petroleum industry’s future will consist of basic fuel refineries, refineries with integrated petrochemical plants, and crude-oil-to-chemicals (COTC) complexes (Fig. 2).

While the global energy transition from centralized hydrocarbon generation to decentralized lower-emission generation, transportation, storage, and use itself will present a demand-driven mandate to incorporate petrochemicals at many traditional manufacturing sites, so too will shareholders, and for good reason. The potential improvement of added petrochemicals integration at a fuels refinery with increased conversion capabilities is about $1.5-2/bbl of crude processed.

Molecular management

Resting at the core of value chain optimization is the concept of molecular management, which targets ensuring the right molecules are at the right place at the right time and the right price. Molecular management enhances gross product worth by maximizing production of high-value products from reduced-cost feedstock.

The key to achieving an effective molecular management practice, however, is is development of holistic, broad, and unsiloed optimization windows that represent and connect the spectrum of operations.

The siloed and uncoordinated approaches frequently employed to date typically involve many stakeholders—including supply chain planning, production planning, production scheduling, process control, production accounting, and other business processes—independently focused on separate operating and optimization activities, all limited in scope, each with different objectives, often working against each other rather than in coordination.

Achieving any practical molecular management of integrated refinery-petrochemical operations—because of their heightened complexity—specifically requires drilling down to the carbon-number level on a continuous basis, across the entire operational scheme, end-to-end.

While traditional digital tools for optimization have relied on bulk properties of feedstocks (such as cut point for stream optimization), many operators find that these methods pose limitations to fully achieving molecular management goals. The latest digital tools, however, eliminate reliance on bulk properties by enabling detailed carbon-number breakdown across the entire production chain. These enhanced capabilities enable identification of optimization opportunities throughout the integrated complex, and provide real-time monitoring and ongoing reoptimization recommendations to maintain existing operational benefits.

First-principle fundamentals

Refineries use naphtha processing units to maximize octane production for blending into the gasoline pool. Isomerization and dehydrocyclization reactions improve octane, with thermal cracking side reactions minimized to prevent yield loss. But molecular management is not limited to optimization of refinery naphtha only, as optimized routings are applicable to streams from the petrochemical complex as well.

Steam crackers at petrochemical plants optimize thermal cracking of naphtha to increase olefins production. Due to differences in the units’ reactions, selection of molecules to be processed becomes extremely important. Rerouting molecules from one process unit to another can improve yields from both units as well as reduce operating expenses (opex), including costs related to energy consumption, other utilities, and supply of catalyst and chemicals. For these reasons, yields from a steam cracker can vary widely depending on the carbon number and different isomers of the feedstock (Fig. 3).

As the carbon number of feedstock increases, ethylene and propylene yields typically decline, while yields of heavier products increase. Even for feedstocks with the same carbon number, cracking yields change with changes in the carbon-hydrogen ratio (e.g., paraffinic feeds increase ethylene output). Different feedstocks can be cracked either separately or together, but whether cracked individually or co-cracked, that decision will also impact production yields and furnace run lengths.

While aromatics components present in feedstock rarely crack to produce ethylene and propylene, it may be too costly to separate these from feed before processing. Profitability of aromatics is driven by the reformate yield and the distribution of those components contained in the reformate. Typically, petrochemical plants prefer to yield higher volumes of xylenes than benzene from aromatics, which can be accomplished by selecting an appropriate feed for the naphtha reformer.

Selection criteria for different feedstocks for refinery process units depends on the projected volume of octane that will be produced by the feed components. Apart from considerations regarding reactions and yields, feed selection criteria strongly depend on opex as well as current market price of fuels relative to that of petrochemicals at the time of processing.

Feedstock analysis

Quality parameters measured and analyzed by plant engineers are usually based on a feedstocks’ bulk properties. For refinery units, distillation and density are often considered the most important. Refineries also occasionally analyze molecules lost en route from the crude unit as well as the composition of hydrocracker naphtha. Though gas chromatography is performed for selected streams in naphtha processing units, components routed to refinery products are seldom analyzed.

For petrochemicals, however, analysis focuses on a feedstock’s pure components rather than its bulk properties. Some of the components can be lumped for monitoring purposes but, for a few units, analysis requires details down to the isomers level. In the case of gasoline reforming, for example, N+2A—a measure of how heavy naphtha will perform when fed to a reformer—is used as the feed-quality indicator, while C7-C9 distribution is an important component of aromatics reforming.

Tools based on linear programming (LP) are inadequate for molecular management. Even when focused on refining operations, they use comparatively simplistic techniques. Petrochemical operators typically begin optimization at the naphtha feed and do not simulate component-based assays and fractionation efficiency on the refinery optimization end. Using simplified models can give erroneous results. Feed-quality parameters in the form of bulk vol % of paraffins, naphthenes, and aromatics (PNA) of naphtha can be used in the LP, but do not capture the effect of carbon numbers in the steam-cracking operating parameters. Also, a large fraction of feed components is continuously recycled in aromatics units, which impacts both opex and the amount of feed these units can process. These recycles are rarely simulated in an LP-based model.

Proven digital model

Many refineries and petrochemical plants have developed individual digital models of their assets to deliver high-fidelity, virtual representations of hydrocarbon-molecule transformation and associated plant operating conditions. This type of information can provide design, operations, and planning groups with tools for configuration studies, unit monitoring, and generating LP data. Most global refineries already use Petro-SIM for these purposes, but very few sites use the program’s ability to seamlessly transition from bulk properties to component-based simulation and vice-versa, across the entire refinery-integrated petrochemical complex.

Petro-SIM carries information for components available in crude assays, as well as generated from the refinery reactor models, through to petrochemical models. Reactor models are calibrated based on the performance of the operating unit, allowing process engineers to track information at a molecular level.

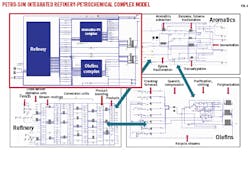

The main function and value of the complex-wide digital model is understanding the interaction between different process units and product yields. The equilibrium and kinetic-based models for the refinery, steam cracker, and aromatics units are present in the integrated process modeling environment (Fig. 4).

This combination captures the effect of feed molecules. The integrated process model carries detailed composition and nonlinear kinetics and can be used to augment the LP model to boost profitability through effective molecular management. LP models are still required for bigger optimization problems. But the integrated process model is necessary to assess operating targets and validate against various constraints of the LP’s estimated, optimized solution.

Various process streams are exchanged between refinery and petrochemical units in the complex-wide model. Apart from feeds to cracker and aromatics, many other streams are also mapped (e.g., off-gases, refinery propylene, hydrogen, etc.). On joint-venture projects, a single integrated model is incredibly valuable for transfer pricing of intermediate streams between respective parties, based on stream quality. After all, it is a stream’s molecular nature that determines its use value. Use of the integrated process model extends to costs side, via integrated modelling of utilities. The integrated model can estimate transfer pricing, as well as optimize the overall complex, to benefit all parties involved.

PTT’s integration

To capture economies of scope and scale as a means of maximizing returns for shareholders, PTT, Thailand’s largest corporation, proposed merging its subsidiaries PTT Chemical PCL (PTTCH)—a petrochemicals producer—and PTT Aromatics & Refining PCL (PTTAR)—a crude oil refiner with some petrochemicals production—into a single integrated refining and petrochemicals operator now known as PTT Global Chemical PCL (PTTGC).

With a total olefins nameplate capacity of 2.89 million tonnes/year (tpy), PTTCH’s complex was equipped to produce 2.38 million tpy of ethylene and 512,000 tpy of propylene.

PTTAR’s operations included a 280,000-b/d crude oil refinery, as well as two aromatics units producing a combined 2.26 million tpy of benzene, paraxylene, cyclohexane, orthoxylene, toluene, and mixed xylenes.

If approved, the merged organization would become the world’s only company to integrate its olefins and aromatics chemical chains with gas and liquid-based feedstock sources, helping the newly merged organization weather subsequent recessions due to its lower cost structure, enhanced economies of scale, and more competitive mixed-feedstock production structure. The expanded product mix would include more high-value petrochemicals such as ethylbenzene (EB), styrene monomer (SM), acrylonitrile butadiene styrene (ABS), styrene butadiene rubber (SBR), polypropylene (PP), and polycarbonate (PC). It would also reduce the site’s dependence on more commoditized output such as petroleum products, ethylene, propylene, mixed C4, and aromatics. Feedstock competitiveness would be accomplished by using gas, a cheaper feedstock than naphtha.

PTTAR and PTTCH commissioned a study with KBC to assess potential gains in synergy following the proposed integration. To articulate the merger synergies to respective shareholders, KBC used Petro-SIM to evaluate complex-wide interactions and optimal stream routing via construction of detailed etro-SIM models of the assets of both businesses.

The bulk of gains identified resulted from the then-theoretical integrated complex’s ability to internally transfer existing products between plants or add value through various product combinations (see accompanying table).

The detailed digital model of PTTAR and PPTCH’s integrated operations identified the following synergy benefits should the merger occur:

- Enhancing value of offgas into olefin products. Offgas streams produced at PTTAR’s plants were routed to plant fuel systems. The model identified these gases, comprising large quantities of C2 and C3+, as suitable feedstock to be upgraded to a higher-value olefin product at PTTCH’s plant.

- Utilizing C3-C4 stream from PTTAR as feedstock for PTTCH’s olefin products. PTTAR plant’s C3-C4 stream was primarily sold to the domestic market for use as fuel. After the amalgamation, the merged entity would have access to the C3-C4 stream, which could be used as feedstock at PTTCH’s steam cracker.

- Substituting of heavy aromatics for wash oil at PTTCH. PTTCH was purchasing wash oil from external sources to use for cleaning equipment. Heavy aromatics were used as a fuel oil blending component. The model identified an opportunity to use heavy aromatics as a lower-cost substitute for wash oil, which meant PTTAR would have to use diesel as a fuel oil blending component in lieu of heavy aromatics. No one, however, expected the value recovered from using heavy aromatics as a substitute for wash oil to be higher than the marginal costs associated with using diesel as a replacement for heavy aromatics.

- Upgrading heavy gasoline, light cracker bottoms, and cracker bottoms from PTTCH into refined petroleum products at PTTAR. PTTCH was producing heavy gasoline, light cracker bottoms, and cracker bottoms. Heavy gasoline was primarily used internally as plant furnace fuel, while light cracker bottoms and cracker bottoms were sold to external customers at a price notably lower than fuel oil. The model identified an opportunity to refine all three heavy streams into refined petroleum products at higher premia.

- Installing a pressure swing absorption unit (PSA) to purify hydrogen at PTTCH as substitution for PTTAR’s hydrogen manufacturing unit (HMU). PTTAR was producing purified hydrogen for quality improvement of refined petroleum products at its refinery. Held to stricter environmental fuel specifications, however, PTTAR required a substantial amount of purified hydrogen for diesel quality improvement. PTTCH had a sizable amount of fuel with high concentrations of hydrogen which could be extracted to replace the higher cost purified hydrogen from HMU.

Savings

The integration allowed PTTAR and PTTCH to continuously transfer products to each other without any legal limitations or excise-tax implications, which neither operator could have done as separate entities. In addition, PTTAR had access to PTTCH’s jetty for the export of aromatics products. Even with additional investment in a new pipeline, this would save on large third-party storage and jetty costs.

PTTCH had its own steam production unit with sufficient capacity to cover PTTAR’s steam demand. PTTAR, therefore, could source from PTTCH its requisite steam demand in excess of minimum offtake obligations to other steam suppliers.

From model to twin

A digital twin is a virtual or digital copy of a human, device, system, or process that accurately mimics actual performance in real-time, is executable, and can be manipulated to improve future outcomes. Utilizing the complex-wide Petro-SIM model with detailed embedded reactor representations calibrated based on operating data allows the integrated digital model to represent a wide range of true unit operations. In doing so, it becomes a process digital twin that can be operationalized with real-time data from sites’ distributed control systems, on-site data historian software, and laboratory information management systems (LIMS). This involves activating in-built capabilities of the digital model, without requiring middleware, to deliver real-time, high-fidelity virtual representations of hydrocarbon molecule transformation and associated operating conditions.

Petro-SIM’s data reconciliation utility assesses the health of raw data available through historian and laboratory information systems, including raw mass balancing of sulfur and nitrogen for naphtha processing and petrochemical units, carbon, and hydrogen.

Unit operations engineers use well-defined key performance indicators (KPIs) for ongoing performance tracking. For each KPI identified, actionable recommendations and procedures for correcting poor or inefficient performance are developed. One of the key KPIs is the comparison of reconciled data with results from the process simulation and LP models used to validate these tools.

The digital twin can estimate parameters which require complex calculations (e.g., cyclone velocity in residual fluid catalytic cracking, chemical hydrogen consumption in each reactor, remaining catalyst life in hydroprocessing units, etc.). Margin improvement indicators (MIIs) configured in the digital twin calculate the margin loss or gap that needs to be closed to improve the complex’s profitability. Monitoring of MIIs ensures that process engineers and operators continue to optimize the unit. Deviations from the targets and associated losses are reported and acted on continuously.

Currently under implementation at Rompetrol Rafinare SA’s 5-million tpy Petromidia refining complex in Navodari, Romania, the Petro-SIM process digital twin delivers a detailed representation of the complex over its full range of operation and lifecycle.

The author

Andrew McIntee ([email protected]) is an industry solutions consultant at KBC-A Yokogawa Co. in Manchester, UK, where he focuses on integrating digitalization, software, and subject-matter expertise to deliver clients solutions for increasing profits across the oil, gas, petrochemical, and power sectors. With a demonstrated history of expertise in asset optimization, he previously served as a process engineer and assistant plant manager for Huntsman Corp.’s petrochemical division in Wilton, UK. McIntee holds an MS (2000) in chemical engineering from the University of Leeds, UK.